There’s actually just one manner to economize. It’s a must to spend lower than you earn.

It’s a easy system. What is available in should be lower than what goes out.

For most individuals which means chopping again on lattes and going out much less, which is why folks hate budgeting and battle to keep it up.

However, there are literally significantly better methods for spending lower than you earn.

At IWT, we consider the easiest way to economize is by using the CEO method.

The CEO Strategy: The Greatest Technique to Save Cash

- C- Lower Prices

- Set Financial savings Objectives

- Observe Your Spending to See The place Your Cash is Going

- The Envelope Methodology

- Automate Your Financial savings

- Pay Down Debt

- Set Cash Guidelines for Your self

- E- Earn Extra

- Ask for a Increase

- Get a Greater Paying Job

- Begin a Enterprise/Begin Freelancing

- Take Benefit of Your Employer’s 401k Match

- O- Optimize Spending

- Negotiate Your Payments Down

- The A La Carte Methodology

Conventional recommendation about saving cash solely focuses on limiting. By different methods to enhance your funds, reminiscent of incomes extra and optimizing your spending, you open up a plethora of latest avenues for saving extra.

That’s what makes the CEO method the easiest way to economize. We’ll present you learn how to get began.

Cash-Saving Technique #1: Lower Prices

The first step in making an attempt to economize is, you guessed it…chopping prices.

Most of us know what it means to chop prices. However chopping prices doesn’t must imply giving up every part you like. One of the simplest ways to economize by chopping prices is to solely concentrate on belongings you don’t actually care about or don’t use. This manner, the change is extra more likely to be everlasting.

So how do you get began? The excellent news is that there are many methods and techniques you need to use to chop down prices in a manner that isn’t too painful. Listed here are some easy methods how to economize each month.

Set Financial savings Objectives

Earlier than we head into learn how to lower prices, there’s one vital factor to maintain first. Don’t skip this half!

Know precisely what you’re saving for.

The most effective methods to economize is to get some focus. If you happen to’re going to make vital way of life modifications to chop prices down, you want a really clear concept of why you’re doing it and what your finish purpose will seem like.

So spend a while fascinated with your financial savings targets. Are you saving for a comfortable retirement? Are you planning an enormous trip? Maybe it’s a down cost for a home or the marriage of your desires. No matter it’s, be certain that it’s one thing you’re enthusiastic about. That’s key to motivating you.

Shut your eyes for a minute, think about your self on the finish whenever you’ve saved sufficient and you’ll lastly get pleasure from no matter you’re saving for. Begin constructing your financial savings plan with that in thoughts always.

Observe Your Spending to See The place Your Cash is Going

Now that you just’ve acquired a transparent concept in your thoughts of the place you need to go, it’s time to dig deep into the numbers.

The first step in any cost-cutting train is to search out out the place these prices are. What are you spending every month and on what? Undergo your financial institution statements for the previous couple of months and be aware down every part you’re spending cash on. Put them into classes reminiscent of dwelling prices, groceries, consuming out, enjoyable stuff, and so forth.

This train virtually at all times surprises folks. I’m spending how a lot a 12 months on croissants on the best way to work?!

When over-spenders do that train, a layer of guilt tends to settle in. However maintain on. Simply since you spend rather a lot on one thing that isn’t key to your survival doesn’t make you a foul particular person or loopy with cash. It’s your cash in spite of everything.

As an alternative, give it some thought like this. If there’s one thing you’re spending usually on that you just’re stunned or confused about since you don’t even get pleasure from it, that’s the stuff to chop.

This train isn’t about taking away your morning espresso if that espresso brings you pleasure every morning. It’s about recognizing the place you may in the reduction of on the issues that don’t matter to you. If you happen to’re shopping for an overpriced bottle of water on the prepare station on the best way to work each morning, it most likely isn’t bringing you an entire lot of pleasure. That’s one thing you may simply in the reduction of on and swap out with a reusable bottle.

Use the Envelope System (money or digital)

The envelope technique works by placing money for all of your month-to-month bills (e.g., gasoline, going out, procuring) into devoted envelopes.

For instance, you may need an envelope for “eating places.” So each time you exit to eat you’ll take cash from it to spend. When you’ve used all the cash within the envelope, you’re completed for the month!

This technique is versatile sufficient to allow you to dip into different envelopes if there’s an emergency. Nevertheless, there’ll be much less cash to spend for the month on that class of bills.

You don’t want to make use of bodily envelopes both. One among my associates who began monitoring her spending some time again had an excellent system: She arrange a separate checking account with a debit card. Most financial institution accounts allow you to arrange separate financial savings accounts or pots to separate your cash.

No matter system you determine to make use of, you simply want to verify to determine how a lot you’re prepared to spend in every class (and that’s all as much as you).

If you happen to assume this technique will allow you to be extra aware about your spending, you may learn extra about it on this publish on learn how to arrange your envelope system.

Automate Your Financial savings

One motive we don’t usually lower your expenses is as a result of ache of placing cash into our financial savings accounts every month.

It’s the rationale why chopping out lattes or skipping lunch is a horrible approach to save more cash.

That’s why automated funds work so effectively. You can begin to dominate your funds by having your system passively do the precise factor for you. As an alternative of fascinated with saving on daily basis — set it and overlook it.

To do that, you want only one hour in the present day to observe these three super-simple steps:

- Step 1: Arrange your payments so that they’re despatched to you on the first of the month for simplicity

- Step 2: Arrange your contributions to your 401k so that you’re saving earlier than you even get your paycheck

- Step 3: Automate your checking account so it pays into your Roth IRA, financial savings accounts, bank card funds, and any miscellaneous payments.

For a extra detailed rationalization of every step, take a look at my 12-minute video on learn how to automate your funds right here.

Pay Down Debt

When you have an impressive bank card, scholar mortgage, or automotive finance debt, you most likely can’t bear to take a look at the quantity you’re paying for the rates of interest alone. It might probably really feel such as you’re making zero progress when most of your repayments are paying off the curiosity, not the debt quantity.

The answer? Pay extra.

That’s most likely not what you needed to listen to, proper? You could be questioning, “How can I probably save extra by spending extra?”

The straightforward reality is the quicker you repay your debt, the much less curiosity you get charged in complete.

Let’s say you could have a $10,000 scholar mortgage excellent, at a 6.8% rate of interest and a 10-year reimbursement interval. Your customary month-to-month funds needs to be round $115 a month. However in the event you pay additional every month, it can save you an entire lot.

[insert table from: https://www.iwillteachyoutoberich.com/blog/how-to-save-money/#6 ]

Making simply $100 additional funds every month might save an enormous quantity of curiosity. It might even lower it virtually in half! If you happen to can’t pay an additional $100, $200 every month, even $20 a month could make a HUGE distinction. See for your self by calculating your financial savings utilizing this calculator.

Set Cash Guidelines for Your self

All of us work in numerous methods on the subject of cash. There’s hardly ever any one-size-fits-all method to spending, saving, chopping bills down. So that is the place setting cash guidelines for your self is available in.

If you recognize you could have a sure dangerous cash behavior, set a rule for your self that will help you keep away from it. For instance, in the event you’re a web based procuring addict or an impulsive spender, a easy cash rule could possibly be to at all times wait 24 hours earlier than making the acquisition if it’s over a specific amount.

Possibly you additionally put away the identical quantity you spend right into a separate financial savings account — that manner you’re down double the cash. So the subsequent time you need to purchase one thing, you’ll assume twice about it.

Setting guidelines for your self is the easiest way to curb your individual dangerous habits and in addition reward your good ones. You don’t must take your cash guidelines from Pinterest, create your individual. You’re more likely to stay to them that manner.

Cash-Saving Technique #2: Earn Extra Cash

Chopping your bills is a superb begin, however bear in mind, there’s a restrict to how a lot you may lower, however there’s no restrict to how a lot you may earn.

Earlier than you roll your eyes and skip this step, it’s ALWAYS attainable to earn extra. Even when there’s a recession, even in the event you’re broke, or busy, or don’t know the place to start out.

The excellent news is that there are a number of methods to start out incomes extra. You may ask for a elevate at your present job, discover a higher-paying job, or begin a enterprise or choose up freelance work.

Negotiate a Increase

Many individuals will simply take their wage, grumble quietly about it and nothing modifications. However do you know that one of many easiest methods to get more cash is to…simply ask for it?

With only a five-minute dialog you can also make 1000’s extra and, what’s higher, the positive aspects add up 12 months after 12 months.

This is likely one of the finest methods to make cash by a single dialog. It’s primarily fast cash that — not like taking surveys or promoting your physique to medical research — provides you a LOT of cash over a few years.

Take a look at this chart demonstrating the results of ONE $5,000 elevate:

[insert chart]

For some actionable suggestions for negotiating your wage, take a look at this complete publish on learn how to negotiate your wage. It’s acquired a ton of knowledge, and the steps are simple to observe. If you happen to’re prepared to start out getting paid what you deserve, go test it out.

In fact, it isn’t at all times that easy. Some bosses and industries have set salaries with minimal wiggle room. In that case, your subsequent transfer is to…

Land a Greater Paying Job

In case your boss isn’t excited by paying more cash, the pure subsequent step is to look elsewhere. Staying at an organization for 10, 20 years is a factor of the previous for many individuals now. Sadly, loyalty and longevity at an organization aren’t rewarded like they was.

So the subsequent answer is to land a higher-paying job. However how?

Do you have to change jobs? Change industries? How have you learnt whether or not to remain put or to take a dangerous transfer which will lead to more cash?

Some jobs simply don’t present the chance to earn extra or transfer up the ladder. If you wish to begin making more cash, you will have to discover a higher job or perhaps a completely different profession.

If you end up on this state of affairs, we now have a ton of nice assets on discovering a greater job on YouTube.

(We even have a whole course devoted to Discovering Your Dream Job. You may study extra about Dream Job right here.

Begin a Enterprise or Begin Freelancing

Discovering a brand new job or altering careers takes time. However within the subsequent few days, you may arrange your first aspect hustle. When you get your first paying consumer, it’ll be simpler to get extra shoppers and make more cash.

Very first thing: Many web sites will inform you to troll for freelance gigs on locations like Fiverr or Mechanical Turk. These locations work if you wish to compete with folks everywhere in the world in a race to do essentially the most work for much less. No thanks.

As an alternative, take a look at what you’ve already acquired. 95% of jobs can translate into some type of aspect gig. Ask your self:

- What do I get pleasure from?

- What do I do with my free time?

- What do folks ask me to do as a result of I’m so good at it?

Begin off by assessing the abilities you utilize on daily basis at residence or at work. Bear in mind, folks pay for options, not your expertise. How will you take your expertise and switch them into an answer for another person’s downside?

Right here’s a quite simple instance:

Ability: You’re good at math

Downside you may resolve: With faculties shut down in most states, many mother and father are struggling to assist their children with distance studying, and would fortunately pay for tutoring

Your New Facet Hustle: Tutoring children in math over Facetime or Zoom

Now think about if by tutoring for just a few hours per week, you abruptly had an additional $500 a month.

That cash can go straight to financial savings with out lowering any of your spending. And this is only one small-scale instance, it may possibly work for just about any talent. That’s why incomes extra is likely one of the finest methods to economize.

If you wish to flip your talent into additional money, take a look at this publish with every part you must learn about beginning a aspect gig.

Take Benefit of Your Employer’s 401k Match

Need free cash? Who doesn’t?

Saving cash isn’t simply in regards to the right here and now, money-savvy persons are at all times wanting forward. In case your employer has a 401k plan, be sure to’re taking full benefit of that free money.

A 401k lets you dedicate a share of your pre-tax wage to your retirement accounts. That additionally means you don’t pay tax on that revenue as a result of it goes earlier than ever reaching your checking account. In case your employer matches your contributions, it’s a no brainer approach to enhance your retirement financial savings. Future you’ll thanks for taking such a easy step.

Cash-Saving Technique #3: Optimize Your Spending

The key to saving cash is not only about chopping prices and going with out. Neither is it to only enhance your revenue. Tie these two issues collectively and you’ve got the right match.

Spending shouldn’t be a grimy phrase. We’re not right here to inform you to throw away the lattes, if the lattes are one thing you like. The philosophy right here is to cease spending on what you don’t love, the stuff you’re feeling obligated to purchase, or when shopping for it’s only a behavior. You are able to do with out these purchases in your life, and as an alternative, put that cash to good use elsewhere.

Relating to managing your cash and evaluating your bills, an excellent behavior to get into is to spend an hour or so wanting by your financial institution statements. Verify what you could have spent your hard-earned money on this month and ask your self truthfully, did you must purchase that? Did you like that buy?

If not, then you recognize what to do. The important thing right here is to turn out to be extra aware of your spending. That’s the largest hurdle you’ll come throughout whenever you need to lower your expenses.

Negotiate Your Payments Down

One other approach to optimize your spending is to barter your payments. Lots of people assume payments are fastened bills, however the reality is every part is up for negotiation.

It’s a little-known reality that you may negotiate lots of your payments with a one-time telephone name. Actually, it can save you HUNDREDS a month on payments in your:

- Automobile insurance coverage

- Cellphone plan

- Health club membership (much less seemingly however nonetheless attainable)

- Cable TV

- Bank cards

It’s easy too. There are solely three issues you must do to barter with these firms on charges and charges:

- Name them up.

- Inform them, “I’m an excellent buyer, and I’d hate to have to depart due to a easy cash subject.”

- Ask, “What are you able to do for me to decrease my charges?”

In fact, you’re going to need to regulate this system for no matter firm you’re calling. Take a look at our video on negotiating your payments for extra on this subject.

Commerce Subscriptions for the A La Carte Methodology

The A La Carte Methodology helps you lower your expenses on providers for which you could have a subscription, like:

- Netflix

- Health club memberships

- Spotify

- Amazon Prime

- Magazines

There’s a superb probability you’re WAY overpaying for these items. Actually, a conservative estimate reveals that we spend over $1,800/12 months on subscriptions alone.

The comfort is simple — subscriptions are a incredible approach to automate our lives.

However when was the final time you scrutinized your month-to-month subscriptions and canceled one?

In all probability by no means. But evaluate this to any time you went out procuring, noticed one thing you favored, however didn’t purchase it.

Learn that once more. It’s the important thing to chopping your spending on subscriptions. The essential concept of this technique is to cancel all of your discretionary subscriptions — magazines, Spotify, Netflix — and purchase what you want a la carte.

- As an alternative of paying an enormous month-to-month charge to firms like Netflix, purchase or lease solely the reveals or motion pictures you need to watch on Amazon or iTunes. Most episodes of T.V. reveals are solely $1.99.

- Purchase a day go for the health club every time you go (round $5 – $10).

- Purchase songs you need from Amazon or iTunes for $0.99 every.

This FORCES you to take heed to your spending. By using the identical rules that make automating your funds nice, you’ll have to actively take into consideration every buy you make on the subject of shopping for a tune or TV present.

If, after some time, you end up spending sufficient cash on this stuff to justify the subscription, by all means, choose it up once more. If not, then you definately’ve saved your self some main money.

Saving cash made simple

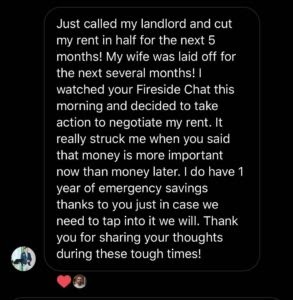

Saving cash doesn’t must be onerous or as painful because it sounds. Easy tweaks to your present spending conduct are sometimes all that’s wanted, or at the least it’s an excellent begin. Have a look at these readers who used these methods to save lots of more cash:

By utilizing all of the techniques outlined on this publish, this could possibly be you in just some hours.

Bear in mind, the easiest way to economize is by chopping prices on belongings you don’t want, incomes extra by bettering your wage or beginning a aspect hustle, and optimizing your spending by negotiation.

It seems like rather a lot, but it surely’s actually simply three steps to save lots of more cash with out giving up every part you like.

If you happen to use this technique and it really works for you, be happy to ship your story to @ramit on Instagram. We love listening to from you.

Have you learnt your incomes potential?

Take my incomes potential quiz and get a customized report based mostly in your distinctive strengths, and uncover learn how to begin making more money — in as little as an hour.

Source link

/GettyImages-836674058-3b2cc93807d64691980e966400a24f10.jpg)