Each 4 years (normally), the world comes collectively in a celebration of sport and competitors on the Olympic Video games. Within the spirit of Tokyo 2020, let’s take a look at international locations which might be deserving of gold medals throughout completely different spheres of the cryptocurrency and blockchain area.

The number of sports activities featured on the Olympics have modified through the years, and the present summer season Olympics in Japan contains a whole of 33 completely different sports activities. Thrilling competitions like skateboarding and browsing have been added for Japan as the worldwide showpiece continues to evolve and undertake completely different sports activities.

The cryptocurrency and blockchain area is analogous on this regard. Many various working elements make for a colourful neighborhood each united and divided by their preferences of cryptocurrencies and blockchain platforms.

Let’s check out which international locations and establishments take house gold medals of their respective crypto and blockchain codes.

Gold for Bitcoin adoption goes to… El Salvador

Sports activities usually have followers cheering for the underdog and El Salvador has emerged as a type of lesser-known gamers which have burst onto the worldwide stage in 2021. The Central American nation grabbed headlines this 12 months because it formally turned the primary on the planet to acknowledge Bitcoin as authorized tender.

With out delving too deep into the specifics, El Salvador’s congress voted to cross President Nayib Bukele’s Bitcoin Legislation which acknowledges Bitcoin (BTC) as authorized tender alongside america greenback, with 62 of a complete 84 votes in settlement with the brand new laws.

The legislation permits residents to pay for items and companies in Bitcoin, and Bukele additionally acknowledged that the Salvadoran authorities will assure the convertibility of BTC into USD on the time of any given transaction. The federal government plans to airdrop $30 price of BTC to each citizen later this 12 months.

There have been critics of the legislation change each regionally and overseas, however the total sentiment appears optimistic for the adoption of Bitcoin and a change of notion towards the preeminent cryptocurrency.

Nonetheless, there are just a few ultimate hurdles that lie forward for the nation. Firstly, the Worldwide Financial Fund has issued its personal warning in regards to the potential downsides of nations adopting Bitcoin that presently have unstable inflation charges.

Secondly, some residents of El Salvador have additionally expressed their skepticism of the transfer. A survey undertaken firstly of July involving 1,233 residents revealed that almost half of the respondents knew nothing about Bitcoin. Of the ballot takers, 20% agreed with the transfer, highlighting the necessity for an academic marketing campaign to enhance the progressive transfer to make BTC a authorized tender within the nation.

Change is commonly met with uncertainty and resistance, however when it comes to development and adoption, El Salvador takes the gold medal on this first class.

Switzerland takes silver within the class, due to its crypto-friendly legal guidelines which have boosted the usage of cryptocurrencies and firms working within the area. The USA clinches the bronze medal due to the efforts of Miami’s Bitcoin-friendly mayor Francis Suarez, who’s been driving numerous initiatives to advertise the usage of BTC.

China leads the CBDC race, however anti-crypto insurance policies result in disqualification

China has been a powerhouse on the Olympics over the previous 20 years with its sporting program producing a nice pedigree of Olympic weightlifters, gymnasts, divers, shooters and martial artists. On the earth of cryptocurrencies, the story is kind of completely different.

China has taken a stern stance towards cryptocurrencies and has continued this coverage in 2021, with its outright ban of mining fully rebalancing the Bitcoin mining ecosystem because of this.

Curiously sufficient, the nation is much forward of the world in the case of the race to develop a fully-fledged central financial institution digital foreign money, or CBDC. Over the previous 18 months, China has piloted and rolled out vital testing of its Digital Foreign money Digital Fee, or DCEP.

Colloquially generally known as the digital yuan, residents started testing the power by lotteries that award a small variety of contributors in numerous cities with digital yuan, which they may use by a cell app to pay for items and companies at 1000’s of collaborating distributors.

There isn’t a denying that China has blazed the path for the event, testing and roll-out of its CBDC. In the identical breath, the DCEP is a government-controlled program, and the specifics of the expertise and programs powering the digital yuan are shrouded in thriller.

Nonetheless, China’s current ban on mining in several areas and its zero tolerance of cryptocurrency exchanges signifies that regardless of its well-developed CBDC program, it falls out of the reckoning for a medal. Fortunately, a variety of different international locations have additionally made vital strides in growing their very own CBDCs.

On the earth of sports activities, followers usually get behind the underdog, and that is actually the case with the Bahamas and its Sand Greenback CBDC. The nation has made vital strides with the event and testing of its very personal CBDC and turned the primary nation to go reside in October 2020.

The Sand Greenback ecosystem continues to onboard extra native banks and monetary establishments, paving the best way for widespread adoption of the CBDC and a completely digital cost atmosphere. The Bahamas is the deserving recipient of the gold medal on this class.

Sweden has begun its first trial of pilot testing the e-krona CBDC with a few native banks and exterior contributors. Because it continues testing its system with native monetary establishments, Sweden earns the silver medal on this class.

Cambodia and Ukraine have been credited for their very own CBDC improvement packages by a current report from PricewaterhouseCoopers, sharing the bronze medal on this class.

North America within the race for gold in Bitcoin mining

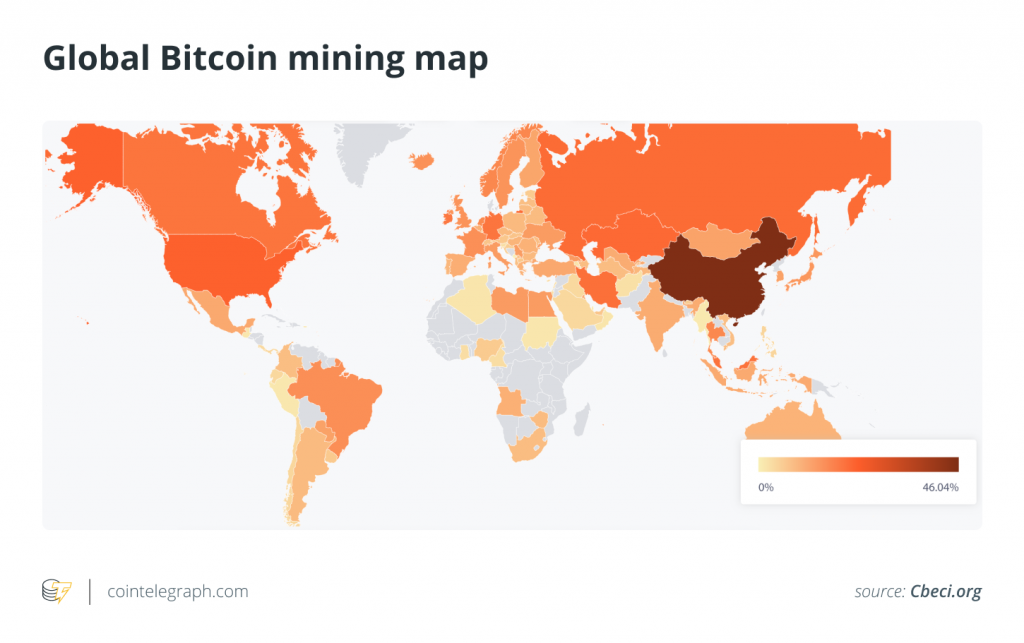

China was undoubtedly the gold medal incumbent of Bitcoin mining however that is shortly altering in 2021. Current estimates noticed China account for greater than 70% of the worldwide hash charge earlier than numerous mining operations have been compelled to shutter in June.

These companies that have been capable of shortly search for greener pastures would welcome their mining tools. Whereas numerous international locations in Asia can be the closest locale to relocate to, North America is shortly changing into the brand new hub of cryptocurrency mining.

Analysis from the Cambridge Centre for Different Finance exhibits that the hash charge of American-based miners has steadily been on the rise over the previous 12 months and the most recent regulatory transfer in China has solely accelerated that time.

The Cambridge Bitcoin Electrical energy Consumption Index world map has but to totally replicate the information from China’s regional mining bans in June, as a way to get a greater understanding of how the Bitcoin mining hash charge’s geo-distribution has modified. The newest map exhibits the distribution as of March 2021.

Nonetheless, from August 2019 to March 2021, the U.S. noticed a rise in its contribution to the worldwide hash charge from 4% to 16%, making it second to solely China when it comes to hash charge. That is largely as a result of a concerted effort from main mining operators in America steadily growing their hash charge by buying new tools throughout this era.

Kazakhstan has additionally opened its doorways to relocate Bitcoin miners from China and has seen its share of the Bitcoin hash charge climb to round 8% of the worldwide charge, in line with Cambridge’s current report.

China’s share of the worldwide hash charge has dropped under 50%, whereas america’ has climbed. This image, nonetheless, has nonetheless not factored within the main relocation of mining operations out of China.

It is likely to be too early to present the U.S. the gold medal for Bitcoin mining, however the nation appears to be on observe to take over within the leaderboards if it continues on the identical tempo. China’s mining clampdown leads to a disqualification, so the U.S. turns into the brand new gold medallist on this class.

Kazakhstan swoops in to take silver with its 8% contribution to the worldwide hash charge, whereas Iran grabs the bronze medal with its 4.6% share. Canada and Malaysia simply miss out on the rostrum within the class.

The regulatory race goes all the way down to a photograph end

In the case of progressive regulation that’s driving cryptocurrency adoption and use, there are a variety of nations which might be vying for a crypto gold medal and might boast to have developed regulatory parameters which might be serving to the business thrive of their locales.

Malta has positioned itself because the blockchain island for just a few years now and has attracted a variety of the world’s greatest cryptocurrency exchanges and different crypto service suppliers. The nation’s regulatory package deal is enticing, as crypto holders should not have to pay capital beneficial properties, wealth, or inheritance tax on their holdings, however buying and selling is topic to revenue tax.

Singapore is one other nation that has established complete legal guidelines which have made it clear what cryptocurrency companies and repair suppliers have to do as a way to function within the nation. Singapore can also be amongst a handful of nations that has zero capital beneficial properties tax on cryptocurrency revenue.

South Korea has lengthy been a rustic with an avid cryptocurrency consumer base and sometimes sees Bitcoin buying and selling at costs far larger than the remainder of the world. The nation has since developed strict regulatory frameworks however has additionally pushed a variety of initiatives to foster numerous companies powered by blockchain expertise.

Switzerland is one other sturdy contender on this class, given its progressive perspective towards the cryptocurrency and blockchain area. Earlier in 2021, the Canton of Zug lastly rolled out its facility for residents to pay taxes in BTC and Ethereum (ETH).

Canada is featured prominently on this race, having change into the primary nation to approve a Bitcoin exchange-traded fund (ETF). The launch of the primary Bitcoin ETF in February 2021 was a big success, with the Toronto Inventory Trade’s Function Bitcoin ETF seeing almost $100 million in commerce quantity on its first day.

All in all, Canada has been hailed for its progressive regulatory atmosphere for cryptocurrency use. Cryptocurrencies are classed as commodities, and their utilization for items or companies is handled as barter transactions.

These 5 international locations, subsequently, finish the crypto and blockchain regulatory race in a photograph end that’s onerous to name. As we convey up the slow-motion replay, we will verify that Canada can take the gold on this class for its broad vary of crypto-friendly laws, from ETFs to clear tax legal guidelines and favorable mining tariffs.

Malta takes silver, as its standing because the “Blockchain Island” has waned considerably as a result of a change in governmental management that had initially championed this trigger. Singapore and South Korea share bronze on this class.

The U.S. takes gold for institutional adoption

The trendy-day United States optimizes a capitalist society, and the disruptive nature of cryptocurrency has led some forward-thinking people, corporations and establishments to maneuver shortly to leverage the potential of cryptocurrencies and blockchain expertise.

Enter MicroStrategy, a worldwide chief in enterprise intelligence companies, which in 2020, pioneered a transfer to transform its fiat-based treasury holdings to Bitcoin. The corporate’s CEO, Michael Saylor, is a fierce Bitcoin proponent and has relentlessly acquired BTC for the reason that agency’s resolution to financial institution on the preeminent cryptocurrency in August final 12 months.

MicroStrategy’s transfer is extensively credited for influencing electrical automobile producer Tesla and its founder Elon Musk to determine to start investing in Bitcoin and, even at one level, accepting the cryptocurrency as a way of cost for its autos.

Cryptocurrencies have been touted as a disruptive drive within the funds business, and American agency PayPal seemed to realize first-mover benefit by asserting that it will roll out cryptocurrency custody and cost companies on its extensively used platform.

American funding companies have additionally led the best way in permitting a wider viewers numerous methods to realize publicity to cryptocurrencies. None extra so than Grayscale Investments, which has a variety of cryptocurrency trusts which might be valued at over $33 billion so far. Its flagship Bitcoin Belief is presently valued at over $24 billion alone.

These elements are greater than sufficient at hand America one other gold medal within the Crypto Olympics within the race for institutional adoption.

Canada takes silver on this class as a result of its crypto-friendly regulation and its progressive ETF legal guidelines which have seen it overtake its North American neighbor in that regard. Thailand walks away with a bronze medal right here, as its oldest banking establishment, Siam Industrial Financial institution, has dedicated $110 million to speculate into the decentralized finance sector by its enterprise capital arm SCB 10X.

DNFs

Quite a few international locations fall into the disqualification class for his or her various stances on cryptocurrency and blockchain expertise.

In February 2021, Nigerians have been caught off guard because the nation’s central financial institution successfully barred native banks from servicing cryptocurrency exchanges. For a rustic that also ranks as primary for Google’s search of Bitcoin, the transfer was criticized each regionally and overseas. Nigeria’s Securities and Trade Fee had been growing crypto regulatory plans which have been suspended because of this.

India is one other nation that has a checkered previous in the case of its perspective towards the cryptocurrency area. The nation’s authorities has lengthy been threatening an outright ban on the usage of Bitcoin, however that is slowly altering with speak of asset classification offering correct regulatory frameworks and oversight for the burgeoning business.

India’s banking sector is nonetheless at odds with the cryptocurrency motion, with a few of the largest establishments reportedly cautioning clients about buying and utilizing cryptocurrencies. It’s clear that combined messages from India’s authorities and central financial institution in recent times have created a swathe of uncertainty that may solely be addressed by correct training in regards to the sector.

China’s current ban on cryptocurrency mining in several areas of the nation additionally sees it function on this disqualification class, because the transfer precipitated main disruptions within the mining ecosystem, forcing operators to shut up store and search for greener pastures overseas.

The Chinese language authorities additionally issued directives to native banks to not service companies concerned within the cryptocurrency business, which is trigger for better concern. Slicing off integration with the normal finance sector signifies that residents within the nation are robbed of the power to entry and use cryptocurrencies to their full potential.

Source link