by: Jp Cortez

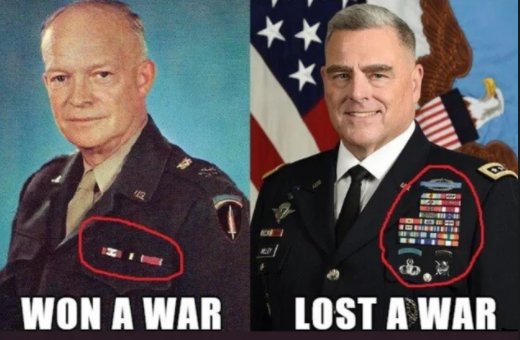

The somber images and movies which have come out of Afghanistan lead many to wonder if the 20-year battle was value the fee.

In keeping with the Related Press, by means of April, greater than 172,000 folks (American and in any other case) have died in the middle of the Conflict in Afghanistan. The estimated quantity of direct Afghanistan and Iraq struggle prices that the USA has debt-financed: over $2 trillion.

The estimated principal and curiosity owed by 2050: as much as $6.5 trillion.

This struggle, as with a lot of presidency spending, isn’t paid by cash the federal government has. It’s borrowed into existence.

The monetary prices of debt-financed spending by at this time’s determination makers will burden future generations. The ache of printing trillions of unbacked payments isn’t felt instantly, so the gravity of the motion is refined, however the finish result’s unavoidable.

When Congress granted then-President George W. Bush the authority to make use of all “mandatory and acceptable pressure” towards these concerned with the 9/11 per week after the assaults, the federal authorities went down a course set for financial spoil.

$1 in 2001 had the buying energy of $1.54 at this time. The greenback had a median inflation fee of two.19% per 12 months between 2001 and at this time, producing a cumulative value enhance of 54.15%.

Inflation is in every single place

Inflation is in every single place

That implies that at this time’s costs are 1.54 instances larger than common costs in 2001, based on the Bureau of Labor Statistics’ Client Value Index, a measure that notoriously understates real-world inflation on account of deploying intelligent hedonic changes, geometric weighting, and substitutions that have a tendency to color a rosier image.

Stated one other means, a greenback at this time buys not more than 65% of what it might purchase in 2001. And by different measures moreover the flawed CPI, it buys even much less.

The federal government’s borrowing has accelerated quickly to the upside because the COVID lockdowns and emergency “stimulus” efforts. That portends doubtlessly a lot larger charges of inflation forward.

Final week, Bloomberg reported that meals costs in July had been up 31% from the identical month final 12 months, based on an index compiled by the United Nations’ Meals and Agriculture Group.

Substituting hen breast for Angus beef… or the cheaper hen thigh for hen breast is likely to be an innocuous sacrifice, however what in case you are now having bother affording hen in any respect?

Inflation harms the poorest amongst us. People with means can spend money on belongings that defend towards greenback devaluation. Gold and silver, actual property, even a attempt on the on line casino often called the inventory market—there are a lot of choices for higher healed traders.

However what about wage earners? Senior residents on mounted earnings? These making an attempt to avoid wasting a bit of further for the longer term?

These most harmed by the elevated prices are these already struggling to afford these items. Greenback menus at quick meals eating places have vanished whereas the prices of properties, meals, vehicles, school tuition, and drugs, have soared.

Considered one of sound cash’s most central options is that it restricts authorities spending to solely what may be extracted from the populace by means of taxation. A print-and-spend method to financial coverage allows wasteful and fruitless authorities expenditures, corresponding to, for instance, unpopular decades-long wars.

For 20 years, People fought a struggle that price 1000’s of lives and trillions of {dollars}. Many are left questioning whether or not the price of this struggle was value it.

There are numerous prices which can be obvious, however the sapping away of the greenback’s buying energy—and the theft of wealth from all of those that maintain it – is among the many biggest price of all.

Picture: Unsplash/Sharon McCutcheon

Source link