21:38

Wall Road closes decrease as greenback rises

21:18

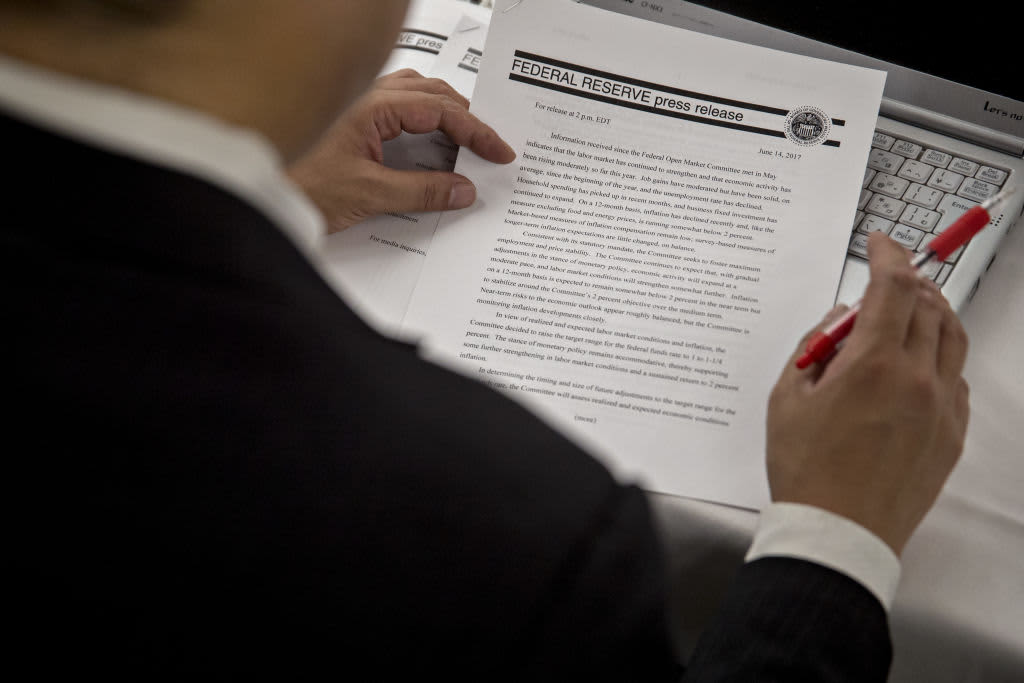

Powell: Financial system recovering from a deep gap

21:11

Powell: We are going to taper, once we obtain our aim

Up to date

20:59

20:43

20:30

Powell: Do not see troubling wage rises

20:17

Up to date

20:06

19:59

19:48

19:42

19:39

Fed chair Powell: Financial downturn has not fallen evenly

Source link