Whereas writing the world’s most well-known white paper, Satoshi Nakamoto outlined the Bitcoin (BTC) mining course of. It was established that the minting of latest cash would happen by means of proof-of-work. To hold out this verification and to have the ability to mine the cryptocurrency, computer systems would wish to unravel complicated mathematical calculations.

To start with, there weren’t many miners. Nevertheless, that modified earlier than the primary Bitcoin bull run. Mining competitors skyrocketed, inflicting a pointy enhance in the price of machines able to competing. Much more importantly, power demand exploded with the brand new machines — which wanted power primarily for processing and cooling.

After eight years, the power demand for mining Bitcoin has grown — and right this moment has reached 116.71 terawatt-hours per yr, in keeping with information from the Cambridge Bitcoin Electrical energy Consumption Index, or CBECI. At first look, this looks as if quite a bit, proper? However let’s take a better have a look at the info to realize a greater understanding of the actual affect that Bitcoin mining has on the surroundings.

Associated: Ignore the headlines — Bitcoin mining is already greener than you suppose

The usage of power in Bitcoin mining

Some influencers have not too long ago appeared on social media and are associating Bitcoin with an alleged enhance in the usage of fossil gas power, particularly coal. In reality, some international locations — similar to China — use coal as an necessary supply of power. However is that the primary gas for the power used?

In response to a research printed by the College of Cambridge in September:

“Hydropower is listed because the primary supply of power, with 62% of surveyed hashers indicating that their mining operations are powered by hydroelectric power. Different kinds of clear energies (e.g. wind and photo voltaic) rank additional down, behind coal and pure gasoline, which respectively account for 38% and 36% of respondents’ energy sources.”

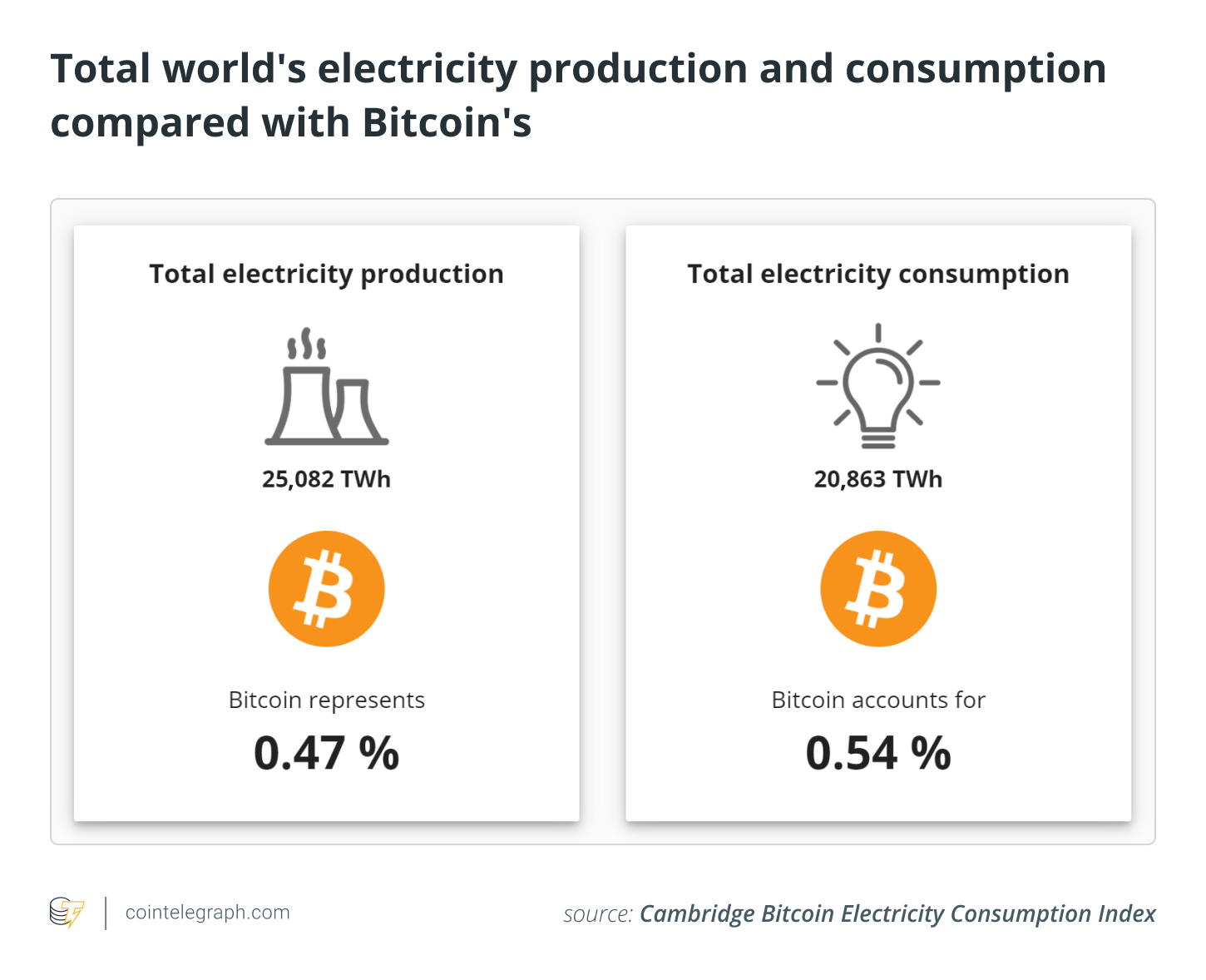

Additionally, in keeping with the CBECI, 25,082 TWh of power is produced on this planet yearly. Solely 20,863 TWh is consumed, that means 16.82% is wasted. Bitcoin represents an power expenditure of 0.47% of the overall power produced and solely 0.54% of the power waste worldwide.

One other survey not too long ago launched by Galaxy Digital compares Bitcoin’s use of power to the usage of banks and gold mining. In response to the doc, the gold business makes use of 240.61 TWh per yr, whereas the banking system makes use of 263.72 TWh.

Much more alarming is what the CBECI factors out relating to unused digital gadgets. In the US alone, with the electrical energy spent in a single yr by linked gadgets that aren’t in use, it will be attainable to feed the Bitcoin community for nearly two years.

Subsequently, it’s clear that Bitcoin’s power consumption is just not as related because it’s stated to be, when put next with world power manufacturing and waste. To not point out that this consumption of roughly 116 TWh is liable for offering safety and entry to a dignified life for tens of millions of individuals around the globe.

What we actually ought to pay attention to when speaking about Bitcoin being inexperienced is its carbon footprint.

Associated: Is Bitcoin a waste of power? Execs and cons of Bitcoin mining

Bitcoin’s carbon footprint

Sadly, a lot of the power at present generated leads to a excessive carbon charge, and that must be the primary concern and focus when discussing Bitcoin’s environmental affect.

In response to information launched in 2019 by the scientific journal Joule, Bitcoin’s carbon footprint is between 22 and 22.9 metric tons of CO2. It’s certainly a related quantity that’s similar to Jordan or Sri Lanka’s emission charges. Nevertheless, it’s significantly much less, for instance, than the power expenditure by the American navy power, which in keeping with information compiled by Statista emits 59 Mt CO2.

Thankfully, there are easy methods to offset the carbon footprint left by Bitcoin. With the tokenization of property, some corporations have chosen to tokenize carbon credit, making it simpler for miners and all these concerned not directly with the cryptocurrency business to reduce the affect brought on by the technology {of electrical} power utilized in mining machines.

Wanting forward, our consideration must be on the discount of the usage of fossil fuels, with the purpose to decrease the remaining carbon footprint.

It’s price noting that the environmental downside won’t be solved solely by lowering the usage of fossil fuels. It’s much more necessary to optimize the usage of the generated power whereas specializing in lowering any waste and pointless carbon emissions within the course of.

Associated: The pandemic yr ends with a tokenized carbon cap-and-trade answer

Growing a inexperienced Bitcoin

It isn’t anticipated that power consumption by mining will enhance quite a bit within the coming years, as it’s extra related to computing energy than the adoption of Bitcoin itself. Subsequently, the 116.71 TWh ought to stay secure for a while.

To attain the aim of a inexperienced Bitcoin community, crypto mining corporations can do their half by shopping for carbon credit score tokens and pushing for manufacturing with much less use of fossil fuels. It’s unfair — to say the least — to accuse Bitcoin or miners of degrading the surroundings whereas turning a blind eye to the opposite 99.54% of the power generated.

Bitcoin is open and may go to the ends of the Earth, no matter limitations or prohibitions imposed by third events. It is very important keep in mind that this cryptocurrency was created to offer a dignified life to extraordinary and underprivileged people, to forestall the depreciation of cash, to ensure buying energy and to enhance the standard of life.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, readers ought to conduct their very own analysis when making a call.

The views, ideas and opinions expressed listed here are the creator’s alone and don’t essentially replicate or characterize the views and opinions of Cointelegraph.

Jay Hao is a tech veteran and seasoned business chief. Previous to OKEx, he targeted on blockchain-driven functions for dwell video streaming and cell gaming. Earlier than tapping into the blockchain business, he had already had 21 years of strong expertise within the semiconductor business. He’s additionally a acknowledged chief with profitable expertise in product administration. Because the CEO of OKEx and a agency believer in blockchain know-how, Jay foresees that the know-how will remove transaction boundaries, elevate effectivity and ultimately make a considerable affect on the worldwide economic system.

Source link