This weekly roundup of stories from Mainland China, Taiwan, and Hong Kong makes an attempt to curate the business’s most vital information, together with influential tasks, modifications within the regulatory panorama, and enterprise blockchain integrations.

After implementing world KYC necessities for all customers, Binance’s dominance in CeFi has slipped from about two-thirds to simply over one half, in accordance with the FTX quantity monitor. The large three of Huobi, Binance and OKEx now seem like a giant 5, with Hong-Kong based mostly FTX and Singapore based mostly Bybit closing the hole.

The worldwide NFT fever appears to be intensifying in per week that noticed Visa make headlines with its $150,000 buy of CryptoPunk 7610. Chinese language netizens on Weibo had been unsurprisingly baffled, with feedback asking what will be carried out with it after buy, whereas others made jokes about whether or not or not a Punk had any creative worth. Since late June, every day searches for ‘NFT’ are actually measuring between 2.5 million and 4 million, exhibiting a rising curiosity within the asset class.

Associated: Shanghai Particular: Crypto crackdown fallout and what occurs subsequent

Proudly owning Bitcoin isn’t banned, however many worry for the way forward for laws in China. Right here’s a have a look at the place we stand and the place we is likely to be headed.

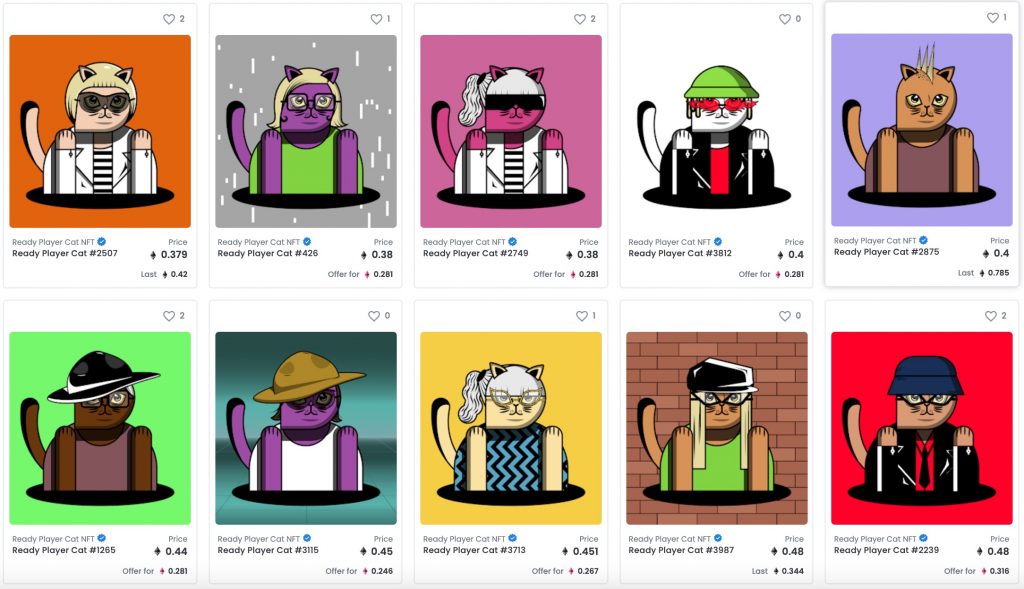

Meet the MAODAO

The MAODAO is without doubt one of the first NFT communities to spring up in Asia, with a spotlight at the moment on China. It’s based mostly round play-to-earn gaming, with the DAO sponsoring gamers within the Axie Infinity world by offering property upfront, after which returning a portion of the proceeds again to the DAO treasury. The DAO makes use of NFT cats used as each a collectible and a governance token. These Prepared Participant Cats, or RPCs for brief, are 3000 NFT cat tokens that had been minted on August twenty second for 0.08 ETH. The colourful cartoon cats now have a value flooring of close to 0.4 ETH.

Chatting with the founder who goes by the identify of Matt Mao, we discovered that quite a lot of inspiration had come from one other well-known NFT mission, Bored Yacht Ape Membership.

“Our most outstanding attribute could also be our Japanese roots. In reality, our first minting occasion was largely carried out by early supporters of the Asian NFT and crypto neighborhood. Perhaps everybody’s enthusiasm stemmed from the dearth of a symbolic NFT mission within the Japanese neighborhood and gave some recognition to us.”

Mao is planning to leverage the ample sources the crypto neighborhood has to develop and lift consciousness, strengthening the alternate between Western and Japanese NFT communities. The outfit is planning cooperations with different artists and tasks to extend rewards for the MAODAO and its members.

Alls effectively that ends effectively?

After an extended and dramatic journey, the dramatic Poly Community hacker returned the remainder of the funds to the cross-chain bridge. The hacker had exploited a bug within the code to raise over $610 million in Ethereum and different cryptocurrencies, earlier than main the cryptocurrency house on a wild trip that included failed makes an attempt to avert a blacklist, sending funds to Vitalik Buterin, and an AMA through the blockchain. Poly Community, which is a mission incubated by Neo’s O3 labs, will likely be glad to have their customers’ funds again, though it stays to be seen if the mission can proceed now that a lot belief has been eroded.

Objection overruled!

A excessive court docket from the Northeast province of Shandong set a precedent when it dominated {that a} plaintiff’s cryptocurrency had no authorized standing in China. The plaintiff within the case had misplaced round $10,000 {dollars} value of tokens when a Individuals’s Financial institution of China ruling again in 2017 had ordered exchanges to shut. The plaintiff had misplaced entry to his account and hoped to get the worth of the tokens again on the grounds of fraud. It’s unknown whether or not the decide had reminded the plaintiff on the conclusion of the case that if it’s ‘not your keys, not your crypto.’

This contradicts a ruling from earlier this month in a district court docket of Shanghai, that dominated Bitcoin was a property protected by Chinese language legislation.

The Minhang District Courtroom in Shanghai acknowledged that Bitcoin is a digital property protected by Chinese language legislation, which is disposable, exchangeable and unique. https://t.co/lUO3yr44Vw

— Wu Blockchain (@WuBlockchain) August 18, 2021

The shortage of readability and consensus on the problem is barely uncommon for China, the place top-down management can often set clear directives to observe. It’s doable that with the federal government’s emphasis on blockchain improvement, rising tech, and upcoming central financial institution digital forex, the federal government is hesitant to place a blanket ban on digital property.

Heading West for summer time

Bitcoin and Ethereum miners look like finishing their migrations overseas following the strict regulation in opposition to them earlier this summer time. That is based mostly on the hash charge information recovering to round 66.7% of it’s pre-regulation peak in Could. In the course of the summer time, a lot of the massive mining corporations have been closing down operations and transport {hardware} to different nations, together with Kazakhstan, Bangladesh, and the US. This rebound signifies that the mining business and the community as a complete has emerged from one other main menace. Now that the community has moved away from being so centralized inside China, it ought to turn out to be extra interesting to danger averse buyers.

Source link