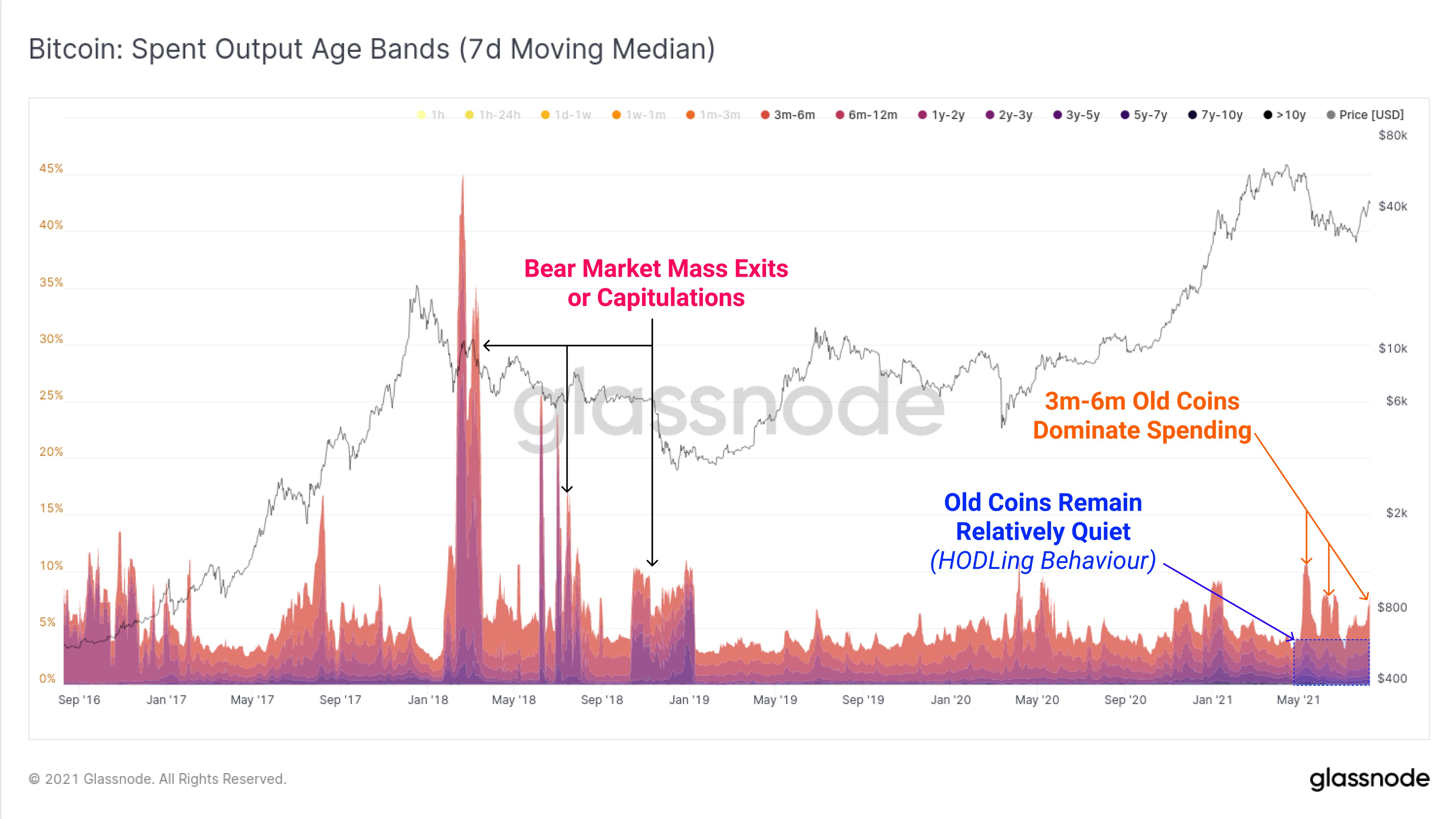

The dimensions of Bitcoin’s (BTC) ongoing draw back correction won’t be as alarming because it was in 2018, signifies knowledge shared by Glassnode.

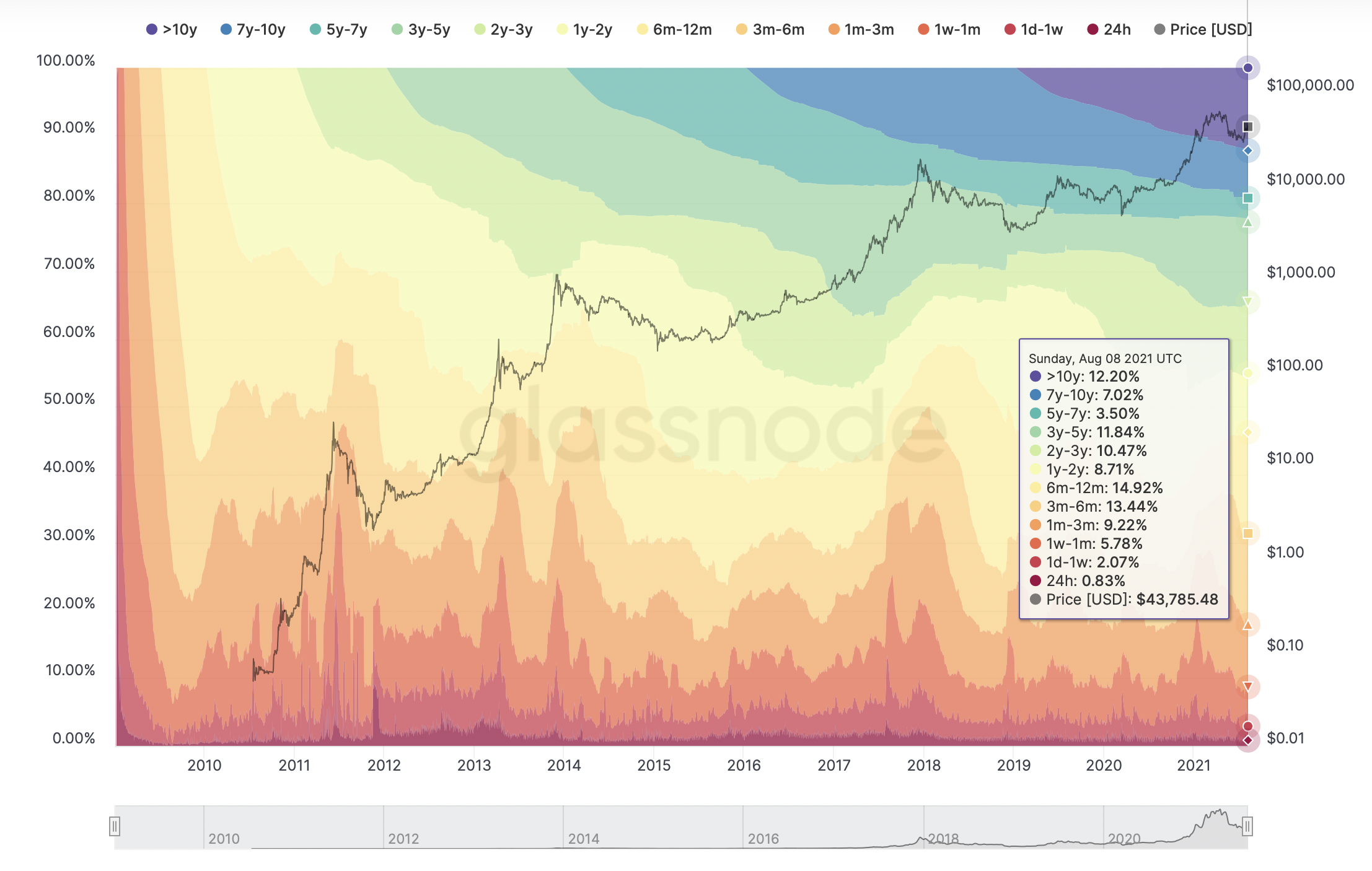

The blockchain analytics agency reported that traders who’ve held Bitcoin for multiple yr confirmed a lesser curiosity in liquidating their investments versus those that held the digital asset for 3 to 6 months. Its dataset coated the interval of Bitcoin’s correction from round $65,000 on April 14 to round $44,000 on Monday.

However, all investor cohorts have been instrumental in crashing the BTC worth in 2018 from $19,891 to $3,128.

With a majority of “outdated cash” not deciding to safe their 275% year-over-year earnings even after a 35% draw back correction, Glassnode knowledge hinted robust “hodling conduct” that may have Bitcoin escape a 2018-like mass capitulation occasion.

Glassnode famous:

“Regardless of a robust rally to $45k, the Bitcoin market nonetheless has not seen a big improve in outdated cash (>1y) being spent. That is very completely different to the 2018 bear market the place outdated fingers took exit liquidity on most aid rallies.”

Panic promoting lacking

Extreme valuations led by the preliminary coin providing frenzy have been the primary trigger behind the 2018 cryptocurrency market crash. Random startups raised billions of {dollars} to construct blockchain platforms, however a majority of them turned out to be both vaporware or scams ultimately.

When the bubble lastly popped, the cryptocurrency market ended up crashing from $700 billion in January 2018 to $102 billion in December 2018. In consequence, Bitcoin, which was one of many currencies of alternative throughout startup fundraisers, fell 85.27% from its then-record excessive of $19,891.

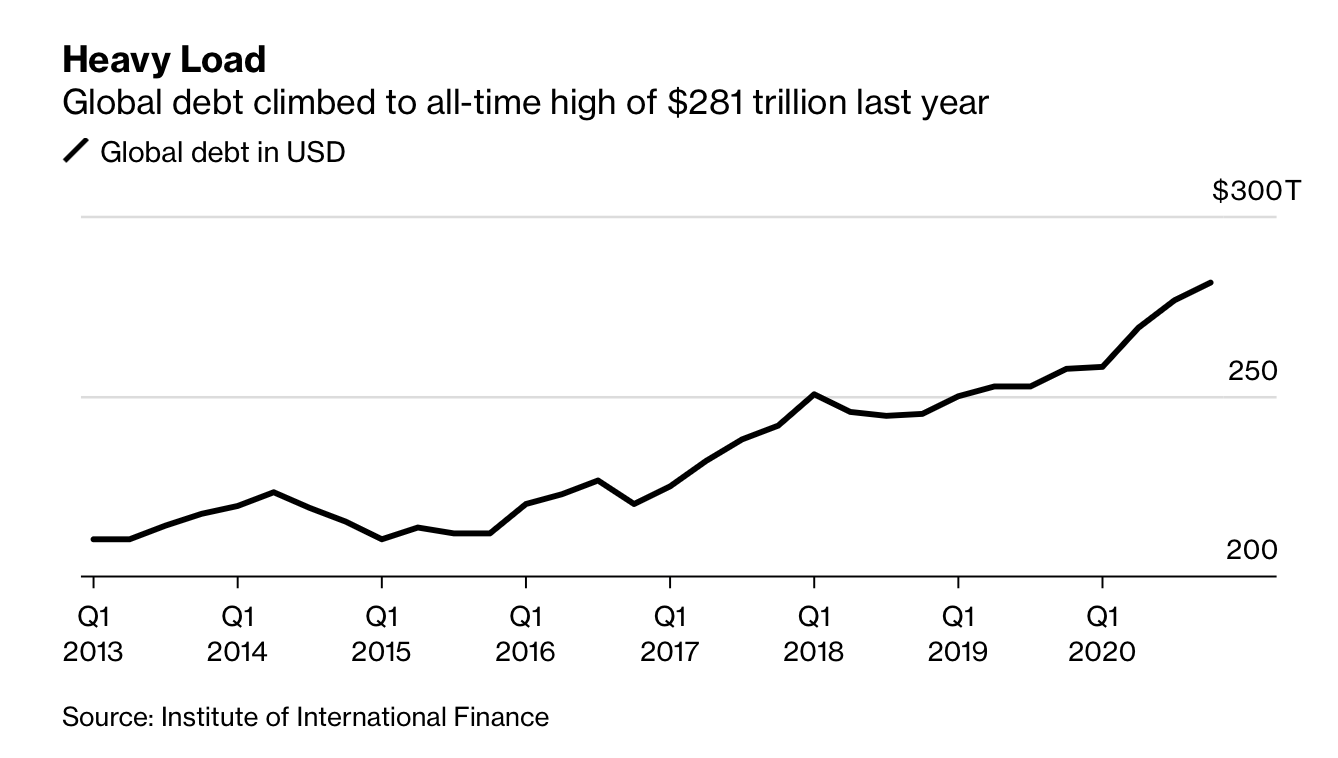

Nonetheless, 2021’s Bitcoin worth rally originated from stable macroeconomic grounds as traders hunted for secure havens in opposition to free financial insurance policies carried out by central banks worldwide. In consequence, central banks’ efforts to protect economies in opposition to the monetary aftermath of the coronavirus pandemic pushed the worldwide debt to over $281 trillion final yr.

Associated: $7B funding agency recommends crypto to beat foreign money debasement

That was 355% of the worldwide gross home product. In response to the Institute of Worldwide Finance, borrowing is predicted to have elevated by one other $10 trillion in 2021.

“Folks have much less wealth and extra debt. The devaluation of fiat currencies has made all the pieces dearer round us,” stated Anthony Pompliano, accomplice at Pomp Investments, in a observe to shoppers, including:

“The promise of bitcoin is that we are going to usher in a brand new period of sound cash. The foreign money is exterior the system. Nobody controls it. Folks will as soon as once more be capable of save their method to monetary freedom. The cash gained’t lose worth over time. In truth, the buying energy will improve.”

Quick-term traders returning?

Bitcoin’s current rebound from beneath $30,000 to over $45,000 additionally coincided with a modest spike within the proportion of traders who final purchased the digital asset three to 6 months in the past.

On July 19, when Bitcoin was wobbling close to $30,000, the cryptocurrency’s internet unspent transaction output for 3 million–6million traders was 12.84%. That surged to 13.44% on Monday. Bitcoin was buying and selling round $45,130 on the identical day, showcasing that weak fingers have been turning robust.

The views and opinions expressed listed here are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails threat, it’s best to conduct your individual analysis when making a choice.

Source link