Bitcoin’s (BTC) 2021 efficiency has been spectacular, however merchants ready for a record-breaking month-to-month candle are more likely to be disenchanted this week.

After peaking at $64,900 on April 14, a jaw-breaking 27% correction adopted, inflicting BTC value to drop to the $46,000 stage.

This draw back transfer obliterated greater than $9 billion lengthy BTC futures contracts in a swift motion that was beforehand unthinkable to most traders.

Regardless that the Bitcoin value recovered $5,800 over the previous 48-hours, within the choices markets, the bulls weren’t capable of take the bears without warning as each side are nearly balanced for April 30 expiry.

The overall Bitcoin futures open curiosity simply three months earlier was $11 billion, though this record-high occurred on April 13 at $27.7 billion. Nonetheless, this reveals how significant the current value correction influence was.

In the meantime, choices markets function on a unique foundation because the contract purchaser pays the premium upfront. Due to this fact, there isn’t any forceful liquidation threat for the holder. Whereas the decision (purchase) possibility supplies its purchaser upside value safety, the put possibility does the other.

Due to this fact, these in search of neutral-to-bearish methods will rely totally on put choices. However, name choices are extra generally used for bullish merchants.

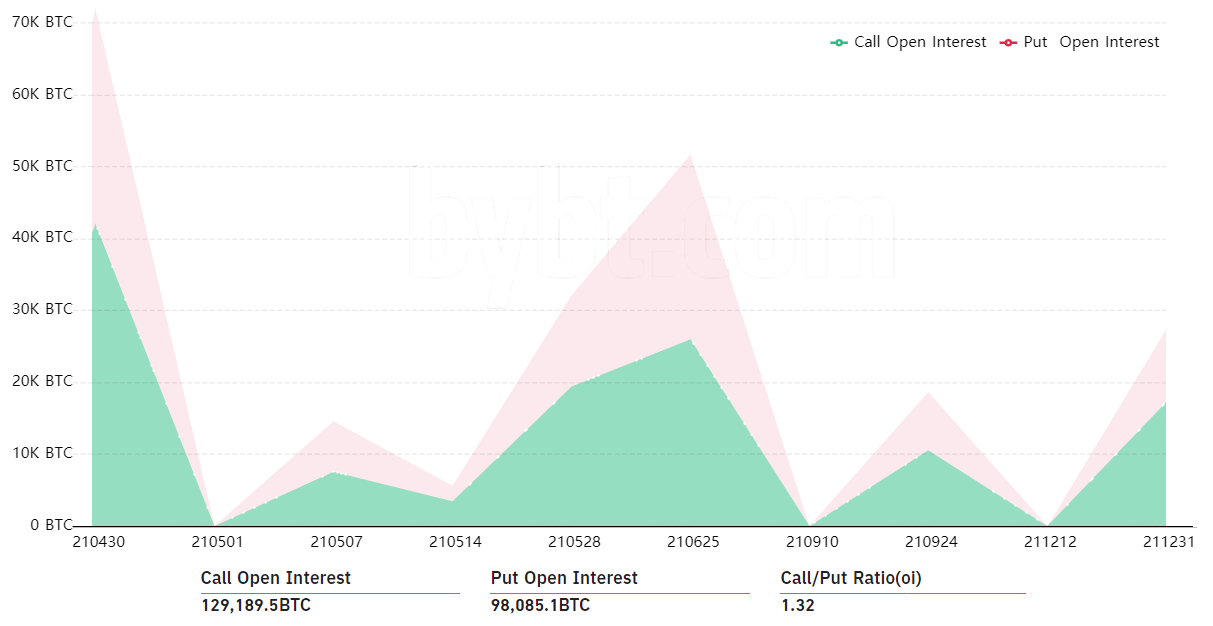

Though some exchanges supply weekly choices contracts, the month-to-month ones normally draw bigger volumes. April shall be no totally different, with 72,000 BTC possibility contracts value $3.9 billion on the present $54,500 value are set to run out.

Take discover of how dominant April’s choices are versus Could or September. Whereas the neutral-to-bullish name choices dominate with 41% bigger open curiosity for April 30, a extra detailed evaluation is required to interpret this information.

It’s value noting that not each possibility will commerce at expiry, as a few of these strikes now sound unreasonable, particularly contemplating there are lower than two days left.

Extremely bullish choices at the moment are nugatory

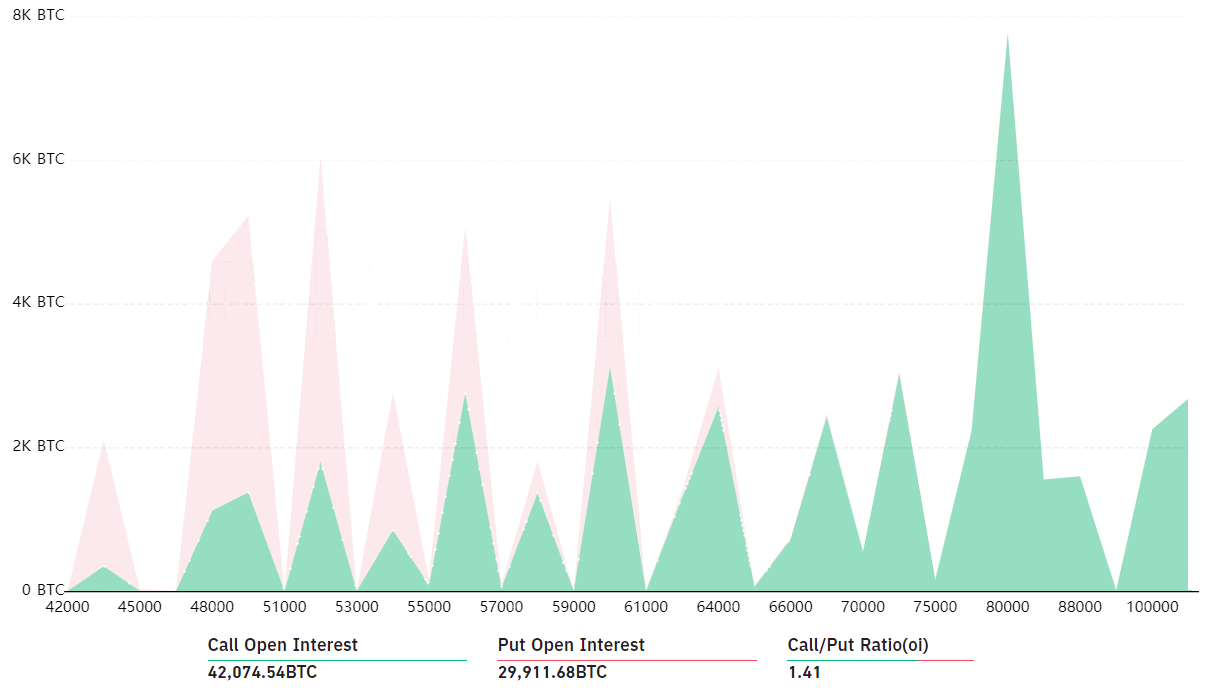

To know how these competing forces are balanced, one ought to examine the calls and put choices measurement at every expiry value (strike).

Though these $80,000 to $120,000 name (purchase) choices may appear outrageous, they’re usually used for ‘calendar unfold’ methods. As beforehand defined by Cointelegraph, the client would possibly revenue even when BTC trades nicely beneath these strikes.

The ultra-bullish choices at the moment are successfully nugatory as a result of there isn’t any profit from gaining the appropriate to amass BTC for $80,000 on the April 30 expiry. The identical could possibly be mentioned for the neutral-to-bearish put choices at $48,000 and decrease.

Due to this fact, it’s higher to evaluate merchants’ positioning by excluding these unrealistic strikes.

$54,500 presents a balanced state of affairs

The neutral-to-bullish name choices as much as $58,000 quantity to 9,950 BTC contracts. These are equal to $540 million in open curiosity on the present Bitcoin value. One other 3,100 would enter the scene at $60,000 and better, producing a $780 million possibility expiry.

However, the extra bearish put choices all the way down to $51,000 complete 12,000 BTC contracts, presently value $650 million in open curiosity.

If the Bitcoin value manages to plunge beneath $50,000, one other 3,850 put choices would even be exercised. This determine represents a possible $700 million open curiosity for the extra bearish choices.

In the intervening time, each calls and places seem nearly balanced. Contemplating {that a} $100 million to $150 million distinction is probably going not sufficient to incentivize both aspect to strain the worth, thus this month-to-month expiry could also be ‘uneventful.’

The futures and choices expiry at Deribit, OKEx, and Bit.com takes place on April 30 at 8:00 AM UTC. The CME futures and choices occur at 3:00 PM UTC.

The views and opinions expressed listed below are solely these of the author and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer entails threat. It is best to conduct your personal analysis when making a call.

Source link