I do know what you’re pondering: Is that this man critical?! Come on, McAlister, have you ever seen the Shiller Index? Have you ever heard in regards to the insane bidding wars?

Have you ever seemed on the underlying shakiness within the economic system? Have you ever thought of what occurs when enhanced unemployment advantages go away, and lenders and landlords can pursue delinquencies?

My reply is sure to the entire above. And I nonetheless suppose housing markets could proceed to develop within the coming months, and that energy could proceed for years.

Earlier than we get into the main points, a short reminder on vital pondering and producing an funding thesis: We don’t take one thought, one concept, one knowledge level and lever our total future on it. We predict on the margin.

We predict by way of possibilities. Anybody who makes a name and claims they know precisely how the longer term will play out is extra involved in fame, likes, or clicks than they’re in being an excellent investor. Should you ever learn up on nice traders like Ray Dalio, Howard Marks, Druckenmiller, and on down the road, one commonality you’ll see is that they forecast, however they don’t assume they’re at all times proper and go all-in on one end result. They perceive pondering by way of possibilities and adjusting mid-course.

What elements are in play at the moment that may impression the longer term, and what potential outcomes carry what possibilities of occurring?

To be clear, I believe the economic system is in bother long-term. We’ve a critical debt drawback and a few ugly demographic points that time to weak GDP progress and productiveness relative to our historical past. I additionally suppose inflation, although at present transitory, has an opportunity to turn into a major problem.

Let’s focus particularly on single-family or one- to four-family “townhome/duplex” housing. Some vital elements at play right here could permit for additional value will increase earlier than the celebration ends.

Housing demographics

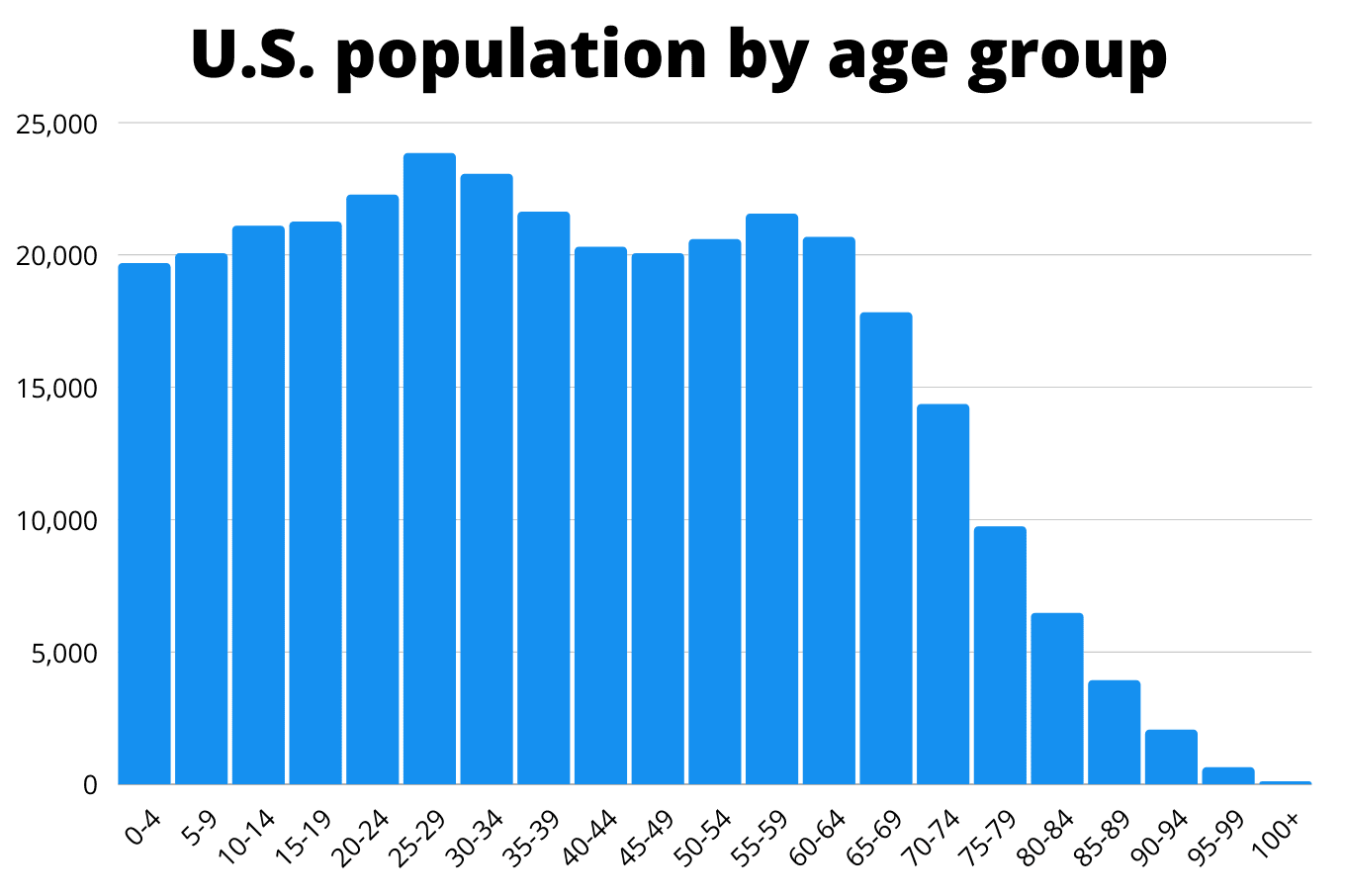

The largest element is demographics. In accordance with U.N. inhabitants knowledge, in 2020, the biggest age group within the U.S. was 25-29 years outdated. The following largest? Thirty- to 34-year-olds. Then 20-24.

Guess what the common age of a first-time homebuyer is? Thirty-four years outdated.

So what we’ve obtained is the three largest age teams within the nation all teed as much as hit prime first-time home-buying age.

Right here’s the factor about being alive: It doesn’t keep that manner perpetually. Persons are much less price-sensitive on the subject of ensuring purchases—like homes. You don’t wait round perpetually to discover a deal. You maintain your nostril, borrow the cash, and purchase the home as a result of your life is occurring now. Children are coming, careers are evolving, and houses are wanted.

New federal insurance policies

What else is occurring on the demand aspect? How a few $15,000 first-time homebuyer credit score? It’s not a achieved deal but, however it’s simple to see one thing like this getting via to regulation.

Some type of scholar mortgage forgiveness or cancellation can also be on the desk.

Lastly, low rates of interest are completely important to the continued sturdy appreciation in residence costs. At present, there isn’t any finish in sight relating to Federal Reserve coverage on low rates of interest. Even with inflation choosing up quickly, it’s unlikely the Fed will permit charges to rise meaningfully increased. They know it is going to finish the celebration and switch everybody (together with the federal government) bancrupt.

You set all these demand elements collectively, and millennials might be plunking down money for brand new properties quicker than my little sister when Justin Timberlake tickets go on sale.

Improve your investing at the moment

Profitable investing requires correct, easy-to-understand details about your properties and the markets you put money into. BiggerPockets Professional offers you the knowledge you might want to discover your subsequent nice deal and maximize your present investments.

Housing provide

We additionally want to take a look at the availability image to raised perceive the place housing could also be going. When it comes to current properties, I don’t see an enormous wave of provide arriving. The primary locations a provide wave of current properties may come from can be financial misery or downsizing child boomers.

Over the long run, some financial weak spot is on the horizon. I don’t suppose, nonetheless, that the market is wherever close to what it seemed like in 2006. Debtors are extra creditworthy and fewer over-leveraged. Nobody can know for certain, however I believe the demographic and authorities help on the demand aspect will outweigh any strain right here, even with the eviction moratoriums burning off.

Some Boomers will completely downsize, and homes will hit the market. Nevertheless, there are extra millennials shopping for than there are boomers promoting. Additionally, growing older in place is changing into extra frequent, the place the aged deliver companies to them as a substitute of the opposite manner round.

Grandparents additionally wish to preserve their properties to have a gathering place for his or her children and grandkids. In some circumstances, they could proceed to personal their properties to accommodate their children and grandkids.

That leaves new development provide as the primary choice.

I believe we’ll see single-family and for-rent “horizontal” rental advanced provide frequently improve. Nevertheless, rising development prices and problem buying and creating land because of excessive costs, labor shortages, and zoning boards will restrict the power of the availability to satisfy the demand within the quick time period.

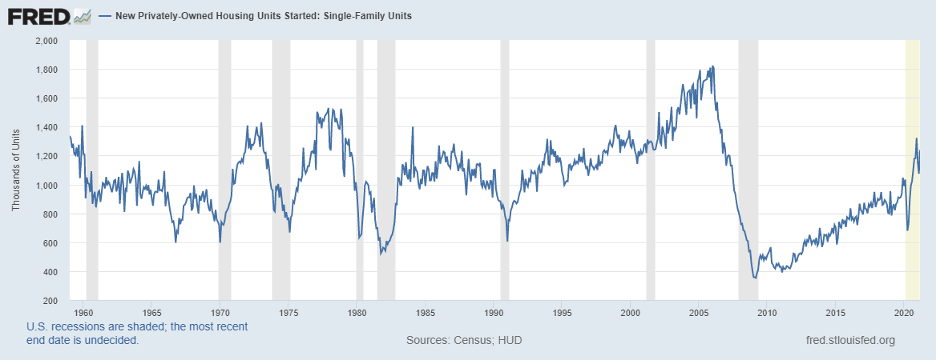

Let’s take a gander at single-family housing begins.

Because the bust, they’ve lagged significantly beneath historic averages. Single-family begins lagged considerably beneath the historic common of round 1 million begins monthly up till 2020, the place we obtained again to that degree regardless of considerably increased populations now.

This tells me that the availability will nonetheless have to catch up for some time earlier than costs reasonable.

House costs are skyrocketing, with the March Case-Shiller Index displaying greater than 13% value appreciation within the March year-over-year quantity. We final noticed this degree of progress because the final housing bubble was peaking between 2004 and 2006. Do I believe that it will unwind over the long run? Sure. Do I believe it is going to be a “crash?” Not essentially. It could possibly be a sluggish deflation.

Extra on the true property market from BiggerPockets

Are we in a bubble? And in that case, how do you have to make investments? Study extra from our consultants.

Will costs proceed to understand?

Despite the fact that housing costs appear insanely excessive (they’re), and it looks like they need to be a lot decrease (they need to), there’s a sturdy case to be made that there’s nonetheless loads of runway because of the demographics, constrained provide, and authorities interventions into the housing market.

This doesn’t imply costs will proceed this tempo of appreciation. It additionally doesn’t imply that there received’t be cycles the place costs reasonable for some time and or which you could shut your eyes and purchase something and anticipate to become profitable.

On the margin and generally phrases, residence outperformance could also be sunsetting, and single-family/horizontal rental complexes could step into the limelight.

Some newer developments provide a reasonably cool mix of single-family models with high-end apartment-like facilities, together with swimming pools, gyms, health facilities, and canine parks. You’re going to begin listening to the time period “horizontal improvement” increasingly more.

Self-storage might also profit right here. Family formation tends to drive storage demand, as nobody desires to do away with their stuff after they transfer in with their companion or downsize.

Glad looking on the market!

Source link