Good morning, and welcome to our rolling protection of the world financial system, the monetary markets, the eurozone and enterprise.

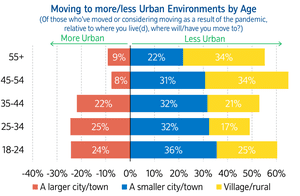

The UK housing growth continues to run, with home worth inflation accelerating once more because the pandemic spurs folks to maneuver to bigger properties in additional rural areas.

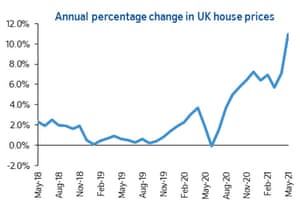

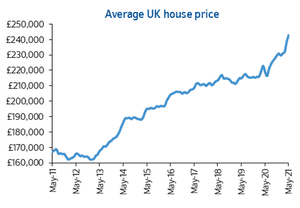

Figures launched by Nationwide this morning present that annual home worth development jumped to 10.9% in Could, up from 7.1%/12 months in April, pushing the brand new common worth to a brand new peak.

It says:

- Annual home worth development rises to 10.9%, the very best stage in almost seven years

- Costs up 1.8% month-on-month, following a 2.3% rise in April

- New document common worth of £242,832, up £23,930 over the previous twelve months

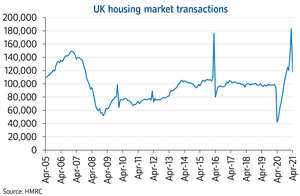

Robert Gardner, Nationwide’s chief economist, says the housing market has seen a “full turnaround over the previous twelve months” for the reason that first lockdown briefly froze the market, with transactions reaching a document excessive of 183,000 in March:

Gardner provides that Nationwide’s analysis exhibits that stress for more room, or a backyard, is the first issue driving the market this spring.

“Amongst householders surveyed on the finish of April that had been both transferring dwelling or contemplating a transfer, greater than two thirds (68%) mentioned this could have been the case even when the stamp obligation vacation had not been prolonged.

It’s shifting housing preferences which is constant to drive exercise, with folks reassessing their wants within the wake of the pandemic.

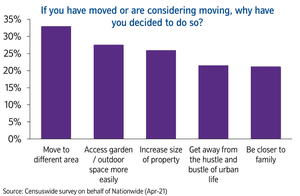

Nationwide says the ‘race for area’ continues to drive demand. Of these transferring or contemplating a transfer, round a 3rd (33%) had been seeking to transfer to a distinct space, whereas almost 30% had been doing so to entry a backyard or outside area extra simply, in keeping with a web-based survey of customers.

Gardner provides:

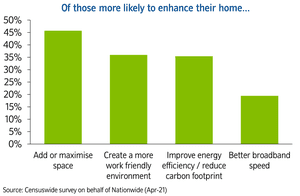

“Over a 3rd (36%) of these surveyed mentioned they had been extra prone to think about enhancing their dwelling because of Covid19, with almost half (46%) of those trying so as to add or maximise area.

Sooner broadband was one other issue, with the transfer to dwelling working and residential education throughout lockdown displaying the worth of internet connection.

Nationwide’s outcomes will curiosity the Financial institution of England, which is rigorously monitoring Britain’s booming housing market because it weighs up the likelihood {that a} fast restoration from the Covid-19 pandemic will result in a sustained interval of inflation.

In an interview with the Guardian at the moment, deputy governor Sir Dave Ramsden mentioned the Financial institution anticipated worth pressures to be short-term however he and his colleagues on Threadneedle Road’s financial coverage committee had been conscious of the dangers.

Ramsden, the deputy governor chargeable for markets and banking, mentioned:

“There’s a threat that demand will get forward of provide and that can result in a extra generalised pick-up in inflationary stress. That’s one thing we’re completely going to protect towards. We’re trying rigorously on the housing market and a raft of real-term indicators.”

Additionally arising at the moment

Surveys of manufacturing unit buying managers within the eurozone, UK and US are anticipated to indicate sturdy development final month, and squeezed provide chains pushing up costs.

Oil ministers from the Opec+ group will maintain a video name at the moment to evaluate the most recent developments within the international markets.

They’re anticipated to stay to the present tempo of regularly easing oil provide curbs, as demand picks up — which has already pushed UK petrol costs up for six months in a row. Crude costs have risen in a single day, with Brent crude rising over $70 per barrel.

The agenda

- Right this moment: OPEC and non-OPEC ministers Ministerial Assembly

- 9am BST: Eurozone manufacturing PMI for Could

- 9.30am BST: UK manufacturing PMI for Could

- 10am BST: Flash studying of eurozone inflation in Could

- 1.30pm BST: Canada’s Q1 GDP report

- 3pm BST: US manufacturing PMI for Could

Source link