Many, many individuals surrender on actual property after only one unhealthy deal, one unhealthy tenant, or one unhealthy flip. However what in the event you misplaced all you had from actual property offers, would you continue to be prepared to wager on actual property? What in the event you misplaced all of it twice? Welby Accely, has been in that place. He misplaced all he had, two separate instances by way of dicey actual property offers. He by no means did surrender on actual property, and now he’s sitting on 50 leases and over 70 accomplished flips.

Welby grew up in Brooklyn, and knew that his godfather was doing properly in actual property, so when he bought older, he determined to present it a shot. He invested in a multifamily deal in Atlanta, overleveraged himself, and had it foreclosed on him. A couple of years later, he had one other Atlanta property taken from house. Welby was worn out. He bought scammed, lied to, and dove in too deep a pair instances.

After these powerful experiences, he knew he needed to do no matter he may to be certain his due diligence was high notch. He was later instructed about Connecticut, and determined to take some severe time exploring the market, constructing relationships, and networking. Then, he began flipping. 1 home a 12 months, 2 homes a 12 months, then 15 homes a 12 months, and now 20 homes a 12 months.

Now, Welby takes younger and aspiring actual property traders on “experience alongs” to allow them to see precisely what it’s wish to be an actual property investor!

Brandon:

That is the BiggerPockets podcast present, 464.

Welby:

And my largest challenge that I had was that, I stored skipping the method. I stored looking for the straightforward strategy to do it. I used to be betting on different folks, I wasn’t betting on me. Each time I used to be ready for different folks to point out me do it, they have been discovering a sucker and so they have been profiting from me. So right here I’m now, these a whole bunch of 1000’s of {dollars} I destroyed that I misplaced, I might wager on different folks. And I mentioned to myself, “Why the hell Welby, you received’t wager on your self? Why you’re not going to wager on your self, however you’ll wager on these different folks?” So I mentioned, “I’m going to take this $90,000 and I’m going to lose this cash. That’s what I’m going to do.”

David:

You’re listening to BiggerPockets radio, simplifying actual property for traders, giant and small. In the event you’re right here seeking to study actual property investing, with out all of the hype, you’re in the proper place. Keep tuned and remember to be a part of the hundreds of thousands of others who’ve benefited from biggerpockets.com, your property for actual property investing on-line.

Brandon:

What’s happening everybody? It’s Brandon Turner, host of the BiggerPockets podcast. Right here with my cohost, Mr. David Cinderella Story Greene. What’s up man, how are you doing?

David:

Thanks for that, Brandon. However I believe the actual Cinderella Man goes to be as we speak’s visitor, who has a narrative that may depart you impressed on the fringe of your seat and simply would possibly get just a little bit tear out of your eye. And this was an unimaginable interview.

Brandon:

It was an unimaginable interview, yeah. I’m tremendous excited to carry you guys, Welby. His superior dude. We’ve been Instagram buddies for some time, however I’d by no means heard his full story. And he has an incredible story of shedding all the pieces a number of instances. You’re going to listen to about that and a few of the causes that he misplaced all the pieces in actual property, so you may keep away from these issues. He talks about how actually had an FBI probe towards a enterprise enterprise he was concerned in, the place somebody went to jail and he’s bought this loopy story. However in the long run, you’re going to listen to how he’s overcome that stuff and as we speak he’s executed over 70 flips. He owns over 50 rental models, he has this superb mannequin the place his recommendation on discovering and creating contractors is one thing you’ve by no means heard on this present earlier than that might change your corporation ceaselessly. Now there’s loads of good things within the present, so I simply need to get to it. So earlier than we get into the interview with Welby, let’s get to as we speak’s fast tip. David, you could have a fast tip for us?

David:

Right now’s fast tip is, don’t search for shortcuts like discovering the proper property proper out the field, or discovering the proper brokers or the proper worker. If you wish to achieve success on this life, you need to make the deal, not simply discover the deal. Now this philosophy goes throughout many alternative elements, however what we talked with Welby as we speak, is methods that he’s taking the contractor that he wants and creating the particular person to play that position in his firm. And he went by way of unhealthy brokers, he did the identical factor. He discovered the proper agent, he taught them assist him with what he wants and now he’s bought a devoted worker. So once you’re annoyed and issues aren’t figuring out in addition to you want, cease interested by, I want I may simply discover the proper particular person, and begin interested by how you would assist develop the proper particular person.

Brandon:

Yeah. We do discuss that later in as we speak’s present as properly. So be sure to guys are listening for that. That mentioned, it’s about time to get into as we speak’s present.

David:

Let’s usher in Welby.

Brandon:

However Hey, actual fast. He’s on Instagram. I’ve to present a shout out as a result of he doesn’t give it to the top. So, atmybest197. So that you would possibly’ve been following him already, he’s bought a reasonably large following. On Instagram it’s at atmybest197. Ensure you guys are following Welby over there. So with that mentioned, I believe we’re able to get into this. Something you need to add David, earlier than we soar in?

David:

Nope, let’s do that.

Brandon:

All proper. Let’s usher in Welby Accely. All proper. Welby, Welcome to the BiggerPockets podcast, man. It’s superior to have you ever right here.

Welby:

I recognize it, man. I can’t even consider I’m right here. Thanks guys a lot for this chance.

Brandon:

For positive, man. Effectively, let’s dig into your story. Let’s go to the very starting. I do know you went in actual property and several other phases. So let’s go to the very, very starting. What was your first enterprise into actual property investing?

Welby:

My first enterprise in the actual property, if I may perhaps return just a little bit, in the event you don’t thoughts. My first concept of ever being in actual property is after I was about perhaps seven to eight years previous. I used to be dwelling within the initiatives in Brooklyn with my dad and mom, my household. And my godfather, he was doing fairly good for himself when he would come and go to us. And he would all the time have these good fancy vehicles and dressed good. And in a while is after I came upon and understood that he was in actual property. He owned one or two properties, he had his personal brokerage and stuff like that.

And I might be capable of go go to him within the suburbs of Lengthy Island. And I used to be all the time intrigued by the truth that I used to be capable of experience my bicycle in the course of the road, versus the place we have been dwelling that we couldn’t do issues like that. From that time after I understood that that’s what he did was in actual property, I knew that someway, one way or the other, someplace in my life, I used to be going to be concerned in actual property one way or the other. So quick ahead, my first time truly buying my first house in actual property was someday round 2004, is after I bought my first house.

Brandon:

And what was that? Was it only a home for your self to stay in?

Welby:

No. Really, I lived in New York and I made a decision to purchase a multiunit in Atlanta. And that is proper the place the subprime mortgages have been going loopy. And so long as you had a pose, you’d be capable of get a mortgage. So, I used to be capable of get a mortgage, 106% financing. So I didn’t actually come out of pocket something. And I used to be capable of purchase a 4 unit constructing. And from the day I purchased it, it was a catastrophe from the day I purchased it.

Brandon:

Clarify that. Why was that so unhealthy?

Welby:

I’d by no means had anyone educate me within the enterprise. Though I did point out my godfather, he by no means personally educated me. I by no means had anyone take the time to clarify something to me. It was a want that I needed and I figured as a result of I went on YouTube actual fast and I learn fast books that had these giant acronyms, HOAs, ARVs and all the pieces else like that. I figured that I used to be ready to go on the market and spend some cash. So I went on the market. Not solely I went on the market, I even have a twin brother. So my twin brother went on the market with me concurrently, my cousin went on the market concurrently, one other particular person on our block went on the market. We actually on the similar time, all flew out to Atlanta, November 2004. And all of us got here again December 2004, with a property, 4 models, two models, single household houses.

After I purchased it, I didn’t perceive acquisition. So I don’t know why I purchased it for, why I paid the amount of cash I paid for it. I didn’t perceive money stream. I didn’t perceive rehab. I didn’t perceive something. And I assumed that at that younger tender age, that the realtor that was smiling and speaking to me as if she cared, I assumed that perhaps the knowledge she was offering me was factual info, it was right info, and I used to be doing the proper factor. However clearly it wasn’t. I paid method an excessive amount of cash for the property. The numbers that was represented to me that the property would be capable of generate per residence was excessive. It was a number of hundred {dollars} much less per unit. I didn’t have a contractor. So the contractor that I did discover, robbed me, ran off with the cash. And it was only a catastrophe. It was a catastrophe.

Fortunately, on the time I used to be employed. So the one method I used to be capable of keep that property was as a result of I used to be taking the cash I used to be making from my employment, I used to be nonetheless dwelling at house on the time, and I used to be feeding the distinction that the property was brief when it comes to rental. The property supervisor was making more cash than me in that property, put it that method.

Brandon:

However Welby, why Atlanta?

Welby:

You already know what? Atlanta at the moment turned the Mecca that everyone was going to. That was the brand new place all people was going to. I’m from NY city, and all people is aware of how costly the town is. I figured that perhaps I may do one thing in Atlanta as a result of I used to be making cheap cash. So I mentioned perhaps my cash will go additional. However one factor that I discovered in a while, massive metropolis folks like myself from different massive cities like Los Angeles or Seattle or different massive areas like that, now we have an ego subconsciously that we don’t understand, that once we go to those smaller markets, we’ll have a look at a property that may be in New York 1,000,000 {dollars}, that’s promoting for $200,000, and we’d method it with the identical mindset of a property that you’d pay 1,000,000 {dollars} for and say, “That’s all that they need, $200,000.” And pay for it. Not realizing and understanding that you’ll lose your cash simply as quick as you may in these massive cities. I’ll be sincere with you, I let my massive ego truly get forward of me and it caught me good.

Brandon:

Effectively, so what occurred to that Atlanta portfolio? You continue to personal that or, I do know you mentioned you went into some powerful instances, did you lose that?

Welby:

That is additionally when folks have been selling the BRRRR Technique, and I came upon in a while the BRRRR Technique works, however it doesn’t work in every single place as environment friendly as you prefer to you to work. So I refinanced that property, and I used to be nonetheless not going to cashflow. However, on the time after I did the 106% financing, I solely had an curiosity solely mortgage. So I needed to get out of it, so I refinanced out. After all, as a result of I’ve refinanced out, I needed to tag on the closing prices on it which elevated the mortgage, however I used to be in a traditional mortgage, principal and curiosity, however the funds went up versus what I used to be initially paying. So the adverse cashflow weren’t even worse.

Someday round 2009 or ’10, I had one other property down there too. By 2009 or ’10, I misplaced all of it. I had ended up shedding that property to a foreclosures. I had loans on it with Financial institution of America, upwards of 40, 50 thousand {dollars}. My credit score on the time, earlier than this occurred was 750. I had pleasure with being a accountable human being. So now you think about that you just needed to decide, you could have a household that you just’re taking good care of at the moment. By that time, I’ve already moved out of my house. You may have a household you’re taking good care of, you by yourself, and now you need to decide. Do I eat or do I let all this stuff fall? So I needed to decide of letting these properties go. I needed to decide of defaulting with Financial institution of America, and the property that I paid $240,000 for was purchased at public sale for $60,000. So you would think about the way it was a darkish time for me throughout that interval.

Brandon:

Wow.

Welby:

Precisely. So I misplaced it. I cried like a child. I used to be embarrassed. I got here again with my tail between my legs. I misplaced all the pieces. I bought worn out. From being worn out, I made a decision let me get entangled with doing another issues. I’ve all the time been a hustler, I’ve been all the time doing one thing. I made a decision to remain give attention to my employment. I had alternatives to make time beyond regulation, I had alternatives to make more cash. So I ate ramen noodles, I ate bread, I didn’t get together, I didn’t purchase a automotive. And I work, work, work, work, work and I constructed myself up and I saved myself up tens of 1000’s of {dollars} once more. From saving up that cash, I mentioned, you understand what? I’m going to start out promoting vehicles. So, me and my brother. Lengthy story brief, my twin brother finally ends up shopping for a used automotive line. Promoting vehicles that make you cheap cash. Lengthy story brief, as a result of this lengthy dragged us, that failed and it went bust.

I went then and determined to get into the nursing company route. I had little bit of cash and I had respectable credit score. And I met this girl, and she or he mentioned that she wanted a enterprise accomplice. And will you go to get a line of credit score from one among these banks, which occurs to be Financial institution of America once more. And in the event you give me X amount of cash, I’m going to pay you X amount of cash per week. So they are saying that when issues are too good to be true, it’s worthwhile to consider that. I mentioned, “No, I’m going to skip the method and I’m going to do it.” I went to Financial institution of America, they authorised me for upwards of $50,000, two days later, the cash was wired to my account. I’ve $50,000. I referred to as her up and I mentioned, “Hey, I bought $50,000.” She mentioned, “Certain, no drawback. Ship it to this account.” As a result of she was with financial institution of America. 9:00 the cash got here into my account by 9:15, it was in her account.

She spent perhaps per week or two, three weeks of paying me, the settlement, after which she disappears. So now, as soon as once more, I’m in default of one other mortgage, I get worn out once more. I ended up preventing, preventing, preventing up once more. I’ve all the time been good with hustling and discovering methods to generate income, sacrificing. I ended up assembly this girl, I’ll give her a reputation, by the title of Liliana Trafficante. Liliana Trafficante approached me and instructed me that she was searching for an angel investor, as a result of she has a water park that’s being inbuilt Goshen, New York. So if anyone need to test it out, you may go and kind the title, Liliana Trafficante. It’s public information, that’s the explanation why I’m in all probability saying this. You can even sort in, goOcean, G-O-O-C-E-A-N, Water Park rip-off. And once you learn it, you’re going to see a rip-off the place this girl embezzled over $6 million from myself and different traders.

And in the event you learn, they determine the victims by numbers. And sufferer quantity 4, was me. lengthy story brief, the Feds got here to my home and got here to different traders’ houses. They have been investigating us. They already knew that we didn’t have something to do with what she was doing, they have been tapping out telephones. Principally, they got here to my house to ensure and validate what occurred. She finally ends up doing 5 years in jail. And what we bought from the courts was, she has to pay us restitution for the remainder of our lives. And until this present day, in any case the cash I’ve misplaced, if I’m fortunate, I bought $50. I’m fortunate.

So I come again, determine I’m going to start out doing enterprise in New York once more. I’m working on the utility firm. I’m making six figures a 12 months. I’ve all people laughing at me, all people joking. As a result of after they see me strolling down the road, they know that Welby goes to speak to you about actual property. They know Welby going to advertise to you or preach to you about actual property, however but, Welby is a failure although. However Welby is a failure, Welby retains speaking about one thing that he consider in, however he’s a failure. I meet a gentleman that insulted what I used to be doing, the cash that I used to be making. He says to me, “Hey, how’s your credit score?” I used to be capable of clear up my credit score moderately. He says to me that we may do some enterprise in New York. Lengthy story brief once more, we did enterprise in New York and he bailed on me.

He principally wanted someone to place the property of their title. You already know straw patrons. Are you aware the terminology, retailer patrons? So he utilized me as a straw purchaser to buy a property to get himself and his brother out of a nasty deal. It’s referred to as straw patrons, no less than out right here, that’s what we name it. He principally bailed on me, ran off and left me with the property. He left me with the property, I mentioned, “I’m not going to lose on this one.” I fought. I went to Dwelling Depot, bought me some guys to assist me repair up the place. Luck me, I used to be capable of promote the property and make about $125,000 on that property. It wasn’t as a result of I used to be sensible, it wasn’t as a result of I knew what I used to be doing. It was pure luck. Pure luck.

I went once more and I did just a few extra offers, I made cheap cash. Then I made a decision once more, I’m going to return to Atlanta once more. So that is the place you guys come into play, in order that’s why I bought to suppose BiggerPockets. Okay, I am going again to Atlanta once more, I discovered me a flip that I needed to purchase. I did all the pieces. I acquired the property appropriately, I adopted the 70% rule. I discovered the right method of what it’s going to price me to rehab the property however I failed on the right contractor. The contractor took eight months, 9 months to finish the property or longer than that. The market shifted, the property tanked. I ended up shedding cash on the property. And I had a $90,000 cheque was reduce out and given to me someday round 2013.

So, you’d suppose that after I got here again to New York now, once more, failing once more, my father, he is aware of I used to be doing. All my household, all my buddies know what I used to be doing, what I used to be working for. Now, that is years of me engaged on this. No mentor, no nothing. My father says to me in Creole, as a result of I’m Haitian American. So he says to me a Creole, “[Creole 00:15:21].” He speaks to me in Creole. He says, “[Creole 00:15:24].” That’s our language. And he says, “Welby, you’re executed with this. You’re completed with this.” I mentioned, “Dad, no.” And I had the $90,000 cheque in my hand. I mentioned, “Dad, I bought it. I do know what to do now. I do know what to do.”

So, that night time, it was on a Wednesday, I Google searched on my laptop, how do you flip? This was emotional for me too, so if I get teary eye, don’t snort at me. So I Google searched it. And I mentioned, “How do you correctly flip houses?” Thanks. After I Google searched it, BiggerPockets popped up. BiggerPockets popped up and also you Brandon, was doing a webinar that night time. And also you have been doing a webinar and the webinar was about flipping houses and about… I apologize if I don’t bear in mind precisely, however what it was about, Find out how to correctly method shopping for a house. And it mentioned, Join.

So I put my e-mail in there and I signed up. I referred to as up all my buddies, my household, as a result of my cellphone rings like loopy. And I mentioned, “Don’t name me, don’t textual content me, don’t trouble me for the day. I’m going to a webinar class as we speak. I’m going to go to a webinar class and I’m going to observe these BiggerPockets guys.” So I mentioned to myself, “You already know what Welby? I’m going to take a pen and a pad, and I’m going to hearken to what these folks say. Whereas he poses his questions, I’m going to reply them earlier than he provides the solutions to the general public, and let me see how I do.”

So, I come house, lock myself in my basement, turned off all of the lights, I put you on my massive display TV and I’m watching the webinar begin. In order you begin posing the questions and giving up the examples, and also you had an entire mob of individuals on there. An entire mob of individuals was on there. In order you giving the instance and asking the folks to comply with by way of, and you then begin placing out the solutions, I used to be hitting 100 for 100. 100 for 100. After which I began crying. As a grown man, I began getting emotional. And I began pumping my fist, and I mentioned, “You bought this, you bought it. Why the hell you retain doing the identical crap time and again?” That’s what I mentioned, “Why do you retain doing the identical crap?”

And my largest challenge that I had was that, I stored skipping the method, I stored looking for the straightforward strategy to do it. So going again with all my errors, I used to be betting on different folks. I wasn’t betting on me. I used to be ready for different folks to inform me do it, so that each time I used to be ready for different folks to point out me do it, they have been discovering a sucker and so they have been profiting from me. So right here I’m now, these a whole bunch of 1000’s of {dollars} I destroyed, that I misplaced, I might wager on different folks. And I mentioned to myself, “Why the hell Welby, you received’t wager on your self? Why you’re not going to wager on your self however you’ll wager on these different folks? So I mentioned, “I’m going to take this $90,000 and I’m going to lose this cash. That’s what I’m going to do.”

So I by no means knew nothing about Connecticut. I’ve by no means been to Connecticut in all my years being within the Tri-State Space, I’ve by no means stepped foot in Connecticut. I had a pal of mine that I used to be working with that lived in Connecticut. I instructed them that I didn’t need to work within the metropolis of New York, as a result of the costs have been ridiculous. I didn’t need to get caught up into that store tank. He says to me, “Welby, why don’t you come out to Connecticut? Come and see how Connecticut is.” I mentioned to him, “You already know what? I’m coming to Connecticut. I’m going to do it proper this time.” So this time earlier than I went to Connecticut, I sat down with an lawyer in Connecticut, defined to him precisely what I used to be seeking to do. The lawyer mentioned, “Effectively pay attention, it’s worthwhile to set your self up this manner and that method when it comes to LLCs and S companies,” and stuff like that. And I spent the cash and I paid for that and I established that.

Subsequent step that I did is, I seemed for a realtor that I do know that I can practice on how I want them to react and to work for me, as a result of I’m the boss. Any investor out right here, I stress with them, “You’re the boss.” You’re the one which runs this present and don’t let anyone, I don’t care if it’s a realtor, it’s a mortgage dealer, if it’s whoever, as a result of on the finish of the day, you’re the one which’s left holding the bag. I went on the market and I began establishing relationships with contractors. And I began establishing relationships with totally different folks earlier than I even did something on the market.

Then sooner or later I took a visit out to Connecticut, took my realtor, began driving round. I began finding out the market. I didn’t spend a dime. The best factor on this actual property enterprise is to spend cash and to purchase a property. That’s the best factor to do. So if that’s the best factor to do and it’s that troublesome, you would think about all the pieces, all the opposite elements of this enterprise, how troublesome that’s. I did what Brandon mentioned on BiggerPockets, and I began simply making a ton of gives, ton of gives. So I used to be actually doing perhaps 50 gives per week. Then lastly, with all of the no’s that I bought, I lastly bought the sure on one among my workplace. So I knew I used to be going to generate income on that deal.

David:

Lovely. All proper. So Welby, we’ve bought just a few issues that we have to unpack out of this, as a result of you could have an unimaginable story. I believe what I like about it essentially the most to be frank, is what you went by way of is each single new investor’s worst worry multiplied instances 4. Complete full failure. And you then went by way of it a number of instances and also you simply stored on coming. So this can be some of the highly effective episodes we ever launched, as a result of as all people who’s on the sidelines desirous to get in, they will’t cease interested by what am I going to do if. You went by way of the if, so I need to pull out the way you dealt with that, the way you handle the rejection, the ache that everyone I’m positive that was telling you, “You by no means ought to do that.” And now they give the impression of being proper. And also you simply stored on going. Let’s soar again to once you had talked about, you misplaced your first properties in Atlanta. And you then needed to go to consuming high ramen to save lots of up cash. After which the subsequent factor was on the automotive dealership you began together with your brother?

Welby:

Yeah.

David:

Okay. So then that didn’t go properly. After which your credit score took an enormous hit. So now that not solely impacts your potential to purchase actual property, however your potential to do all the pieces else in life. That doesn’t really feel good. Then some girl approaches you and also you suppose, “Effectively, I’ll let an professional do it as a result of I did it unsuitable.” After which that professional rips you off and steals your cash and finally ends up being prosecuted for it. You’ve taken for an enormous L’s earlier than you’ve even bought shut to smell a victory. And never solely have you ever screwed it up your self, however you’ve been screwed over by different folks. I’m simply considering, there’s not an angle you didn’t strive that didn’t go unsuitable. And you then get into this flip that you just generate income that your CPA tells you about. Is that proper?

Welby:

The primary flip that I did that I made $125,000 that was profitable, that occurred within the Bronx. And that was a property that I did, that somebody that I assumed that was seeking to assist me, and primarily, he was searching for somebody to make the most of to take the property out of his title. And he put it in my title, principally offered it to me with out me realizing it, cashed out. And he was supposed to assist me with rehabbing the property after which in fact promoting the property. However he ran off. With him working off from me, I couldn’t simply depart it that method, I needed to take over the property and repair it. Then I bought me a few guys from Dwelling Depot, and I bought the property fastened myself. Then I put the property available on the market and the property offered 125,000.

David:

So that is the definition of a hustler?

Welby:

I believe it is best to put my title in a dictionary in the event you see that.

David:

So right here’s what I need to ask you. After you had so many issues go unsuitable, after which this one seemed prefer it was going unsuitable too as a result of the particular person jumps into the take care of you after which drawback you and leaves you in it. What did you need to inform your self to maintain getting up and hold coming, once you’re getting punched within the face on each single deal? As a result of it clearly labored out, you made $125,000 on this deal.

Welby:

Simply so I may make clear, I don’t need to come off that I used to be so sensible after I made the 125,000. It was pure luck that I made the cash. It was like capturing fish in a barrel at the moment, like what’s happening as we speak. And so it was luck that I made it. So fortunately, I did make it. However I’ve all the time had a unbelievable perception in myself and a religion in myself, to some I’m a child. I don’t know the place it got here from, I couldn’t actually inform you the place that got here from, however you may’t inform me I can’t do it. You possibly can’t inform me I can’t get it. You possibly can’t inform me I can’t acquire it. And all the pieces I’ve ever needed, all the pieces, I don’t care what it’s that I’ve needed, I’ve had so many naysayers that inform me I can’t do it, or those who have deserted me or ran off from me, speak behind my again, no matter you need to name it. However I’ve all the time simply had unbelievable perception in myself that I can do it. So I simply stored pushing.

Brandon:

Yeah. You went by way of all that hassle, all the problem. You discovered BiggerPockets sooner or later, you understand like, “Hey, I bought to cease betting on different folks. I can do that, I bought what it takes.” And also you jumped in and began making all these gives and you bought one accepted. Earlier than we go there although, why Connecticut? I don’t suppose I do know anyone who spend money on Connecticut. Why did you determine that’s going to be my market to leap into? Since you weren’t dwelling there. You have been in New York.

Welby:

I by no means lived in Connecticut, I nonetheless don’t stay in Connecticut. However Connecticut and the place I spend money on, is a few hour and a half away. I simply knew that I’ve executed enterprise in New York, however I simply felt that I may do much more and larger issues in a smaller market. So I put my ego apart, as a result of I’m from an enormous metropolis, after which I additionally have a look at these sensible. The rationale why God gave us vehicles is to go from level A to level B, not simply to flash and to point out folks, “Hey, have a look at this fancy automotive I bought.” So I mentioned, “You already know what? I bought this automotive, I’m going to drive out of state.” So I drive and it takes me a median of an hour and a half, two hours, to get there. That’s why I mentioned, I’m going to take an opportunity. I didn’t know a soul in Connecticut. I didn’t know anyone in Connecticut, by no means been to Connecticut in my total life till I made a decision that point to go there.

So if anybody says about being fearful, when anybody tells me that it may possibly’t be executed, there’s nothing someone can inform me to persuade me in any other case as a result of I had to try this. So, going to Connecticut, I might say it was a combination of luck, chatting with someone that occurred to stay in Connecticut, however he wasn’t an investor in Connecticut. And all of it form of snowballed to me saying, “Let me strive it out over there.”

Brandon:

So that is what I needed to carry up is that, loads of instances individuals are nervous about moving into actual property as a result of they stay in an costly market. They stay in New York, they stay in LA, they stay in Seattle or Maui. And so they’re like, “I can’t spend money on my native space, so I assume I’m simply going to not make investments.” And so they sit down and so they let years and years go by with out investing. After which different individuals are like, “Effectively, I can’t discover the proper market.” I’m going to go to a distance, like David wrote the e book, Lengthy-Distance, however I don’t know what the proper market is, and I’ve been finding out demographics and numbers and charts and graphs and all the pieces ceaselessly. And I’m simply caught on this evaluation paralysis.

However I really like that you just did it. You’re similar to “Connecticut, I’m going to make it work there.” And also you simply went there and made it work there. And we’re going to get into your story and I do know just a little bit about it. I do know you’ve had loads of success there. It doesn’t sound such as you sat there considering and planning and doing each knowledge level for years, attempting to determine this excellent spot. It’s a type of, it’s extra necessary that you just determine, then what you determine. And also you jumped in, you discovered what labored and also you made it occur. Is {that a} fairly correct summation of that?

Welby:

Just about. I used to be the sufferer of study paralysis too. So there’s no such factor as the proper situation. And I inform all people that speaks to me about this enterprise, “You attempting to attend for all the celebrities to line up, it’s by no means going to occur. So if that’s what you ready for, you’re going to attend to the top of your life. That’s by no means going to occur.” So I simply knew that if I comply with the method, I don’t care what market you drop me in on this planet, I’m going to generate income. Give me sufficient time to review, give me sufficient time to do my analysis, I’m going to generate income. In order that’s how I checked out it after I determined to go to Connecticut. I just like the entry level of going into Connecticut, the worth level I ought to say, of going into Connecticut. That’s what I appreciated. And I knew that if I adopted this, I’m going to make some huge cash if I adopted this. In order that’s what I did. And I wager on myself.

David:

So let’s speak just a little bit about once you went to Connecticut. The worth level was interesting to you, you knew you would get pre-approved, you knew you would in all probability discover rents that may cowl your mortgage by the price-to-rent ratio. As soon as you bought there, how did you determine what neighborhoods you needed to be in, what varieties of properties you needed to go after stuff like that?

Welby:

What I did, just like what loads of different folks which were in your platforms have mentioned, I went and began seeking to construct relationships with folks. I believe that it’s respecting once you’re going into another person’s yard, that you’ve someone welcome you and present that you’ve respect of their yard, and that you just simply need to come and spend money on their yard with love. In order that was my method. I wasn’t attempting to return in like some massive shot and saying, “Hey, I bought some cash and I’m coming right here to take over.” So I simply began seeking to construct relationships with folks. And the best factor to do is to get into actual property and to purchase one thing. I didn’t need to simply go and spend the cash. I went on the market to go be taught the neighborhood. I went to the nook bodegas.

I don’t know if that what you name that in your space, however the bodegas are the little mini marts the place you will get meals and drinks and stuff like that. Or I might go to the barber store or I might go to BJ’s or the native BJ’s or Walmart, simply so I may get the sensation of the folks, the neighborhood, the scent of the environment, in order that I may adapt to the folks there. In order that’s what I did. After which, I used to be going on the market, I might say upwards of about two months. After which I mentioned, “You already know what? I’m going to start out proper right here. That is the place I’m going to start out shopping for.” So then I turned laser centered for that space solely. And I stayed in that space, which occurred to be on the time, West Haven, Connecticut. And I stayed laser centered in that space and I used to be laser centered, put my workplace simply in that space and its surrounding space, till I bought instructed the sure on my workplace for a flip.

Brandon:

That’s superior. All proper. So let’s get into the subsequent few years. So that you picked Connecticut, you began shopping for there. Convey us as much as as we speak, what sort of offers have you ever executed, what are you centered on flipping, leases? What’s your general technique appear like as we speak?

Welby:

Effectively, at the start of me going to Connecticut, my objective was for me to construct up my capital. As a result of bear in mind, I simply went up there with the 90,000 as a result of I misplaced all of it, so I had the 90,000. My objective was to construct up capital as a result of I do know with any investor on this enterprise, you finally go that it is best to need is passive earnings. So, flipping is nice, you’ll make a ton of cash, however you’re solely pretty much as good as your final flip. So I do know that my objective was going to have the ability to begin to take these earnings that I’m making off of this flip cash, and I used to be going to take this to earnings from my flip cash after which finally begin investing in a rental portfolio. So in my first 12 months in Connecticut, I did one house, in my first 12 months. And my second 12 months in Connecticut, I did flipping-wise, I did two to a few houses. In my third 12 months in Connecticut, I used to be at perhaps 10 to fifteen houses, I flipped. So fast-forwarding 12 months 18, 19 and 20, my common was 20 houses or extra, flipping and promoting.

Brandon:

Wow.

Welby:

Through the pandemic was one among my finest years. After which if we need to discuss 2021, I did some strategic partnerships, which is what you guys talked about too in BiggerPockets. And I did a strategic partnership and for 2021, we’re proper at about 12 or 13 already, within the first quarter of the 12 months, flips that we’ve executed.

Brandon:

You discover Connecticut, you begin small, you probably did a flip, you bought some confidence, bought some data, gained the expertise, gained the networking, did it a pair extra the subsequent 12 months, did a bunch extra. 10 to fifteen, 20 flips we’re speaking in a 12 months now, that’s insane. I struggled with a pair. I need to dive into the way you have been in a position to do that. And I do know you could have some rental stuff too, so we’ll get there however let’s cowl the flip stuff first. How are you pulling this out? How are you discovering them? How are you funding them? Stroll us by way of a few of these particulars.

Welby:

The best way I’m discovering 90% of my offers for the those who don’t suppose that there’s offers available on the market, 90% of my offers is off the MLS, is the place I discover my offers. So, what I did is, through the years, I began constructing relationships with different realtors, particularly new realtors, those who simply bought their licenses that have been moist behind the ears. As a result of I do know that if I have been to inform a extra seasoned realtor the method that I want them to comply with when it comes to making gives and issues of that nature, they’re going to have a look at me like I’m loopy. I began getting new realtors that have been moist behind the ears and I might inform them, belief me, hearken to me, do that what I’m asking you. Two issues, I want you to present me, the ARV of the property and simply give me a few footage of the property. Primarily based off of that, with out me even having to bodily go, I do know what I’m going to do, how a lot my provide’s going to be about when it comes to my most provide. Simply belief me and simply put the provide in for me.

Effectively, loads of them thought I used to be loopy, however they did it. Effectively, as soon as they bought their first deal underneath their belt with me, they turned a believer. So what I did is I might have two, three, perhaps even 4 of them, working in several elements of Connecticut concurrently, doing precisely what I simply completed describing to you. So that is how I used to be capable of get two or three properties on the contract on the similar time. Now I bought these properties on the contract, now I’ve my contractor. Initially after I began, I began with one particular person and his father. That was it. I didn’t have a workforce of individuals. However once we first began, I had a dialog with him and I instructed him, in the event you please will belief me, and in the event you simply comply with me and simply consider in me, I’m going that will help you to construct up your individual contracting workforce. That’s what we did. Simply him and his father with the primary house, and the second and third house, it was simply actually him and his father and perhaps his spouse that have been demoing and doing the work to get the property executed and to be put available on the market.

Within the technique of we doing that, he was studying the enterprise and studying of work on much more distressed properties, as a result of we’d purchase principally lipstick properties. So over the time, we began with the ability to purchase properties that even your finest flipper wouldn’t even contact. We began shopping for these properties. So, by us doing that, I instructed him, “Pay attention, I bought to get outta right here, you bought to take my place out right here. You bought to start out hiring folks to be in your place and rent your father to be in your place.” And that’s how we began build up our workforce. From that time of going from one to 2 folks, we have been capable of construct up upwards of 12 to fifteen folks on the time. And we have been capable of then unfold them out concurrently to work on the properties at totally different factors of the rehabbing, to then put the properties again available on the market for them to promote. That’s how we began turning them over. We simply began making some huge cash with that.

David:

Welby, can I ask you about how you’re structured? How did you rent these folks? How are you managing these groups of contractors? Are you simply letting the final contractors run the present or are you extra actively concerned in that?

Welby:

Proper now although, I needed to do from the start, even describing what I mentioned with the one or two folks, I needed to try to hold all the pieces in-house as a lot as doable, in order that I may make it construct the way in which I needed it to be. As we began hiring folks, sure, he’s the final contractor, however he solely is a common contractor with me. He’s the one particular person I wanted to talk to. I didn’t have to talk to the plumber, I didn’t have to talk to the electrician or the folks which are doing the roof. I solely needed to converse to him. After which I do know he was going to deal with all the opposite those who have been there. The one particular person I needed to pay was him. I didn’t have a large number of individuals and I had totally different invoices coming from. I solely needed to pay him, and he was the one one accountable. And he’s the one one that may be yelled at if I wasn’t happy with what was happening.

Brandon:

And what about financing these offers? Are you utilizing laborious cash for them, or what do you do with then?

Welby:

I used to be utilizing my cash at the start. So that is the explanation why, in the event you bear in mind, I mentioned I used to be solely doing one deal at a time, after which I used to be doing two offers at a time, as a result of each dime that I used to be making, I used to be reinvesting the cash again. I didn’t take a penny of any of the cash I used to be making to purchase something lavish or to do something further. So ultimately at one level, I had over $600,000 in liquid cash that I used to be capable of construct up. I met a gentleman that now individuals are beginning to see what I’m doing. And I spoke with him and I used to be bragging to him how I’ve $600,000 tied up in three properties. And he mentioned to me, “Are you loopy? Why are you doing that? It’s essential to begin studying leverage your cash.” So when he instructed me that, is after I began finding out about leveraging my cash, using laborious cash. By that time, I began bringing in laborious cash, which helped me to scale up as a result of now that very same $600,000 that may have been tied in three properties, that very same $600,000 could possibly be unfold between 10 properties or extra, and I might nonetheless have cash within the financial institution to keep up the interest-only funds and the opposite issues that include doing that.

Brandon:

Yeah. Actually good. Actually good things. The laborious cash factor provides a level any lending. It provides the diploma of threat. There’s just a little bit one thing like, “Oh, now I bought a funds, I bought to take care of all these items.” However simply the power to multiply what you are able to do and be capable of do one deal or two offers or 5 or 10 offers, is an outstanding factor that now we have proper now. Very sensible. Additionally, I need to level out one factor that you just mentioned, I don’t need to gloss over this as a result of it’s tremendous sensible. You mentioned that you just discovered this contractor and principally mentioned, and proper me if I’m unsuitable right here if I misheard this, however you’re like, “Hey, this particular person was not an excellent profitable massive contractor. They have been simply a few folks doing this.” And also you mentioned, “Include me, belief me, I’ll educate you and practice you be principally enterprise homeowners. I’ll aid you discover ways to make this a legit massive factor.” And so due to that, it looks like they’ve loads of loyalty with you. Does that sound about proper?

Welby:

They’ll die for me. They’ll actually die for me as a result of this similar contractor was employed on the similar time when he was doing his contracts for work. Then he got here to me and mentioned to me, “Hey Welby, do you suppose that I may cease working since you hold me busy sufficient that I don’t should go to work anymore?” And I mentioned that in the event you bought my again, you don’t should go to work anymore. And he was capable of stop his job. He ended up making quadruple the cash he was making at his job. He was began making it with me, and he turned his personal boss. And I helped him to create his personal firm, and I hope to do create his personal payroll system. So sure, sure.

Brandon:

I really like. I really like, love, love, love that. It truly jogs my memory loads of what you’re doing David, with, I do know bringing in brokers and doubtless in your lending aspect, I believe you’re doing that form of stuff by enabling different folks and by giving them a greater life. Since you discovered just a little bit about enterprise, we’ve all discovered just a little bit about enterprise. That’s such a strong ability you may pour into someone and now they’re going to be loyal to you, hopefully for all times. David, do you need to converse to that in any respect?

David:

So this is part of human nature the place we’re all our personal worst enemy. Each one among us is searching for the fast repair. I need to discover a property supervisor that may simply do all the pieces for me and I don’t have to fret about it. I need to discover an agent that might go discover me nice offers, negotiate superb, and get me what I want. And I need to be that particular person’s high precedence. And the issue is, in the event you do discover that one fast repair and so they get actually good, now they turn out to be good and everybody else needs to make use of them. And it’s laborious to maintain them. I’ve had this occur with a number of contractors, a number of folks. And what I’ve ended up doing, such as you mentioned Brandon, was simply searching for proficient those who have been prepared to sacrifice for me to start with, typically within the type of an internship, or they labored one job, however they discovered one other whereas they have been doing it, to construct up the talents that I wanted that particular person to have. And I wanted that extra folks in our group would do this.

There’s an enormous want from those who need to be taught the sport and wish somebody to show them, and there’s additionally a necessity for those who want someone to leverage the work onto once you discover proper match. That mannequin is absolutely the very best one, as a result of hopefully that particular person is loyal to you for the time period. You don’t have to fret about them studying these abilities after which, “Oh, now I’m good, I can retire. I don’t should work anymore.” So, I commend you Welby for doing it. Brandon, I do know you do the identical factor with Open Door Capital. You usher in interns on a regular basis, actually you’re flying folks to Hawaii to work with you. I believe that that is form of what the sensible enterprise folks of the world have discovered, you can’t all the time discover a able to go, proper out the field answer that works excellent. That typically you bought to perform a little little bit of investing right into a folks and never simply properties.

Brandon:

So in different phrases, you don’t all the time discover good folks. Generally you need to make good folks.

David:

Make good folks.

Brandon:

All proper. Welby, let’s return to your story just a little bit. So that you making some huge cash with flipping, however such as you mentioned, flipping is, I believe you mentioned, you’re solely pretty much as good as your final flip, which is true. The cash begins coming in. So that you transitioned as properly, and also you began including leases to your portfolio. What’s that appear like as we speak? What number of leases do you could have? What are you doing with them? What’s your technique with leases as we speak?

Welby:

If I can, I may go into how I bought into doing the leases. What occurred is with largest challenge that I’ve discovered with the leases was, the price of moving into the rental. I do know that lots of people promote in regards to the BRRRR Technique and various things like that. And does the BRRRR Technique work? Sure. However does it work effectively in every single place? No. So the realm that I’ve my rental in, the BRRRR Technique doesn’t work that effectively. So I had to determine a method, how can I get into shopping for these properties, however then on the similar time, ensuring that these properties are going to money stream? So what I began doing is that, I constructed up a big sum of liquid cash from my flips, and I made a decision to cease shopping for my leases and distressed properties.

My methodology of shopping for my distressed properties is that I used to be searching for three households or increased or extra, so if it’s three, 4, 5, six, no matter it’s, and I might put 20% down on the property. With me placing 20% down on the property, it could get rid of the PMI. I have already got the fairness within the property, I do know that by the point I completed making the property what it may be, the worth goes to shoot to the roof and I might simply depart the fairness within the property, as a result of all I would like is the money stream. So now, the strategy of how I am going about it, actually one third of my property being rented, covers all bills, together with mortgage, taxes, insurance coverage, utilities. The opposite two third is pure revenue. In order that’s how most of my portfolios carry out.

Brandon:

That’s [inaudible 00:40:59]. So what number of do you could have complete now, unit-wise?

Welby:

Unit-wise, nearly 50, roughly. Take about 50. I’m greater than assured I’ll be double that by the top of this 12 months.

David:

You’ve educated folks that will help you achieve success at ventures, which you didn’t stop once you took some losses, which made you a greater enterprise particular person. You’ve scaled a flippy enterprise to be very profitable. You’ve taken the earnings from set flippy enterprise, put them into leases that develop cashflow in a comparatively protected method as a result of the debt could be very low to the cash they’re bringing in. Now you’ve bought revenue coming in from these leases that you just select to pour again into the flip fund, again into creating new those who aid you develop every of those companies. Is that truthful?

Welby:

That’s primarily, yeah. Yeah.

David:

Yeah. And you then’ve additionally bought fairness in these small multi-families, that in the event you determine you need to go greater, you may 10/31 these into greater offers. So is that form of the time period plan?

Welby:

I’m not seeking to promote them to be sincere with you, as a result of they cashflow ridiculous to the purpose that if I inform folks how a lot I generate, they suppose I’m mendacity to them. However I’m one which’s extraordinarily clear, that I’ve no drawback exhibiting you the mortgage statements, so what the bills are. And I bought no issues exhibiting you actually cash coming into the account so you may see it your self. So I would like folks to see, perceive that it’s not a made up story, it’s a real story. What I’m truly engaged on now’s, as a result of the properties are price a lot greater than what I all need them that we’re truly working now to get a portfolio line of credit score, the place then now I may decrease and even get rid of using laborious cash, that I’ve a line of credit score on my portfolio with a extraordinarily low rate of interest after which I’ll begin doing that to start out persevering with to purchase.

Brandon:

Very sensible. All proper. So, I really like this entire image, as a result of I hope individuals are seeing what’s doable with actual property. Even coming from a tough begin, having problem, not giving up although, you work it out lastly, scale this flipping enterprise, generate huge quantities of earnings as we speak, now. After which take that cash and never simply go spend it on flashy vehicles and issues like that, however you’re shopping for property like actual property that produces extra cashflow, that provides longterm wealth and monetary freedom. But in addition you’re constructing fairness you can then take and use that line of credit score that you just’re going to get, to go and flip extra homes, to have the ability to dump it into extra leases.

And it’s simply this like cycle of awesomeness that actual property permits an individual to do. And also you didn’t determine it out in a single day. That is spans like we’re speaking a decade or two of time right here that you just’ve been in that. Nevertheless it simply exhibits what’s doable once you persist with one thing longterm. Is there anything earlier than we get out of right here? I truly know one factor I need to ask you about, I do know in your Instagram, you speak loads about just like the Experience Alongside. What’s that? What are you doing proper now exhibiting different folks the power, what you’re doing, I assume? What does that entire actual property Experience Alongside?

Welby:

Effectively, it’s two issues truly. So I’ve an actual property boot camp, the place it’s actually a boot camp the place I determine a brand new flip that I’m shopping for. Then I’ll carry perhaps 10, 15 folks, and so they should dedicate six weeks as a result of my common flips take about six weeks. They should dedicate sooner or later per week, which might usually be a Saturday. They’ve to return out each single week with me, in order that they may see the progressing of the house till completion. Then upon their completion, and through that point, I assist them to get their very own LLC or firm constructed up. I helped them to seek out strategic methods of getting funding for his or her potential future flip. After which when the properties truly offered, I create a operational settlement between myself and their firm. And that operational settlement will determine that flip that offered as their precise first flip, which any laborious cash lender or any banking establishment will truly acknowledged as their first flip.

No person else is doing that. I may assure you that no person else is doing that. Experience Alongside, is principally the members being me for the day. One of many largest issues that I hate is that everyone needs to do on-line, on-line, or going into only a seminar area with a large number of individuals. And I’ve executed that, I don’t care who you’re, you’ll by no means be taught something. And even in the event you be taught one thing, you’re a little bit nervous to boost your hand to ask the query.

So I like maintaining my occasions small and intimate purposely. So my Experience Alongs, I’ll have 15 folks, 20 folks typically, and so they’re actually going to be with me in vans. And so they experience together with me for the complete day. And it could possibly be for 12 hours actually. There’ll be with me for 12 hours. And I’ve your head spinning. I’ll take you to a number of flips that I at present have happening in actual time, I present them the HUD statements in order that they will believe that it’s truly my property and never a property that’s being borrowed. I present them the actual numbers of the acquisition value. I confirmed them the actual numbers of what I spent and rehabbing it and I present them the estimate of what this property goes to promote for and my potential revenue.

After which from that time, I then take them to a few of my rental portfolios, and I stroll them by way of to point out them the earlier than’s and the after. And present them how I make the most of the cash I constituted of the flip for them to purchase the leases, in order that they will truly do the identical factor too. Then by the point they depart… I can’t inform you I’ve helped a number of folks turn out to be millionaires with the technique that I present. I’ve a number of those who I’ve helped with that. I simply principally simply need to be as clear as doable.

Brandon:

Actually cool to see how a lot that may have helped me getting began. Simply comply with alongside someone. It’s like a experience alongside, it’s like a cab. David, I don’t know in the event you ever did Experience Alongs, David, as a cab? You in all probability did take pleasure in these just like the little highschool children asking annoying questions all day. Is that what you probably did?

David:

Think about attempting to run a race with actually excessive stakes and so they’re like, “Hey, take this 45 pound, highschool child and carry it round with you all time.”

Brandon:

That’s humorous.

David:

You’re doing God’s work on the market.

Welby:

I’m attempting. I’m attempting.

Brandon:

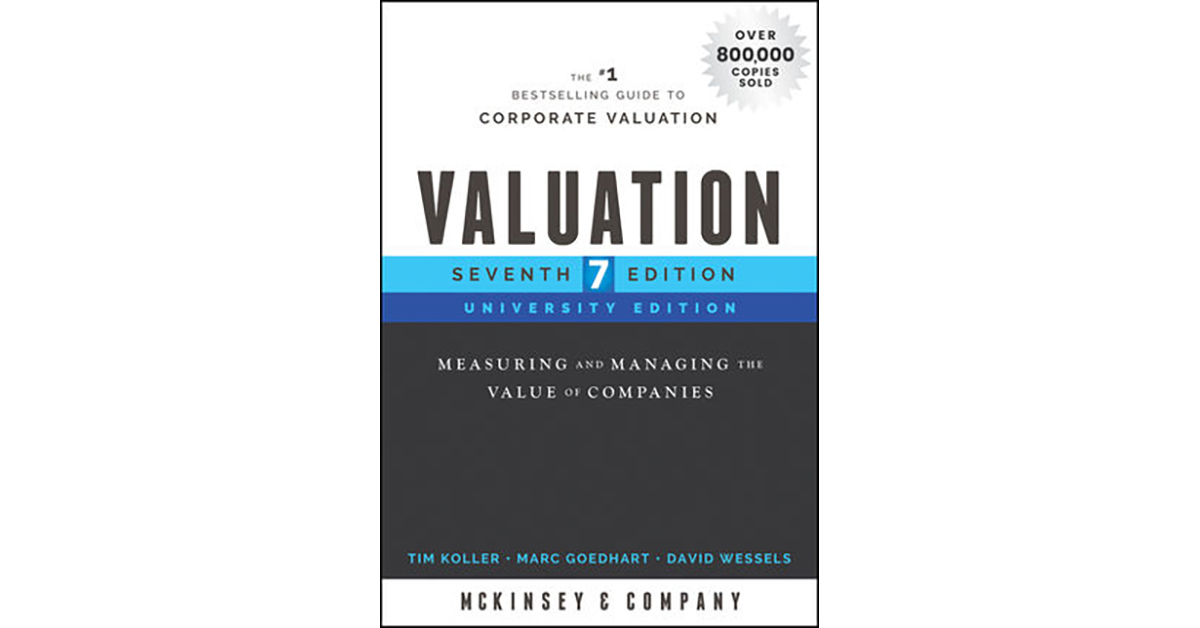

Final phase of the present, our Well-known 4. Hello, that is the Well-known 4, similar 4 questions we ask each visitor each week. We’re going to throw them at you now Welby. So query primary, do you could have a favourite actual property associated e book?

Welby:

I assume the primary, I do know lots of people have mentioned it, was the Wealthy Dad Poor Dad. I’ve to learn it 4 instances to lastly get it. After which there’s couple that you just guys have executed. This one was actually good for me.

Brandon:

Oh, the e book on flipping homes.

Welby:

Yeah. That was actually good for me.

Brandon:

And what’s the opposite one? Repair and Flip Your Manner To Monetary Freedom. Very cool.

David:

All proper. What a few favourite enterprise e book?

Welby:

I don’t bear in mind the writer, however it was titled, The One. I don’t do not forget that writer, I apologize, however it was, The One. One thing about, The One.

Brandon:

Is it The ONE Factor?

Welby:

If you wish to name {that a} enterprise e book, that was one among my favourite books I learn.

David:

Do you suppose it was, The ONE Factor, by Gary Keller and Jay Papasan?

Welby:

I’m fairly positive it was.

David:

Yeah. That’s a very talked-about enterprise e book. Actually good. I like to recommend that. All proper, subsequent query. While you’re not educating different folks flip homes, flipping homes, your self, shopping for leases, creating principally an superior story for everybody to be impressed by, what hobbies do you could have?

Welby:

I wish to prepare dinner after I get a possibility. I personal a few vehicles, so I take pleasure in cleansing my vehicles and driving them on my own with my music good and loud, spending time with those who love me, that I really like and that I do know that actually need to see me win, and being house alone in quiet time. I actually take pleasure in these issues.

Brandon:

Final query from me. Welby, what do you suppose units aside profitable actual property traders from all of those that surrender, fail or simply by no means get began?

Welby:

Perception in themselves, betting on themselves. That’s what I believe separates. I believe anyone that you just discovered profitable in no matter enterprise that they’re going by way of, they betting on themselves and consider in themselves that they will do it. I believe that’s what separates us from lots of people.

David:

Yeah. I bought to say primarily based in your story, Welby, there’s no denying that. You needed to wager on your self again and again and again and again. And the one factor cooler than the truth that you didn’t stop when all the pieces went unsuitable, is how massive your corporation has grown to now. So perhaps there’s a lesson to be discovered there that the tougher it’s to get began, the larger it’s going to be once you get there. I actually recognize you sharing that. So I do know you’ve impressed lots of people, I do know there’s lots of people which are going to need to choose your mind about the way you dealt with varied issues.

Welby:

I actually recognize that.

David:

Thanks for that. The place can these folks get ahold of you?

Welby:

Primarily on Instagram, they may get me at, atmybest197, A-T-M-Y-B-E-S-T-1-9-7. They will additionally get me at atmybest197.com. They will additionally get me on Twitter with the identical title as properly.

Brandon:

Hey, what’s the 197? What’s the background of that?

Welby:

197 is the precise block that I grew up on in Hollis, Queens. And it’s a well-known block as a result of the house that I grew up in was the house of DMC, from Run-DMC. In order that’s why I added the 197 to it.

Brandon:

Very cool man. Effectively, thanks a lot, it’s been phenomenal. I can’t look forward to folks to get this interview and hearken to it. I believe it’s going to alter loads of lives. So recognize you and hold crushing it, man. I recognize you.

Welby:

Pay attention, I need to thanks. I need to suppose BiggerPockets and each one among you guys. You guys are life-changing, I’m a testimonial to that reality that you just guys… I actually recognize you guys. And this was truly one among my targets. Seven years in the past, I mentioned, “I’m going to be on BiggerPockets sooner or later.” And have a look at that, goals come true. So thanks guys a lot, males.

Brandon:

I really like to listen to that, man. Thanks.

David:

Thanks to your transparency Welby.

Welby:

Thanks guys.

David:

That is David Greene, for Brandon. Don’t simply discover good folks, make good folks [crosstalk 00:49:59]. Signing off. You’re listening to BiggerPockets radio, simplifying actual property for traders, giant and small. In the event you’re right here seeking to study actual property investing, with out all of the hype, you’re in the proper place. Remember to be a part of the hundreds of thousands of others who’ve benefited from biggerpockets.com your property for actual property investing on-line.

Assist us attain new listeners on iTunes by leaving us a score and assessment! It takes simply 30 seconds and directions may be discovered right here. Thanks! We actually recognize it!

Source link