The financial system is booming proper now. Few would argue with this truth.

However there are storm clouds on the horizon.

You may shut your eyes and attempt to ignore the longer term, however that gained’t change what’s coming.

What’s coming?

I don’t know. My crystal ball is damaged. (Ha ha ha. However this over-used citation is kind of true. Warren Buffett and Howard Marks affirm this.)

Right here’s what I do know.

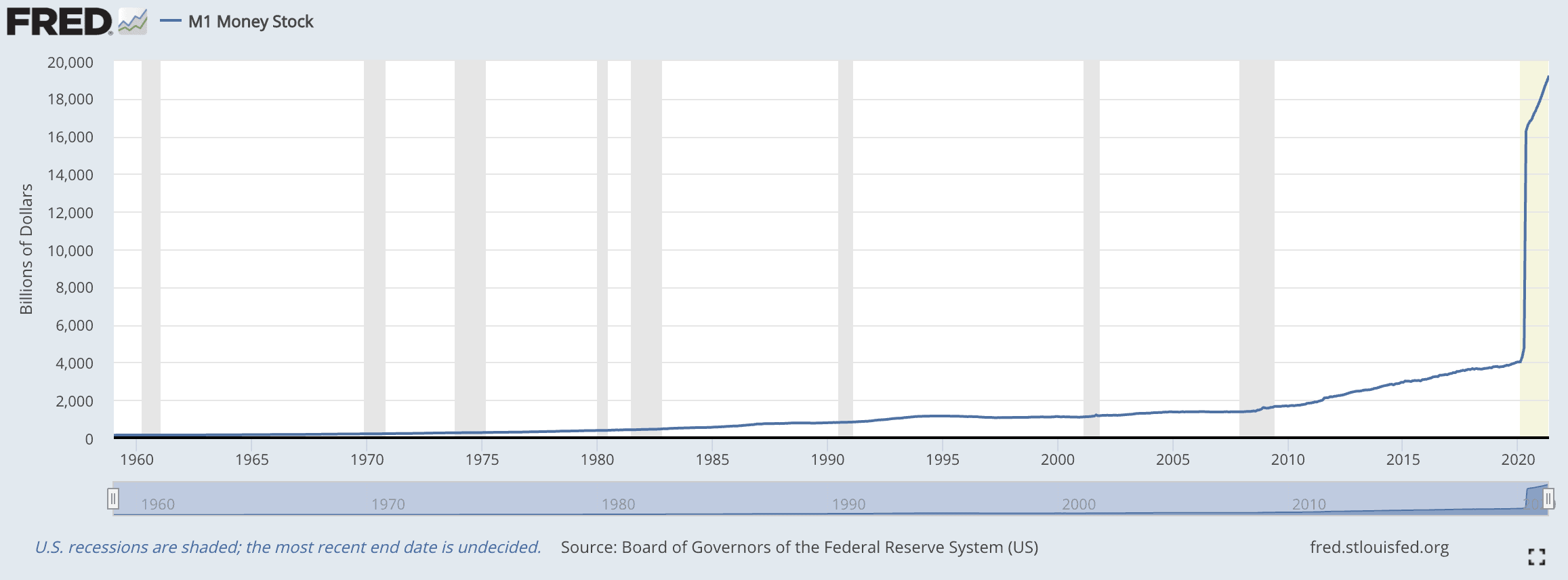

The Fed is printing money like there’s no tomorrow. (I hope that’s not literal.) See the chart from the St. Louis Fed beneath.

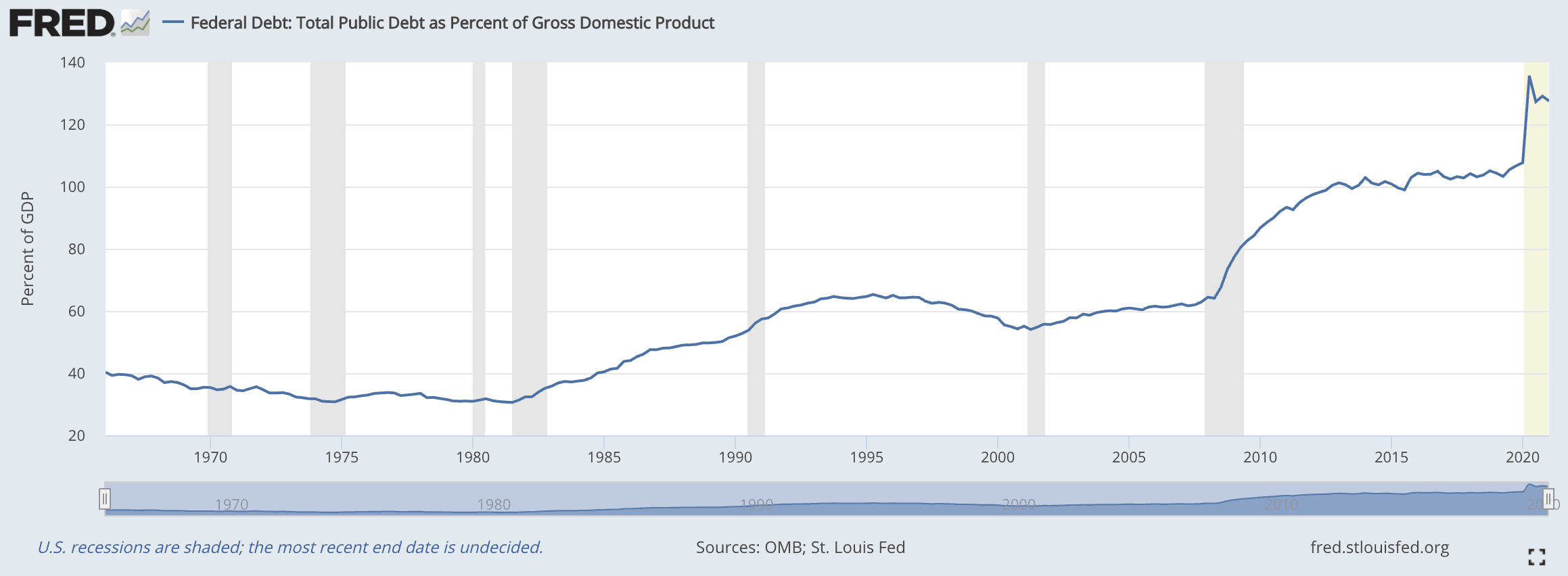

Inflation simply skyrocketed to about 2.5 instances the Fed’s focused charge in Might 2020. And U.S. debt as a share of GDP (Gross Home Product) is 2 to 4 instances its historic ranges. (See chart beneath. Ranges from 1966 to the tip of 2007 ranged from about 30% to about 65%. The Q1 2021 degree is over 127%.)

Let’s drill down on simply this final truth. Based on my astute pal and podcaster Jason Hartman, we’re in large hassle. Hartman reminds us that the federal government has not solely the debt-to-GDP downside but additionally a large albatross of unfunded liabilities (like social safety, Medicare, army safety, and different applications) totaling many instances our present debt.

Hartman says there are solely six methods for our authorities to get out of this gap.

- Default. Break its guarantees. Extremely unpopular and impossible.

- Increase taxes. Nope. They can’t elevate taxes sufficient to get out of this mess.

- Yard sale. The U.S. sells off its belongings to international international locations to boost capital. (Who would like to get their palms on our worldwide ports?)

- Steal. Begin a conflict. Take over different international locations or not less than their belongings. Napoleon did it, and maybe we must always, too. Or not.

- Innovate. Tech improvements in vitality, biotech, and nanotech pull us out of the mire.

- Inflate. Devalue our greenback by printing extra of it. That is virtually definitely the “finest” means out.

Take a look at the M1 cash provide chart above once more. It’s been stated that roughly 30% of all U.S. cash ever printed was produced since COVID-19 hit. This is likely one of the biggest elements of actual property investing, so I hope you’ll test that out.

However the financial and political turmoil in the USA can’t be inflated away by financial coverage alone. The issues are means too complicated at this level.

Extra on investing throughout a recession from BiggerPockets

What’s an investor to do?

Take a look at this infographic I discovered at Visible Capitalist. This text discusses how buyers can hedge in opposition to portfolio volatility.

Although it’s typically geared toward monetary planners and people who make the most of them, I really like how all three volatile-resistant classes describe actual property. Not less than the kind of actual property my group invests in. Test it out.

Actual property usually, and sure industrial actual property particularly…

- Has a low correlation to the market

- Is defensive or non-cyclical

- Generates money move

Let’s discuss every of those in slightly element.

Low correlation to the market

Who’s up for slightly quiz?

Query: What occurs to my funding portfolio worth when Elon Musk tweets a sad-face emoji?

Reply: It might crash and burn, if I’m steeped in cryptocurrency.

However what occurs to my actual property portfolio?

Zero. Zip. Nada.

My actual property consists of actual belongings with actual money move. It’s unconcerned about any superstar’s tweets or some other opinions.

And actual property resides in an inefficient market. That alone scares off a number of buyers. However this is likely one of the causes I really like actual property investing!

Are you able to get a deal on Bitcoin? Can you discover Apple inventory on sale? How a lot can you enhance the returns in your bond portfolio? Three questions with three now-familiar solutions: Zero. Zip. Nada.

However actual property is solely totally different. You will discover offers. You may sniff out inefficiencies that create huge upside potential. The illustrations are too quite a few to record right here, and I’ve written about this so much. Listed below are a couple of examples.

- I simply obtained off the cellphone with my pal and BP member Alex Jarbo. Alex is an actual property agent and investor in Asheville, North Carolina. He defined how he generates cash-on-cash returns of nicely over 50% yearly by constructing cabins to lease on Airbnb and VRBO. By designing and constructing these cabins, he can create much more income than shopping for an present cabin. (Although that might work too.) The inefficiencies of the actual property market enable him and his buyers to make returns like this.

- My son should purchase a bit of steep, landlocked mountain land and work out a number of methods to show a revenue on it. These could embody timber, billboards, cell towers, photo voltaic, carbon credit, and leases to hunters and farmers. And he can subdivide heaps to proprietor finance for a revenue. A few of these parcels sat available on the market for years with no purchaser.

- BP member AJ Osborne was on the BiggerPockets Podcast in the summertime of 2018. He defined how he acquired an outdated Tremendous Kmart, offered off the parking zone for flats, minimize the constructing in half, and turned it into a phenomenal self-storage facility. Whereas he was in a coma. He had about $2.5 million in money plus about $5 million in debt within the undertaking. He turned down a suggestion of $26 million for the property whereas it was nonetheless being leased up.

The inefficiency of actual property allowed for all these offers and lots of extra.

And actual property’s worth is just not tied to the temper on Wall Avenue, a rumored conflict within the Center East, or a CEO scandal. Actual property has a low correlation to Wall Avenue’s casinos.

Put together for a market shift

Modify your investing techniques—not solely to outlive an financial downturn, however to additionally thrive! Take any recession in stride and by no means be intimidated by a market shift once more with Recession-Proof Actual Property Investing.

Defensive or non-cyclical

Properly, I suppose it’s not all non-cyclical. However sure actual property belongings are considerably defensive and counter-cyclical.

Take into consideration long-term leases on Amazon sorting amenities or triple-net leases on CVS shops. Or 20-year cell tower leases.

Photo voltaic leases are sometimes 40 years and should have a built-in escalation clause. Who’s up for a wind farm on their land?

My agency invests in belongings that are typically counter-cyclical, like cell dwelling parks and self-storage amenities.

Self-storage revenues usually rise in troubled instances. The 4 D’s (divorce, dying, downsizing, and dislocation) drive elevated occupancy and income. Tenants are fairly sticky and don’t often go away over hire hikes.

Cellular dwelling parks have an identical stickiness to them. That is the one asset class I do know of that has growing demand and reducing provide yearly. And there’s a actual reasonably priced housing disaster. In powerful instances, those that can’t pay their cell dwelling lot hire (usually a fraction of condominium hire) have few different choices. They virtually all the time pay their hire.

Generates money move

Actual property is often not that liquid. However the tradeoff is a extra secure and predictable money move stream.

Take into consideration the definition of actual wealth. Actual wealth is proudly owning belongings that produce a money move stream. (Actual property does that so nicely.) I’d say an revenue stream, however revenue is a monetary idea. Revenue leads to taxes, and actual property buyers typically keep away from taxes for years on finish. In some instances, endlessly.

Have you ever studied Robert Kiyosaki’s money move quadrant? He teaches buyers to make use of cash to become profitable (quadrant I). He additionally explains the estimated tax brackets for every quadrant:

- E = Worker: ~ 40%

- S = Self-employed: ~ 60%

- B = Enterprise proprietor: ~ 20%

- I = Investor: ~ 0%

It’s a phenomenal factor

I’ve been a serial entrepreneur for many years. Earlier than that, I labored at Ford with an engineering diploma and an MBA. I began or was concerned in fairly a couple of companies earlier than I found actual property.

Now that I’m on this monitor, I can’t think about doing the rest. I solely want I’d have began sooner, for extra causes than I can record right here.

Howard Marks’s traditional “Mastering the Market Cycle” satisfied me there’ll all the time be ups and downs so long as people are concerned within the funding course of. So, we reside with a continuing expectation that markets will ultimately transfer in opposition to us. Our agency chooses asset lessons accordingly.

Our favourite recession-resistant investments are self-storage, cell dwelling parks, RV parks, and senior and assisted dwelling amenities. We additionally like a tiny chunk of actual property generally known as well-placed ATMs. However many different actual property lessons (multifamily, single-family, and extra) fall into these recession-resistant classifications, too.

Source link