Introduction

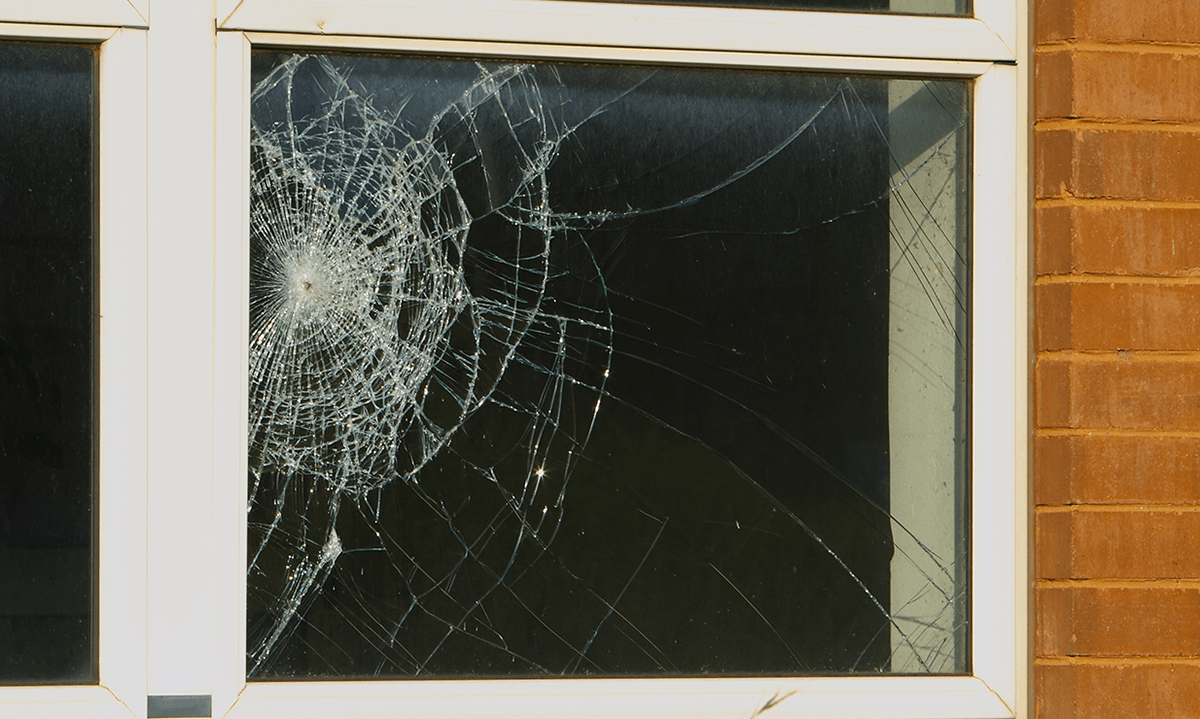

London ranks ninth on the UBS International Actual Property Bubble index for residential properties. Like in lots of different international locations, property costs in the UK reached an all-time excessive in 2020. A world pandemic with sudden mass unemployment ought to have pressured UK residents to promote their properties, however the furlough insurance policies, stamp responsibility holidays, and record-low rates of interest greater than counterbalanced that.

A two-bedroom residence with 1,000 sq. ft of residing area in a fancy neighborhood like Hampstead in North West London prices about £1.5 million. The hire is roughly £3,000 per thirty days, which equates to a measly gross rental yield of two.4%. After accounting for upkeep and taxes, it’s extra like 1.7%. Lots of the homes in that space are greater than a century previous and want plenty of love.

Though such a low yield could seem unattractive to buy-to-let house owners, it

was significantly worse all through a lot of the final decade when the price of

financing was above the rental yield. Consumers had been purely betting on value

appreciation and prepared to just accept adverse money move throughout their funding

interval.

Now, because of COVID-19 and the Financial institution of England (BOE), financing prices are lower than the rental earnings, and the money move of property buyers has turned optimistic. For these contemplating shopping for a property for their very own use, paying curiosity and amortization is now typically cheaper than renting. What an odd world.

However shopping for an residence in neighborhoods like Hampstead tends to require no less than 25% of fairness as banks have turn out to be extra conservative for the reason that international monetary disaster (GFC). If a possible purchaser was profitable sufficient to avoid wasting about a number of hundred thousand kilos for a down fee, they’ll nonetheless must ultimately repay the £1.1-million mortgage. From a pre-tax perspective, this suggests virtually twice the amount of cash that must be earned.

Some potential patrons are actively betting on inflation to assist scale back the debt load over time. The speculation is that every one the financial and monetary insurance policies of the final decade will result in greater inflation. Revenue and actual asset valuations ought to enhance together with inflation, however the mortgage quantity stays the identical and erodes in actual phrases.

Is that this the wishful considering of property speculators or does the info help the idea?

Central Financial institution Steadiness Sheet Growth

Central banks are sometimes credited with saving the world with their aggressive financial stimulus throughout the GFC in 2008. However the disaster is greater than a decade behind us and the identical primary insurance policies are nonetheless in place. Central financial institution steadiness sheets carry on increasing. In international locations like Germany, this steady cash printing is seen with pure horror given its affiliation with the hyperinflation of the Weimar Republic within the Nineteen Twenties.

With the COVID-19 disaster, the central banks have kicked their cash printing into a fair greater gear. The US Federal Reserve’s steadiness sheet has breached $7 trillion, which is akin to the European Central Financial institution (ECB)’s €7 trillion. The central banks appear to have chained themselves to the general public markets and really feel pressured to step in every time shares drop meaningfully.

The unnatural penalties of this habits have gotten increasingly apparent. For instance, the Financial institution of Japan (BOJ) owns greater than 75% of the exchange-traded funds (ETFs) domiciled there.

Central Financial institution Steadiness Sheet Growth

Cash Provide

There are numerous metrics to measure the cash provide. M1 represents all of the bodily cash in circulation, each in money and in checking accounts, and has been trending decrease in america, Europe, United Kingdom, and Japan for the reason that Nineteen Eighties.

Not one of the financial stimulus carried out since 2009 has influenced cash circulation. That holds true even with broader cash provide measures like M2 or M3 that embody financial savings deposits and cash market mutual funds.

In 2020, the US authorities issued COVID-19 stimulus checks which considerably affected M1 by vastly rising the money in circulation. The UK and EU governments responded in another way and didn’t concern direct money funds to their residents, so M1 in these international locations remained the identical.

Improve in M1 Cash Provide

The change represents 10-year rolling returns.

Central Financial institution Growth, Cash Provide, and Inflation in Japan

Japan affords compelling insights into the connection between central financial institution steadiness sheets, cash provide, and inflation. The Japanese authorities and central financial institution have been on the forefront of financial coverage experimentation since Japan’s financial system tanked within the Nineteen Nineties after epic bubbles in shares and actual property.

At this time, Japan’s financial system is preventing demographic headwinds, however the targets of the federal government and central financial institution have remained the identical: create average inflation and optimistic financial progress.

After calculating the 10-year rolling returns of the central financial institution steadiness sheet, M1 cash provide, and inflation, we’ve three observations:

- The BOJ’s steadiness sheet has elevated by multiples since 2008.

- The central financial institution’s exercise had little affect on the cash provide or inflation.

- Inflation and cash provide had been generally extremely correlated, however not all the time.

Intuitively, inflation ought to comply with the cash provide. The extra money that circulates in an financial system, the extra demand for services, which ought to result in greater costs. Nevertheless, the financial system consists of many interrelated variables and linear fashions continuously fail to characterize actuality.

Central Financial institution Growth, Cash Provide, and Inflation: Japan

Axes present 10-year rolling returns.

Central Financial institution Growth, Cash Provide, and Inflation in america

The identical three financial variables in america, present the identical enhance within the central financial institution steadiness sheet as in different markets and solely muted results on cash provide and inflation. Moreover, inflation can happen with out significant modifications within the cash provide, for instance, throughout the oil disaster within the Nineteen Seventies.

Some buyers are betting on inflation to comply with the spike within the cash provide in 2020. Whereas that is potential, the cash provide has been rising for greater than a decade however inflation has fallen constantly over the identical time interval.

Central Financial institution Growth, Cash Provide, and Inflation: United States

Axes present 10-year rolling returns.

Central Financial institution Growth, Cash Provide, and Inflation in the UK

The BOE has time collection that return to method earlier than the Center Ages. It’s an El Dorado for economists and monetary information aficionados.

The UK information highlights a powerful optimistic correlation between the BOE’s steadiness sheet, cash provide, and inflation between 1947 and 1995. However thereafter, the relationships broke down. Cash provide and inflation nonetheless moved in tandem, however the central financial institution exercise appeared largely irrelevant.

We aren’t economists and have no idea why these relationships modified. It could possibly be as a result of sort of central financial institution exercise. Perhaps central financial institution actions was immediately linked to the cash provide whereas trendy insurance policies are extra targeted on influencing monetary markets.

Central Financial institution Growth, Cash Provide, and Inflation: United Kingdom

Axes present 10-year rolling returns.

Additional Ideas

Related evaluation on the eurozone displays the identical pattern: Central financial institution cash printing is essentially irrelevant to cash provide and inflation.

Given their typical mandate to create average inflation, the omnipotent central banks appear fairly powerless. Or they’re merely preventing forces they can not overcome: specifically, the adverse demographics and adverse productiveness progress that contribute to low financial progress.

Ought to buyers fear concerning the mass cash printing by central banks? Actually. It has distorted monetary markets and inflated costs throughout asset courses. However maybe this merely results in decrease future returns slightly than greater inflation.

Nonetheless, if extra direct fiscal or financial stimulus is delivered on an ongoing foundation, buyers might have higher trigger for concern. Historical past exhibits that it is a recipe for catastrophe for renters and house owners alike.

For extra insights from Nicolas Rabener and the FactorResearch crew, join their e-mail publication.

In case you preferred this submit, don’t neglect to subscribe to the Enterprising Investor.

All posts are the opinion of the creator. As such, they shouldn’t be construed as funding recommendation, nor do the opinions expressed essentially mirror the views of CFA Institute or the creator’s employer.

Picture credit score: ©Getty Pictures / M_D_A

Skilled Studying for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Members can document credit simply utilizing their on-line PL tracker.

Source link