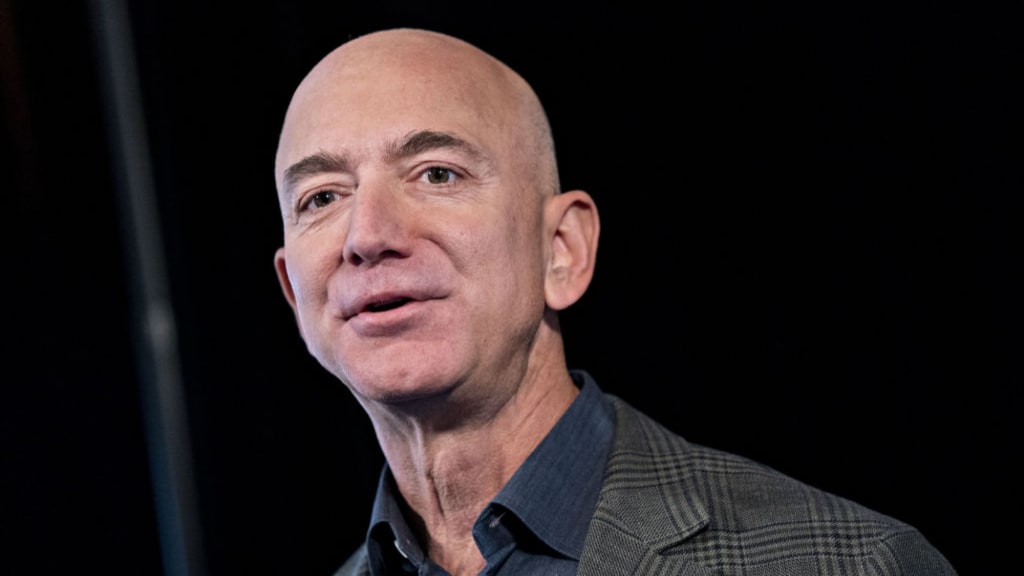

arren Buffett faces a showdown this weekend with greater than 1.6 million peculiar savers over his firm’s failure to offer even primary details about its environmental influence and the dangers it faces from the local weather disaster.

The world’s most well-known investor has amassed a $102bn fortune whereas espousing the advantages of considering long-term. But, on the most important challenge dealing with the planet, Buffett seems to be uniquely short-sighted.

Over six many years Buffett – who’s now 90 years previous – has constructed Berkshire Hathaway right into a sprawling conglomerate of corporations price $670bn and promoting every little thing from batteries and power to insurance coverage. Of 60 totally different corporations within the group, simply 15 have printed sustainability info.

The guardian firm refuses to make any climate-related disclosures – thought of to be the naked minimal that companies needs to be doing on the difficulty.

Most controversially, Berkshire Hathaway maintains vital investments in coal-fired energy, a serious contributor to the local weather disaster.

Now the corporate’s shareholders, together with the most important public pension fund within the US, are flexing their muscle tissue and taking motion in a bid to power Buffett’s hand.

The California Public Staff Retirement System (CalPERS), EOS Federated Hermes, and Caisse de dépôt et placement du Québec (CDPQ) have tabled a decision to make the corporate report on local weather dangers.

It pits peculiar pension savers towards one of many richest males on this planet. If the decision will get sufficient votes from firm shareholders, Berkshire should take motion, in what could be a big victory for shareholder energy.

Even when it doesn’t go, a giant vote in favour by institutional traders would ship a robust sign to the market that Berkshire must cease ignoring local weather change.

Each shareholder wants to understand which you could purchase, promote or maintain your shares however you too can vote and each vote issues, it’s simply that easy

Tim Youmans, head of engagement for EOS Federated Hermes

Berkshire’s board has flatly rejected the plan, urging shareholders to vote towards it and claiming that it could not be sensible to implement as a result of the group is “unusually decentralised”.

Tim Youmans, head of engagement at EOS, who tabled the decision, says Buffett’s firm’s method is “utterly inadequate”.

“They’ve carried out nothing on the guardian firm degree,” says Youmans.

Berkshire is one among solely a handful of corporations to attain zero out of 10 for its local weather disclosures on a benchmark designed by Local weather Motion 100+, an initiative to carry companies to account on emissions.

On Saturday, at Berkshire’s annual basic assembly, Youmans will get up and make the case for change on behalf of traders.

It will likely be a tall order to assemble the votes wanted as a result of Buffett holds nearly a 3rd of the voting rights, however Youmans stays assured.

EOS is likely one of the main voices speaking to firm boards and inspiring them to take motion on points like local weather change, range and governance.

With a staggering $1.2 trillion belongings beneath recommendation, EOS has critical clout. When Youmans and his colleagues make their level to corporations’ boards, they have a tendency to pay attention.

EOS has had notable successes towards a number of the greatest carbon emitters on the planet. In 2019 it helped to influence BP to reveal way more info on climate-related dangers.

The corporate determined to help the proposal which was backed by 99 per cent of shareholders.

“BP has now gone past that and adjusted their entire technique,” says Youmans, referring to plans laid out by the oil big final 12 months to slash its funding in fossil fuels over the following decade.

“We consider it’s shareholder energy writ giant and EOS, in a small approach, had one thing to do with that.”

Buffett has been a lot much less keen to interact, nevertheless.

“Sadly we’ve been making an attempt to speak to Berkshire Hathaway for 3 years and now we have had no dialogue with the guardian firm in that point,” Youmans says.

“In truth, most just lately Warren Buffett, via his company secretary, wrote to inform me he had little interest in speaking to me.”

Each shareholder wants to understand which you could purchase, promote or maintain your shares however you too can vote and each vote issues, it’s simply that easy. The democratisation of capitalism is critically essential

Tim Youmans

What’s clear is that Buffett is changing into an more and more lonely determine in his stance on the local weather disaster. Over 1,400 corporations have supported a worldwide initiative to reveal info on local weather dangers.

Local weather Motion 100+ studies that the initiative, run by the Process Pressure on Local weather-Associated Monetary Disclosures, is supported by 59 of the 167 corporations it recognized because the world’s largest greenhouse gas-emitting corporations.

This public info is essential because it allows traders to make knowledgeable selections about the place to place their cash.

Stress is rising because the monetary dangers posed by local weather change ramp up alongside the environmental ones.

Pension funds and asset managers have an obligation to the folks whose cash they handle to make sure that corporations are doing what they’ll to halt the local weather disaster, notably as a result of many funds make investments for the long-term.

Youmans is optimistic in regards to the influence that anybody can have via their possession rights in an organization, irrespective of how small their shareholding.

“I actually suppose that shareholders exercising their rights and voting, mixed with public opinion, can transfer the needle,” he says.

“Each shareholder wants to understand which you could purchase, promote or maintain your shares however you too can vote and each vote issues, it’s simply that easy. The democratisation of capitalism is critically essential.”

Berkshire Hathaway stated in an announcement: “The Board recognises the significance of responsibly managing climate-related dangers to each shareholders and the way forward for Berkshire and its working companies.

“The Board usually receives studies on the key dangers and alternatives of the working corporations, together with these associated to local weather, and discusses these dangers and alternatives ”

Source link