Uneven markets have outlined the crypto house since Bitcoin (BTC) offered off on April 19, and indecisive markets like these can check the endurance and fortitude of even essentially the most devoted merchants and analysts, particularly when the incessant requires a backside are met with decrease lows.

Whereas the intervals of low buying and selling quantity and whipsaw value actions stands out as the good situations for whale-sized merchants to play in, the common investor doesn’t stand an opportunity, particularly with multimillion-dollar funds now starting to get in on the motion.

Information reveals that as a substitute of day buying and selling and making an attempt to time the market backside, dollar-cost averaging (DCA) is the perfect methodology for retail buyers trying to construct long-term income in each conventional and crypto markets.

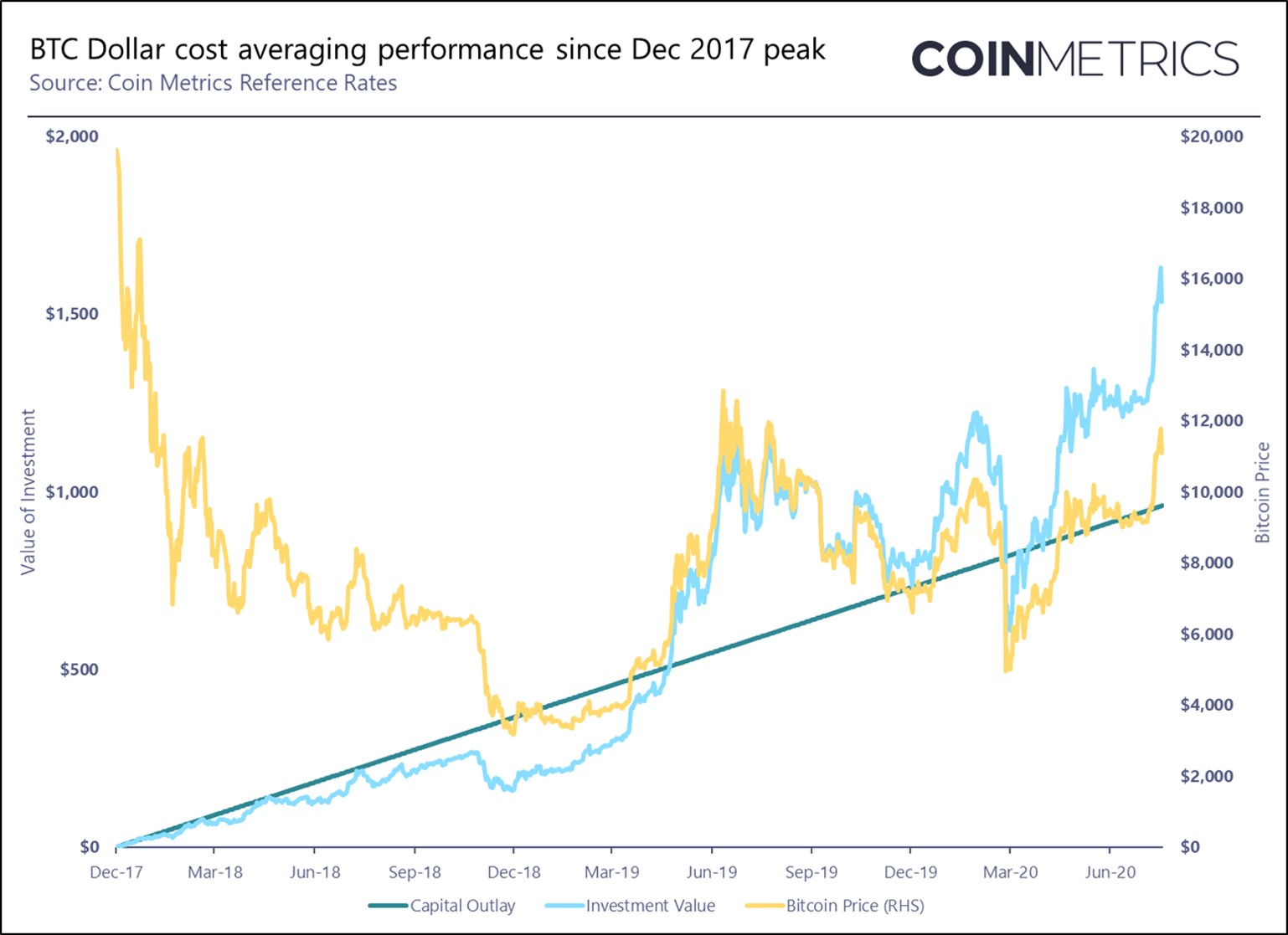

In 2020, Coin Metrics identified that buyers who dollar-cost averaged into BTC ranging from the December 2017 peak have been nonetheless in revenue three years later.

Coin Metrics tweeted:

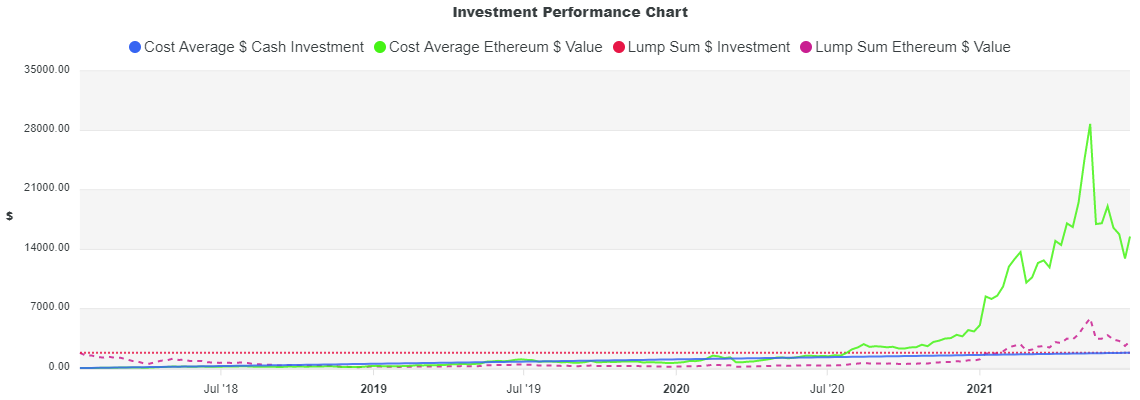

“Regardless of #Bitcoin remains to be buying and selling 30% under ATHs, greenback value averaging from the height of the market in Dec 2017 would have returned 61.8%, or 20.1% yearly. Equally for #Ethereum (nonetheless down 71% from its peak), greenback value averaging from Jan 2018 would have returned 87.6%, or 27.9% yearly.”

Whereas the graph is slightly dated now, one can see that over the long run, constant investments unfold over time have led to an general improve in portfolio worth.

At the moment, with BTC down greater than 47% from its all-time excessive of $64,863 and the cryptocurrency market persevering with to ship blended alerts, it might be an opportune second to deploy the DCA technique.

There’s extra to investing than simply “shopping for the dip”

Let’s check out the outcomes of dollar-cost averaging into a number of cryptocurrencies from 2017–2018 by the tip of June 2021.

The place to begin for every evaluation would be the day of the token’s 2017–2018 bull market all-time excessive worth, and weekly investments of $10 will probably be utilized from that time ahead.

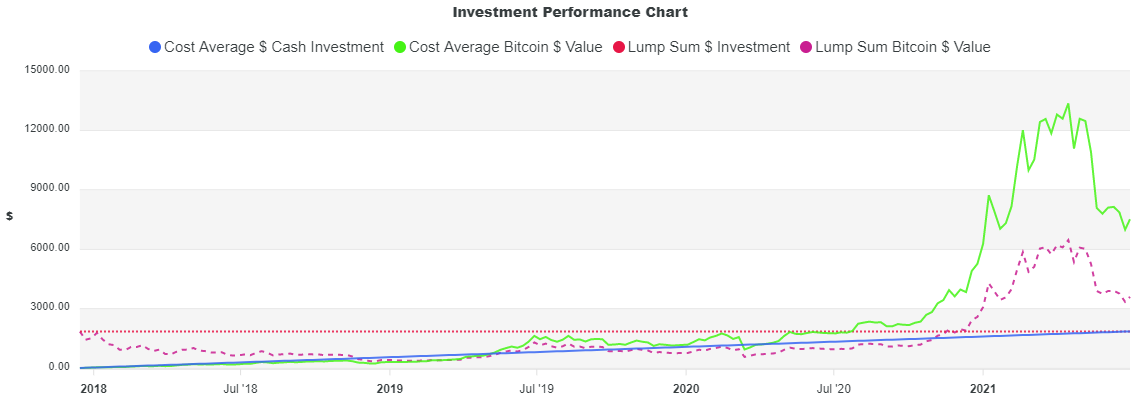

The height for Bitcoin in the course of the cycle got here on Dec. 15, 2017, when BTC traded for $19,497, in keeping with knowledge from CoinMarketCap.

Utilizing the DCA estimation software offered by CostAVG.com, one can see that if $10 was invested in BTC every day from Dec. 15, 2017 till June 30, 2021, the overall funding of $1,850 would have seen a 306% improve in worth to be price $7,519.

If one have been to ask the opinions of most fund managers or merchants who earn a residing within the conventional investing world, a 306% improve in portfolio worth over a four-year interval is a spectacular fee of return.

Ether kicks again an outsized return

The value of Ether (ETH) exploded from late 2020 by early 2021 because the rise of decentralized finance (DeFi) and nonfungible tokens (NFT) exponentially elevated the usage of the Ethereum sensible contract blockchain and boosted demand for ETH.

Elevated demand helped ignite a rally that despatched Ether’s value to $4,363 on Could 12, 2021, however its value has since fallen almost 50% to commerce under $2,200 on the time of writing.

In the course of the 2017 bull market, the worth of ETH reached an all-time excessive of $1,396 on Jan. 12, 2018. Buyers who used the DCA technique, investing $10 per 30 days beginning on the peak, would have spent a complete of $1,810 and generated a portfolio worth of $15,507 at Ether’s present value. This represents a rise of 757%.

Associated: Ethereum 2.0 approaches 6 million staked ETH milestone

The proportion acquire for Ether is greater than double what it could be for Bitcoin, giving some credence to those that have argued that Ether has been a greater funding over the previous couple of years.

Smaller-cap altcoins additionally profit from the DCA technique

To indicate the good thing about making use of the DCA technique to smaller-cap altcoins, let’s do a fast evaluation of Theta, which has been one of many breakout stars of 2021.

THETA started a parabolic value climb in December 2020, with its value rising from round $0.80 to $2.40 by Jan. 1, 2021. It then skyrocketed to an all-time excessive at $14.28 on April 15.

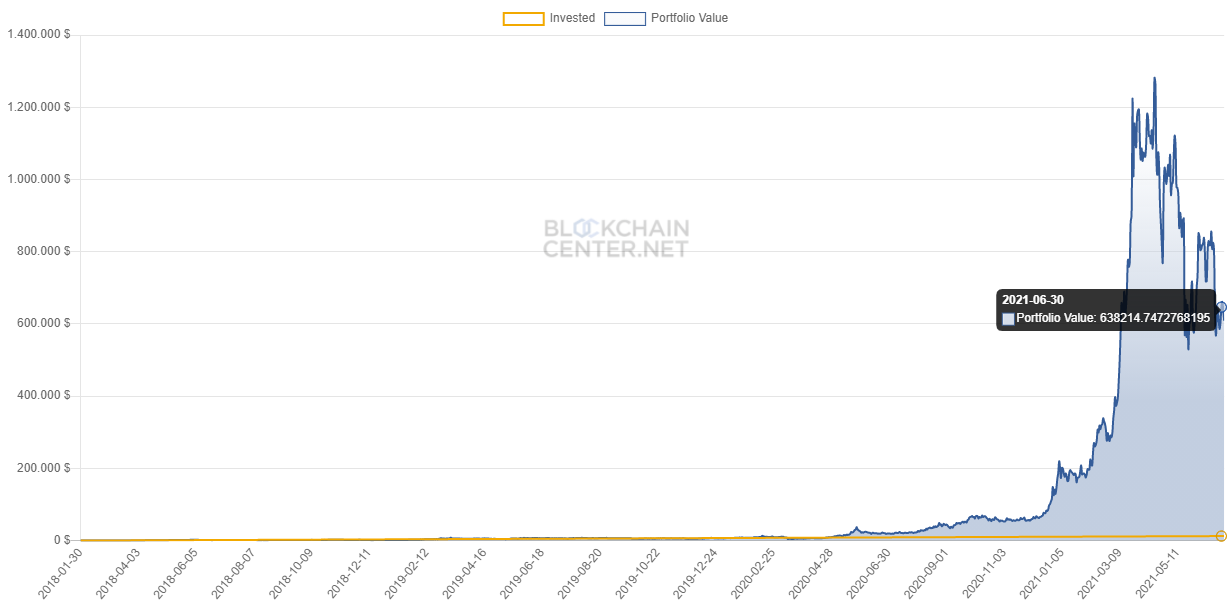

In accordance with Blockchaincenter.web, which provides knowledge for dollar-cost averaging quite a lot of tokens at a set funding of $10 per day, if an investor had begun investing in THETA on Jan. 1, 2018, the cumulative funding of $12,480 would now be price greater than $638,000 — a 5,000% improve.

Whereas it’s apparent that not all altcoins carried out in addition to THETA throughout that point interval, it’s a superb instance of how regular investing right into a smaller-cap venture can reward affected person buyers.

The advantage of dollar-cost averaging is that it removes emotion from the funding course of and permits the investor to deal with different issues, whereas day merchants spend hours behind screens and sometimes tackle extra losses than features.

This additionally removes the necessity to seek for market tops and bottoms and permits buyers to achieve publicity to quite a lot of property in a measured, constant method.

No approach is ideal, and never each crypto venture will make substantial features and even survive till the subsequent bull market cycle, however dollar-cost averaging is one method that has offered constant outcomes for newbie and professional buyers alike

Need extra details about buying and selling and investing in crypto markets?

Quotes on this publication taken from beforehand revealed sources have been frivolously edited.

The views and opinions expressed listed here are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer entails threat, it is best to conduct your individual analysis when making a call.

Source link