11:00

10:33

10:21

10:02

Jet2 to droop all flights and holidays as much as 23 June

09:47

Mike Ashley’s Frasers expects one other £100m hit from pandemic

Frasers Group, which incorporates Sports activities Direct, Home of Fraser and Flannels, has doubled the hit it expects to take from the coronavirus pandemic to £200m within the expectation {that a} third wave will result in extra restrictions on retailers.

The retail chain, managed by the Sports activities Direct founder, Mike Ashley, had estimated in February that the affect of the Covid-19 disaster would result in a £100m non-cash writedown within the worth of its properties and different property.

“Additional restrictions are in our view virtually sure,” it mentioned on Friday.

You’ll be able to learn the total story right here:

09:40

09:34

09:10

08:43

UK home costs at new report to mark yr since first lockdown

08:32

08:23

Sanjeev Gupta criticises financial institution ‘endangering hundreds of jobs’

08:13

07:53

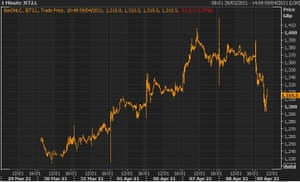

Introduction: Inventory markets in Goldilocks temper

Source link