Some would name Terrance Doyle a “baller”. Not as a result of he’s performed lots of of thousands and thousands of {dollars} in actual property transactions, or as a result of he has performed over 600 flips, or as a result of he helps lead the Tribe of Multifamily Mentors. Terrance performed faculty basketball, which grew into working as an NBA sports activities agent, garnering him entry to well-known coaches, gamers, and executives.

Terrance and a few his faculty teammates began a franchise after faculty, and wanted someplace to park money. One other teammate helped Terrance purchase a foreclosures at a public trustee sale, which he flipped for a large revenue. That is when he knew that the actual cash was made in actual property. Between 2008 and 2014, Terrance did over 600 flips, in a number of totally different areas of the nation.

As he learnt to construct relationships and rapport with patrons, sellers, lenders, and contractors, Terrance began taking over greater and higher offers. He’s performed $35,000,000 in transactions because the begin of the pandemic and depends on the 5 primary fundamentals of actual property: know your market, be aggressive, be quicker than the competitors, have strong lenders, and ensure your geese are in a row.

Brandon:

That is the BiggerPockets podcast, present 462.

Terrance:

I’ve heard that Denver is such a sizzling market since I began in 2014. In truth, after I began in 2014, folks informed me I’d by no means have the ability to discover off market offers that match my standards. I’ve heard that each single yr. My line to everybody on our staff is, if we simply keep on with the basics, if we observe up with sellers, if we observe up with brokers, if we keep in contact and we ship on what we are saying we’re going to do. I’m making an attempt to use the very same ideas, whatever the asset class, or how rather more institutional or aggressive it will get.

Speaker 3:

You’re listening to BiggerPockets radio, simplifying actual property for traders, massive and small. For those who’re right here trying to find out about actual property investing, with out all of the hype you’re in the precise place, keep tuned and you’ll want to be a part of the thousands and thousands of others who’ve benefited from biggerpockets.com, your property for actual property investing on-line.

Brandon:

What’s occurring everybody, it’s Brandon Turner, host of the BiggerPockets podcast, right here with my different host of the BiggerPockets podcast, David, the worth decide inexperienced. What’s up, David Inexperienced. How are you doing, man?

David:

I might not be the sexiest decide, however I’m in all probability essentially the most beneficial decide. Precisely stated.

Brandon:

That may make rather more sense later in in the present day’s present. As a result of in the present day we’re interviewing a visitor who’s a former sports activities agent, is that what we name him? He was a basketball agent and he transitioned from that into actual property investing, began with smaller offers, flips, received into the medium measurement residences, received into some bigger offers and we dive into his complete journey in the present day. It’s a phenomenal present. One thing you’re going to like. Terrance Doyle is our visitor in the present day. Very, very cool, shiny man. We simply cowl a ton of actually great things in the present day. Every part from, learn how to spend money on an costly market. What do you do when the market’s loopy? Must you simply not make investments? Must you anticipate decrease returns?

Terrance says, no. And he tells you 5 or 6 issues that it’s best to do as an alternative. That plus a complete lot extra to return. However earlier than we get to that, let’s get to in the present day’s [crosstalk 00:02:00] fast tip. At this time’s fast tip is very same as a fast tip that we simply launched on the final episode, the one which got here out on Sunday, is that this coming Sunday, we’ve been saying it now for a few weeks in a row. This coming Sunday, we’re releasing a particular episode of the BiggerPockets podcast. It’s all concerning the actionable course of pushed issues try to be doing in your corporation to land a deal within the subsequent 90 days. It’s the 90 day problem webinar that I usually do reside.

We’re going to truly be doing it right here on the podcast. I did this quite a lot of years in the past, I don’t know, 4 years in the past, three, 4 years in the past. And other people, so many individuals went and made large modifications to their enterprise and acquired property and simply went to a complete new stage due to it. We’ve up to date it, we’ve revamped it and we’re launching it right here on Sunday. So concentrate for that developing right here in just a few days. All proper, that stated, I believe it’s time to get into in the present day’s present. Something you wish to add earlier than we usher in Terrance, David?

David:

No, I assumed this was a enjoyable present. I assumed you and I and Terrance all had a fairly good rapport and received alongside. This is without doubt one of the funnier reveals that we’ve performed. What does come up, at this, what does come up throughout the present is that BiggerPockets has extra sources than simply this podcast. There’s complete YouTube channel with tons of BiggerPockets, personalities, and folks which might be making an attempt to show you by sharing what they’re doing. So get on there, subscribe to BiggerPockets YouTube, discover the folks that you just join with the perfect, that you just vibe essentially the most with and begin studying from extra than simply me and Brandon.

Brandon:

There you go. Good second fast tip. Terrance is definitely one of many hosts of a brand new present on the BiggerPockets YouTube channel. So that you’ll hear extra about that later. With that stated, let’s get into our interview with Terrance Doyle. Terrance, welcome to the BiggerPockets podcast, man. Good to have you ever right here.

Terrance:

Thanks quite a bit for having me. I’ve been watching you guys because the begin of my actual property profession 2014, and I’m a giant fan and tremendous honored to be right here with each of you guys. So thanks for having me.

Brandon:

Thanks, man. Properly, let’s leap into it. The beginning of your actual property profession, you talked about it, so let’s go there. How did you first uncover this concept of actual property investing? What have been you doing earlier than? Stroll us by way of that starting psychological journey.

Terrance:

Early on, in faculty, like we have been speaking about earlier, I had the chance to play faculty basketball. I used to be the brief white man on the finish of the bench that stored his GPA up in order that the staff was compliant with NCA regulation. That was my position. I performed it fairly nicely. I performed faculty basketball in faculty. Two of my teammates and I began an organization, we franchised it in 2006. And so, we have been single, 21, 22 making a pair bucks. In 2007, late 2007, certainly one of my different faculty teammates got here to me and stated, hey, we’re going to start out shopping for foreclosures on the public trustee sale. I used to be dwelling with roommates, had no concept what a foreclosures was or a public trustee sale, however it sounded actually fascinating. And so I used to be the primary investor.

We purchased a home on the Denver public trustee sale for $58,000, two or three months later, we bought it for 98 and a few change. I used to be like, oh my gosh, that is, that is phenomenal, let’s do extra of those. So between 2008 and 14, I used to be capable of join some various things. We did a couple of hundred of these a yr. We did roughly 600 flips between 2008 and 14. I nonetheless didn’t know something about actual property. I simply knew that when you went to the public sale and also you knew learn how to underwrite, you would make some good cash. And in order that was my first expertise with that. I wouldn’t actually name it actual property investing. It was extra, when you had entry to capital and had a beating coronary heart, you have been going to become profitable.

Brandon:

The great outdated days.

Terrance:

Yeah, precisely. These have been the times, a lot has modified as everyone knows. 2014 and we had had some good success, I used to be actually eager to get married, and simply the partnership we had had a very good run for six years and we wished to do some various things. And so I actually wished to department out and do bigger offers and actually simply get to know actual property for myself. And so I branched out and actually found that with the ability to communicate fluent Spanish, my household, my mother is from Bogota, Colombia. I spent numerous time there rising up and that turned out to be a very pivotal, aggressive benefit for me. I used to be capable of put collectively this group of Hispanic subcontractors. I used to be capable of construct a scalable resolution the place we might simply do the identical flooring, similar paint, similar cupboards, in each single property.

I used to be positively not an artist. That was one thing that simply got here pure to me and I used to be capable of see, hey, there’s numerous worth right here. Let me lean into this. That was actually the beginning. I used to be capable of finding properties and had this actually superb building course of that we constructed, and that was actually the beginning of it by myself in 2014.

Brandon:

Okay. Once you have been getting in, in 08, 09, 10, going by way of the recession there, what was your position in that enterprise on the time? Have been you operating issues? Have been you only a piece of it? The place did you slot in? Was that your full time job? Did you’ve got one other one? What was occurring there?

Terrance:

It was not my full time job and I used to be principally simply connecting. We had a fairly good capital supply and we’d transfer quick with money, is what we prefer to say. I related operators in Tampa, Indiana, Vegas, and LA, and we have been the capital. We had different boots on the bottom that they’d go to their native auctions. They knew the market, they’d their very own building staff and we’d simply fund them. My full time job at the moment was, I used to be an NBA sports activities agent. In faculty, I performed faculty basketball like we talked about, I received an opportunity to intern for the president of Nuggets, after I was in faculty and actually simply received passionate concerning the enterprise of sports activities and every thing round that. I signed my first NBA consumer in 2009 and actual property was at all times supporting every thing.

We made some cash in sports activities, however we made our actual cash in actual property and I at all times knew that. Earlier than, athletes, it was actually fashionable for them to be in companies and to be extra entrepreneurs. That was type of my factor. I had began a enterprise in faculty, two of my actually shut pals performed within the NBA. I used to be the man round them that was serving to them, negotiate their shoe offers or negotiate their finance settlement with their monetary advisor. We did issues like, we received into Fb inventory, pre IPO. We have been simply capable of leverage, I actually noticed athletes as, with their platform and their affect in native markets as a possibility to leverage them into different companies and to actual property and the franchises.

I simply actually had an urge for food and a need to domesticate that. And in order that was my full time job, 2008 to 2013. It was a really, very tough, very aggressive business. One of many issues that basically separated me, as a result of after I was 22, 23, 24, you’re recruiting these athletes and it’s like, I used to be going to Florida state. I used to be going to Illinois, all these large time faculties and also you’re competing in opposition to large time corporations with grown man with large resumes and very well spoken, it’s excessive, excessive gross sales. A number of the most gifted salespeople on this planet are both faculty coaches or sports activities brokers. These guys are loopy, loopy, gifted, unbelievable communicators, excessive vitality, can actually resolve issues at a excessive stage.

It was extraordinarily difficult. However one of many issues that I discovered that has actually helped me in actual property was the power so as to add worth. And so what would occur is, I’d construct relationships with these faculty coaches and I had to have the ability to separate myself from everybody else that was coming to satisfy them, to principally get an introduction to one of many gamers on their staff, as a result of that’s the way it occurs. Is, faculty coaches recruit gamers in highschool, they get actually shut with them within the household, after which when the participant is able to go professional, the household usually, and the participant involves them and says, hey coach, who ought to I interview? Who ought to I signal with?

And so having deep relationships with faculty coaches is essential, much like having actually good dealer relationships, proper? That’s key, as a result of they’re going to refer you to, they’re going to inform the vendor, hey, that is the precise purchaser. I used to be capable of, I actually minimize my tooth and I’d say perfected the talent of with the ability to construct relationships rapidly, earn belief actually rapidly, and discover methods so as to add worth. And at that stage, what’s fascinating is that, they’re not going to return out and let you know what their drawback is or how one can add worth, you actually must learn between the traces. However that was one thing that I used to be capable of actually develop that I believe after I went off by myself in actual property, I used to be capable of apply that very same scale of, what is that this dealer’s drawback and the way can I add worth, so the subsequent time they’ve a deal, they’re going to ship it to me?

Brandon:

That’s sensible. That’s sensible. I used to be going to ask, truly need one of many questions was, what abilities did you decide up on throughout that point that made a distinction in the present day? That’s sensible. What ways or suggestions do you’ve got for individuals who wish to begin constructing higher relationships with brokers, brokers, lenders, whoever, that you would be able to train them? What works nicely for you?

Terrance:

It’s one thing that I’m regularly occupied with. I believe, the primary factor is you need to ask questions. Once you sit down with a brand new dealer or lender, I believe a few of this comes from being from the Midwest and simply the way in which persons are, simply very customized, I wish to ask them as many questions as I can to get them speaking about themselves. Proper? I wish to get to know them genuinely, wish to get to know somebody, asking questions as you guys have talked about quite a few occasions on the present, folks love to speak about themselves. So get them speaking. I’m asking questions and I’m simply taking notes and observing, and I’m simply following up and being constant. I believe if somebody does these two issues, is simply ask questions and is genuinely and follows up in a constant method, I believe you’re going to maneuver to the highest of the checklist there of somebody they’re going to recollect.

After which as you do these two belongings you’re noticing and documenting, making psychological notes of, hey, this individual stated that they’re searching for a home or this individual stated, they’re searching for a contractor or this individual stated, they’re brief $10,000, to shut on this home or regardless of the element could also be. However persons are at all times going to have issues, it doesn’t matter what business you’re in. And so when you can doc that, construct a relationship and simply search for methods to resolve their issues, you’re going to separate your self from everybody else that wishes the identical factor from them.

It simply got here, like I stated, that’s one of many issues that was superb about sports activities, was with the ability to meet coaches, construct a relationship, achieve belief, and see what I may do so as to add worth to them and resolve an issue. After which naturally they have been like, hey, I need you to satisfy this participant and this household on my staff, I believe you’d be nice for them. They even began to refer former gamers that have been sad with their illustration. And so I believe that that has translated into actual property probably higher than the rest, that I discovered in sports activities.

Brandon:

That’s sensible. What are some examples of issues that a number of the brokers that you would possibly resolve, or ways in which you would present worth to an actual property dealer, for instance, what have you ever performed?

Terrance:

Early on, I used to be doing extra single household, again in 2014, I used to be doing duplexes and triplexes and fourplexes, however actually began to chop my tooth in single household. One of many first issues that I simply thought would, and now it’s frequent, however in 2014, I’d principally go to an agent and say, hey, if yow will discover me a flip, you may checklist it for me at a very good fee. They have been capable of double finish offers. Now that’s actually frequent, however in 2014 within the markets I used to be in, it actually wasn’t frequent. And so after I got here to them and stated, hey, look, assist me discover the deal, convey it to me, I’ll make it actually simpler for you as a result of I’ll have the ability to shut rapidly and also you’re going to get it again in 90 or 120 days. That was one thing that rapidly received me numerous deal movement.

Brokers knew that I may shut, and clearly as soon as I closed on one or two on time they usually noticed that every thing I stated got here true, then they have been much more motivated. After which as I transitioned into multi-family and small, I began out with 10, 20, 30 items, so mid-size multifamily, which was a special set of brokers. And so I needed to reinvent myself once more and try to determine, okay, what are a number of the issues and what are some issues that I can do for them now that everybody can shut rapidly and all this stuff, it’s extra of a stage enjoying subject. What I discovered was that, they wished to purchase homes off market, so then I used to be capable of assist them discover, join them with wholesalers, as a result of Denver’s appreciated fairly quickly.

A few guys have been like, hey, are you able to assist me discover a home for my household? After which a few guys wanted assistance on inspection objects or wanted assist with a very good countertop man or a very good flooring man. And so I used to be in a position to make use of my energy in building so as to add worth to what they have been making an attempt to do, which was, discover a actually whole lot on a house or get building performed cheaper. Another examples that come to thoughts are, they wished to journey to South America. And so as a result of I used to be from Columbia, I used to be capable of introduce them and get them reductions on their lodges, launched them to those that I knew in that metropolis. So simply little issues, I believe it doesn’t must be one thing large, even simply referring them or getting them right into a restaurant they couldn’t get into. I believe one time I received a brokerage staff right here, courtside tickets to the Nuggets, as a result of I had a relationship there.

I believe something alongside the traces of, if I knew somebody was fascinated about basketball or soccer and to go to a Broncos sport, I had a relationship there, I believe it comes again to the basics of asking questions, getting them to speak about themselves, being constant. After which by way of these two issues I used to be capable of, this individual likes basketball, this individual wants assist with this. You simply put that collectively and you need to watch out, you wish to just be sure you’re doing it in a very pure method. You’re not anticipating one thing in return, and it’s a real. I believe numerous good issues have come from that and I do assume that that works.

David:

One thing that you just talked about that I believe doesn’t get talked about sufficient, is that profitable folks resolve issues. When Brandon and I’ve folks come to us which might be having a tough time getting began or getting their first property or simply having success. They’re typically asking questions that when you look deeper are indicative of the very fact they’re making an attempt to keep away from having to resolve an issue. They’re saying, give me a system, simply give me a step, inform me what to go do, I don’t wish to must determine one thing out. However in any business, what the perfect folks do, is resolve both more durable issues or extra issues than everybody else does. That’s the way you earn the next earnings.

Terrance is representing skilled athletes. They’ve an issue the place they’ve a brief window of their profession. They’re in a extremely aggressive atmosphere the place different folks need their job and they’re making an attempt to get as a lot cash as they’ll throughout that window whereas the staff is making an attempt to pay them as little cash as they’ll and preserve as a lot flexibility as they’ll, to interchange that individual with any person else if they need. And so there’s a battle there with quite a bit at stake, if Terrance steps in and solves the issue, he’s going to receives a commission extra. That’s actually simply every thing in life that you just have a look at. That’s the case. I’m curious Terrance, in your journey that you just went, you stated you went from single household to mid-sized, to large offers. Are you able to speak a bit of bit concerning the totally different issues that you just needed to study to resolve at every step of the way in which that allowed you to ascend into these greater offers?

Terrance:

So many issues, it’s unreal, so many issues. It’s a unbelievable matter. And simply going again, I believe the preliminary drawback was, with single household, while you’re making an attempt to scale and you actually wish to construct one thing, and I do know you guys have each been there, I had 10 or 12 tasks going on the similar time, I’m operating round throughout Denver, which is fairly large. I’m spending hours within the automotive, and simply making an attempt to handle all the small print. Once you’re promoting single household houses in Denver and the common buy worth is 4 or 5, $600,000. The small print actually matter. The final 10% is the toughest. And in order that was an enormous problem. The capital clearly was not a problem, I used to be very liquid discovering personal cash lenders and the development.

It wasn’t a lot a capital factor, it was extra of, how do you run that group effectively and handle the small print? And so rapidly that’s the place multifamily, smaller multifamily turned actually enticing, as a result of I may purchase one 30 unit constructing and I used to be doing 30 loos and 30 kitchens all at one tackle. So naturally is rather more environment friendly. However the issue there turned capital, proper? In Denver and I used to be shopping for, I believe the primary bigger deal that I purchased in Denver was two and a half million {dollars}. On the time that was an insurmountable quantity. I didn’t have any capital, companions. I didn’t have LPs, I didn’t even know what syndication again then. It was 2015. I used to be like, oh my gosh, how am I going to return up? I believe I needed to provide you with $500,000 for the down cost, after which the renovation was like 400, so $900,000.

I used to be used to doing flips the place we might get personal cash fund 100% of the acquisition after which we might convey the development. If we’ve 10 tasks occurring, we have been speaking about $400,000, however you would time it otherwise. Proper? You didn’t must have that unexpectedly. So the fairness and the development, while you get into smaller multifamily was positively a problem. After which the second problem is lending. Lenders are rather more tough, proper? I’m not W2, I’ve truly by no means had, I’ve by no means been employed as a W2. So bankers, it’s tough, proper? It’s very difficult making an attempt to get that first mortgage. I truly needed to go to Des Moines, Iowa. My first two multifamily tasks that I did in Denver, I did with an area financial institution in Des Moines, that knew me and I knew what I had performed. It was extra of a private relationship.

They flew out, noticed the tasks, knew that I may execute on it they usually took an opportunity. After which when you do this, the lending will get simpler. However that first two, first one or two are very, very tough. I’d say the challenges going from single household to small multi, was getting snug with the cash, the acquisition worth, the fairness wanted and the development, after which the lending, rather more tough. A variety of hurdles there. Bankers are defensive by nature. I prefer to say they love the examine packing containers, which as an entrepreneur, I simply wish to do offers. I’m not trying to examine all of your packing containers. That’s a problem. After which as I received actually snug with that, and I began to do 10 to twenty of these a yr, I had the relationships with brokers and now brokers are calling me and now I’ve a full pipeline and now bankers all are calling me they usually wish to all lend to me.

And so now I’m in the identical place the place I’ve needed to reinvent myself the previous couple of years, I’m making an attempt to do bigger offers. Clearly everybody needs to do bigger offers, so there’s much more competitors. They’re rather more institutional. It’s a special set of brokers. I had simply constructed these relationship with these brokers that I’d solved issues for, constructed relationships, I’m on the prime of their checklist, and now I’m having to do it once more for this new set of brokers, as a result of it’s totally different. It’s not the identical guys which might be promoting these. The lending truly, I believe will get simpler, the bigger the offers go, however the fairness checks, they develop by a number of zeros.

And in order that’s been one thing within the final two years that I’ve began doing, is syndicating, making an attempt to combination capital. I’m having to have relationships with some privately rich people, possibly some household workplaces, having the pipeline to find a way the fund these bigger, we’re doing 20, 30, $40 million offers now, that you need to convey 10, $15 million of fairness with the development. Clearly that’s a a lot totally different individual. And so I’ve needed to learn to navigate, though lending received simpler, elevating the cash received tougher and getting the deal for my part. is definitely the toughest factor proper now, in these markets, particularly Denver. Denver is so sizzling. There’s a lot institutional, even worldwide cash chasing multifamily in Denver. There’s no yield wherever.

Multifamily, I believe considerably a cell house parks is the rising star within the industrial asset class. There’s yield, there’s a housing scarcity. And in order that’s made it much more tough, that everybody’s transferring to Denver, all the cash’s chasing Denver. And now I’ve received all these different folks from all these different components of the nation which might be all making an attempt to purchase the identical offers I’m shopping for. Attempting to separate myself proper now, I’m nonetheless within the strategy of doing that, making an attempt to use those self same fundamentals to standing out and making an attempt so as to add worth to those brokers, in order that I can transfer to the highest of the road.

Brandon:

Properly, so this can be a factor we cope with on a regular basis. It opened our Capitol in our companies, because it will get an increasing number of aggressive, we face this query, will we diversify into different asset courses? We’re going so as to add multifamily on this yr as nicely due to this, or do you decrease your return expectations? Are we resetting? Do we have to as, to not say we’re main the cost, however ought to we be decreasing expectations for traders for LPs going ahead? As a result of the great outdated days are gone or will we simply do fewer offers? How do you are feeling on this entire? As a result of this can be a drawback with numerous syndicators proper now’s, it’s simply so darn aggressive, is driving the power to get offers.

Terrance:

So aggressive within the provide, there’s such an below provide. Our enterprise mannequin is, we personal the development, we personal the property administration. Again within the day once we have been doing flips, I used to be truly doing flips, as a result of I had these relationships on the bottom, so I used to be doing flips and Louisville and Dallas and Indiana. We have been doing stuff in South Carolina and Denver and Iowa and all these totally different markets. There’s so many markets that I like, and if every thing labored out in actual life, the way in which it appears to be like on paper, I’d be doing offers throughout. The issue was, I misplaced some huge cash, trusting different folks with the operations and the small print of building and property administration. And so we’ve actually condensed to Denver and Des Moines as a result of we all know the market, we personal the development, we personal the property administration.

And so what we’ve performed is simply needed to be affected person, we simply had Sterling White on our present, Tribe of Multifamily Mentors right here, that we’ll get into later. We’ve needed to get inventive on sourcing offers. Our LPs, what’s fascinating as you understand this Brandon, coping with privately, rich people in open door, they don’t wish to hear, they assume a pandemic or they assume a recession they usually’re like, I needs to be getting higher returns. The concept we may even convey that up is just not one thing they wish to entertain. They need higher returns. They’re seeing all types of offers, household workplaces, institutional traders, they’re seeing unimaginable deal movement. They’re not even open to the subject of a decrease return.

And in order that’s not one thing that we’ve considered. We’re simply having to stay to the basics, be very constant, construct relationships, repeat that and put ourselves able to win, simply creating, simply filling pipeline and placing ourselves in the precise place. And hopefully the ball will go our far more than it gained’t, however yeah, it’s tough and we’re simply being affected person and sticking to the basics.

Brandon:

Let’s speak concerning the fundamentals a bit. To return to a basketball analogy, proper? there are these, the elemental drills that we’re going to be engaged on, which might be going to enhance our sport. Understanding that our viewers is people who find themselves shopping for their first home. There’s some folks making an attempt to purchase 20 items, some folks making an attempt to purchase 100 unit, proper? And every thing in between. What are the basics that may apply throughout the board to everybody, for investing in a loopy costly market? A few them I’ll simply pull that you just already talked about, one, you actually focus down into a few markets, proper? You bought actually particular on the place you’re investing. You’re not simply in every single place. In order that’s a very good one we are able to pull out.

I wish to dive a bit of bit extra into that. One other one you stated is get inventive discovering offers, get inventive in your pipeline. Perhaps these are a pair factors we are able to dig on. And possibly we are able to undergo just a few extra, David, you as nicely. Why don’t we begin with the targeted in on a market, how broad are you wanting proper now? Why did you say you’re specializing in fewer? Logic needs to be the other, proper? I’m having a more durable time discovering offers, go to extra markets, develop greater, however it doesn’t appear to be what you stated. Why is that? What’s your views?

Terrance:

I’m going to reply that query. I wish to inform a narrative. So fundamentals, that is certainly one of my favourite matters and browsing. You’re a surfer. Now I heard-

Brandon:

That’s a stretch. That’s a stretch. That’s a stretch. I can-

Terrance:

Properly, you posted about it on Instagram.

Brandon:

I stand with a surf board. I stand, I stand with a surf board.

Terrance:

Properly, you stand subsequent to it. Properly you’re 6’5. You bought the beard. You bought that look. However what’s fascinating is I heard Jerry Seinfeld speaking about this a few months in the past. He was saying, skilled surfers are literally simply skilled paddlers, proper. They’ve simply perfected paddling after which they develop into a surfer. Basketball and sports activities, and I believe life is the very same method. A narrative that hopefully will resonate with numerous viewers that like basketball, is that, I represented a consumer in 2012. We have been in Orange County and he would work out with Kobe Bryant just a few days every week. We get to the fitness center at 6:00 AM. I’m actually drained. However hey, I’m actually excited to look at Kobe exercise, with out making an attempt to make it awkward.

Kobe labored out along with his coach for 2 hours on one facet of the courtroom and he by no means shot the basketball one time. I used to be there, by no means shot the basketball one time in two hours, he actually labored on one transfer on either side of the courtroom and that was it. He was drenched in sweat. Two hours, by no means shot the basketball one time. His focus there was, he had missed a shot, I believe the yr earlier than, that would have gained the finals for them. And he was engaged on this transfer. It was a pivot transfer with simply actual footwork. He’s solely engaged on the essential fundamentals, issues that youngsters in third grade would work on. That cemented concept in my thoughts, if the perfect basketball participant on this planet reveals up at a fitness center and works on one factor for 2 hours, how rather more ought to I, as somebody that’s making an attempt to develop into the perfect at one thing, actually simply concentrate on essentially the most primary fundamentals and grasp the basics.

And so the basics in actual property and sourcing offers, I believe are the identical factor. It’s, you need to know the market. I believe when you’re actually unfold out, going into your counterintuitive level is, after I was doing offers in eight totally different markets and have been funding, it received so scattered and there was so many zip codes and so many neighborhoods. It might take a lifetime to know all of these markets, however as a result of we’re doing offers in Denver and Des Moines, I grew up in Des Moines. My brother’s there, my dad’s there, my sister’s there and I reside in Denver. I’ve been right here for 16 years now. Now, if somebody brings me a deal in Des Moines, both my brother, myself and my dad are going to know that space, or we already personal a property there, or we did personal a property.

So we’re going to know what the tenant goes to be like. If it’s historic, we’re going to know if the town has any particular zoning there. We’re going to know the age of that constructing. We’re going to understand how it was constructed. We’re going to know if it has any quirky electrical, plumbing points. Similar factor in Denver, proper? If somebody sends me a zipper code, I probably have performed a deal or personal a deal in that zip code, actually near that avenue. And so I’m going to know. And so having that native data simply accelerates the power to underwrite actually rapidly and know who the gamers are in that space. Proper? Each market has three or 4 folks, that I believe, management the deal movement. And so when you may go deeper and you actually focus in, you’re going to get it to know these folks.

After which from there simply involves, how do you keep by way of communication, asking questions, being clear about that, after which being constant and trying to resolve issues for them. For those who do these issues in that market, you’re going to see deal movement no matter how sizzling the market is. I’ve heard that Denver is such a sizzling market since I began in 2014. In truth, after I began in 2014, folks informed me I’d by no means have the ability to discover off market offers that match my standards. I’ve heard that each single yr in each markets. My line to everybody on our staff is, if we simply keep on with the basics, if we observe up with sellers, if we observe up with brokers, if we keep in contact and we ship on what we are saying we’re going to do. Typically we’ve to tighten up our phrases, proper?

I believe proper now what we’re doing is, we’re making an attempt to undergo due diligence the quickest. We’re making an attempt to possibly get a bit of bit extra aggressive on earnest cash. We’re making an attempt to have lender relationships already locked in, proper? If I hear a couple of deal and I do know that the vendor is basically motivated by comfort and pace and certainty, which you persons are going to begin to hear much more, certainty. They wish to know that you would be able to shut. Naturally what we do is, we simply attain out to banks forward of time and say, hey, there’s this deal. Listed below are the numbers on it’s, is it one thing that matches your field and the way rapidly can you progress? They’re going to need us to shut and below 35 days or 40 or regardless of the information are for that specific deal.

And so, once more, basic, simply reaching out, ensuring that I’ve every thing that I want in line. In order that method, when the vendor’s able to transact, I’ve received my geese in a row and I’m prepared to maneuver ahead. I hope that that answered your query relating to fundamentals.I’m making an attempt to use the very same ideas whatever the asset class or how rather more institutional or aggressive it will get.

Brandon:

That’s so good. Let me simply summarize what you stated. I scribbled some notes right here when you’re speaking. Primary, once more, realizing your market, simply realizing the place you’re going. To convey up some extent that I get on a regular basis requested, they are saying, what’s the perfect actual property market to spend money on? And the overall reply is that, the perfect market to spend money on is the one which you understand, proper? I used to be actually good at Grays Harbor, Washington. It’s like this armpit of Washington state, horrible little location. I can become profitable there like nobody else, as a result of I knew that market higher. For those who have been in Seattle and also you simply got here to Grays Harbor to go purchase actual property, yeah, you’d fail. If I went proper now and purchase in Detroit, I’d in all probability fail. I don’t know Detroit, however I do know folks in Detroit, which might be simply cleansing up there proper now, as a result of they know Detroit, and also you and Denver.

I have a look at Denver, I’m like, there’s no method I’d spend money on Denver proper now, as a result of I don’t know Denver. It’s not as a result of it’s not going to market, it’s as a result of I don’t comprehend it. Primary is that, realizing your market, you talked about being aggressive in your provide phrases. I believe that’s nice. Being keen to do what the vendor needs to make your self stand out, that applies to everyone right here. Quicker pace, each with closing and with making provides. That’s large. Extra certainty together with your lending, which is large after which getting all of your geese in a row, your paperwork, every thing, making it straightforward on everybody. These are factors that everyone can apply, whether or not you’re making an attempt to purchase your first deal or your one centesimal deal, these items issues.

It’s simply doing a very good job at your job, of actual property. Anyway, thanks for sharing that stuff. David, something you wish to add on there? You’re the man that wrote the lengthy distance ebook on realizing your market. Something in there?

David:

What I used to be pondering after I was studying this, is I wager I may create a basketball analogy for all 5 of this stuff, that Terrance simply went over. Know your market and focus there, could be know your sport as a participant, know what your photographs are, know the place you’re assured and what you shouldn’t be doing. Extra aggressive on provide phrases could be like, you’re at all times attacking the offense. The cool factor about basketball is that you just at all times are aggressive, however you don’t must make errors. If there’s nothing there, you pull it again and you progress round. However you get in bother while you get lazy and also you anticipate stuff to return to you. The sport works greatest when you find yourself attacking the protection and forcing them to be able that they don’t wish to be in, which is analogous to placing your self able the place you discover a vendor who must promote that home greater than you want to purchase one.

And also you’re able of benefit. Quicker pace to closing provides is clearly transferring the ball, enjoying the sport a complete lot quicker. Extra certainty with lending could be taking excessive share photographs and getting them by way of your offense. After which having your geese in a row, could be having a staff round you that is aware of the way you guys play the sport. It will get you the ball and the positions the place you need it and also you do the identical for them. What I like about what Terrance gave us was, he principally stated, I watched how Bryant performed the sport and he took what Kobe did and he’s now utilized it to actual property. These are the strikes that it’s best to observe. I truly wish to see if we are able to take a step backwards and speak about why Terrance has developed these particular strikes for the market that we’re in, as a result of the foundations of the sport dictate the way in which that we play it.

We’ve given folks a playbook for what to do. I wish to speak concerning the distinction between the alternatives traders have. What lots of people are seeing is that is clearly a sizzling market. Some cities are hotter than others. That usually is the place the massive wins come from. Individuals have the choice to make, do I spend money on what’s a sizzling market is and probably get my butt kicked, making a mistake, or do I’m going to the tough markets the place I can play it secure and I can get extra cashflow. However my upside is severely restricted. You talked about, you have been doing flips in Louisville. You’re more likely or much less prone to get harm in a market like that. You’re additionally a lot much less prone to put factors on the board.

I believe Denver is the proper place that we are able to begin with, as a result of that metropolis actually sums up what occurs when tech cash strikes into someplace and capital floods right into a market and the wave that you just see coming. Terrance, what’s your opinion on if folks needs to be investing in a market like that or if they need to keep away from the craziness and they need to go someplace safer?

Terrance:

That’s a wonderful query and fairly loaded. I hope that I can do it justice. Ought to folks spend money on Denver? Completely. However then they need to pause and say, okay, what are my objectives? Proper? You guys have talked about it. Simply the basics of actually simply being self-aware of understanding your individual private scenario. For those who’re in San Francisco and somebody has thousands and thousands of {dollars} to deploy, then yeah, Denver is a superb market. I believe over the subsequent 10 years, Denver could have extra progress than in all probability numerous cities in California and has higher tax remedy, numerous different benefits. So ought to somebody with numerous liquidity come to Denver? Completely. Ought to they do it on their very own? Most likely not. Since you’re going to face numerous competitors from those that have liquidity and have higher market data and have a aggressive benefit, far more than you.

I believe, when you’re trying to make investments at a state in Denver, I believe you need to have an area accomplice or you need to be investing in a syndication or doing one thing with somebody that basically is aware of Denver. As a result of though Denver has grown, it’s similar to the place you guys are at, each market, no matter how massive it may really feel or appear, it’s nonetheless is basically small with regards to the actual property neighborhood. Denver is large, however within the industrial multifamily area, there’s 5 or 6 corporations or teams that basically management who’s gaining access to the offers, who’s wanting on the offers, who’s lending on them. It’s very small on the prime as you develop. And even on the one household facet, it’s nonetheless run by possibly 4 or 5 brokerages.

For those who’re with an agent in a kind of 4 or 5, you’re going to get entry and actually good service, and also you’re going to see the precise factor and also you’re going to get the precise recommendation. However when you’re working with somebody that doesn’t do numerous quantity, you’re going to get crushed. I like the concept of investing in markets that you just both… The aggressive benefit comes right down to, do somebody on the bottom that has a aggressive benefit?, I’m not in Des Moines, however my brother is, so naturally I’ve a aggressive benefit. And that’s why we’ve been capable of place in capital in Des Moines and we’ve performed extraordinarily nicely. However with out my brother there, or my father, or having grown up there, I’m at an enormous drawback, proper?

As a result of Des Moines is small. There’s only a few those that run it. It has a factor referred to as rental inspections with the town, which is extraordinarily tough. A variety of capital that’s come exterior institutional capital has gotten utterly crushed, as a result of they didn’t perceive the foundations of the sport. They didn’t perceive and what the opponent, the town was going to throw at them. And they also went into that sport unprepared. I believe that you need to actually, actually analyze, what are my objectives? If it’s somebody searching for a home hack or searching for their first funding, I’m with Brandon, you’ve received to speculate the place you understand, or with somebody that has a aggressive benefit elsewhere. These are issues that each investor has to determine for themselves. Once we do the Q&A, on the Tribe of Multifamily Mentors, this query comes up quite a bit, ought to I’m going out of state?

My market’s appreciated, blah, blah, blah. It’s overpriced. I simply assume that you need to actually have a look at the entire knowledge. You may’t simply have a look at worth, proper? Individuals like to throw round, oh man, the value per door has gone by way of the roof, however they’re probably not taking into consideration what the distinction between the cap fee is and the debt. As a result of truly the unfold is bigger now than it’s ever been between you should purchase and what you’re getting debt at. Again in 2014, 15, debt was at 5% and cap charges have been at 5.5, 6%. Your unfold was quite a bit decrease. Now you should purchase a 5 cap or possibly excessive fours and money owed at three. So that you even have a much bigger unfold. I’d say, truly the market’s even higher now. However generally traders get caught up with one or two knowledge factors they usually’re not wanting on the full image.

I believe that simply comes right down to, which is why we named the present, Tribe of Multifamily Mentors, is have a mentor, have a coach, have a accomplice, have somebody that’s an professional, has extra expertise, has possibly some grey hair or has had sufficient expertise to provide them grey hair. That’s the place it’s best to begin. I believe when you’re simply taking a look at worth per door or the acquisition worth on a house, you’re not wanting on the full image and also you’re not going to make the precise choice when you’re not wanting on the full image or you’ve got a very good coach.

David:

Terrance, are you able to break down why it’s related that there’s a selection between cap fee and rate of interest?

Terrance:

Yeah, completely. The cap fee is, it’s a perform of the bills and the NOI, the web working earnings. And so properties commerce at a a number of of that, that’s the cap fee. And so NOI, internet working earnings doesn’t think about debt. You will have all of the earnings after your bills, and the decrease the debt the extra the distributable cashflow you’ve got, that’s what you may reside on, proper? That’s what you may both ship to your individual checking account or ship to your traders, which is an efficient factor. And so the cheaper debt will get and as cap charges keep fairly mounted near that 5% or, someplace in there, relying available on the market, you’ve got extra distributable money movement there, between what your NOI is, your earnings after bills and what the debt is. And so the bigger unfold, that’s an excellent market.

Proper now we’ve a fairly good unfold due to how low cost debt is specifically on multifamily. A single household I believe has floated a bit of bit. I believe relying on whether or not it’s a jumbo or what worth level wherein market, I believe that’s bumping, however truly multifamily, we’re getting quoted proper now within the excessive two’s, on a 20, 30, $40 million buy, with the ability to lock in a excessive 2% rate of interest is unprecedented. The punchline for me is, sure, costs have gone up. Sure, market is sizzling. Markets are sizzling. Sure there’s competitors. However that doesn’t imply you shouldn’t nonetheless purchase in your yard simply due to these issues.

David:

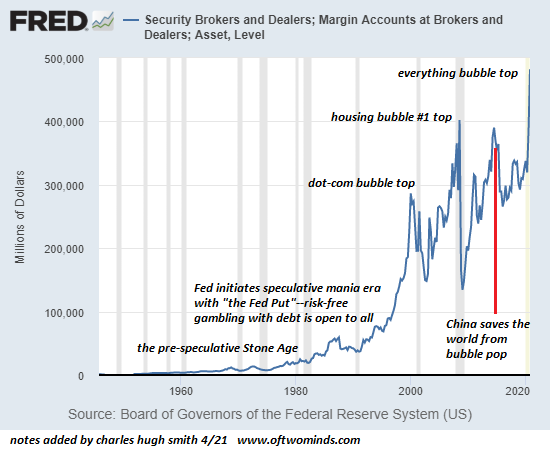

I believe a part of the explanation markets are sizzling proper now’s as a result of debt is so low cost. You made an excellent level, while you simply have a look at the value, it appears to be like like that is ridiculous, however that’s an novice method of taking a look at an actual property asset, is how a lot does it price? What you actually wish to be taking a look at is how a lot does it convey me in a return. The rationale the market is sizzling, is as a result of debt is so low cost, which is nice for you, proper? For those who’re capable of purchase one thing at a 5 cap, which suggests you’d get a 5% return in your cash with no debt, however you may borrow cash on it at 2.5 or 2.9% rate of interest, the money movement you’re going to see after you tackle that debt remains to be actually excessive, which is strictly why everyone’s placing their cash into actual property.

There’s additionally fears that we may very well be going into bubbles in several asset courses, and actual property is the most secure one. It’s going to be valued at a premium. What I like about what you’re saying, is that, you may’t be easy sufficient as to only say, costs are excessive so I’m going to attend for them to return down. You bought to know the basics of what’s occurring that’s inflicting these excessive costs, as a result of that may nonetheless, though the costs are greater, it’d nonetheless be the perfect and most secure funding for lots of people. Would you agree?

Terrance:

I received a very good analogy for you. You’re going to understand this because you had the 5 factors associated to basketball. It’d be the equal, so simply taking a look at worth level, is it equal of strolling right into a fitness center together with your staff and also you look throughout they usually’re warming up they usually’re all tall. They’re all 6’5, like Brandon, they received beards, they give the impression of being severe and also you’re like, whoa, we’re 5’10.

Brandon:

They appear like professionals surfers.

Terrance:

Yeah, yeah. Perhaps a bit of bit bulkier. And also you’re like, let’s get out of right here. These guys are taller, we’re out. With out even watching them run or dribble, you don’t even know if they’ll tie their sneakers, however you stroll into the fitness center and also you see a taller, extra athletic wanting staff. And also you’re like, these guys are tall. We’re out. Let’s go house. You haven’t even performed any analysis. You’re simply scratching the floor. It’s important to go deeper than simply buy worth. It’s important to have a look at the total image.

Brandon:

I can speak concerning the hell home that I purchased again, I don’t know, 15 years in the past now. One of many very first property I ever purchased. I purchased it as a result of it was $45,000. And I used to be like, that’s a loopy low cost worth for a home. That’s superb. That deal was the worst deal I ever did. As a result of as an novice, I used to be solely taking a look at worth. It really works each methods, proper? Like, that’s too costly. I don’t wish to purchase that as a result of it’s an excessive amount of. Or that should be a very good deal as a result of it’s low cost. It’s received to be good. Slightly than such as you’ve stated a number of occasions, have a look at the total image. What does that appear like? Anyway, tremendous essential level for everyone it doesn’t matter what stage they’re at, is to not get overwhelmed by these, I don’t know, name them vainness metrics as a result of they’re essential, however they’re not as essential.

Now, one factor I do fear about, I’m curious of each of your ideas on this. David, you stated it a minute in the past, that one of many causes actual property appears to be doing so nicely proper now and simply continues to creep greater and better in worth, is as a result of debt is so low. Proper? I simply received a industrial mortgage at, I believe it was 2.89 or one thing like that. It’s loopy, proper? Nuts. Due to that, it retains the value of actual property excessive. What occurs then if and when rates of interest go as much as 4, 5, six, seven? Once more, are we going to see a drop in values due to that? Are cap charges going to start out going up dramatically due to that? Or what do you guys anticipate there?

Terrance:

That’s a wonderful query. I believe from a macro financial standpoint, for the federal reserve to lift rates of interest, we must be in a serious financial growth. Proper now, the whole world is getting crushed. The financial scenario all over the world is, everybody’s printing cash, everybody’s struggling. And so I believe our Fed has come out and stated, they’re not going to lift charges for a yr, two years. They wish to see inflation. They wish to see the price of issues go up. They wish to see unemployment get again down. They wish to see wages rising. We have to see large progress throughout the nation, particularly in cities like LA, New York, Seattle, Chicago, Minneapolis, which have simply been decimated by the final 12 months.

I used to be simply in Alabama with my faculty buddies on a golf journey and downtown Birmingham. I like Alabama, however downtown Birmingham was a ghost city. There was one restaurant open within the Birmingham airport, one, as a result of everybody’s on unemployment and their minimal wage is so low that they’re making more cash being at house. Now, it’s not a political dialogue in any respect, however the easy truth is, there’s lots of people not working proper now. And so to ensure that rates of interest to go up, there’s going to must be an enormous financial growth. And so then what’s going to occur when persons are making more cash, rents will go up, proper? It wouldn’t be the worst factor. If rates of interest begin to creep again up, that implies that the Federal Reserve is saying, hey, issues are coming again.

Individuals are beginning to pay extra for issues. Individuals are beginning to earn more money, earn extra earnings, and we are able to now increase rates of interest and rents are going to go up. Rents usually go up disproportionate to debt. And so cap charges truly may keep the identical, as a result of rents would leap greater than the debt. And so I believe if rates of interest go up, it’s truly a very good factor for us, as a result of Denver has an enormous below provide of workforce housing. If the middle-class and the working class could be earning profits, then they’re going to be paying extra in hire, and naturally that’s going to be higher. For me. If I’ve 10 yr debt locked in at 3% and rents are going up, I don’t actually need to promote. Proper? But when rents go up sufficient and cap charges possibly develop a bit of bit, then I’m nonetheless going to get rather more for the property as a result of rents could have gone up disproportionate to debt. And so I believe debt going up would sign a very good factor.

Brandon:

That’s an excellent reply. I wasn’t even occupied with the hire concern, however yeah, if rates of interest go up, I believe most of us anticipate rents to go up, inflation simply on the whole to go a bit of bit nuts the subsequent decade. I believe that’s an excellent chance. David, something you wish to add on that?

David:

Nice level. I had the identical query after I first began investing and I had a smart individual with some grey hairs that broke this down for me. They principally stated, when rates of interest go up, it’s to decelerate inflation. If inflation has gone up, the very last thing you want to fear about are rates of interest, since you’re going to be making hire on, will increase on all 50 items that you just simply purchased, not simply this share that you just’re taking a look at. It’s very onerous for rates of interest to go up excessive sufficient, that it may ever meet up with the inflation that you just’ve already seen. After which the subsequent man isn’t going to have the ability to purchase the property, so banks aren’t going to have the ability to make loans on it they usually’re not going to do this.

Terrance:

I believe, it’s onerous for me to ascertain a state of affairs. Not that it’s not attainable as a result of something is feasible. We’re dwelling in wild occasions. It’s onerous for me to ascertain a state of affairs the place debt goes up, however hire doesn’t go up much more. We’d be in a very powerful financial spot, as a result of principally that simply slows down the financial system. And the very last thing that anybody needs to do is decelerate our financial system. We have to gas it. And the way in which to gas it’s to maintain debt low, so folks like us are keen to take extra possibilities, do extra tasks and traders and establishments are eager to do extra to create extra jobs, which then can gas, persons are spending extra. I believe so long as rents are going up and the financial system is booming, debt going up is just not a foul factor.

Now, if debt goes up and rents will not be going up and the financial system isn’t booming, then I believe there’s going to be some challenges there. I believe to keep away from that the elemental proper now, and the sensible factor to do could be both refinance, if in case you have costlier debt, refinance, or while you’re shopping for simply lock in long run low cost debt. As a result of cycles usually final 24 to 36 months, so when you lock in 10 yr debt, I believe it’s going to be onerous to get caught in a foul spot. I believe these could be two basic issues you would do proper now, both refinance or while you’re buying, lock in low cost debt, seven, minimal, 10 years.

David:

I believe getting that long run debt, the longer you may go proper now, I believe is a smart transfer.

Terrance:

What are you seeing Brandon on the cell house area, what sort of debt are you seeing on the market? Are you guys capable of get 10 yr mounted proper now?

Brandon:

We’re. I believe the two.9 we simply locked in was a ten yr mounted. What we’re discovering is the nicer parks, it’s tremendous straightforward. The finance is simply there. We get nicer properties. The battle we had and we needed to pivot, was the crappier properties, as a result of that dried up very a lot, those that have been keen to take these dangers on the tough ones. Now these are nonetheless much more tough. They’re all recourse. They’re a bit of extra shorter time period. We’ve actually pivoted quite a bit to only purchase nicer parks. Most of our stuff has quite a bit nicer, quite a bit bigger, as a result of we actually need that non-recourse, Fannie, Freddie [crosstalk 00:47:39] institutional debt. It’s been fascinating.

I’m curious, shifting a bit of bit, we don’t have numerous time left in in the present day’s present. 2020 by way of numerous actual property traders into panic mode, and lots of people simply stopped investing. They only stated, you understand what, I’m going to attend for this factor to cease. What was 2020 like for you? Did you simply sit on the sidelines and wait, did you develop in any respect? Did you shrink, what occurred throughout that point?

Terrance:

2020 was wild man. It was wild. I had a child boy in Could, Noah. That was in the midst of the pandemic. The hospital kicked us out after 24 hours. We moved homes. My spouse and I had purchased a house the yr earlier than, we had renovated it. We have been transferring, having a child and I used to be making an attempt to develop an organization and lift cash. It was wild. I did the other. In 2008, I used to be 22, 23 years outdated. I had no concept what was occurring on this planet. I keep in mind my dad referred to as me one time, it was late 2007. He stated, “Hey man, you want to watch out, lots of people are shedding their jobs, the financial system is wanting dangerous. You must begin saving.” Blah, blah, blah. And I used to be like, “Dad, what are you speaking about? We’re promoting franchises, we’re killing it. Recession, I don’t even know what which means.”

Via the recession, I used to be single, had no danger, had no accountability and we crushed it. I didn’t even really feel it, proper? We have been shopping for homes at foreclosures. We have been printing cash. After which this final yr was the primary time that I used to be like, oh my gosh, that is what this appears to be like like, to have a mortgage and have a household. Everybody goes right into a bunker and tremendous, there was concern in every single place, concern in every single place. It was not snug. I misplaced, inside a seven day interval, there was in all probability three or 4 offers we had below contract to promote, and we have been in all probability going to make, I don’t know, a number of seven figures on these gross sales. And so they all terminated, each single one. I used to be sitting there like, oh my gosh, what are we going to do?

It wasn’t snug. It was extraordinarily tough, difficult, all these issues. And this sounds the precise factor to do, however actually I simply went again to the basics and I stated, hey, look, if everybody else is afraid, I have to get aggressive. I’ve received the infrastructure in place. I’ve received the capital, I’ve received the development, I’ve received the property administration. I actually imagine in Denver. We’ve received the precise relationships. If the precise deal comes throughout, we’re going to purchase it. And so we truly had the perfect yr we’ve ever had. We purchased $35 million price of actual property in Denver. I used to be capable of purchase, a number of the greatest offers I’ve ever performed in the midst of the pandemic. Really somebody referred to as me a couple of house and the woman had bought it a yr earlier than for possibly 1.1 million in a very nice a part of Denver.

I purchased it for 735, put 35,000 into it. The concern was jumbo loans, proper? That was the concern. Everybody’s like, we don’t wish to contact that house as a result of nobody will have the ability to purchase it. I purchased it in Could. We bought it in July for 1.2, 1.3 million, put 35,000 into it. It was insane. We purchased an residence advanced for 100 a door and I bought it actually 90 days later for 125 a door, didn’t even do something to it. And so, I believe that, once more, having, we had the items in place and I caught to the basics and I stated, look, if a deal comes throughout my desk that meets this standards, and I knew what my standards was and I used to be actually clear about it. And other people have been calling me, they stated, hey, are you continue to shopping for? Nice, as a result of we expect that this man needs to promote this. Man’s actually scared. And there was concern in every single place.

Now, I didn’t go loopy. I positively modified the underwriting. I made certain that we had financial institution debt. I made certain that I may execute and shut on what I wished to do. As soon as I checked these packing containers and had these fundamentals in place, we did what I nonetheless assume are a number of the greatest offers that I’ve ever performed. I want that I’d have had extra capital. I want I’d have been capable of do extra final yr. Everybody says that, proper? Warren Buffet’s large factor is, when everybody’s shopping for, try to be promoting, when everybody’s promoting try to be shopping for. And that sounds good. And the ebook says that. Everybody is aware of that, however it’s a lot tougher within the second when everyone seems to be afraid and the information is dangerous and everybody’s freaking out and your spouse, it’s chaos. It’s a lot more durable to truly execute on pulling the set off.

Brandon:

For this reason everybody’s like, I’m simply ready for the market to say no once more, so I can leap in. I’m like, no, you’re not. You’re not, you’re going to be freaked out like everybody else is. You’re going to be like, you understand what, I believe actual property is a foul concept, and also you’re not going to do it. You’re going to attend till it goes up once more, and also you’re like, I ought to’ve performed it again in… Make investments now, make investments later, spend money on good offers anytime and also you’ll at all times be effective then.

David:

Terrance had an excellent instance of a home you picked up for 735 and then you definitely put 35 in, so that you’re all in for 70, 70. And the explanation it was accessible to you at that worth was that different traders have been pondering, they’ll’t get a jumbo mortgage, as a result of when COVID first hit, that’s precisely what occurred. All of the jumbo lenders. In truth, everybody we labored with in my mortgage firm actually stated, no extra loans. We’re going to attend and see what goes on. That does ship a shockwave of concern by way of the market. However concern is at all times a short lived emotion. It doesn’t keep there on a regular basis. Terrance, you performed sports activities, you understand what it’s prefer to go from being heartbroken to pondering you’re going to lose, to at least one play, and also you’re like, they’ll’t cease us. We’re on. Proper?

That’s simply how feelings work. And so the those that acknowledge that and function out of religion, I do know actual property goes to bounce again. That is the way it works, that took motion, made half 1,000,000 {dollars} on one deal. I simply did the identical factor in Maui. COVID shut down the brief time period rental market in Hawaii. It was very onerous to journey there. Hawaii made it very tough for anybody to go. Everybody that had brief time period leases was getting hammered. I walked into that market to go purchase brief time period leases when there was a bunch of homeowners that have been pondering, I have to do away with this factor. I’m shedding cash each month. I purchased it and I had a protracted escrow, however every of them had appreciated by over six figures, simply throughout the time period we have been in escrow, is the exact same precept you’re describing.

Like Brandon stated, the accountable, skilled traders to make use of a Steven Pressfield phrase, acknowledge when everyone else is feeling afraid, and that’s once they go take motion. the folks that aren’t professionals, as a result of when it switches and you’ve got the 2010 when, oh my God, there’s offers in every single place, no one’s shopping for them. As a result of they’re listening to everyone else say the identical factor. It’s helpless. It’s taking place much more, don’t catch a falling knife, after which these alternatives go.

Terrance:

And it’s onerous, as a result of you need to go in opposition to your complete being saying, it’s screaming, no, no, no. It’s making an attempt to speak you out of it. It’s like taking a chilly bathe within the morning my thoughts is at all times like, you don’t want to do this. You are able to do this. Why don’t you go stretch? Attempt to speak you out of doing the factor that’s what you want to do the precise factor. It’s the very same factor, when shopping for when everybody else is promoting, your complete being is screaming no, however you continue to have to have the ability to pull the set off. I actually assume that that sounds good. Proper? Everybody listens like, yeah, yeah, yeah, that’s the precise factor, however it’s so onerous to do.

I believe with a purpose to do it, you actually must dial in and have, we talked about mentors, a coach, the precise folks round you, that you would be able to return, do away with all of the noise and say, okay, what are the ideas of this deal? Will it cashflow if this, and this occurs? What’s the debt I can get? And actually, as soon as you understand your ideas and also you perceive the draw back, perceive the place the dangers are. I knew that the jumbo mortgage was the danger there, however I had plans and had inventive options of how we have been going to get round it if we had the precise purchaser that simply couldn’t get the jumbo mortgage. And so I believe understanding the danger, clearly figuring out that, realizing what the house would hire for, realizing I had backup choices. Once more, it simply comes right down to the basics of the deal.

If you understand your fundamentals and also you perceive and may determine the danger, I believe that’s among the finest issues you are able to do. Even in the present day, and I’m to listen to what Brandon says, however the way in which we’re capable of separate ourselves is, we are able to purchase offers that don’t match different establishments field. Both the yr it was constructed, the crime ratio, the unit measurement, generally possibly the unit measurement is simply too small for greater establishments, however it’s good for us. And so with the ability to creatively discover options for offers that different institutional, quote unquote, sensible cash gained’t purchase, that’s the place I’ve made my dwelling. And that’s the place I like enjoying. It’s simply the place nobody else is ready to function and understanding the dangers there and inventive options to these issues.

Brandon:

Properly, I like that. Earlier we talked concerning the significance of realizing your market, actually niching down in your market, but additionally that’s precisely how we function as nicely, is like, what can we be actually good at doing? I’ll offer you an instance. Within the cell house park area, there’s a factor referred to as septic lagoons. You ever heard of a septic lagoon? It’s like a lake. This cell house park will simply have a lake, and that’s the place all of the crap goes to, actually. It’s a factor with tons of cell house parks, simply have a septic lagoon. Don’t go swimming within the lagoon.

Terrance:

How distant from cell?

Brandon:

Proper across the nook. It’s there, within the park. And these septic lagoons are very, quite common. They scare me. Ryan Murdock, my accomplice, has this shaggy dog story the place he needed to go to this lagoon each week at one of many parks. He managed it years in the past. He’d go there each week and do that take a look at. The EPA will get concerned. There’s all this drama, proper? We at Open Door Capital have chosen to not contact septic lagoons. We simply is not going to do them it doesn’t matter what. However you understand what, when you have been proper, now simply pondering you wished to get right into a cell house parks and also you didn’t wish to compete with me. what I’d do? I’d go do septic lagoons. I don’t wish to cope with them, neither does any of the opposite large operators I do know, we don’t wish to cope with them.

When you will get actually good at a factor that no one else needs to the touch, that’s the way you get in there. It’s not so dangerous then, since you get it. You’re like, septic lagoons, these are the 5 issues to fret about. Right here’s how we take a look at about it. Right here’s how we’re going to cope with it. Right here’s how I wish to rework it. No matter. I gained’t even go there. Like stated, you discover these little areas and this once more works at each a part of the market. It goes again to our complete theme of in the present day’s present, is how do you spend money on a loopy aggressive market? Get actually good at some area of interest that no one else needs to the touch and also you’re going to be effective. Our area of interest is infill, we love the properties which might be 30, 40% empty, as a result of I do know I can put 30, 40, 50 houses a yr into these properties, as a result of we’re actually good at that.

It’s extremely tough to do. We’re actually good at that. That’s what we selected as our area of interest. Everybody listening, what’s your area of interest? What’s your bizarre factor that you would be able to be higher than anybody else had? After which go, simply crush it. I do know David, you assist numerous traders with home hacking. It’s a bizarre little area of interest. Turning a single household house into one thing that may generate cashflow, however you guys crush it at that, and that’s why everybody goes to you, within the Bay space that wishes to do home hacking.

David:

That’s precisely proper.

Brandon:

I like that.

David:

It goes right down to what Terrance stated earlier, the place you’re fixing an issue.

Terrance:

How a lot does it assist determine and make clear the bullseye for brokers, when you may inform them, hey, we are going to or gained’t purchase septic lagoons? That applies to David, you, everybody else listening. It’s like, while you clearly know what your field is and you’ll make clear that to brokers and get them motivated, hey, go discover me each deal that has a lagoon, septic lagoons. Then they know, they create it to you and there’s no surprises or something like that. Hey, go discover me each house with the carriage home. And David’s like, yeah, we are able to go do this. 100%, simply with the ability to clearly determine listed here are the issues that we do higher than anybody and realizing that, I believe that’s the place the worth is.

You simply have to seek out area of interest. There’s a distinct segment on the market for everybody. You simply have to find and spend the time, attending to know your market, the gamers, and what’s the one factor that you are able to do that separates you from everybody else.

David:

There’s solely sure groups that JJ Reddit can play on. He can resolve the issue of that staff. However different teams-

Terrance:

This man has received the perfect analogies. David must be a basketball coach.

David:

What Brandon has received me pondering is, I wish to go open a septic lagoon firm the place all these cell house parks are.

Terrance:

I believe I wish to go compete with Brandon.

David:

I resolve the issue for individuals who don’t wish to cope with septic lagoons, proper? They’re clearly onerous for a purpose, when you can have the corporate that may resolve it higher and cheaper, you’ll be the one individual getting all of the enterprise.

Brandon:

And it’s not, by the way in which, there there’s so many sub niches in all of this stuff. I believe cell house parks is the septic lagoon drawback. There’s tenant owned house versus each owns their very own house versus I personal the houses. There’s all of the stuff. In a multifamily there’s outdated properties, there’s new properties, there’s location. There’s what you stated, measurement. It’s-

Terrance:

Motel conversions.

Brandon:

Precisely. I don’t need [crosstalk 00:59:47]. What number of occasions have you ever heard any person say, I don’t wish to cope with a property the place the proprietor pays the electrical. I do know, personally I hate that. I’d not wish to deal, as a result of then the tenants go away their home windows open and the air con operating all winter lengthy. Proper? That appears like a possibility. If you wish to get actually good at that area of interest, to purchase a property which might be grasp meter for electrical, as a result of you understand how to cope with that. You understand how to handle tenants to verify they don’t preserve their window open. That appears like a option to become profitable in a aggressive market proper there.

Terrance:

100%.

Brandon:

Actually great things. All proper. Properly, we’ve received to get out of right here fairly quickly, however earlier than we do, let’s recover from to our deal deep dive. We don’t do that on a regular basis, solely with our favourite friends. We’re going to throw this out.

Terrance:

My coronary heart is warmed.

Brandon:

We ask it when we’ve time recently, and we’ve a bit of little bit of time proper now. We wish to tear aside a deal that you just’ve performed, and never in a foul method. Simply we wish to dig into the small print on that. We’re going to ask you a sequence of seven or eight questions right here concerning the property. Do you’ve got a property in thoughts that we are able to dive into?

Terrance:

I bought 135 unit in Des Moines, Iowa, late 2019.

Brandon:

Des Moines, Des Moines? Des Moines.

Terrance:

Yeah. Des Moines. Des Moines as when you don’t know Geography.

David:

I wish to hear Brandon pronounced Louisville. [crosstalk 01:01:12]. I can’t wait until we get into that.

Terrance:

Louisville.

David:

Would be the new rural of the [crosstalk 01:01:15]. Keep in mind these days?

Brandon: