by Jim Quinn

“Fools, because it has lengthy been mentioned, are certainly separated, quickly or finally, from their cash. So, alas, are those that, responding to a normal temper of optimism, are captured by a way of their very own monetary acumen. Thus it has been for hundreds of years; thus within the lengthy future it’ll even be.” ― A Quick Historical past of Monetary Euphoria

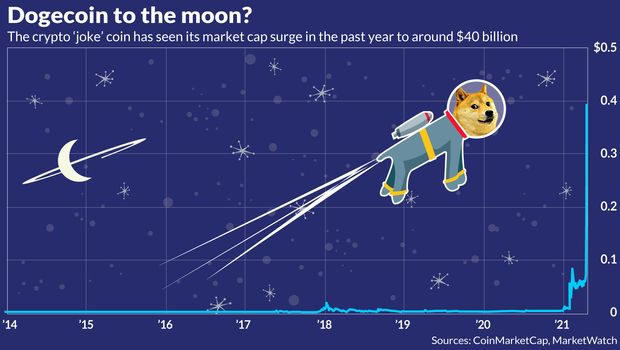

The indicators of an epic bubble of historic proportions are in every single place. The inventory market is a bubble, with valuations exceeding 2001. Margin debt is at all-time highs. The bond market is a bubble, with the Fed artificially suppressing charges and pumping trillions of QE into Wall Avenue. Housing is experiencing one other bubble, with costs now far exceeding the 2005 peak. Bitcoin and the remainder of the crypto-currencies are a bubble, being pushed by the surplus liquidity sloshing across the system. A joke crypto forex like Dogecoin soars into the stratosphere as a result of cash has no that means anymore.

Company, authorities and private debt are at all-time highs and heading greater. Clueless millennial dolts are utilizing their stimmy checks to day commerce on Robinhood. Now the shysters have provide you with a ridiculous idea known as Non-fungible tokens (NFT), which has created an extra frenzy of greed and fleecing. We’re busy promoting nugatory digital ideas to one another at greater and better costs. The world has really gone mad.

The herd will certainly be separated from their cash when this every thing bubble bursts. The idea of danger has been bastardized and ignored, for now. Greed will certainly flip to concern and nobody sees it coming. The “specialists” will proceed to declare “purchase now or miss out on the riches”. I’m positive these bubbles will burst, however I don’t know when. It may very well be subsequent week or they may develop for one more few years. I don’t fake to know, however I cannot take part within the insanity. Changing into debt free and extra anti-fragile is my sole focus as these bubbles develop.

Even Charles MacKay’s epic tome relating to mass delusion and insanity of countries fails to seize what is occurring immediately.

“In studying The Historical past of Nations, we discover that, like people, they’ve their whims and their peculiarities, their seasons of pleasure and recklessness, after they care not what they do. We discover that complete communities all of a sudden repair their minds upon one object and go mad in its pursuit; that tens of millions of individuals change into concurrently impressed with one delusion, and run after it, until their consideration is caught by some new folly extra fascinating than the primary.” ― Extraordinary Widespread Delusions and the Insanity of Crowds

Our nation has not simply fixated upon one object, however each object that may be purchased or offered for a revenue. Common People have concluded it’s a sucker’s sport to work arduous, construct wealth by means of saving, delay gratification, stay beneath your means and obtain happiness by means of non-material means. I can perceive why they really feel this manner, because the Federal Reserve, Wall Avenue bankers, and company America have fleeced them by means of inflation, stagnant wages, and stealing of their wealth. When these simultaneous bubbles burst as soon as once more, for the fourth time since 2000, the citizenry can be crushed. What occurs at that time is anybody’s guess. Revolution wouldn’t be out of the query.

I’ve two private anecdotes which have satisfied me these bubbles are all-encompassing and reaching their zenith. I purchased a rental in Wildwood again in 2004 with a good friend, close to the highest of the housing market. The plan had been to flip it in a pair years for a pleasant revenue. One of the best laid plans usually go awry. We purchased it for $325,000. We obtained loads of use from it and had been in a position to lease it out each summer time, but it surely was a monetary drain yearly.

We put it up on the market in 2015, asking $275,000. Not a drop of curiosity. We saved it on the market for 3 years and nil presents. We lowered the value to $250,000 and finally obtained a proposal of $240,000 in January 2018. Fourteen years later we had offered it for a lack of $85,000. A lot for actual property at all times appreciating. Quick ahead to 2021 and the unit above ours simply offered for $383,000. In simply over two years the worth of those condos within the eyes of present consumers rose by 60%, after sitting at $240,000 for over a decade. Nothing modified aside from notion of worth. Is the subsequent cease $500,000 or $250,000? I don’t know.

Over the Christmas vacation I put collectively a To Do record designed to make my life extra anti-fragile. Issues I had delay for years now wanted a way of urgency. Tops on the record was turning TBP into an LLC, to try to protect my private property from the woke cancel tradition crowd after they finally attempt to destroy my web site and my life. Additionally included on the record was trying into getting a stand alone back-up generator for my house, for when issues go sideways. I had left my retirement funds at Wharton after I left in 2019. I lastly transferred them to my IRA account the place I may very well be in full management of my funding selections.

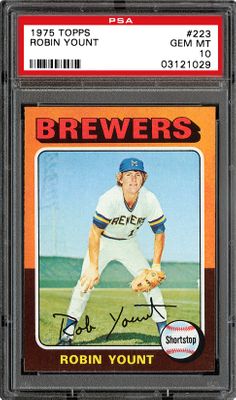

The one merchandise on the record I thought-about low precedence and didn’t set in movement was promoting some baseball playing cards I’ve had for nearly 50 years. I collected playing cards from the age of 8 to 12 again within the early Nineteen Seventies. I collected them as a result of I cherished baseball, the Phillies, and favored to commerce them and pitch them within the schoolyard. I had no ideas about them being price one thing a few years into the long run. A pair many years in the past when baseball playing cards had been sizzling, I put essentially the most useful ones in plastic sleeves, put them in a plastic bag, and didn’t take into consideration them for years.

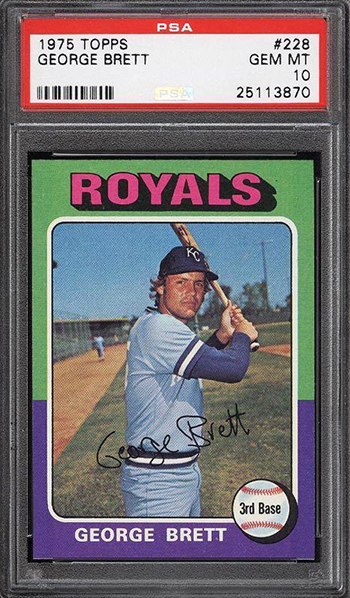

For the final yr I’ve sensed this monetary insanity would possibly supply a possibility to promote just a few items of cardboard for costs that can by no means materialize once more. I’ve tons of of playing cards, principally from 1975. Included on this set are 3 Robin Yount rookie playing cards and a pair of George Brett rookie playing cards. There’s a firm known as PSA that prices you to grade the playing cards. This then units a promoting worth for the playing cards. I don’t know what constitutes a close to good card with a ten grade from a close to mint card with a grade of seven, however the worth distinction is huge, as you may see right here from their web site.

A Robin Yount grade 10 card is price $55,000 and a George Brett grade 10 playing cards is price $97,500. I discover this completely ridiculous, however it’s definitely price exploring for that sort of cash. Even getting a pair hundred for a grade 7 card can be advantageous. I don’t see any imperfections in my playing cards, however who am I to evaluate.

Again in December after I went to the positioning, it appeared like a ache within the ass to undergo the grading course of and I used to be confused by their pricing scheme. Life obtained busy, so I forgot about it till this week. I made a decision I used to be going to ship the playing cards in and see what they concluded. I went to the PSA website and obtained this message from the CEO of PSA:

Howdy PSA Prospects,

Since my final replace, the momentum behind the pastime has solely accelerated. The truth is, our Collectors Universe President and CEO, Joe Orlando, not too long ago shared the fact of the surge of submissions to PSA.

I’ll attempt to additional illustrate what has occurred. The sheer quantity of orders that PSA acquired in early March has essentially modified our capacity to service the pastime. The fact is that we not too long ago acquired extra playing cards in three days than we did through the earlier three months. Even after the surge, submissions proceed at never-before-seen ranges.

Given our rising backlog, it will be disingenuous for us to proceed to just accept submissions for playing cards that we’ll be unable to course of within the foreseeable future. It’s an disagreeable conclusion, particularly after the March 1 worth improve, however it’s essential to correctly serve the purchasers who’ve already submitted to PSA.

Efficient instantly, PSA is briefly suspending our Worth, Common and Specific service ranges. This can enable us to completely unbox and obtain the latest surge of orders and give attention to our most impacted service traces.

We’ll take a tiered method to reintroducing these service ranges. Our objective is to convey all suspended service ranges again by July 1, 2021.

There may be now a baseball card bubble frenzy, on par with shares, bonds, actual property, crypto, artwork, used vehicles, lumber, NFTs, and absolutely anything not tied down. With my investing luck, the baseball card market will certainly collapse earlier than July 1. So anybody prepared to take probability can contact me. I’ll promote you all three Robin Younts for $55,000 and the 2 George Bretts for $97,500. Generally the stupidity of the lots exceeds my lowest expectations.

In my opinion, the indicators are in every single place. Getting wealthy fast has engulfed your complete nation in a insanity by no means seen earlier than in human historical past. Easy enrichment is a delusion. And all delusions finish in tears. A complete nation was satisfied, by these controlling the narrative, the annual flu was a pandemic by giving it a brand new title, advertising the hell out of it, utilizing a defective check to artificially inflate instances, and understanding they had been coping with compliant obedient sheep. If they will make you imagine that, they will make you imagine something.

“The recurrent and sadly inaccurate perception that easy enrichment is an entitlement related to what’s regarded as distinctive monetary perspicacity and knowledge isn’t one thing that yields to legislative treatment.” ― A Quick Historical past of Monetary Euphoria

The indicators are in every single place, however few will heed them.

262 views

Source link