It’s simple that Bitcoin (BTC) and Ether (ETH) are at present the 2 most dominant cryptocurrencies, and in consequence, they obtain a lot of the consideration from the mainstream media, institutional traders and retail traders, however this does not imply that the sector leaders should not sometimes challenged by competitor networks.

Two forked initiatives that when sought to problem Bitcoin and Ethereum for his or her seats on the high are Bitcoin Money (BCH) and Ethereum Traditional (ETC). Up to now week, each cash have demonstrated that they’re nonetheless able to producing pleasure and producing massive positive aspects.

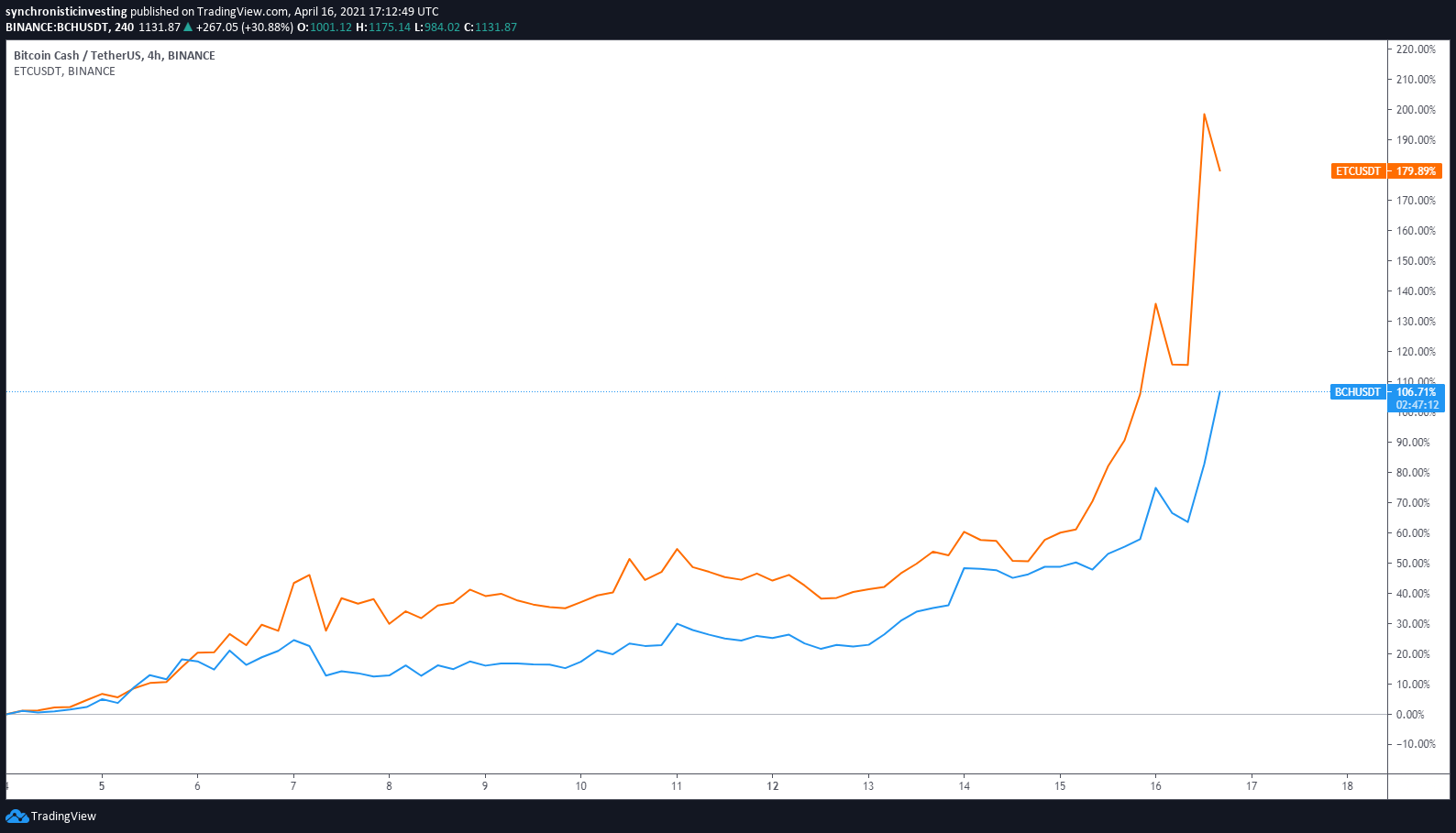

Knowledge from Cointelegraph Markets and TradingView reveals that the worth of BCH has climbed 125% over the previous two weeks, ring from a low of $523 on April 4 to a excessive of $1,175 on April 16. Throughout the identical time interval, ETC staged a 250% rally from $13.30 to a brand new all-time excessive at $46.53 on April 16.

BCH/USDT

Bitcoin Money arose out of competition within the Bitcoin neighborhood centered across the scalability of the Bitcoin blockchain and the need to extend the block dimension.

On account of the disagreement, a part of the neighborhood break up off and “forked” Bitcoin to create Bitcoin Money to be able to implement the specified code updates.

The protocol now goals to be a peer-to-peer digital money system able to getting used to conduct quick funds world wide with low charges, consumer privateness and a excessive transaction capability.

Momentum for Bitcoin Money started pickup up initially of April because the cryptocurrency market as a complete acquired elevated consideration from the mainstream media and monetary markets. One concept means that new traders search for older cash with decrease valuations as a place to begin as an alternative of chasing after Ether and Bitcoin, which can seem costly to new crypto merchants.

With Bitcoin now again above $61,000 and its hash fee hitting a document excessive of 200 exahashes per second, the highest cryptocurrency is out of attain for a lot of smaller traders and miners who could also be turning to BCH as a extra possible choice.

ETC/USDT

Ethererum Traditional emerged in 2016 as the results of a tough fork inside the Ethereum neighborhood following the hack of a well-liked platform referred to as The DAO. Initially, The DAO was an early decentralized autonomous group meant to behave as an investor-directed enterprise capital agency.

Ethereum Traditional is definitely the unique legacy chain of the Etherum community that didn’t take corrective measures to recuperate funds misplaced within the hack, an act take as a manner of sustaining the ethos of finality.

Whereas Ethereum has gone on to change into the broadly adopted model of the community, Ethereum has continued by itself path and is as soon as once more gaining consideration from the crypto neighborhood as excessive transaction prices and Ethereum’s transition to a proof-of-stake consensus has lifted ETC to new highs as customers search for appropriate choices.

The hash fee of the Ethereum Traditional community has steadily been climbing over the previous six months alongside the rising value of ETC, serving to to make the community extra engaging to miners and growing the general safety.

With a better value comes better block rewards, which then creates a bigger incentive for miners be part of community. This each will increase community safety and retains trustworthy miners pleased to take action. pic.twitter.com/Kkob0nvqht

— ETC Cooperative (@ETCCooperative) April 16, 2021

As extra contributors enter the crypto market in quest of good offers on established initiatives, legacy cash like BCH and ETC might presumably see additional value development.

The views and opinions expressed listed here are solely these of the writer and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer entails danger, and it is best to conduct your personal analysis when making a call.

Source link