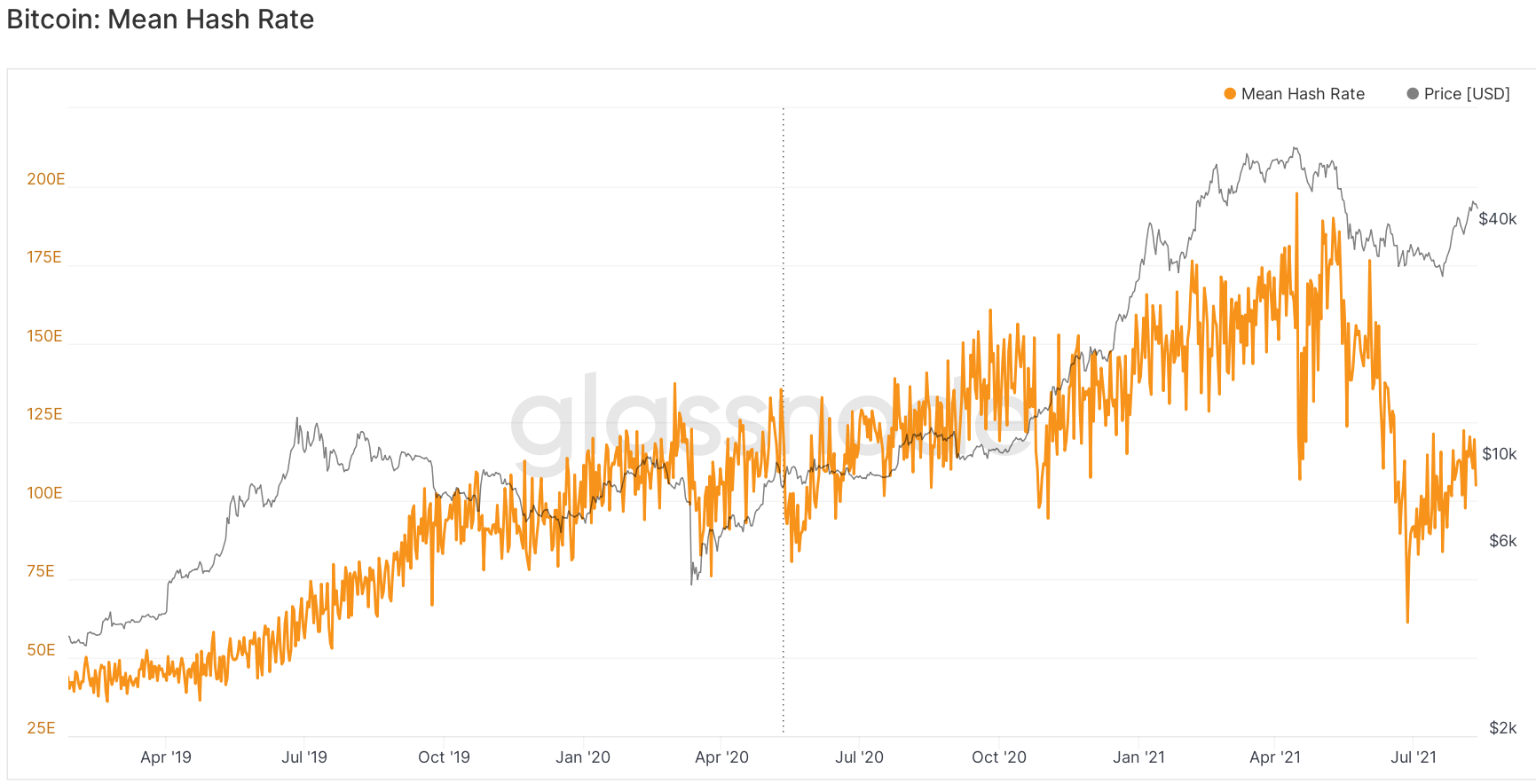

Bitcoin’s (BTC) speedy restoration above $46,000 has renewed requires a $100,000 BTC value by the tip of 2021, whereas the consequences of China’s crackdown on the mining business are slowly starting to fade because the Bitcoin community hash fee reveals indicators of restoration.

One of many facet advantages of China’s crackdown is that it has lowered the limitations of entry into the Bitcoin mining area, which has been proven to offer income in each bull and bear markets.

Bitcoin mining is among the few ways in which traders can purchase BTC with out instantly buying it from the market, and is rapidly changing into an business dominated by huge cash pursuits that may afford the electrical energy prices and maintenance required to run a mining operation.

Listed below are some choices out there for the common crypto stacker to amass extra BTC by way of cloud mining contracts, crypto lending platforms and centralized exchanges (CEX).

Cloud mining contracts

The cloud mining business has been round since Bitcoin’s early days, and it gives these fascinated with mining Bitcoin who lack the area, gear and electrical energy required a chance to outsource their manufacturing.

A few of the extra well-known firms that supplied cloud mining companies embody Genesis Mining and HashNest, however demand for his or her companies has exceeded their capabilities, leading to all their Bitcoin mining contracts being offered out.

One of many present mining operators with out there contracts is Shamining, an organization primarily based in the UK that has been in operation since 2018, and claims to have knowledge facilities worldwide with areas in California, Mexico, Cape City, South Africa and London, England.

By means of this service, customers can hire mining gear and pay for the related prices of working the models, whereas the corporate handles the bodily housing, operation and upkeep. As soon as operational, generated proceeds may be withdrawn to a Bitcoin pockets specified by the person.

Present rental contracts embody two choices for GPU miners, which price round $283 for 23,580 gigahashes per second (GH/s) or $1,066 for 94,340 GH/s, and an alternative choice for ASIC miners with a present price of $2,571 for 235,849 GH/s of mining energy.

All contracts point out that they’ve profitability that begins at 143%.

An alternative choice that enables customers extra flexibility concerning the parameters of their mining contract is ECOS, an organization that grew out of the Free Financial Zone positioned in Hrazdan, Armenia, and has been in operation since 2017.

As seen within the graphic above, a 50-month contract for 9 terahashes per second at present prices $1,668 and is projected to lead to a revenue of 272.82% at a BTC value of $70,000.

It ought to be famous that every one cloud mining companies supply warnings concerning the excessive dangers concerned and that no degree of revenue may be assured. This might be resulting from a wide range of circumstances, together with fluctuating electrical energy costs, Bitcoin value volatility and advances in mining know-how that result in substantial will increase in mining issue, which renders older gear out of date.

Associated: Bitcoin mining issue jumps a second time as miners settle offshore

Crypto lending companies

A extra conventional possibility out there for hodlers to amass extra Bitcoin by using their present stack that doesn’t require any additional funding, like mining, is thru lending companies that provide a yield on deposits.

Nexo and Celsius are two of probably the most well-known lending platforms that permit cryptocurrency customers to borrow funds in opposition to their crypto holdings or earn rewards for deposits.

On the time of writing, Celsius gives customers an annual proportion yield (APY) of 6.2% for Bitcoin deposits, and Nexo gives a typical return of 5% on flexible-term deposits, whereas fixed-term deposits that go a minimal of 1 month can earn 6%.

A 3rd possibility that gives customers with a 4% return on BTC deposits is BlockFi, a crypto asset service supplier that gives curiosity accounts and crypto-backed loans and has additionally not too long ago launched a Bitcoin rewards bank card.

Associated: What bear market? Buyers throw document money behind blockchain companies in 2021

Earn BTC from centralized exchanges

A number of centralized exchanges additionally supply Bitcoin holders a return on their BTC deposits, albeit at decrease charges than these talked about above.

Binance, the most important CEX within the crypto ecosystem, gives customers an estimated APY of 0.5%, whereas third-ranked change Huobi gives 1.32%.

The very best yield supplied on a United States-based CEX may be discovered on Gemini the place customers can earn 1.65% on their deposits.

KuCoin gives a extra free-market strategy to BTC lending the place lenders can set the parameters of the mortgage phrases, selecting between contract lengths of seven days, 14 days and 28 days whereas attending to set their very own each day rates of interest to compete with different lenders available on the market.

The bottom fee at present supplied on KuCoin is an annual fee of 1.82% on a seven-day contract.

As seen within the knowledge supplied, there are a number of methods to extend a Bitcoin stack versus merely shopping for on the open market, however they’re changing into scarcer as time progresses.

With giant establishments, vitality firms and governments starting to develop Bitcoin mining infrastructures, smaller market individuals are more and more being squeezed out as cloud mining services are unable to maintain tempo with demand.

Bitcoin lending is more and more wanting like the primary method BTC holders will have the ability to earn a yield paid in BTC sooner or later, whereas Bitcoin-backed loans supply a method for hodlers to entry the worth of their tokens with out the necessity to promote and create a taxable occasion.

Need extra details about buying and selling and investing in crypto markets?

The views and opinions expressed listed below are solely these of the creator and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, it’s best to conduct your individual analysis when making a choice.

Source link