Companies linked to members of Congress obtained tens of millions in Paycheck Safety Program (PPP) loans, in response to CREW’s evaluation of new information launched by the Small Enterprise Administration. Most of the lawmakers who benefited from PPP loans opposed laws to make this system extra clear.

Among the many PPP beneficiaries was Rep. Vern Buchanan (R-FL), one of many prime ten wealthiest members of Congress as of 2018. His automotive dealerships in Florida and North Carolina–Sarasota 500 and Nissan of Elizabeth Metropolis–obtained between $2 and 6 million in PPP loans. Buchanan has reported pursuits within the Florida and North Carolina dealerships, which he valued at exceeding $50 million and between $1 and $5 million, respectively.

One other considered one of Congress’s wealthiest members, Rep. Roger Williams (R-TX), benefitted from a PPP mortgage valued between $1 and a couple of million for his automotive dealership in Texas. Williams is the Sole Director and President of the corporate that obtained the mortgage, JRW Company, which is valued at $50 million, in response to his newest monetary disclosure. Williams beforehand acknowledged receiving a PPP mortgage, however declined to specify the quantity.

www.citizensforethics.org/reports-investigations/crew-investigations/members-of-congress-ppp-transparency/

The Florida Democratic Get together is returning $780,000 it obtained by way of the federal Paycheck Safety Program after enduring criticism from state Democrats and Republicans alike for taking the small enterprise loans.

In a press release, Florida Democratic Get together spokesperson Luisana Pérez Fernández mentioned Congress handed the PPP “to assist employers and their efforts to offer funds to maintain folks working — and like many employers in the course of the shutdown, FDP was involved about assembly payroll and retaining our employees employed, so we utilized. The financial institution, the mortgage processor and brokers of the Small Enterprise Affiliation permitted the funding.”

However Pérez Fernández added that the SBA “made a mistake in approving the funding, so we’re volunteering to return it.”

In keeping with Politico, the celebration utilized for the mortgage in March, proper after Congress handed the $670 billion PPP initiative, “despite the fact that there was dialogue on the time that the cash ought to go to neither lobbyists nor political causes.”

www.orlandosentinel.com/politics/2020-election/os-ne-florida-democrats-return-ppp-loan-20200709-sw6pnajgb5e35dged7p6icp47m-story.html

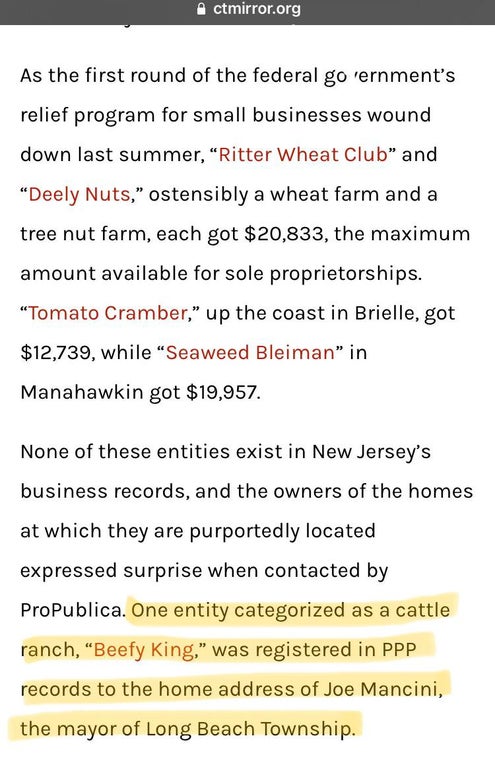

Greater than a 12 months after the pandemic introduced a lot of the financial system to a standstill, mounting fraud instances underscore how the Small Enterprise Administration’s (SBA) oversight of its huge taxpayer-backed lending applications proved to be insufficient as they turned magnets for fraudsters.

The Justice Division has introduced legal fees towards not less than 209 people in 119 instances associated to Paycheck Safety Program (PPP) fraud since banks and different lenders started processing mortgage functions on behalf of the Small Enterprise Administration on April 3, 2020. And these instances are just the start.

www.pogo.org/investigation/2021/04/red-flags-the-first-year-of-covid-19-loan-fraud-cases/

h/t roylennigan

182 views

Source link