Reality checking politicos, headlines and central bankers is one factor. Placing their “details” into context is one other.

Towards that finish, it’s vital to position so-called “financial development,” Treasury market development, inventory market development, GDP development and, after all, gold worth development into clearer perspective regardless of an insane world backdrop that’s something however clearly reported.

Context 1: The Rising Progress Headline

Lately, Biden’s financial advisor, Jared Bernstein, calmed the plenty with one more headline-making boast that the U.S. is “rising significantly quicker” than their buying and selling companions.

Truthful sufficient.

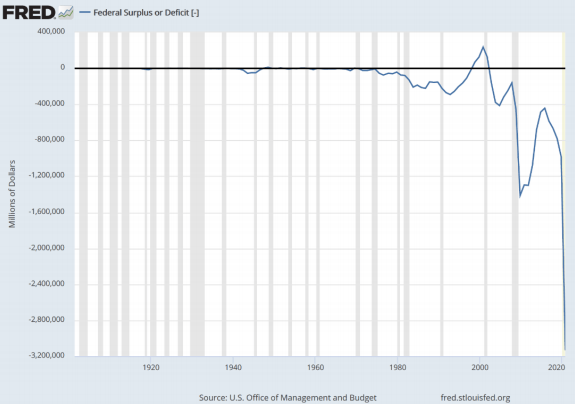

However on condition that the U.S. is operating the most important deficits on historic report…

…such “development” is no surprise.

In different phrases, bragging about development on the again of utmost deficit spending is sort of a spoiled child bragging a couple of new Porsche secretly bought along with his father’s bank card: It solely seems to be good till the invoice arrives and the automotive vanishes.

In a monetary world gone mad, it’s vital to look underneath the hood of what passes for development specifically or fundamental rules of worth discovery, debt ranges or provide and demand basically.

In brief: “Progress” pushed by excessive debt shouldn’t be development in any respect–it’s simply the headline floor shine on a sports activities automotive one can’t afford.

And but the insanity continues…Take the U.S. Treasury market, for instance.

Context 2: The Treasury “Market”?

How can anybody name the U.S. Treasury market a “market” when 56% of the $4.5T of bonds issued since final February have been purchased by the Fed itself?

Sounds extra like an insider price-fix than a “market,” no?

Such context offers a completely new which means to the thought of “consuming your individual Kool-aide” and should be a cool reminder that Treasury bonds basically, and bond yields specifically, are zombies masquerading as credit score Olympians.

The Fed, after all, will faux that such “help” is as momentary as their “transitory inflation” meme, however most market realists understood way back that extra and crazier bond yield “help” is the one means for nationwide debt bubbles (and IOU’s) to remain zombie-like alive.

In brief, the higher phrase for Treasury “help,” “lodging,” or “stimulus” is just: “Life Help.”

With central banks just like the Fed persevering with to create fiat currencies to monetize their unsustainable debt effectively into the distant future, we are able to safely foresee an extra weakening of the USD and additional strengthening of gold costs, mining shares and key threat property like tech and industrial shares.

Context 3: Deflation is again?

Hardly.

Final week’s jaw-boning from Powell, Fisher and Bullard had the markets questioning if the Fed shall be elevating charges within the distant future.

The actual fact that Powell raised the difficulty is as a result of the Fed is realizing that inflation goes to be sticky somewhat than “transitory”and thus they’re already pretending to pose as Hawkish.

But when the Fed raises charges to quell actual somewhat than “transitory” inflation, the markets and Uncle Sam will go right into a tantrum. Finish of story.

As I’ve written elsewhere: Decide your Fed poison—tanking markets or surging inflation. Ultimately, we foresee each.

In the meantime, and totally conscious that inflation, with some dips, is barely going to development greater, Powell is already utilizing semantics to vary the principles mid-game, now saying that somewhat than “enable” 2% inflation, they’ll accept an “common” of two%.

Translated into trustworthy English, this simply means anticipate extra inflation across the nook.

Context 4: Rising Inventory Markets

Regardless of reaching nosebleed ranges which defy each conventional valuation ceiling, from CAPE ratios and Tobin ratios to e-book values and FCF information, the headlines remind us that shares can go even greater—they usually can certainly.

However context, in addition to historical past, reminds us that the larger the bubble the larger the mean-reverting fall.

No Treasure in Treasuries = Lot’s of Air in Shares

Based mostly upon the target details above, we now know that the one main patrons exhibiting up at U.S. Treasury auctions is the Fed itself.

It is because the remainder of the world (Asia, Europe and so forth.) doesn’t need them.

The following query is “why”?

The reply is a number of but easy.

First, and regardless of the open fantasy of American Exceptionalism, traders in different international locations can truly assume, learn and depend for themselves, which suggests they’re not merely trusting the Fed—or its IOU’s– blindly.

Said in any other case, they aren’t shopping for the “transitory inflation” or “robust USD” story pouring not too long ago out of the FOMC mouthpieces.

Inflation shouldn’t be solely rising within the U.S., it’s additionally creeping up elsewhere—even in Japan, however particularly in China. That is largely as a result of the U.S. exports its inflation (and debased {dollars}) offshore through commerce and monetary deficits.

Such deliberate inflation exporting by the U.S. locations these international locations (collectors) that lent cash to Uncle Sam right into a dilemma: They’ll both 1) let their currencies inflate alongside the greenback (hardly enjoyable), or 2) attempt to quell the outflow of exported (debased) US {dollars} to avoid wasting their very own currencies from additional debasement.

Possibility 2, after all, is the higher possibility, which suggests overseas traders want to purchase one thing extra interesting than discredited U.S. Treasuries.

Sadly, paradoxically, and but factually, the one property higher than bogus US Treasuries are bloated U.S. shares.

In brief, nosebleed-priced US shares are nonetheless the lesser of the 2 US evils, and foreigners are subsequently shopping for/seeing shares as a greater hedge in opposition to the debased USD than sovereign bonds.

Don’t imagine me?

See for your self—the remainder of the world is including a number of air to the U.S. fairness bubble:

That is contextually troublesome for plenty of causes.

First, it means the declining US of A has gone from hocking its bonds to the remainder of the world to hocking it shares to the remainder of the world (i.e., China…).

Long run, this merely implies that through direct inventory possession, foreigners will slowly personal extra of company America than, effectively America…

As for this sluggish gutting of the once-great America to overseas patrons, don’t blame the information. Blame your Fed and different coverage makers (together with labor off-shoring CEO’s) for selling-out America and pretending debt will be magically solved with magical (faux) cash creation.

In fact, the second pesky little drawback with shares rising past the pale of sanity, earnings and trustworthy FCF information is a factor known as volatility—i.e., market seasickness.

Nothing goes in a straight line, together with the greenback or the market. There shall be swings.

Proper now, the brief on the USD is the best it has been in 4 years.

But if, by some probability, the Fed ever makes an attempt to taper or increase charges, all these overseas {dollars} piling into U.S. shares (above) create a bubble that all the time pops, as do the foregoing greenback shorts, which get squeezed.

That might trigger a large sell-off in U.S. fairness markets as foreigners promote their shares to purchase extra {dollars}.

In brief, there’s a number of totally different needles pointing on the present fairness bubble, and a correction throughout the subsequent month or so is greater than doubtless.

The sharpest of these needles, by the way in which, is the appallingly comical degree of U.S. margin debt (i.e. leverage) not making the headlines but now making all-time highs.

As a reminder, at any time when margin debt peaks (above), markets tank quickly thereafter, as anybody who remembers the dot.com and sub-prime market fiascos of yore can attest.

Simply saying…

Context 5: The Darkish Facet of “Surging” GDP Progress

The World Financial institution not too long ago made its personal headlines projecting 5.6% world GDP development, the quickest seen in 80 years.

Good things, proper?

Effectively, not when positioned into context…

The final time we noticed 5.6% world GDP development was throughout a world world warfare.

Clearly, when the world is in a state of worldwide army rubble, development of any variety is more likely to “surge” from such an historic (and horrific) baseline.

Popping out of World Conflict II, everybody, together with the U.S. was in debt. World wars, in spite of everything, can try this…

Because the victorious and civilization-saving U.S. got here out of that warfare, it made some justifiable sense to de-lever that noble but excessive debt by printing cash, repressing bond yields and stimulating GDP development.

What adopted was a minimum of a defendable 40-year stretch through which US nominal GDP ran 500-800 bps above US Treasury yields.

In brief, bond-holders acquired slammed, however the trigger, disaster and re-building after defeating the Axis powers justified the sacrifice.

The identical, nonetheless, can’t be stated at present as bond-holders get crushed but once more in a new-abnormal through which GDP will enormously (and equally) outpace long-term bond yields.

For sure, present coverage makers, the very foxes who put the worldwide financial henhouse into the present pile of debt of rubble, prefer to blame this on COVID somewhat their lavatory mirrors.

Paradoxically, nonetheless, central bankers (versus the Wehrmacht, the Japanese Empire or Italy’s Mussolini) managed to do as a lot hurt to the worldwide financial system at present (with deficit insurance policies and extend-and-pretend cash printers) as Germany’s Blitzkrieg or Hirohito’s Banzai raids did within the 1940’s.

In terms of context, can or ought to we actually be evaluating a worldwide flu (demise toll 3.75M) to a worldwide warfare (demise toll 85 million)?

The coverage makers would really like you to assume so.

People like Mnuchin (final yr) or Yellen, Powell and the IMF (this yr), are in actual fact making an attempt to persuade themselves and the world that the warfare in opposition to COVID was the true casus belli (cause for a justifiable warfare) of our present debt misery—equal in scope to World Conflict II in its drastic influence on the monetary world.

However no matter anybody’s views on the COVID “Conflict” or its questionable coverage reactions, evaluating its financial influence to that of World Conflict II is an insult to each historical past and army metaphors.

The easy, goal and mathematically-confirmed reality is that the worldwide financial system was already in a debt disaster lengthy earlier than the primary Corona headline of early 2020.

As we speak, US debt to GDP is at ranges it has not seen since that tragic and Second World Conflict, and it’s projected to go a lot, a lot greater.

So, simply in case you continue to assume the Fed can and can meaningfully increase charges to struggle apparent inflation, because it did within the 1970’s or 1980’s, assume once more.

Within the 1970’s and 1980’s US debt/GDP was 30%. As we speak it’s 130%.

Given this self-inflicted (somewhat than COVID-blamed) actuality, the Fed merely can’t afford to lift charges. Interval. Full cease.

However as my colleague, Egon von Greyerz reminds, that certainly not means that charges can’t and received’t rise.

The Fed (and different central banks) could also be highly effective, however they aren’t divine. In brief, there’s a restrict to their powers to easily “management” charges with a mouse-click.

In some unspecified time in the future, there’s not sufficient credible faux cash to handle the yield curve—particularly on the lengthy finish.

As extra printed and tanking currencies attempt to buy decrease yields and charges, finally your entire experiment fails.

At that vital level, charges spike, inflation raises its ugly head and the central bankers search for one thing apart from themselves guilty as the remainder of the world stares at nugatory currencies being changed by comical central financial institution digital {dollars}.

Fantastic…

Context 6: That Barbaric Relic?

What the foregoing inflation and price contexts means is that within the years forward, inflation will run greater and charges will run (be pressured/managed) decrease till each charges and inflation spike collectively.

This additional implies that actual charges (i.e., these adjusted for inflation) may run as deep as -5% to -10% within the years forward.

Such unfavorable actual price ranges may simply surpass these seen within the 70’s and 80’s, which suggests gold (and silver), each of whom love unfavorable actual charges, has nowhere to go however up, up and away on this completely debt-distorted backdrop.

How’s that for context?

Source link