Lumber costs have actually spiraled uncontrolled. Sure, we’re seeing some drops—costs have dropped 40% since Might’s peak. However many buyers imagine greater costs are right here to remain.

Whereas it has impressed some nice memes, the at-one-time 232% (!) improve in lumber costs for the reason that pandemic started has put an unlimited quantity of strain on rehabbers and builders. Certainly, the explosion in lumber costs provides an estimated $36,000 to the prices of constructing a brand new dwelling!

So what’s going on? Why are lumber costs so excessive? And what ought to actual property buyers do about it?

First: Why are lumber costs so excessive?

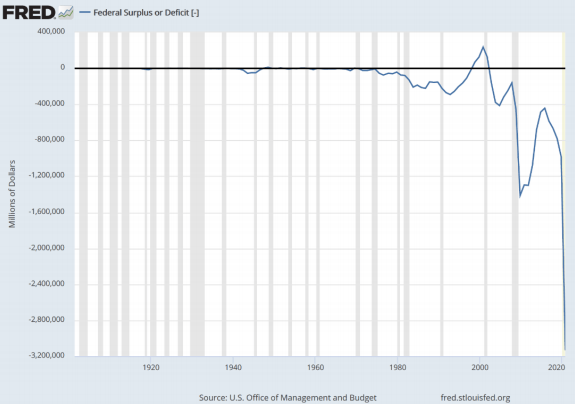

One comparatively minor element of the rise in lumber costs is inflation generally, which is actually greater than the two.6% reported by the CPI.

The CPI tends to underreport inflation as a result of it doesn’t take issues like housing or asset costs into consideration. Cash is normally created by means of credit score (financial institution loans) or the Fed shopping for property (akin to bonds). Which means inflation is normally seen first in property and never in commodities. And there was some huge cash creation over the previous yr. One thing like 1 / 4 of all the cash in circulation was printed in 2020 or 2021.

And never surprisingly, asset costs have skyrocketed just lately. For instance:

- Home costs are up 16.9% for the reason that starting of 2020.

- The Dow Jones is at a file excessive regardless of the current recession and is up 77.6% since its trough in March 2020 (and up virtually 12% for the reason that starting of 2020).

- Cryptocurrencies are uncontrolled.

After the newly created cash has elevated asset costs, it then begins to filter into commodities, which we at the moment are seeing. Fuel costs are up 62.7% since a yr in the past, and meals costs are rising too.

After which, after all, there’s lumber.

Lumber is a key enter in housing development, that means its worth might be affected by cash creation sooner than different commodities’. However lumber has its personal points which are inflicting it to rise a lot, a lot sooner than the speed of inflation usually. And these points all come all the way down to good previous provide and demand

Actual Property Information & Commentary

Right here, seasoned buyers and analysts present updated knowledge, information, and commentary on the main shifts happening in the true property market. In case you are searching for extra in-depth dialogue in your explicit market, you may be capable of discover extra particular discussions in your space in our Native Actual Property Networking Discussion board. Begin a dialogue there right this moment!

Actual Property Information & Commentary

Provide down, demand up

Why are lumber costs so excessive, proper now? It seems that provide and demand are undefeated, and proper now, demand for lumber is hovering on the similar time that provide is means down.

We’ll begin with demand.

There was a normal consensus that the true property market was going to crash when COVID-19 got here round. Seems predictions are both value subsequent to nothing, or hindsight is 20/20 (or each) as a result of the precise reverse occurred.

A lot of this was due to the cash creation talked about above. However a extra long-term situation additionally exists: The USA has a housing scarcity.

One report from Freddie Mac notes that “The U.S. housing market is 3.8 million single-family properties quick of what’s wanted to satisfy the nation’s demand.”

This housing scarcity has been brewing ever for the reason that monetary disaster of 2008. Since that crash, housing development has been extraordinarily sluggish.

From 2000 to the top of 2007, whole housing begins had been over 1 million annually and went over 2 million from 2004 to the crash. That was evidently an excessive amount of. However even nonetheless, the variety of begins cratered all the way down to round 500,000 and solely slowly elevated from there. The quantity didn’t even cross over one million per yr till the start of 2020. Then COVID-19 hit, and the variety of begins crashed once more, as seen on the Visible Capitalist weblog.

Many job websites and the like additionally needed to be quickly shut down throughout the pandemic. Once they began once more, security protocols delayed development much more. Now they’re enjoying catch-up as housing begins have as soon as once more elevated dramatically.

With traditionally low rates of interest, individuals wish to purchase homes. However we’ve a housing scarcity, and the market is squeezed with traditionally low charges of stock. For instance, in Jackson County, Missouri, the place I’m, there are solely 0.6 months of stock—actually one-tenth of what a “balanced market” could be. Delayed development, low value of funds, and traditionally low stock have despatched demand by means of the roof.

On the similar time, provide is down—means down.

Those self same shutdowns for housing development affected the lumber business much more. Because the Deseret Information factors out: “A lumber business that noticed contraction and consolidation following the 2008 housing disaster and subsequent Nice Recession was additional hamstrung by pressured shutdowns and workforce reductions underneath guidelines aiming to curb the rise of COVID-19. Now, whilst lumber manufacturing ramps again up, a frenzy of dwelling shopping for and renovation exercise… across the nation, pushed by shoppers throwing off the shackles of pandemic-induced dwelling isolation, has skewed the market and led to cost will increase.

Many lumber mills are nonetheless closed down even right this moment.

The tariffs on Canadian lumber (which had been 20% till lower to 9% in December 2020) didn’t assist both.

General, low provide and excessive demand imply costs go up. And on this case, it means they go up lots.

Improve your investing right this moment

Profitable investing requires correct, easy-to-understand details about your properties and the markets you spend money on. BiggerPockets Professional provides you the knowledge you want to discover your subsequent nice deal and maximize your present investments.

What ought to actual property buyers do?

Inflation is right here to remain, however in all chance, lumber costs will proceed to normalize over the subsequent six months or so. As a Wells Fargo report notes, “The availability-demand imbalance will ultimately treatment itself as working restrictions are eased, provide chains normalize, and mills extra totally reopen.”

Certainly, a lot of this was attributable to sudden resilience in housing costs (which is now being accounted for) and the COVID-19 shutdowns (that are abating).

Within the meantime, although, it could be smart for actual property buyers to focus on rehab tasks on the smaller aspect. The “paint and carpet” jobs conspicuously lack a necessity for lumber.

After all, in a decent market like this, avoiding massive rehab tasks won’t be possible. In that case, you want to ensure that to fatten up your funds greater than what you had been allocating.

Don’t be silly and chase yield. If the deal isn’t there, it isn’t there. Don’t sit on the sidelines, but additionally don’t be gung-ho to purchase simply any deal in a market as scorching as this, with lumber costs as loopy as they’re proper now. At the moment, it’s okay to overlook on most offers and solely get the few that also make sense.

Source link