Yearly when tax season rolls round, buyers rapidly turn into acquainted with capital positive aspects and losses. What’s a capital acquire or loss? Briefly, it’s the distinction between what you purchased an funding for and what you promote it for. If the result’s constructive, it’s a acquire. If the result’s detrimental, it’s a loss.

The implication of capital positive aspects and losses is basically associated to taxes. The belief of capital positive aspects or losses solely happens after you promote an asset, which triggers the taxable occasion. It’s in the very best curiosity of buyers to grasp how these positive aspects or losses have an effect on them financially, and methods to maximise positive aspects whereas minimizing losses.

Realizing Capital Positive factors and Losses

All portfolio positive aspects and losses are “unrealized” till the investor sells the asset. It is because exiting a place “locks in” the brand new worth. So long as you maintain an asset, it might proceed to achieve or lose worth relative to the unique worth paid. For that reason, positive aspects and losses aren’t capital positive aspects and losses till the sale of the asset, once they’re “realized.” Right here’s an instance:

Gustaf buys 100 shares of ABC Firm for $5 per share, for a complete funding of $500. After two years, the share worth is now $12 and Gustaf’s holdings are value $1,200. He has unrealized positive aspects of $700. He decides to comprehend these positive aspects and sells his whole holdings in ABC Firm. The sale triggers a taxable occasion for the $700 in now-realized positive aspects.

On this instance, the identical can be true if the share worth fell. As an alternative of locking in positive aspects, the investor would lock in a loss. The sale would nonetheless set off a taxable occasion, however as an alternative of paying capital positive aspects tax, there can be a capital loss offset. Extra on taxation under.

Quick-Time period vs. Lengthy-Time period Positive factors and Losses

Capital positive aspects and losses fall into certainly one of two classes: short-term or long-term. This distinction has implications for taxation, in addition to how they’re handled as investments:

- Quick-term capital positive aspects and losses are held for lower than one yr.

- Lengthy-term capital positive aspects and losses are held for a couple of yr.

This distinction is most vital for capital positive aspects, since tax charges differ for short- and long-term realized positive aspects.

How Are Capital Positive factors Taxed?

Realizing capital positive aspects means understanding how they’re taxed. Particularly, buyers want to concentrate on when they understand positive aspects. Quick- and long-term capital positive aspects face completely different tax charges.

Lengthy-Time period Capital Positive factors

Relying in your submitting standing, tax for long-term capital positive aspects can vary from 0% to twenty%. Right here’s a have a look at the efficient tax charges capital positive aspects (2021) primarily based on submitting standing and earnings:

| Submitting standing | 0% fee | 15% fee | 20% fee |

| Single | As much as $40,000 | $40,000 to $441,450 | +$441,450 |

| Head of family | As much as $53,600 | $53,600 to $469,050 | +$469,050 |

| Married submitting collectively | As much as $80,000 | $80,000 to $496,600 | +$496,600 |

| Married submitting individually | As much as $40,000 | $40,000 to $248,300 | +$248,300 |

Quick-Time period Capital Positive factors

Quick-term capital positive aspects face a lot greater tax charges than long-term positive aspects. They vary from 10% to 37% relying on submitting standing and earnings. Right here’s a have a look at efficient tax charges (2021):

| Submitting standing | 10% | 12% | 22% | 24% | 32% | 35% | 37% |

| Single | As much as $9,875 | $9,876 – $40,125 | $40,126 – $85,525 | $85,526 – $163,300 | $163,301 – $207,350 | $207,351 – $518,400 | +$518,400 |

| Head of family | As much as $14,100 | $14,101 – $53,700 | $53,701 – $85,500 | $85,501 – $163,300 | $163,301 – $207,350 | $207,351 – $518,400 | +$518,400 |

| Married submitting collectively | As much as $19,750 | $19,751 – $80,250 | $80,251 – $171,050 | $171,051 – $326,600 | $326,601 – $414,700 | $414,701 – $622,050 | +$622,050 |

| Married submitting individually | As much as $9,875 | $9,876 – $40,125 | $40,126 – $85,525 | $85,526 – $163,300 | $163,301 – $207,350 | $207,351 – $311,025 | +$311,025 |

State-Degree Capital Positive factors

Some states tax capital positive aspects, whereas others don’t. Traders have to be aware of the place they file their taxes relating to claiming capital positive aspects. It often is dependent upon how the state taxes earnings. States with no earnings taxes have a tendency to not tax capital positive aspects:

|

|

Internet Capital Achieve

When tax season comes round and buyers must report realized capital positive aspects and losses, the IRS issues itself with internet capital acquire. That is the sum complete of all capital positive aspects and losses realized through the earlier interval. That is to say that capital losses offset capital positive aspects. For instance:

Tom sells his stake in ABC Firm, which realizes $10,000 in capital positive aspects. He additionally sells his stake in XYZ Firm, which leads to a capital lack of $5,000. His internet capital acquire is $5,000.

In some circumstances, capital losses will truly outweigh capital positive aspects. Traders with detrimental internet capital acquire can use as much as $3,000 in losses a yr to offset bizarre earnings on federal earnings taxes—and carry over the remainder ahead.

The Backside Line on Capital Positive factors and Losses

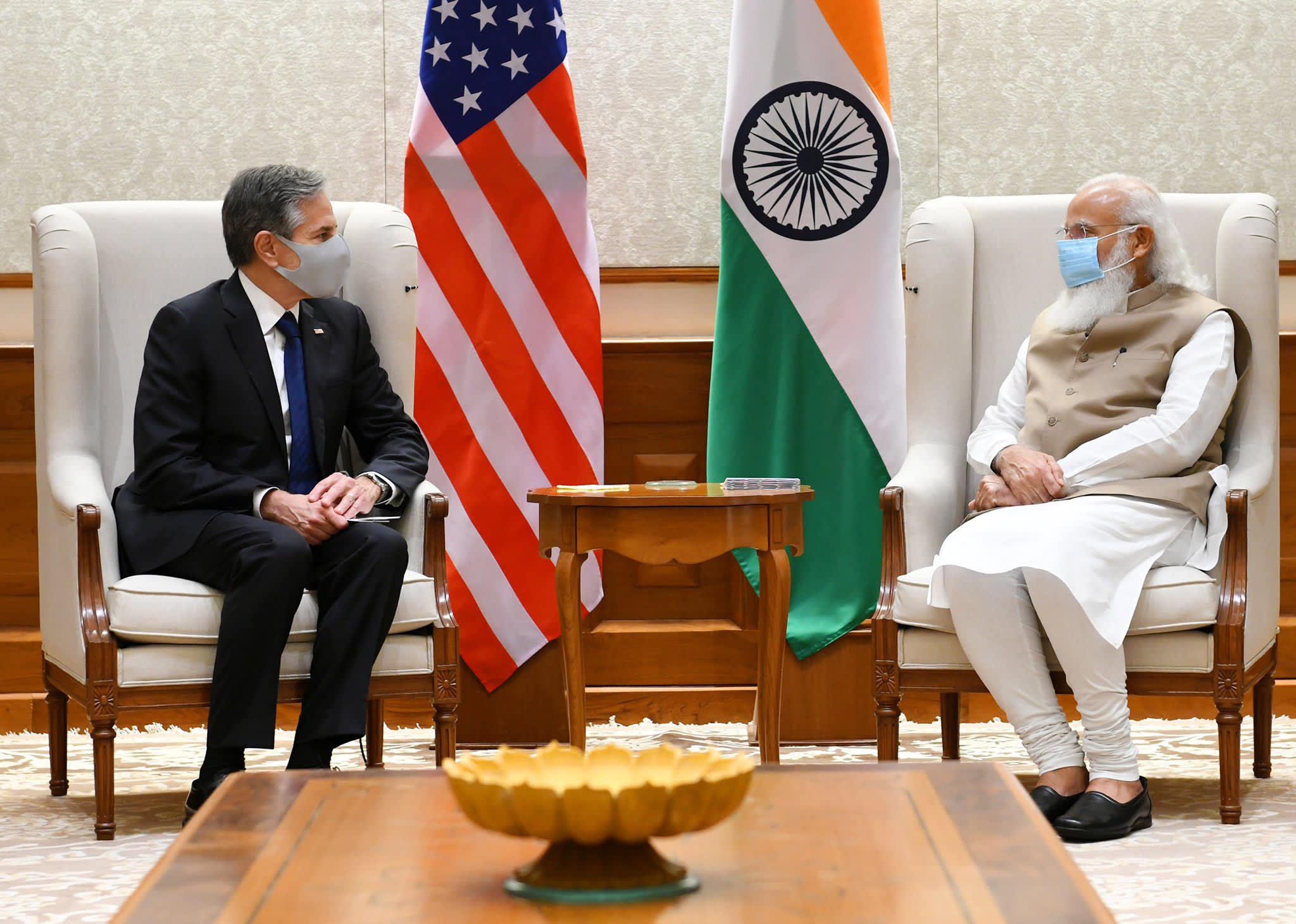

Each investor will face the prospect of capital positive aspects and losses—it’s essential to understand them ultimately! The perfect factor any investor can do is to grasp the tax implications of a taxable occasion. What’s your internet capital acquire? Are your positive aspects short- or long-term? What tax bracket do you fall into? Do you reside in a state with earnings tax? Is there a chance to offset capital positive aspects with capital losses? Perceive these implications earlier than you exit a place and understand the capital positive aspects or losses. That is much more vital for retirees as a result of your investments are very important to your day by day wants. To be taught how one can maximize your funding alternatives in retirement, join the Rich Retirement e-letter under!

Source link