The financial system is recovering sooner than had been anticipated as lately as this spring. Nice cause to panic, apparently.

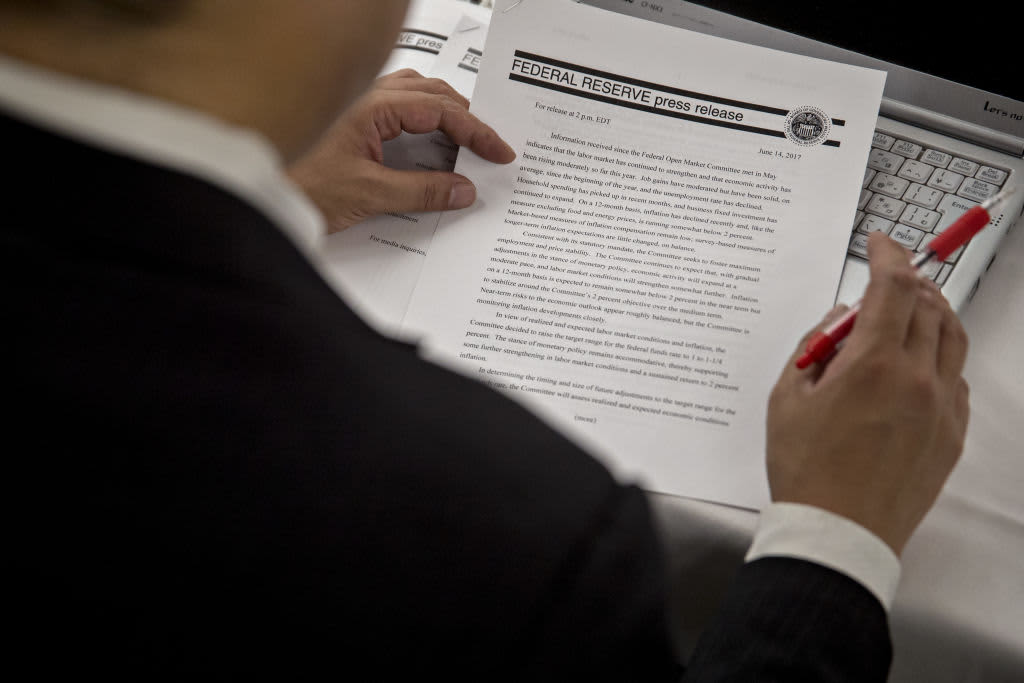

WSJ:

Federal Reserve officers signaled they count on to boost rates of interest by late 2023, before they anticipated in March, because the financial system recovers quickly from the results of the pandemic and inflation heats up.

Their median projection confirmed they anticipate lifting their benchmark price to 0.6% from close to zero by the tip of 2023. In March that they had anticipated to carry it regular via that yr.

That is dangerous information how?

Would you like rates of interest at zero and emergency bond shopping for packages to go on eternally, no matter financial circumstances? Have you ever been struck by lightning, sir? Fallen in your head in current days?

“Progress on vaccinations has lowered the unfold of Covid-19 in the US. Amid this progress and robust coverage help, indicators of financial exercise and employment have strengthened.”

That’s Chair Powell, resetting expectations as he ought to. Ignore kneejerk inventory market reactions and sudden swings in sentiment. Issues are getting higher, extraordinary stimulus goes away, charges will normalize.

I’ll be on CNBC’s Closing Bell as we speak at 3:45pm as we speak, bringing my very own explicit taste of calm, rational market commentary to the desk. Pull up a chair.

Source link