Cryptocurrency worth corrected sharply right now, together with Ether (ETH), however this can be a short-term transfer which isn’t reflective of the extra macro-level occasions which nonetheless paint a bullish image for belongings like Ether and Bitcoin.

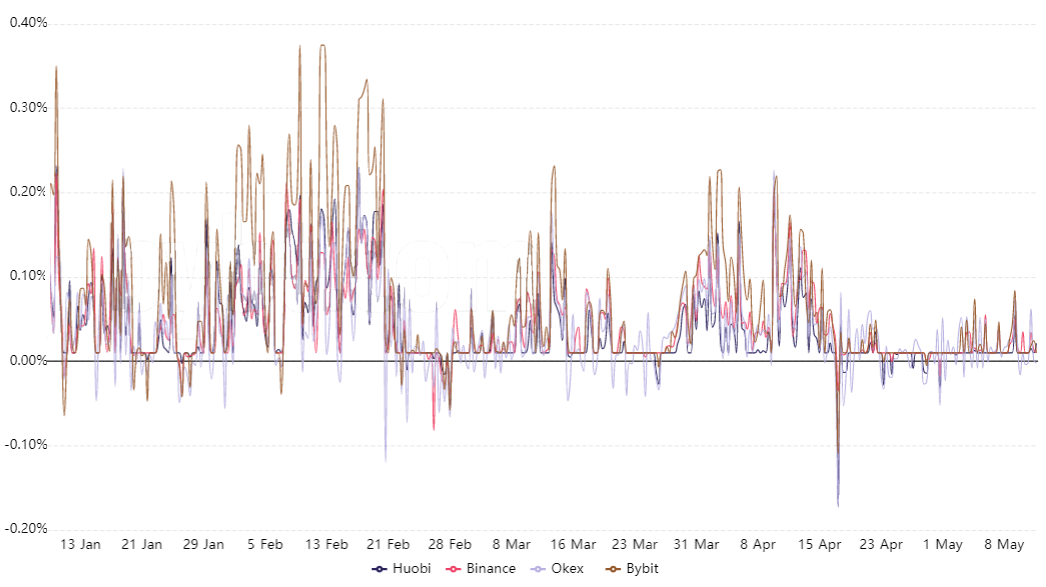

Within the final 30 days, Ether worth gained 96%, shifting from $2,138 to $4,200 on Might 11. Usually the idea can be that each dealer is consumed with euphoria and this may be seen within the funding charge reaching document highs on Ether futures contracts however in the intervening time this isn’t the case.

The funding charge seems to have flatlined on April 18 and in the intervening time evidently there’s nothing that may be carried out to re-ignite consumers’ leverage.

Take discover of how the price for longs (consumers) to hold open positions on Feb. 20 reached 0.20% per 8-hour, equal to 4.3% per week. A 74% worth hike in 30 days fueled that scenario as Ether tried to interrupt the $2,000 resistance.

Extra lately, an identical scenario occurred on April 3 after Ether rallied 43% to a $2,150 all-time excessive. Actions like these sometimes mark retail merchants’ extreme use of leverage. In the meantime, whales and arbitrage desks open longs utilizing the fixed-month future contracts to keep away from the funding charge oscillations.

The 19% damaging worth swing on April 17 induced $1 billion lengthy futures contracts liquidations. That occasion crushed bulls’ morale additionally impacted their confidence in constructing leveraged-long positions.

High merchants additionally lack confidence

Usually retail merchants are extra inclined to take an extended time to recuperate from sudden losses, however this time round, professional merchants additionally lack conviction regardless of the rally.

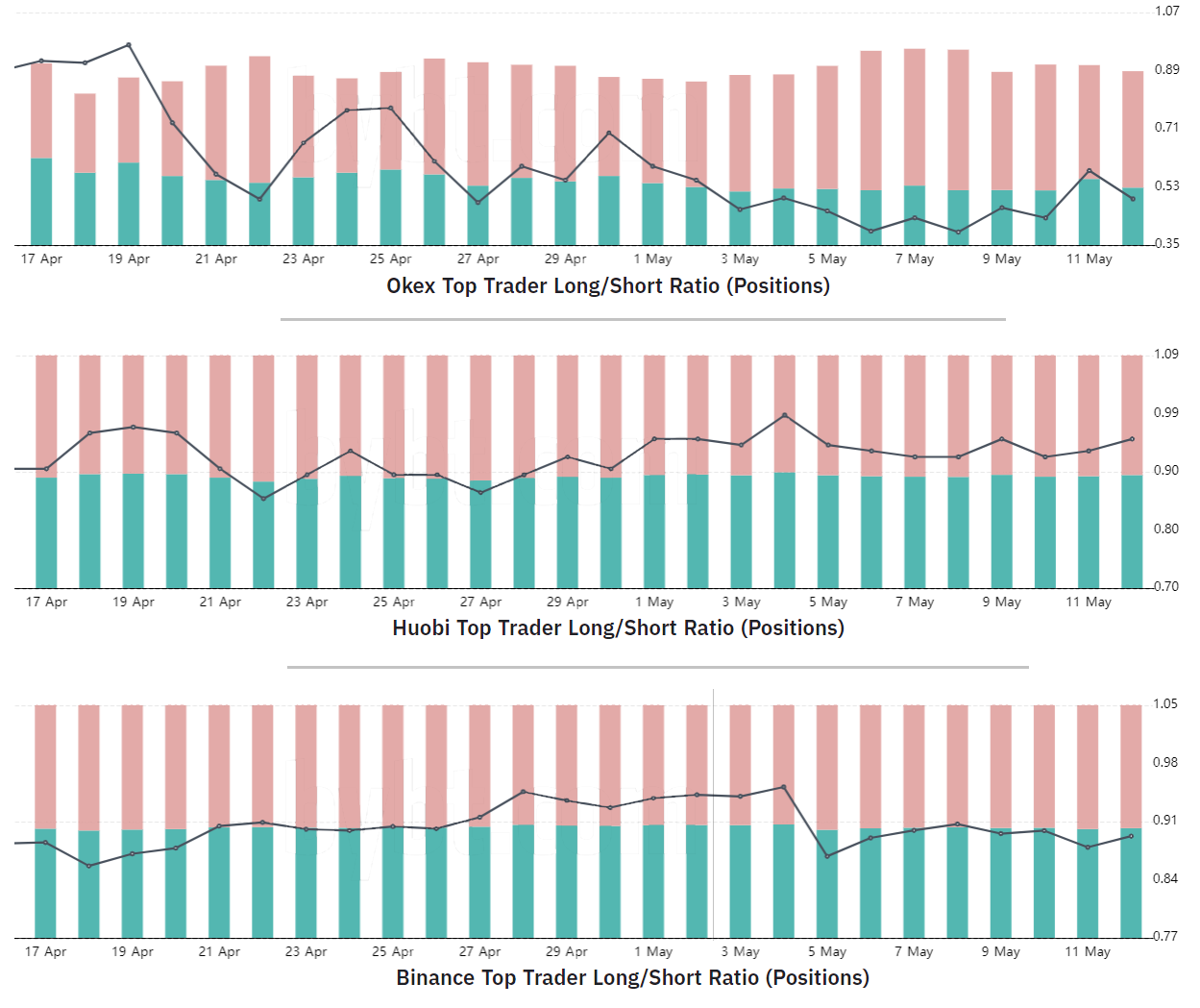

The highest merchants’ long-to-short web positioning is calculated by analyzing the consolidated positions on the spot, perpetual and futures contracts, offering a clearer view of whether or not skilled merchants are leaning bullish or bearish.

With this in thoughts, there are occasional discrepancies within the methodologies between totally different exchanges, so viewers ought to monitor adjustments as an alternative of absolute figures.

Regardless of the $4,380 all-time excessive on Might 12, these high merchants are nowhere close to the best long-to-short ratio. OKEx presents probably the most drastic change because the indicator reached 0.97 on April 18 and has since declined to 0.50, that means high merchants are 2:1 web quick.

Binance high merchants long-to-short oscillated between 0.86 and 0.95 over the previous thirty days, and the indicator at the moment stands at 0.89. That ought to be interpreted as a ‘impartial’ place, which appears odd contemplating the 96% rally throughout this era.

Lastly, Huobi’s high merchants’ leverage indicator peaked on Might 4 at 1.00, indicating a balanced scenario between longs and shorts. Nevertheless, it at the moment stands at 0.95, due to this fact signaling a scarcity of pleasure.

Bitcoin’s worth motion may very well be the explanation

It is no secret that Bitcoin (BTC) actions dictate merchants’ basic emotions, even when it means cheering for its worth to stabilize close to $55,000.

#BTC

The true G’s referred to as altseasons months in the past nevertheless it’s no disgrace to tweet “altseason” now as a result of it is nonetheless going

Ideally Bitcoin goes sideways till it breaks out right here. When Bitcoin drops and drags altcoins down, that is the place you purchase dips for max features.

You might be welcome pic.twitter.com/5f8SyCuUxf

— muro - will not DM you (@MuroCrypto) May 5, 2021

This #BTC Flag is sandwiched by two main resistance (purple) and assist (inexperienced) areas

It is an incredible market construction to advertise additional BTC consolidation within the short-term

In the meantime, Altcoins will proceed to make spectacular features till $BTC lastly breaks out#Bitcoin pic.twitter.com/L0peyMgt6o

— Rekt Capital (@rektcapital) May 5, 2021

Posts like these might be discovered throughout Twitter and in a manner, they verify that traders count on altcoins to crash if Bitcoin strikes under $50,000. This can be the first motive for the insecurity in Ether longs.

The views and opinions expressed listed below are solely these of the author and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer entails danger. It is best to conduct your individual analysis when making a choice.

Source link