Good morning, and welcome to our rolling protection of the world economic system, the monetary markets, the eurozone and enterprise.

UK authorities borrowing dropped final month, because the reopening of the economic system helped to enhance the general public funds, with extra corporations reopening and other people returning to work.

The Workplace for Nationwide Statistics experiences that public sector internet borrowing got here in at £24.3bn in Might (that is excluding public sector banks).

That’s £19.4bn lower than a yr in the past, when the federal government needed to borrow round £43.8bn because it ramped up spending to combat the pandemic, and the economic system was in lockdown.

It signifies that the easing of lockdown restrictions, and the reopening of hospitality venues and non-essential retailers this spring, is now feeding by means of to the general public funds.

It’s additionally the second-highest borrowing figures for the month of Might on document.

Fraser Munro

(@Fraser_ONS_PSF)The UK public sector borrowed (PSNB ex) £24.3 bn in Might, £19.4 bn lower than in Might 2020 however nonetheless £18.9 bn greater than in Might 2019. Borrowing makes up the shortfall between spending by the federal government and pub sector orgs and its earnings akin to taxes. https://t.co/xDUNgifkZz pic.twitter.com/TgAAkqolDY

The ONS experiences that tax receipts rose in comparison with a yr in the past, whereas authorities spending dipped:

- Provisional Might 2021 estimates of central authorities receipts have been £56.9 billion, £7.5 billion greater than in Might 2020, whereas central authorities our bodies spent £81.8 billion, £10.9 billion lower than in Might 2020.

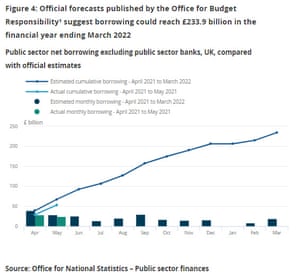

Within the first two months of this monetary yr, the UK has borrowed £53.4bn. That’s the second borrowing for April-Might on document (after final yr), however nonetheless 41.4% much less (or £37.7bn) than a yr in the past.

Encouragingly for the chancellor, that is beneath the official forecasts for borrowing this yr from the Workplace for Funds Duty, as this chart exhibits:

Michal Stelmach, senior economist at KPMG UK, says:

The discount in spending from its peak firstly of the Covid-19 pandemic meant that authorities borrowing was down by £38bn within the first two months in comparison with final yr, amounting to over a half of the advance forecast by the OBR for the entire yr.

“It ought to come as no shock that borrowing has fared higher than anticipated this yr contemplating the improved financial outlook. We count on the deficit to fall to £211bn this fiscal yr, undershooting the OBR’s forecast by round £23bn.

“Spending ought to proceed to get well within the coming months because the economic system absorbs extra furloughed staff throughout the reopening part. The furlough scheme, which the OBR anticipated to price almost £50bn much less this monetary yr, is more likely to undershoot that forecast due to stronger demand for employees and a few firms returning unused money to the Exchequer.”

Workplace for Nationwide Statistics (ONS)

(@ONS)Borrowing final monetary yr was at its highest as a share of GDP since 1946, although it was increased throughout each World Wars https://t.co/wmF7QSA718 pic.twitter.com/Nad9fmmeeC

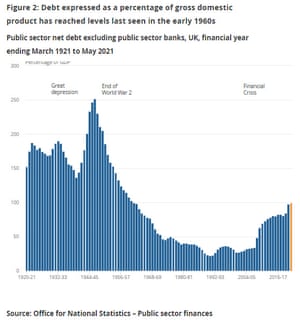

The nationwide debt is at its highest degree because the early Nineteen Sixties.

Public sector internet debt has now risen to £2,195.8 billion on the finish of Might 2021 or round 99.2% of GDP — that’s the very best ratio because the 99.5% recorded in March 1962.

Response to observe…

European markets are set for the next open, after rising yesterday.

IGSquawk

(@IGSquawk)European Opening Calls:#FTSE 7087 +0.36%#DAX 15650 +0.30%#CAC 6630 +0.41%#AEX 727 +0.38%#MIB 25502 +0.41%#IBEX 9080 +0.32%#OMX 2276 +0.44%#STOXX 4129 +0.40%#IGOpeningCall

The agenda

- 7am BST: Public Sector Web Borrowing for Might

- 11am BST: CBI Industrial Developments survey for June

- 3pm BST: Eurozone client confidence flash survey for June

- 3pm BST: US current house gross sales for Might

Source link