Netflix—going through powerful competitors from Fortnite and YouTube, the place folks enjoying video video games get tens of millions of views—hopes the addition of video games with out adverts or in-game purchases will offset the sluggish development it is now seeing as folks cease watching as a lot TV. In its second-quarter earnings on Tuesday, the service stated it added 5.5 million clients, the slowest development interval the corporate has seen for the reason that first half of 2013—when it was in fewer than half as many international locations. “The rationale we’re doing is to assist the subscription service develop and be extra necessary in folks’s lives,” stated Reed Hastings in the course of the firm’s earnings name.

Zoom and Peloton are additionally down double digits from inventory market highs they noticed in the course of the peak of the pandemic and have been pigeon-holed as “COVID shares” by buyers who worry enterprise declines because the pandemic subsides. Nevertheless, each Zoom and Peloton’s first-quarter earnings beat analysts’ expectations. Peloton’s push into gaming additionally accompanies its Olympics marketing campaign that’s operating in the course of the opening ceremony of the video games.

Zoom and Peloton are distinctive amongst manufacturers increasing their companies to succeed in avid gamers. Somewhat than constructing out present merchandise to incorporate video games, firms together with Amazon, Google and Apple have launched gaming-focused choices as standalone merchandise, comparable to Amazon’s cloud gaming service Luna, Google’s Stadia game-streaming service or Apple’s Arcade.

Extra from Advert Age: Out of house advert prices are again to pre-pandemic ranges

With gaming persevering with to see an upward trajectory in shopper development and demand even because the pandemic wanes, it additionally is sensible for manufacturers to lean into the buyer pattern—particularly these which are digital-focused and have already got a mission to entertain. “Leisure and tech manufacturers are including gaming as a result of it’s adjoining to their video merchandise, which makes gaming a considerably pure extension of what they already do,” says Benes.

Of the world inhabitants of avid gamers, cell phone avid gamers symbolize the biggest phase—159 million, or 47.5%, and are projected to develop to 167.6 million, or 48.7%, by 2025, in accordance with a February 2021 outlook from Emarketer. There are 97.5 million digital console avid gamers, or 29% of the inhabitants, whose numbers are estimated to drop barely to 95 million, or 27.6% of the inhabitants, by 2025.

Not surprisingly, viewers of gaming video content material are additionally on the rise. In 2021, there have been 55.2 million viewers of gaming content material, or 17% of the world gaming viewing inhabitants. By 2025, that quantity is anticipated to rise to 62.7 million viewers, or 18%, in accordance with Emarketer.

Including video games might additionally increase advertising potential with different manufacturers, particularly with product placement. If video games turn out to be widespread sufficient, adverts is also inserted throughout the sport, Benes says. “Netflix is unlikely to do that since they’ve been detest to run adverts, however it’s a chance down the road that these primary video games turn out to be an advert income supply as they’ve with cell gaming,” he says.

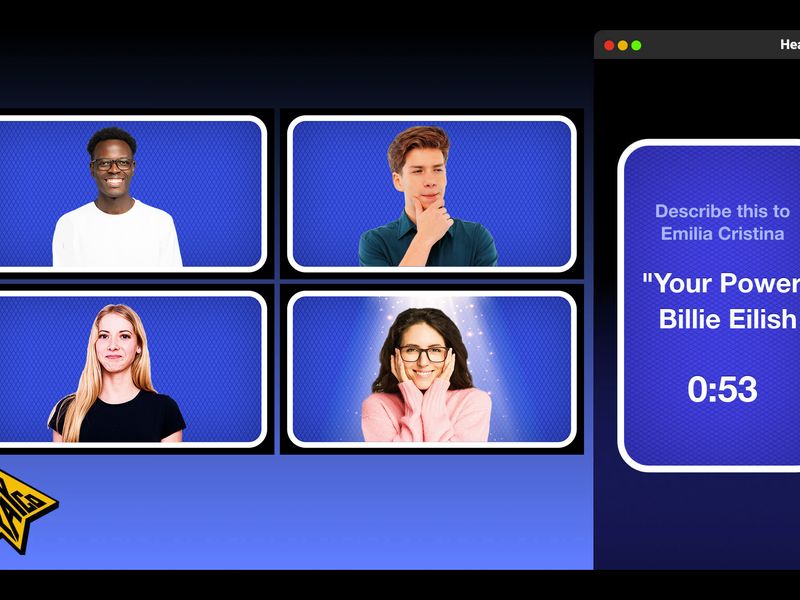

Customers have seen this technique earlier than, with social media platforms together with Fb and Snapchat providing video games to customers for years. The truth is, Zoom is working with gaming firm Playco, which often works with social media platforms, to carry video games to customers. Social media platforms proceed to develop their gaming choices. Fb, for example, just lately expanded its cloud-streaming platform to the entire U.S., Mexico and Canada initially of July.

Subscribe to Advert Age now for the newest business information and evaluation.

Source link