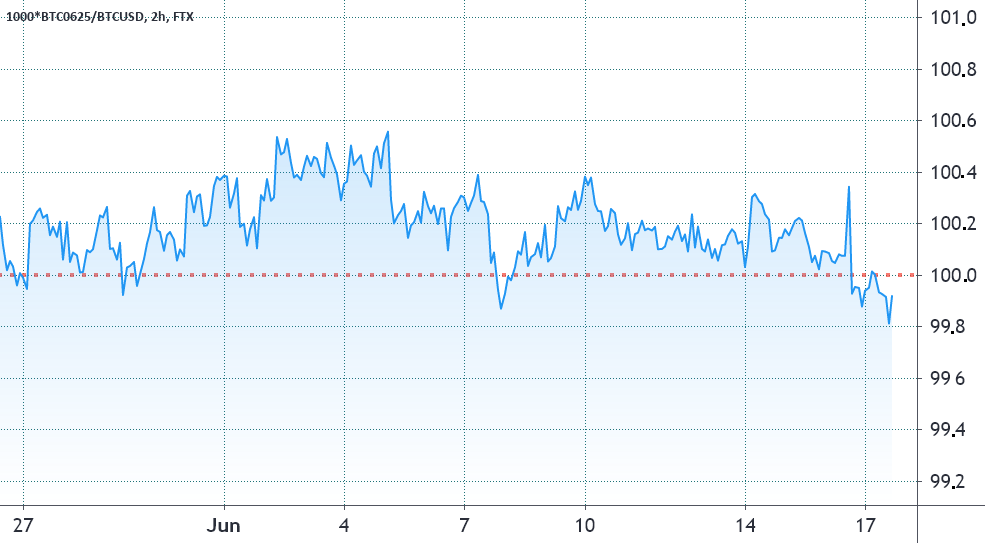

An uncommon phenomenon referred to as ‘backwardation’ is happening in Bitcoin (BTC) futures buying and selling, primarily the June contract, which expires on June 25.

The fixed-month contracts normally commerce at a slight premium, indicating that sellers request extra money to withhold settlement longer. Futures also needs to commerce at a 5% to fifteen% annualized premium on wholesome markets, according to the stablecoin lending fee. This example is named contango and isn’t unique to crypto markets.

Every time this indicator fades or turns damaging, that is an alarming crimson flag. This example is named backwardation and signifies a bearish sentiment.

As displayed above, a wholesome 0.1% to 0.5% premium befell for many of the earlier three weeks. That is equal to a 2% to 9% annualized fee, due to this fact oscillating between barely bearish and impartial.

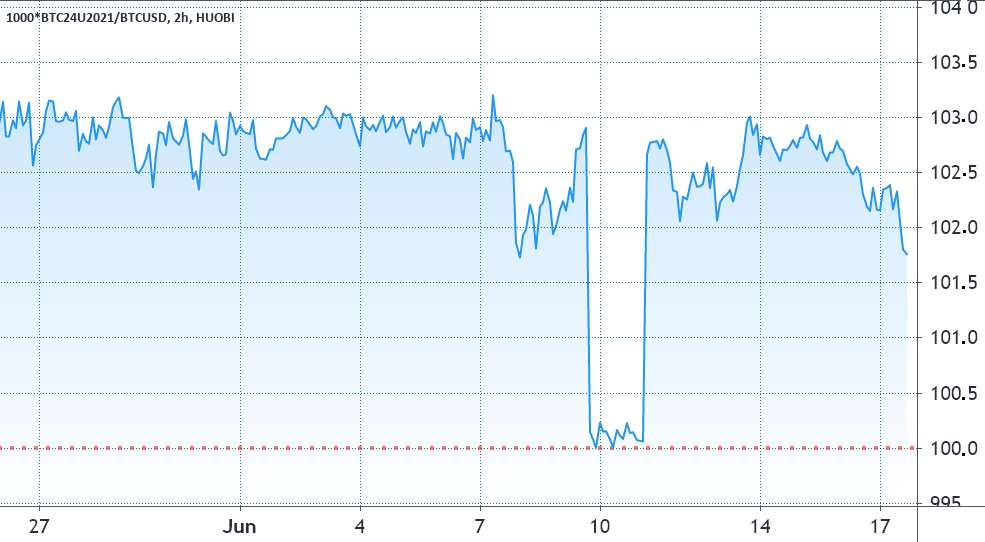

When quick sellers use extreme leverage, the indicator will flip damaging, which has been the case on June 17. Nonetheless, contemplating there is just one week left for the June expiry, merchants ought to use longer-term contracts to verify this state of affairs. Because the contract approaches its ultimate buying and selling date, merchants are compelled to roll over their positions, thus inflicting exaggerated actions.

The September futures have displayed a 1.7% or larger premium versus spot markets, a 7% annualized foundation. This means a scarcity of urge for food from longs, however far sufficient from backwardation.

Associated: This is how execs safely commerce Bitcoin whereas it vary trades close to $40K

What’s actually happening?

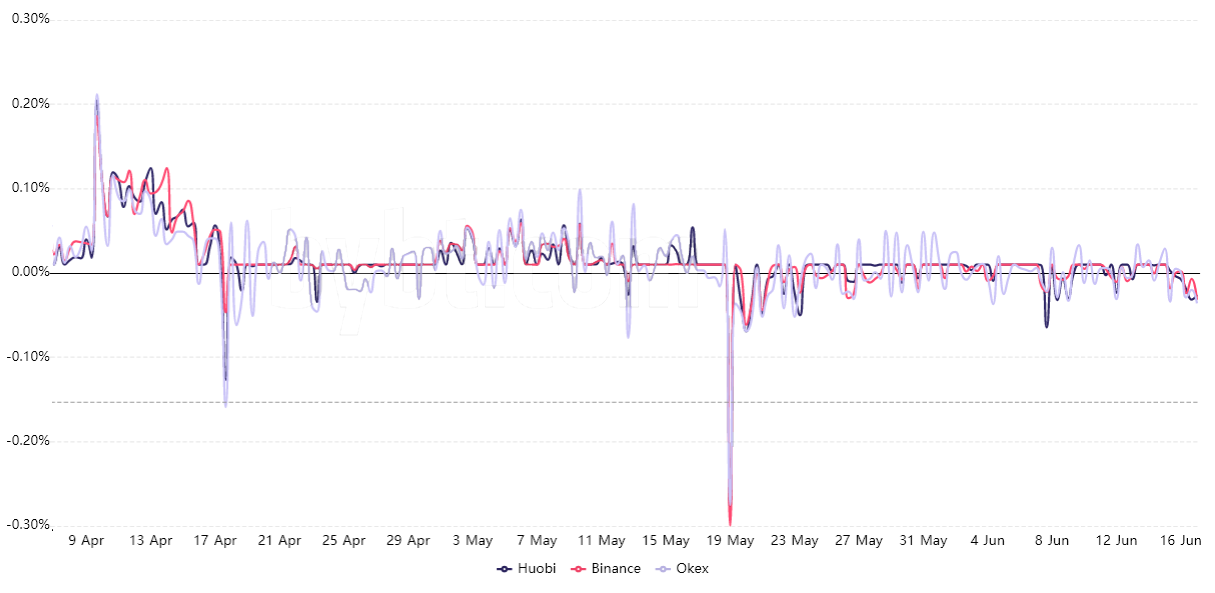

The ultimate piece of the puzzle is the funding fee on perpetual contracts, that are retail merchants’ most popular instrument. Not like month-to-month contracts, perpetual futures costs (inverse swaps) commerce at a really comparable worth to common spot exchanges.

This situation makes retail merchants’ lives lots simpler as they not must calculate the futures premium or manually roll over positions nearing expiry.

The funding fee is mechanically charged each eight hours from longs (consumers) when demanding extra leverage. Nonetheless, when the scenario is reversed, and shorts (sellers) are over-leveraged, the funding fee turns damaging and so they develop into those paying the payment.

Since Could 24, the funding fee has been oscillating between optimistic 0.03% and damaging 0.05% per 8-hour. Thus, on essentially the most “bearish” moments, shorts had been paying 1% per week to keep up their positions.

Compared, on April 13, longs had been paying 0.12% per 8-hour, which is equal to 2.5% per week.

Whereas many merchants level to backwardation as a bearish sign, there’s at the moment no signal of extreme leverage from shorts. Because of this, the absence of consumers’ curiosity for the June contract doesn’t precisely replicate the general market sentiment. If merchants had successfully been bearish, each the longer-term futures and perpetual contracts could be displaying this development.

The views and opinions expressed listed here are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer entails threat. It’s best to conduct your personal analysis when making a choice.

Source link