by Charles Hugh-Smith

It’s all so pathetic, isn’t it? The one approach left to get forward in America is to leverage up the riskiest gambles.

It’s painfully apparent that the one approach left to get forward in America is crazy-risky hypothesis, however no one appears to even discover this stark and gorgeous actuality. Why are individuals piling into crazy-risky bets on speculative automobiles like Gamestop and Dogecoin? The plain reply is as a result of others have reaped a decade or two of wages in just a few weeks, and skimming a pair hundred thousand {dollars} in just a few weeks or months is the one approach a median wage earner goes to have the ability to purchase a home, fund a retirement account, afford to have a household, and many others.

Take a look at the truth of wage stagnation: I made $12 an hour in 1986, and I wasn’t some extremely paid techno-guru or Wall Road shill. $12 an hour was an OK wage in 1986 but it surely wasn’t incredible. Now 35 years later, $12 continues to be an OK wage. Lots of people make lower than $12/hour.

However what occurred to the price of healthcare, housing, childcare and every thing else required to have a household in these 35 years? These prices have exploded larger. It was already a stretch to purchase a home in 1986 making $12/hour, however now–are you joking? Relying on the area, the price of a modest home has tripled or gone up five-fold and even ten-fold previously 35 years.

As for getting forward by beginning your individual enterprise–that’s one other bitter joke. In 1986 I used to be in a position to present our single workers respectable healthcare insurance coverage for $50 every and people with households for about $150 per 30 days. Our workers didn’t pay a dime for this protection. We (the employers) paid all of the healthcare insurance coverage prices in addition to employees compensation, legal responsibility insurance coverage and unemployment insurance coverage (federal and state).

In keeping with the Bureau of Labor Statistics (BLS), the patron value index (CPI) has risen such that what $1 purchased in 1986 now prices $2.40. Attempt shopping for actual healthcare insurance coverage for an worker right now for $50 X 2.4 = $120 per 30 days. The CPI is a pathetic joke in the case of housing, childcare, healthcare, larger training and all the opposite big-ticket bills of getting a household.

All of the bills of working a enterprise have soared at the same time as legal responsibility publicity, compliance prices and junk charges have skyrocketed. And by definition, you’re “wealthy,” even for those who’re dropping cash, since you’re a enterprise proprietor, so there’s a tax goal in your again as state and native governments jack up junk charges, penalties, fines and taxes on every thing that isn’t already overtaxed.

As for getting a graduate diploma to position your self above the competitors–credential inflation is even worse than value inflation. There are 100 different equally credentialed candidates for each high-paying slot, and for those who (foolishly) settle for the big-bucks job, your life outdoors of labor is over. You’re primarily a well-compensated indentured servant of your Company America masters.

And now that you simply’re “wealthy,” you’re additionally a Tax Donkey, paying between 40% and 50% of your earnings in taxes. The billionaires and their firms pay little or nothing, as they’ve received the tax dodges (philanthro-capitalist foundations, offshore tax gimmicks, subsidies enacted by cheaply-bought politicians, and many others.), however you, indentured servant of Company America–you’re “wealthy” and may pay extra.

So please work tougher and make much more earnings, and for those who’re fortunate we’ll allow you to maintain a slice of the upper earnings. However possibly not, as a result of, nicely, you’re “wealthy.” You don’t personal something and might barely afford a household, however you’re “wealthy” by way of earnings, and that’s what counts.

And so the final finest hope for the non-elite workforce with out the privileges of a rich well-connected household is to play the riskiest tables within the Federal Reserve’s on line casino, maxing out margin (borrowing cash towards one’s inventory portfolio) and shopping for choices, which expire nugatory if the wager goes south.

As a result of the truth of American life is the methods to get forward are all the way down to: 1) select rich mother and father 2) win the lottery 3) observe the FIRE path (monetary independence, retire early) which requires a high-paying job and super-low bills, 4) be a part of a buddy’s software program start-up that will get purchased by Microsoft, Google, Apple or Fb for mega-millions, or 5) gamble and win on the Fed on line casino’s riskiest tables.

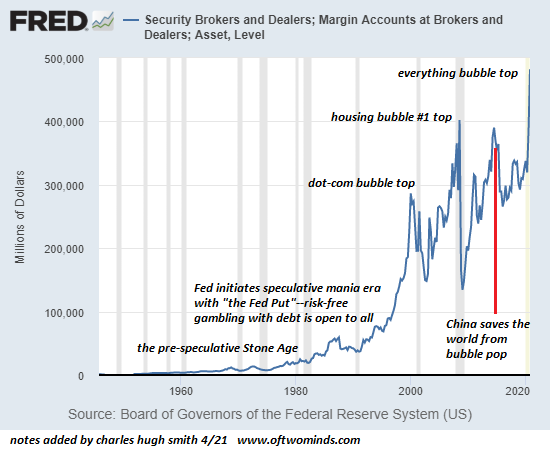

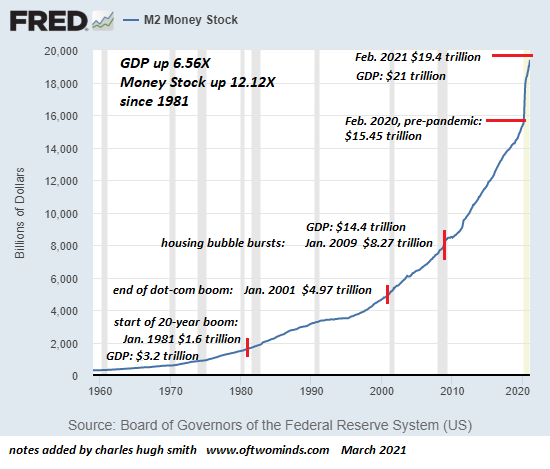

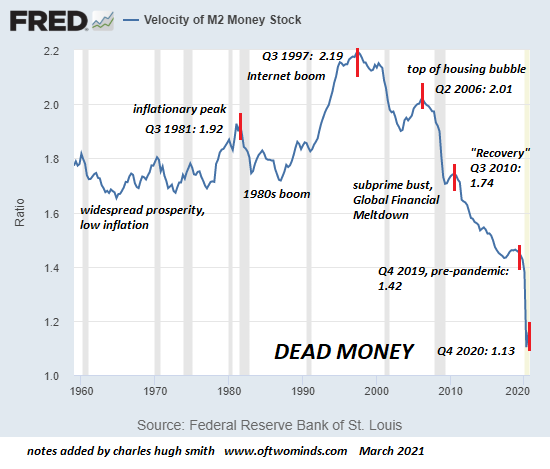

Check out three charts: margin debt (all-time excessive), M2 cash provide (all-time excessive), and cash velocity (all-time low). The Fed creates trillions of {dollars} out of skinny air which flows into speculative asset bubbles, punters with no different real looking choices to get forward max out their margin accounts to spice up their bets on the riskiest tables and in the meantime, again in the actual economic system, stagnation reins supreme: stagnant wages, stagnant household / family formation, stagnant enterprise formation and the rate of cash is in a free-fall to useless cash.

It’s all so pathetic, isn’t it? The one approach left to get forward in America is to leverage up the riskiest gambles on the riskiest tables, betting that everybody will likely be a winner on the Fed’s rigged tables–however it’s important to play to win.

Or lose, however no one mentions that. All you’ll hear within the Fed’s on line casino is the Fed has our again, till your entire on line casino collapses in a putrid heap of fraud, corruption, greed, systemic danger and hubris.

When you discovered worth on this content material, please be a part of me in looking for options by turning into a $1/month patron of my work through patreon.com.

My new ebook is out there! A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet 20% and 15% reductions (Kindle $7, print $17, audiobook now obtainable $17.46)

Learn excerpts of the ebook without cost (PDF).

The Story Behind the E-book and the Introduction.

Latest Podcasts:

AxisOfEasy Salon 41: Can’t get you out of my head (58 min)

Disconnects between the Economic system and the Monetary Markets (FRA Roundtable, 41 min)

My COVID-19 Pandemic Posts

My latest books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Learn the primary part without cost (PDF).

Will You Be Richer or Poorer?: Revenue, Energy, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Learn the primary part without cost (PDF).

Pathfinding our Future: Stopping the Closing Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Learn the primary part without cost (PDF).

The Adventures of the Consulting Thinker: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); learn the primary chapters without cost (PDF)

Cash and Work Unchained $6.95 (Kindle), $15 (print) Learn the primary part without cost (PDF).

Develop into a $1/month patron of my work through patreon.com.

292 views

Source link