Up to date on June twenty third, 2021 by Nikolaos Sismanis

Based in 1989, OrbiMed Advisors is an funding agency with roughly $21.4 billion of belongings underneath administration (AUM). The corporate invests in a large spectrum of healthcare companies: from non-public start-ups to giant multinational corporations.

Scouting the world for improvements that may help in making human lives more healthy, the OrbiMed group has helped nurture and commercialize a few of at the moment’s most profitable healthcare corporations. OrbiMed was based in New York Metropolis however has additionally expanded its operations in San Francisco, Shanghai, Mumbai, Herzliya, and Hong Kong.

Traders following the corporate’s 13F filings during the last 3 years (from mid-Might 2018 by mid-Might 2021) would have generated annualized whole returns of seven.89%. For comparability, the S&P 500 ETF (SPY) generated annualized whole returns of 18.60% over the identical time interval.

Word: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

You may obtain an Excel spreadsheet with metrics that matter of OrbiMed Advisors’ present 13F fairness holdings beneath:

Hold studying this text to be taught extra about OrbiMed Advisors.

Desk Of Contents

OrbiMed Advisors’ Investing Methods

OrbiMed focuses solely on investing within the healthcare sector, leveraging its group’s experience within the {industry} to determine essentially the most promising corporations and assist them to commercialize a brand new, revolutionary product.

To separate its operations primarily based on its several types of investments, OrbiMed allocates capital by embodying three completely different methods:

Public Fairness:

OrbiMed manages quite a few public-equity funds, together with each lengthy and quick event-driven funds, and varied funding trusts. This section focuses on all forms of publicly traded healthcare corporations, resembling biopharmaceuticals, medical gadgets, and healthcare providers shares. Now we have included a few of OrbiMed’s largest public fairness holdings beneath.

Personal Fairness

OrbiMed’s second funding technique revolves round looking for essentially the most promising non-public start-ups, to which the fund is normally a number one investor, meaning to have an lively position within the firm’s journey.

OrbiMed’s experience in figuring out the longer term winners within the healthcare sector has been well-established, contemplating that the corporate numbers greater than 140 profitable exits. A few of them embrace:

Galecto (GLTO):

Galecto is a clinical-stage biotech agency that develops molecules to deal with fibrosis, most cancers, irritation, and varied different associated ailments. OrbiMed’s managers participated in Galecto’s Collection C spherical again in October of 2018 when the corporate raised $79 million.

Precisely 2 years after the corporate IPOed on the NASDAQ, it’s at present valued at round $373 million. Contemplating that shares are lacking from the fund’s newest 13f submitting, it’s greater than seemingly that administration offered its place, reserving a fast revenue in a comparatively quick time period.

Invitae (NVTA):

One in every of OrbiMed’s most profitable early picks was its participation in Invitae’s Collection F non-public spherical, serving to the corporate increase $120 million. Immediately, Invitae is likely one of the most hyped DNA-processing corporations, rising revenues at 35% year-over-year and boasting a market cap of $6.45 billion, clearly displaying OrbiMed’s funding instinct.

Arrowhead Prescribed drugs (ARWR):

Arrowhead Prescribed drugs develops medicines that deal with intractable ailments by silencing the genes that trigger them. In 2016, the corporate introduced a non-public providing with a choose group of buyers, together with Orbimed, RA Capital Administration, and Perceptive Advisors, elevating $45 million at a worth of $5.90 per share. Immediately, shares are buying and selling at $85, implying a 10-fold enhance of OrbiMed’s funds inside only a few years. To mitigate its threat OrbiMed had been step by step trimming its place, reserving some earnings, and lately exited its fairness stake fully.

Now we have beforehand coated OrbiMed’s co-investors talked about like RA Capital and Perceptive advisors, which you could find right here, and right here, respectively.

Personal Credit score/Royalty

OrbiMed’s third funding technique is offering healthcare companies with non-dilutive structured debt in alternate for royalty rights on their product gross sales. For the fund to reduce the chance of an organization defaulting, administration will solely mortgage to commercial-stage corporations to make sure its royalties will begin flowing in from the get-go.

By ensuring that OrbiMed’s debt is non-dilutive, it additionally ensures that its funding’s authentic shareholders are additionally incentivized to carry out nicely. It is because they keep their authentic fairness, due to this fact making a win-win scenario for all.

OrbiMed’s Portfolio & Prime Holdings

The fund’s public-equity portfolio is well-diversified, comprising of 96 particular person shares, all of which function within the healthcare sector. No holding accounts for greater than 7% of its whole portfolio, aside from Springworks, which accounts for that a lot.

The ten largest holdings collectively occupy simply over 40% of the portfolio’s whole weight, which suggests a diversified capital allocation.

Supply: OrbiMed’s 13f submitting, Creator

In the course of the quarter masking the fund’s newest 13f submitting, the corporate made the next noteworthy new Buys/Sells:

New Buys:

- Gracell Biotechnologies Inc. ADR (GRCL)

- Haemonetics Corp. (MA) (HAE)

- Terns Prescribed drugs Inc (TERN)

- Ikena Oncology Inc (IKNA)

- Chemomab Therapeutics Ltd (CMMB)

New Sells:

- Prevail Therapeutics Inc (PRVL)

- Teva Pharmaceutical Industries Ltd (TEVA)

- 908 Units Inc. (MASS)

- Change Healthcare Inc (CHNG)

- Zymeworks Inc (ZYME)

- Syndax Prescribed drugs Inc (SNDX)

- Acadia Prescribed drugs Inc (ACAD)

- Viatris Inc (VTRS)

A few of its prime holdings embrace:

Springworks Therapeutics, Inc. (SWTX)

Springworks is OrbiMed’s largest holding, with the fund holdings round 12.6% of the corporate’s shares. In contrast to Galecto and Invitae, which the fund offered upon their IPOs, Springworks fairness was held upon its transition from a non-public to a public firm, therefore the fund’s giant stake.

Because the firm’s preliminary itemizing worth of round $23 round a 12 months in the past, shares have surged to a present all-time excessive of $79, reaffirming the fund’s determination to carry on to the inventory. Contemplating that OrbiMed’s participation in each of the corporate’s two funding rounds, the inventory’s present market cap of $3.9 billion signifies that the fund is sitting on large unreleased beneficial properties, making Springworks one in every of its most profitable investments ever.

Traders needs to be cautious of the actual fact Springworks is actually nonetheless a pre-revenue firm, at present buying and selling at greater than 200 instances its ahead gross sales. As soon as and if gross sales begin snowballing its valuation could possibly be nicely justified. Till then, nonetheless, the inventory stays dangerous for the common investor.

The place was as soon as once more trimmed by 16% as of Orbimed’s newest 13F submitting, more than likely for the fund to e book some beneficial properties off of the inventory’s extended rally.

Bristol-Myers Squibb Firm (BMY)

Bristol-Myers Squibb, following its Celgene acquisition, has turn into one of many fund’s largest holdings. OrbiMed has been rising its fairness stake within the firm since 2007, which is a testomony to the inventory’s skill to ship long-term returns.

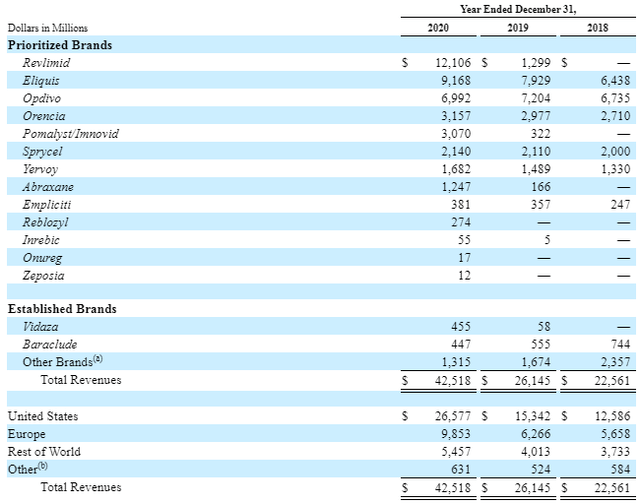

The corporate’s present long-term debt place is at an enormous $44.5B following the Celgene and MyoKardia acquisitions. Consequently, nonetheless, BMY at present shows a diversified portfolio of industry-leading belongings. Revlimid is the second-bestselling drug on the planet behind AbbVie’s immunology juggernaut Humira.

Supply: 10K

Regardless of BMY shifting in direction of a youthful and extra diversified portfolio of medicines, with gross sales and earnings anticipated to stay sturdy at the least within the medium time period, the inventory is at present buying and selling close to an all-time low ahead P/E of 8.6. The inventory can be providing a passable yield of round 3% at its present worth ranges, which dividend progress buyers are more likely to respect contemplating the inventory’s speedy dividend will increase.

OrbiMed hiked its place by 27% in the course of the quarter.

Merck & Co (MRK)

One of many mega-cap pharma companies within the fund’s portfolio is Merck & Co, which accounts for round 4.6% of its holdings. The corporate has been enriching its remedy portfolio by executing varied acquisitions, resembling its latest acquisition of vaccine developer Themis.

The corporate has been a steady funding for OrbiMed, constantly elevating its dividends and at present yielding a stable 3.4%. The corporate’s most up-to-date dividend enhance was by 6.6%, to a quarterly charge of $0.65, additional reassuring buyers of its monetary resilience.

Supply: Firm filings, Creator

The fund has been holding shares since early 2016, having loved some low volatility, predictable returns from this pharma behemoth. Shares are at present buying and selling close to a decade-low ahead P/E of round 12.6, which, mixed with Merck’s sturdy deal with shareholder returns, may sign an amazing shopping for alternative for brand spanking new buyers to leap in.

Along with the dividend, Merck can be constantly shopping for again its shares. Whereas not an aggressive buyback play, at its present valuation, the corporate ought to be capable to scale back its share rely fairly quickly. Inventory repurchases at a ahead P/E within the low teenagers are more likely to unlock extra shareholder worth creation than speedy dividend will increase.

OrbiMed continued including to its place, which elevated by round 40% as of its newest submitting.

Boston Scientific Corp (BSX)

Boston Scientific is Orbimed’s third-largest holding, accounting for round 4.6% of its public fairness portfolio. It’s a comparatively new place for the fund, initiated throughout Q2 of 2020. The corporate lately achieved FDA approval for its Ranger Drug-Coated Balloon to deal with sufferers with peripheral artery illness, which ought to add to the corporate’s prime line over time.

Shares are at present buying and selling a ahead P/E of 26.5 at present. Whereas the inventory is unquestionably not low-cost, analysts anticipate gross sales to extend by round 18.61%+ subsequent 12 months, seemingly justifying the present premium.

OrbiMed hiked its stake in Boston Scientific by 6% in the course of the newest quarter.

Vertex Prescribed drugs Integrated (VRTX)

Vertex Prescribed drugs is Orbimed’s sixth-largest holding, accounting for round 3.8% of the fund’s whole portfolio. The corporate engages in creating and commercializing therapies for treating cystic fibrosis. The corporate’s revenues have been rising continuously because it grows its affected person base, leading to increasing gross margin.

The corporate has began allocating its growing earnings in inventory buybacks, repurchasing round $830 million price of shares over the previous 4 quarters. Vertex at present trades at a decade low valuation of round 20.5X its ahead internet earnings. Traders on the lookout for a fairly valued, high quality firm within the sector are more likely to discover Vertex interesting, consequently.

OrbiMed elevated its place by 36% in the course of the quarter, making the most of Vertex’s seemingly enticing valuation.

Last Ideas

OrbiMed’s option to separate its funding methods into three completely different classes has allowed its skilled group to scout and determine among the healthcare sector’s present superstars from early on. Whereas the corporate’s public fairness portfolio has not outperformed the general market, it’s necessary to do not forget that the fund’s multi-bagger investments should not included in our estimated returns, as they had been non-public investments.

Contemplating that OrbiMed’s know-how within the healthcare sector is well-proven, buyers can make the most of its public-equities portfolio to be supplied with some doubtlessly enticing investments.

On the similar time, we suggest that retail buyers carry out their very own due diligence and be cautious of their capital allocation in OrbiMed’s holdings. A number of of these stay very speculative, that includes damaging free money flows, and usually require industry-related information as a way to perceive their enterprise fashions.

Extra Assets:

Baker Brothers’ 93 Inventory Portfolio: Prime 4 Holdings Analyzed

Melvin Capital’s 56 Inventory Portfolio: Prime 10 Holdings Analyzed

Appaloosa Administration’s 40 Inventory Portfolio: Prime 10 Holdings Analyzed

Viking International’s 75 Inventory Portfolio: Prime 10 Holdings Analyzed

Lone Pine Capital’s 37 Inventory Portfolio: Prime 10 Holdings Analyzed

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

Source link