In the event you’re pissed off by looking for a deal that provides nice money movement, you’re not alone. Sadly, it’s difficult to discover a take care of a superb cash-on-cash return in at the moment’s market.

Fundamental market dynamics have been making money movement more durable to seek out for practically a decade, and the present red-hot market is making issues worse. I just lately simulated money movement for the most important 588 cities within the U.S., and the common (unweighted) cash-on-cash return was -6.5%.

However worry not. Money movement is just one of 4 ways in which actual property traders generate earnings from rental properties. There are different methods to generate nice returns.

Money movement is tremendous necessary for traders seeking to give up their jobs or reaching retirement age quickly. However should you’re within the recreation for the long term, there are good returns on the market even with out money movement.

Why is money movement onerous to seek out?

Money movement is getting more durable to seek out for a simple purpose: House costs are rising quicker than lease.

As a result of the house worth is the inspiration of lots of the largest bills an investor faces (precept, curiosity, taxes, insurance coverage), when dwelling costs go up, so do bills. Due to this fact, if lease doesn’t hold tempo with the speed of dwelling worth appreciation in a given market, the money movement potential of that market (or the market as an entire) will lower.

Let’s have a look at a quite simple instance from Columbus, Ohio (which I selected randomly).

Again in 2014, the median worth of a house in Columbus was $148,600, with a month-to-month lease of $954. By April of 2021—precisely seven years later—the median dwelling worth in Columbus was $244,200 with a lease of $1,302.

Each went up quite a bit! However housing costs went up extra. If you calculate the compound annual progress price (CAGR) for dwelling costs, you get a progress price of seven.4% for dwelling costs, in comparison with a progress price of simply 4.54% for rents. This discrepancy could have a big influence on money movement.

Let’s see how these modifications would influence money movement if our solely bills have been taxes and P&I. I’m utilizing simply these bills as a result of they’re simple to calculate and don’t differ from dwelling to dwelling. All we’d like is the worth of the home to calculate them.

Utilizing the BiggerPockets mortgage calculator, I decided month-to-month principal and curiosity funds for the median dwelling in 2014 and the median dwelling in 2021. I additionally noticed that the efficient tax price in Columbus is 1.48% and calculated estimated taxes (I do know that the median gross sales costs don’t equal the assessed worth for many homes, however I’m simply attempting to make a easy instance right here).

2014

| Month-to-month lease | $954 |

| Annual earnings from lease | $11,448 |

| House worth | $148,600 |

| Month-to-month funds and curiosity | $567.55 |

| Whole yearly funds and curiosity | $6,810.60 |

| Efficient tax price | 1.48% |

| Yearly taxes | $2,199.28 |

| Whole yearly funds, curiosity, and taxes | $9,099.88 |

| Money remaining | $2,438.12 |

2021

| Month-to-month lease | $1,302 |

| Annual earnings from lease | $15,624 |

| House worth | $244,200 |

| Month-to-month funds and curiosity | $932.67 |

| Whole yearly funds and curiosity | $11,192.04 |

| Efficient tax price | 1.48% |

| Yearly taxes | $3,614.16 |

| Whole yearly funds, curiosity, and taxes | $14,806.2 |

| Money remaining | $817.80 |

The money remaining after simply two bills – P&I and taxes—was about thrice larger in 2014 than it was in 2021.

That is only a quite simple instance, however this dynamic exists throughout virtually all markets within the U.S. Trying again to 2014, the common CAGR for lease is 4.1%, which is nice! However, in comparison with dwelling costs with a CAGR of 6%, earnings just isn’t retaining tempo with bills in most markets within the U.S.

Sadly, this dynamic is accelerating of late as effectively. Because the starting of 2020 and the COVID-19-induced craziness within the housing market, dwelling costs have gone up on common 12.8% within the U.S., whereas lease progress charges are lower than half at 6.1%.

In the event you’re questioning why rents haven’t stored tempo with housing costs, that’s an amazing query with a really sophisticated reply.

Storm situations are excellent for rising housing costs: low rates of interest, surging demand, and really low stock. On the lease facet of issues, my private opinion is that stagnating wages within the U.S. restrict lease progress.

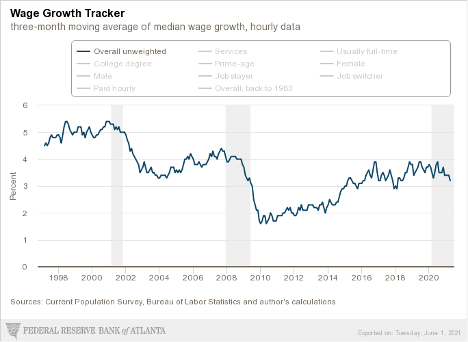

As you possibly can see from the chart above, wage progress has not recovered from the monetary disaster. Consultants suggest that renters spend not more than 30% of their earnings on lease. If their earnings doesn’t rise, the full {dollars} renters can/ought to spend on lease doesn’t rise.

Because the chart reveals, wage progress has averaged round 3.5% since 2014. I don’t assume it’s a coincidence that lease progress has averaged the same quantity (4.1%) in the identical time interval.

Extra Professional articles from Dave

Professional

What to do about it

Let me begin with what I do know might be a controversial assertion: you don’t want money movement to achieve actual property investing.

Money movement is only one of 4 methods to generate returns from rental properties. The opposite three are amortization (utilizing your rental earnings to pay down your mortgage), appreciation (positive aspects in property worth), and tax benefits.

And whereas many, significantly right here on BiggerPockets, preach that “money movement is king,” that’s solely true for people who find themselves desperate to give up their jobs and make investments full-time or those that are approaching retirement age. For anybody seeking to generate returns for the long term and never reside off their investments proper now, you have to be investing for whole return. That you must have a look at all 4 methods of producing returns and decide what investments assist you improve your internet value essentially the most.

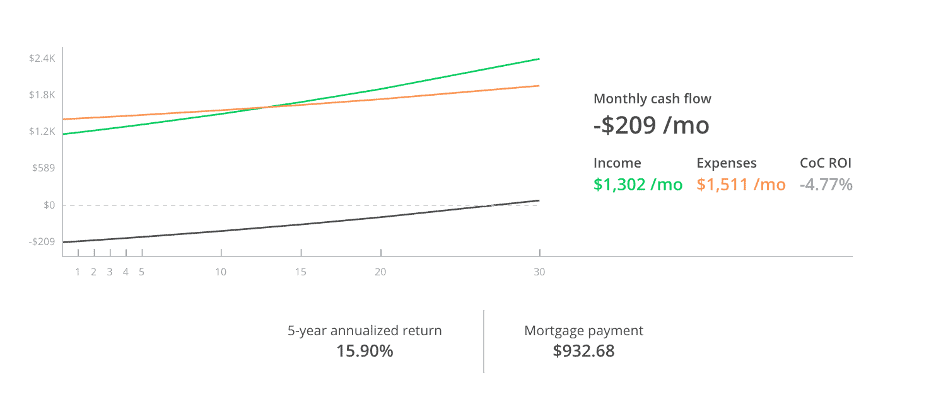

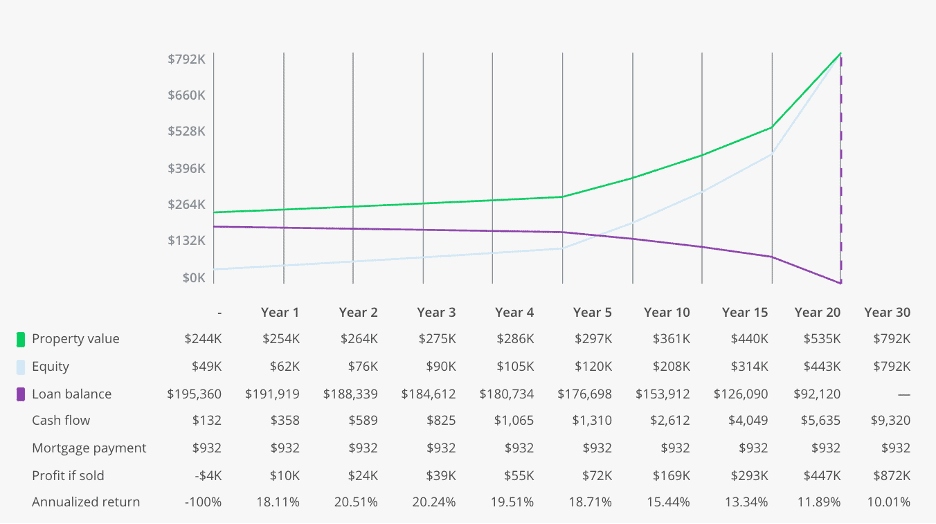

First, let’s have a look at that common deal from Columbus from earlier. Then, I ran the 2021 numbers by the BiggerPockets calculators, and here’s what I bought.

Doesn’t look nice. With -$209 per thirty days in money movement and a CoCR of -4.8%, this deal stinks, proper?

Effectively, by way of money movement, sure, it does. However have a look at that five-year annualized return quantity.

The common annual ROI is sort of 16%. That’s wonderful. And should you’re questioning, I assumed 4% appreciation (it’s averaged 7% since 2014) and a pair of% lease progress (it’s been over 4% since 2014). So even when forecasting declining progress charges, you possibly can anticipate an superior return even with unfavourable money movement.

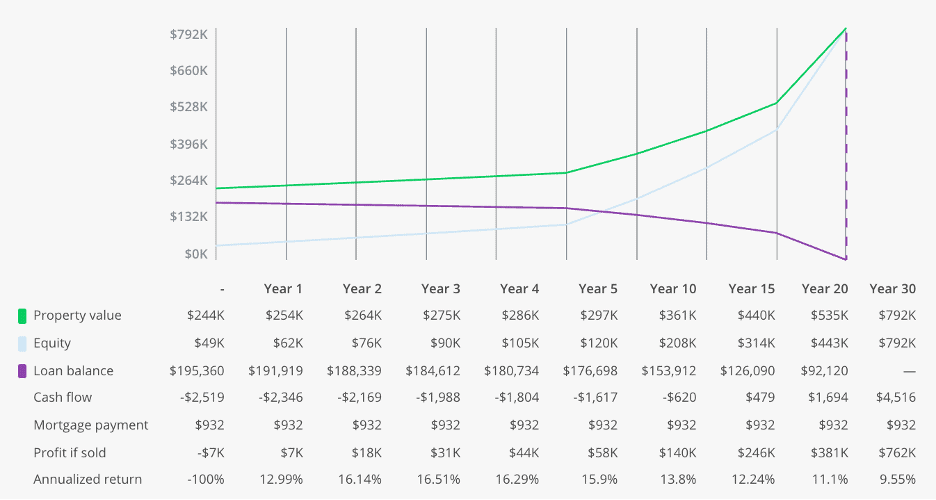

How is that this taking place? With property costs appreciating every month and your rental earnings paying down your mortgage, your fairness continues to develop. I just lately did an evaluation that reveals that paying down your mortgage alone can ship a 4-5% CAGR for a median-priced property. That’s fairly good for simply paying your mortgage on time!

Constructing fairness can, as proven on this instance, generate an amazing return. In the event you construct up sufficient fairness, you possibly can flip that into money movement once you wish to reside off your investments.

How? Deleverage your portfolio.

If, for instance, you amass $1 million in fairness over the following 10 years, you possibly can promote your portfolio and proceed to purchase a rental for all money at a 7% cap price.

With an all-cash buy, cap price = CoCR, so you’d be netting $70,000 a 12 months (7% * $1 million) out of your $1 million in amassed fairness. Fairly good!

That’s an excessive instance, however my level is to indicate that you’ll have choices sooner or later should you construct fairness now. It is possible for you to to determine how one can alter and redeploy your fairness to suit your altering way of life and targets.

To be clear, I’m not essentially recommending working a rental property at a loss (though you possibly can). Nevertheless, I might wish to, at a minimal, break even on any funding I make.

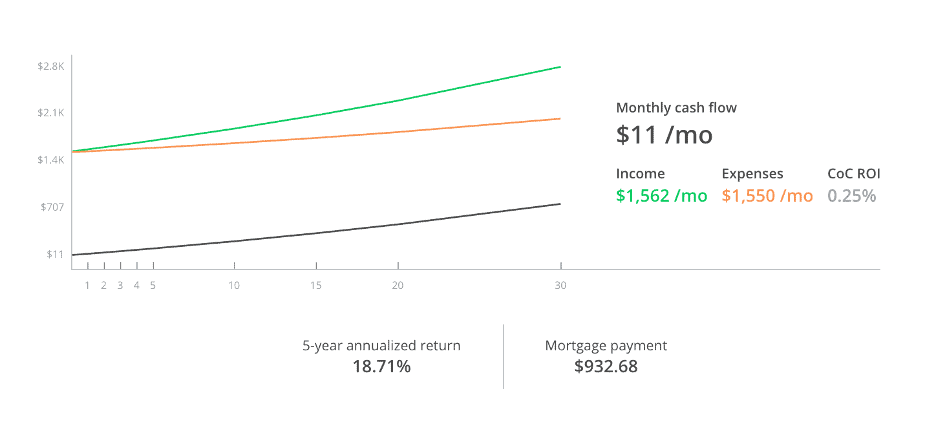

To reveal this level, I cooked the quantity on the final calculator report I confirmed to modestly break even.

$11 per thirty days definitely isn’t one thing to brag about, however an almost 19% annualized return is. Additionally, simply since you begin merely breaking even, that doesn’t imply you’ll by no means money movement. If lease goes up, your money movement will too.

If you’ll find a deal that breaks even and has the potential for market appreciation, you possibly can generate an amazing whole return with out money movement. Search for cities with sturdy inhabitants progress, earnings progress, and low unemployment charges.

So what ought to traders do?

It’s time to face actuality. Money movement is hard to seek out. If you’ll find it, nice! Go for it! But when your market isn’t producing sturdy CoCRs, that’s okay too.

After I simulated money movement for 588 markets within the U.S., solely about 18% of them produced a optimistic CoCR. This isn’t 2010–issues have modified!

Alternatively, over 50% of markets produced dwelling appreciation charges of over 2% yearly during the last decade. That is sufficient to outpace inflation and generate a stable return. Furthermore, 40% of markets even delivered higher than 4% appreciation per 12 months.

That you must look critically at your market, the technique you wish to pursue, and your private targets. Don’t keep away from offers simply because money movement isn’t nice. As a substitute, it’s good to take what the market is supplying you with—and proper now, in lots of markets, it’s giving appreciation.

Source link