by Ryan McMaken of Mises Institute

On Wednesday, the Federal Reserve’s Federal Open Market Committee voted to proceed with a goal federal funds charge of 0.25 p.c, and to proceed with large-scale asset purchases. In line with the committee’s press launch:

The Committee determined to maintain the goal vary for the federal funds charge at 0 to 1/4 p.c and expects it is going to be applicable to keep up this goal vary till labor market situations have reached ranges in keeping with the Committee’s assessments of most employment and inflation has risen to 2 p.c and is on observe to reasonably exceed 2 p.c for a while. As well as, the Federal Reserve will proceed to extend its holdings of Treasury securities by a minimum of $80 billion per thirty days and of company mortgage‑backed securities by a minimum of $40 billion per thirty days till substantial additional progress has been made towards the Committee’s most employment and worth stability targets. These asset purchases assist foster easy market functioning and accommodative monetary situations, thereby supporting the movement of credit score to households and companies.

This assertion is perhaps summarized greatest as “extra of the identical,” and despite no matter different statements is perhaps made about Fed officers or about how the economic system is comparatively robust or bettering, the very fact is Fed policymakers voted unanimously on Wednesday in opposition to tapering of any sort, and in favor of continued extraordinarily accommodative coverage.

In different phrases, on the Fed there isn’t a urge for food in any respect for ever testing the waters to see simply how fragile this present economic system is despite all we hear a couple of “V-shaped restoration” and GDP numbers displaying an economic system roaring again.

And why ought to the Fed act as if the restoration have been effectively underway? As of final month, whole employment continues to be greater than 7 million jobs under the February 2020 peak. In the meantime, new jobless claims elevated by greater than thirty thousand final week, rising to a sickly 412,000.

Nonetheless, the “huge information” popping out of the Fed—a minimum of so far as many information shops have been involved—is the truth that many FOMC members anticipate the Fed to boost the benchmark charge “as quickly as 2023” primarily based on the so-called dot plot displaying FOMC member expectations. As CNBC reviews:

Wednesday’s forecast confirmed 13 members of the Federal Open Market Committee consider the Fed will enhance charges in 2023 and the vast majority of them consider the central financial institution will hike a minimum of twice that 12 months. Solely 5 members nonetheless see the Fed staying pat via 2023. Actually, seven of the 18 members see the Fed presumably growing charges as early as 2022.

In Washington phrases, this implies nothing in any respect. This wasn’t a dedication from FOMC members to truly increase the speed two years from now. This was merely an opinion—polled FOMC members anticipate the speed to go up. An expectation that one thing would possibly occur two years from now hardly constitutes a significant prediction. One would must be extraordinarily credulous to learn the FOMC’s evaluation as a “hawkish” transfer.

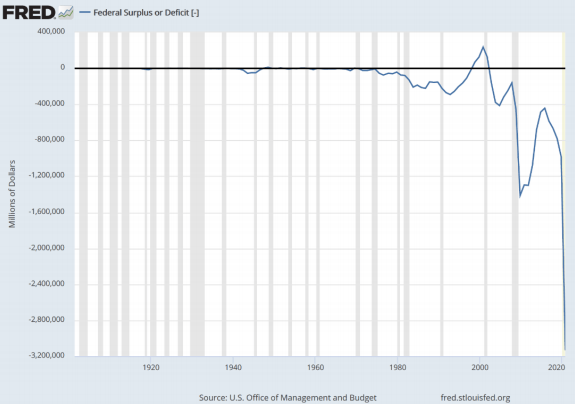

In any case, the coverage scenario was very comparable through the decade that adopted the 2008 monetary disaster. For a few years, the Fed below Janet Yellen repeatedly described the economic system as “strengthening” and experiencing average progress. The Fed repeatedly hinted at a tapering and tightening of coverage that might occur “quickly.” And but the Fed saved the goal charge at 0.25 p.c for almost seven years, from early 2009 via most of 2015. The speed by no means climbed above 1 p.c till 2017. However all of the whereas, the FOMC repeatedly urged that any day now it could “normalize” issues.

So, now after we hear that the Fed can be tapering in 2023, we should always learn this as one thing that’s doable, after all, however “2023” might simply as simply imply 2025 or 2028. Not less than, that’s actually what expertise suggests, particularly as our jobless restoration continues.

And talking of “normalizing” issues, the Fed through the Yellen years had lengthy additionally hinted at scaling again its portfolio. This, after all, by no means occurred. Complete belongings owned by the Fed solely grew from 2012 to 2015, after which held regular at round $4.4 trillion till 2018, when the Fed barely scaled issues again. However indicators of bother have been already obvious by late 2019 with the repo panic, because the Fed was again within the asset-purchasing sport. Now Fed belongings have climbed to an eye-watering $8 trillion. Mix this with this week’s promise to maintain shopping for “a minimum of $80 billion per thirty days and of company mortgage‑backed securities by a minimum of $40 billion per thirty days” and it’s clear the discuss of getting hawkish on the Fed is little greater than discuss at this level.

Alternatively—this shift towards predicting charge hikes in 2023 did characterize a change in messaging from the FOMC, probably compelled by the very fact the Fed can now not deny that worth inflation is happening.

In March, for instance, FOMC members stated they didn’t anticipate any motion on tapering till 2024. However then the Fed, as a way to appear like it has some connection to actuality, modified its inflation forecast:

The Fed additionally sharply elevated its inflation forecasts for the 12 months. It now sees inflation working to three.4% this 12 months, above its earlier estimate of two.4%. The central financial institution additionally barely hiked its PCE inflation estimates for 2022 and 2023.

So, the Fed has been compelled to confess the truth that has been lengthy clear to regular individuals who purchase homes, schooling, meals, and different providers. Inflation is actual. Nonetheless, the Fed insists it’s all short-term:

Although the Fed raised its headline inflation expectation to three.4%, a full share level larger than the March projection, the post-meeting assertion stood by its place that inflation pressures are “transitory.” The raised expectations come amid the most important rise in client costs in about 13 years.

It’s unlikely any of that is something greater than optics and public relations, nonetheless. The Fed has to appear like it’s taking worth inflation significantly, so it admits there’s some however dismisses it as short-term. Furthermore, FOMC members ship the message they’re involved by saying, “We would have to boost charges in 2023 as an alternative of 2024.”

In the true world, nonetheless, none of this tells us something in any respect about what the Fed really plans to do in 2023.

But markets are so shaky and so depending on straightforward cash from the Fed that when the Fed despatched the message it might need to behave on inflation in some unspecified time in the future just a few years from now, the Dow Jones crashed by greater than 300 factors.

This additional illustrates what some Fed observers are actually saying concerning the state of the US economic system: the Fed isn’t right here to remove the punch bowl anymore. The Fed is the punch bowl. Even the mildest suggestion that it’d increase charges years from now sends panic via the ranks.

Certainly, Fed chairman Jerome Powell stepped in to guarantee the markets that even this miniscule step towards “hawkishness” in some unspecified time in the future sooner or later shouldn’t be taken too significantly. Overlook about that dot plot, Powell insisted. We’ll hold charges low perpetually:

“The dots aren’t an important forecaster of future charge strikes and it’s simply because it’s so extremely unsure,” Powell instructed reporters after the central financial institution’s announcement that it was holding rates of interest at close to zero.

Powell added that dot plots ought to be taken with a “huge grain of salt,” reminding Fed watchers that the central financial institution will information coverage primarily based on outcomes, not outlooks.

Creator:

Contact Ryan McMaken

Ryan McMaken (@ryanmcmaken) is a senior editor on the Mises Institute. Ryan has levels in economics and political science from the College of Colorado and was a housing economist for the State of Colorado. He’s the creator of Commie Cowboys: The Bourgeoisie and the Nation-State within the Western Style.

Source link