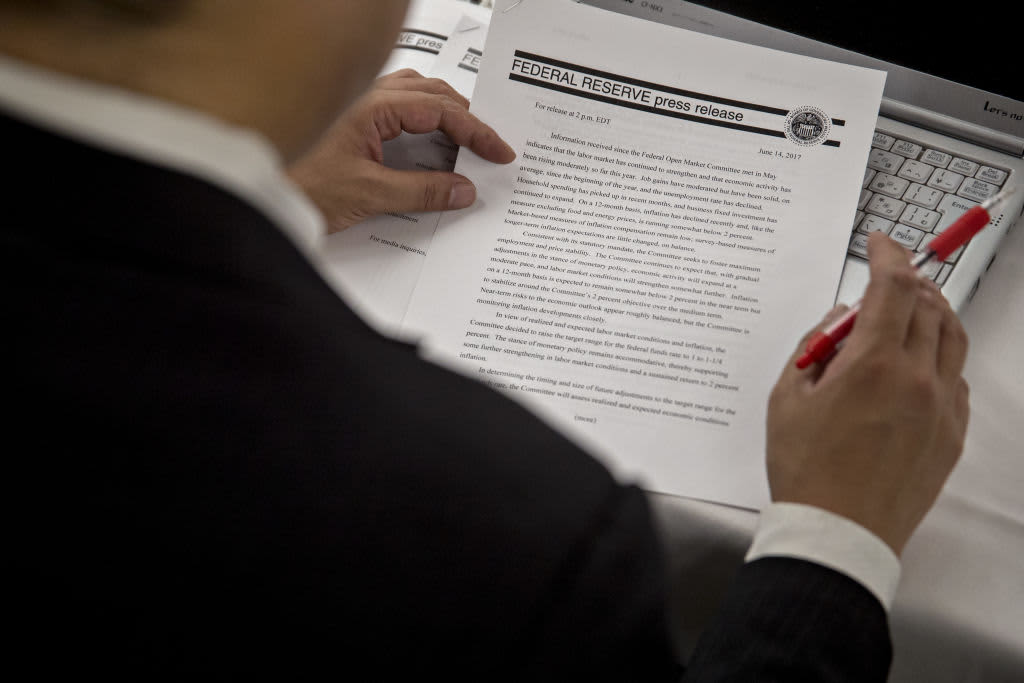

The cryptocurrency market is within the midst of one other lackluster day as Bitcoin (BTC) value dipped under $40,000 forward of the Federal Open Market Committee (FOMC) assembly the place officers intend to debate whether or not rates of interest must be raised or stored close to zero.

Whereas many traders anticipate that BTC will quickly resume its bull run and rally above $40,000, technical analysts are sounding the alarm a few looming death-cross that might ship Bitcoin value to $30,000 and under.

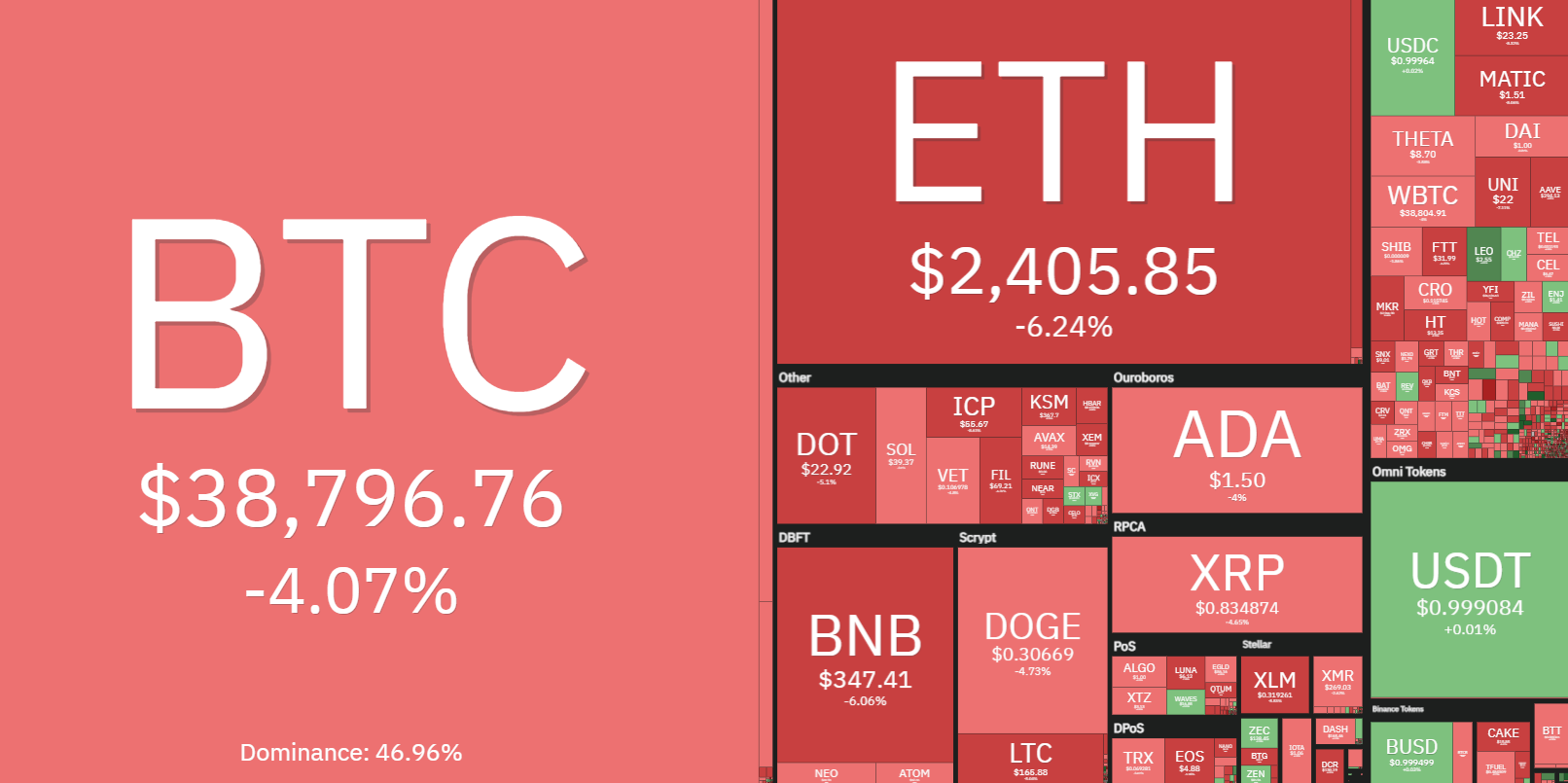

Knowledge from Cointelegraph Markets Professional and TradingView exhibits that after dropping the $40,000 assist stage, Bitcoin bulls have been overrun by sellers, triggering a drop to at this time’s intraday low at $38,415.

Regardless of the specter of a dying cross and vital headwinds residing within the $40,000 to $42,000 resistance cluster, current information from Glassnode means that the most recent crop of Bitcoin hodlers present no indicators of promoting on the present ranges, particularly for wallets which were holding for longer than 3 months.

Bitcoin stays vary certain

In response to David Lifchitz, managing companion and chief funding officer at ExoAlpha, the value motion for Bitcoin has been caught in a variety between $33,000 and $40,000 for greater than three weeks because the market makes an attempt to stabilize following the Might 19 sell-off.

The market crash managed to “wash out speculators who have been those who tended to maneuver the value in a ‘quick and livid’ means,” resulting in a decline in momentum for BTC which is now “caught in limbo” with “a fierce battle brewing below the floor between bulls and bears” and has resulted in a “increased common traded quantity post-crash.”

Lifchitz indicated that the bulls are comprised of “dip patrons and institutional traders resembling Micro Technique which benefit from the dip to strengthen their holdings,” whereas the bears are “most likely miners who need to unload at one of the best value they will get now (i.e. circa $40k) so as to not crash the market extra and thus shot themselves within the foot.”

From a technical perspective, Lifchitz highlighted the $42,000 stage as a major hurdle for the value of Bitcoin which might possible want miners to “exhaust their promoting or be satisfied that they may unload at the next value in the event that they let Bitcoin breathe a little bit bit” to be able to overcome.”

Lifchitz stated:

“A break above $42,000 can be wanted for Bitcoin to be able to extract itself from its buying and selling vary, at which level it might energy rapidly increased to the $50,000 stage which coincides with the native bottoms of April 26 and Might 12 earlier than starting to lose floor on Might 15.”

Coinbase gives aid for choose altcoins

Altcoins additionally confronted strain as Bitcoin value fell under $40,000 however there have been a number of tokens that managed to buck the bearish pattern.

The very best performing token for the day is Amp, which gained 44% to determine a brand new document excessive at $0.1211. Shiba Inu (SHIB) and Chiliz (CHZ) additionally rallied one other 18% following yesterday’s 20% acquire after the information that Coinbase Professional would checklist each belongings.

The general cryptocurrency market cap now stands at $1.6 trillion and Bitcoin’s dominance price is 45.3%.

The views and opinions expressed listed here are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, it’s best to conduct your individual analysis when making a choice.

Source link