A historic offshore wind public sale by the Queen’s property supervisor, the crown property, helped to counter a pointy drop within the worth of its retail portfolio, however couldn’t stop a 22% decline in annual income to £269m.

The crown property, which manages the seabed round Britain in addition to an enormous land and property portfolio that features Windsor Nice Park and Regent Avenue and St James’s district in London, mentioned its revenue for the 12 months to March fell by almost £76m from the 12 months earlier than, primarily because of a drop in its lease take.

The group fingers its income to the Treasury and 25% is returned to the royal family within the type of the sovereign grant – a funding method that is because of be reviewed subsequent 12 months.

The worth of the group’s complete portfolio rose by 7.5% to £14.4bn, pushed by a rise within the marine portfolio of £2.1bn reflecting a sale of windfarm leases, which offset a £1.1bn drop in property values, primarily within the London and regional retail portfolio, as retailers had been hit onerous by the coronavirus pandemic.

The crown property collected 81% of lease due from its retail and workplace purchasers, after providing them lease deferrals or rent-free durations to assist them get by the pandemic.

Offshore wind makes up a rising a part of the crown property’s portfolio. It goals to extend offshore wind capability from lower than 10 gigawatts presently to 40GW – sufficient to serve the ability wants of each house within the UK – over the subsequent 10 years to assist the UK obtain its net-zero carbon targets.

The UK’s offshore wind growth handed the crown property a multibillion-pound windfall earlier this 12 months after its public sale of seabed plots for windfarms off the coasts of England and Wales attracted runaway bids from windfarm builders and oil corporations.

The crown property’s first public sale of windfarm licences in a decade set document highs after vitality companies, together with the oil firm BP, supplied to pay a complete of virtually £880m a 12 months to lease seabed plots whereas they construct six new offshore windfarms to generate the equal of sufficient clear electrical energy to energy greater than 7m properties.

The builders are required to pay the choice price as “lease” on the seabed licences whereas they develop plans for the windfarms. This might take as much as 10 years, which might hand an virtually £9bn windfall to the Crown, however vitality corporations will attempt to full the event of the websites in half this time to save lots of on prices.

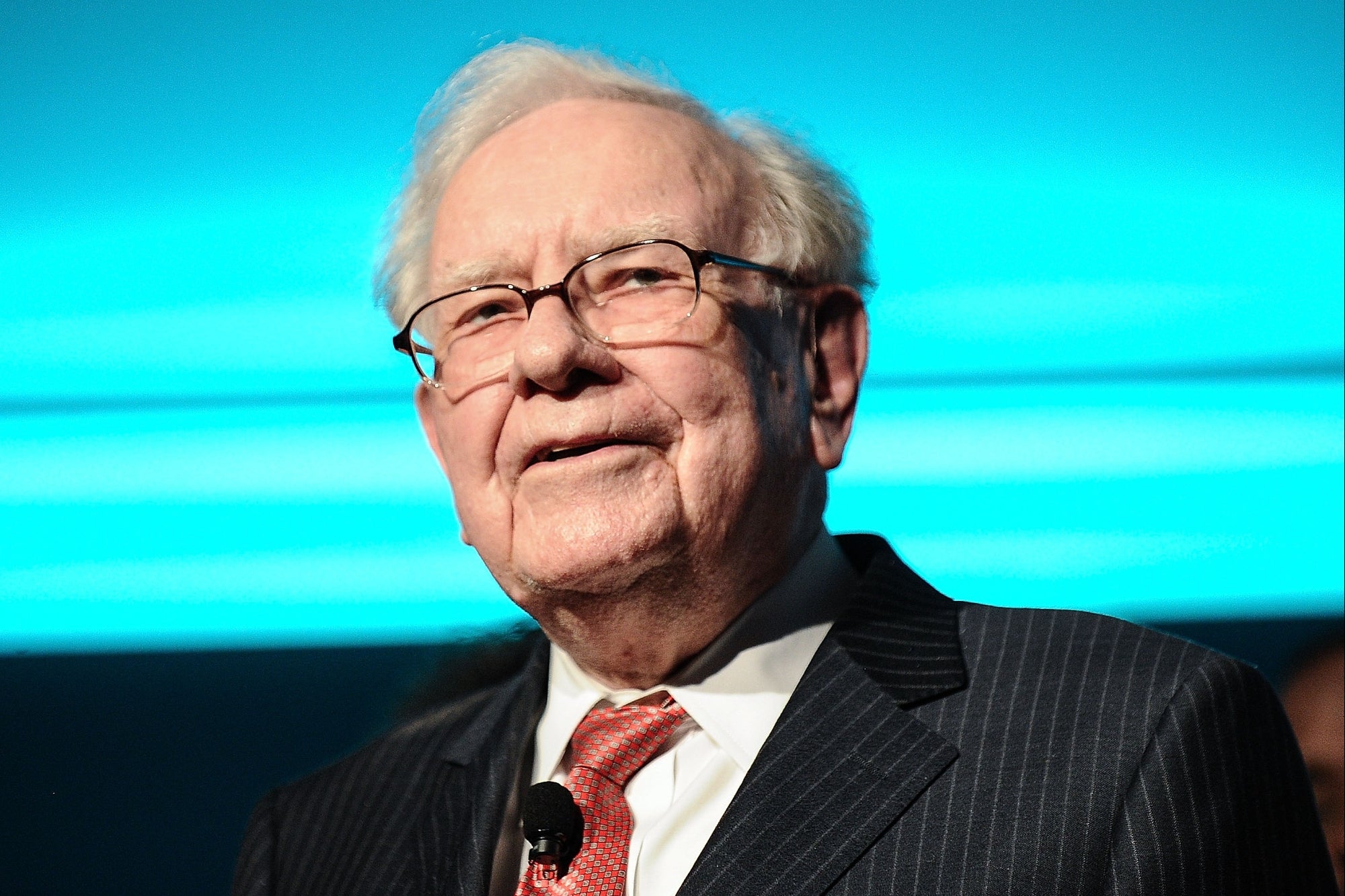

Dan Labbad, the chief govt, warned that regardless of the wind growth, “one other powerful 12 months” lay forward for the crown property. “There isn’t any doubt that we’re involved about retail and have been for a while.”

Labbad mentioned the group would run extra pilot schemes to determine what purchasers wished. It has supported the part-pedestrianisation of Oxford Circus and is adapting its workplaces for versatile working. “The largest problem for us is making certain that we will repurpose the enterprise for the long run.

“We had 50 million individuals stroll down Regent Avenue two years in the past. That quantity has fallen by 75%. So much will come again naturally, however we aren’t counting on that.”

He added that retail parks had been performing fairly nicely as a result of buyers may drive there, quite than city-centre areas, to which individuals usually journey by public transport.

Source link