Bitcoin (BTC) traders proceed to hodl BTC at $40,000, even when they purchased it at decrease ranges earlier in 2021.

Within the newest version of its e-newsletter, The Week On-Chain, on June 14, on-chain monitoring useful resource Glassnode revealed that consumers from the primary months of this yr’s bull market are refusing to money out.

“Very younger” provide in decline

Bitcoin has been marked by low quantity in latest weeks as value motion remained rangebound between $30,000 and $41,000.

The previous few days has seen modest volatility return, however for many hodlers, there are few alternatives for profiteering beneath present circumstances.

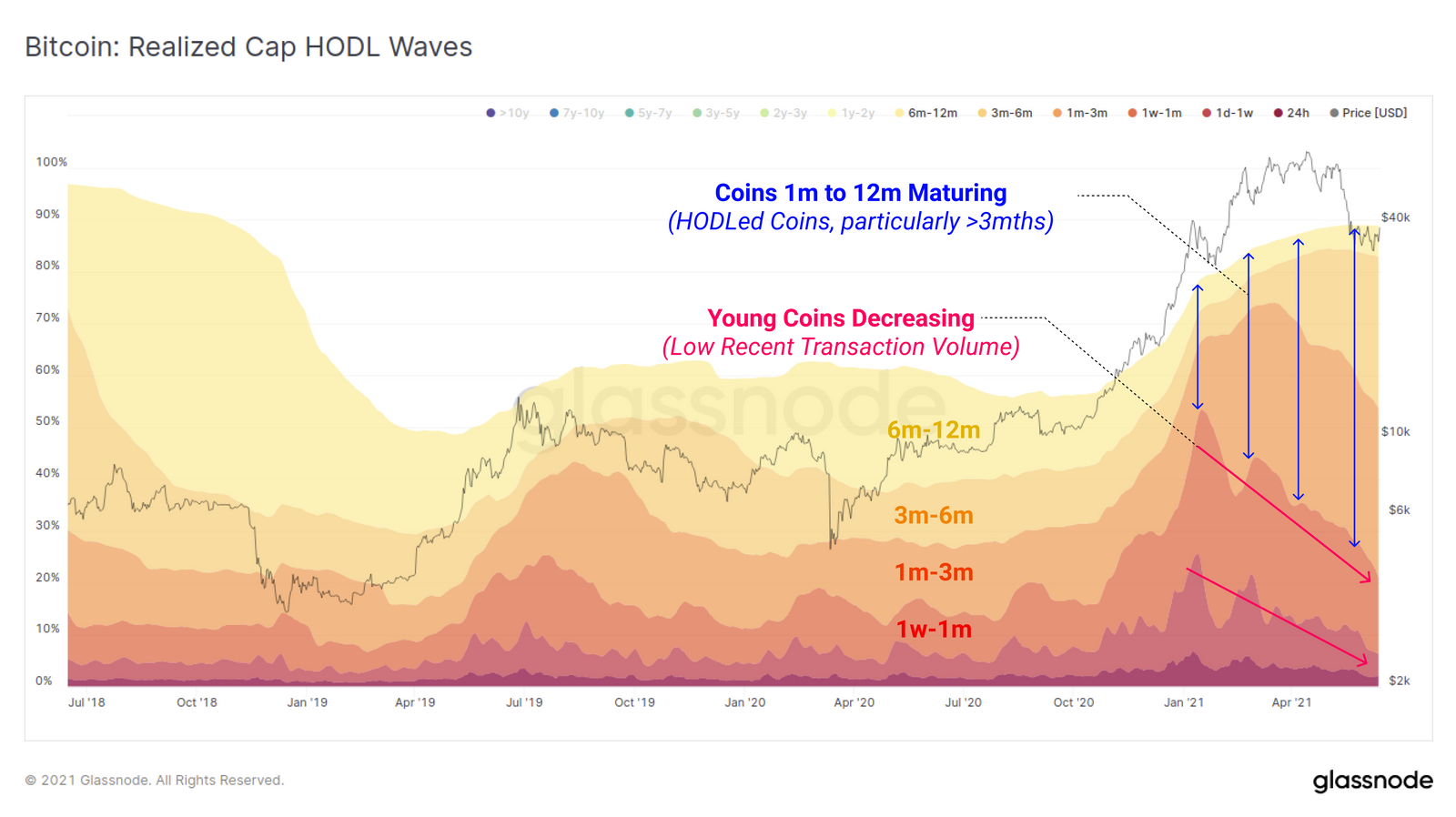

Glassnode means that that is clear by taking a look at so-called HODL Waves, an indicator which reveals what quantity of the Bitcoin provide final moved. These are based mostly on Bitcoin’s realized cap, a measure of market cap which takes under consideration the worth at which every coin final traded.

HODL waves affirm that, partially because of low volatility, the Bitcoin provide is ageing, and few traders are promoting.

“Not solely are we seeing a decline in very younger cash (

“These are those self same HODLed cash that had been accrued all through the 2020 to Jan 2021 bull market.”

As such, even cash now in revenue by a big proportion, if not double their buy-in value, stay dormant.

“Some LTHs (long-term holders) have and can take earnings on their cash,” Glassnode acknowledged.

“What’s frequent in all Bitcoin cycles is that LTHs spend a bigger majority of their cash into the power of bull rallies, and sluggish their spending on pull-backs as conviction returns.”

The “little man” makes a comeback

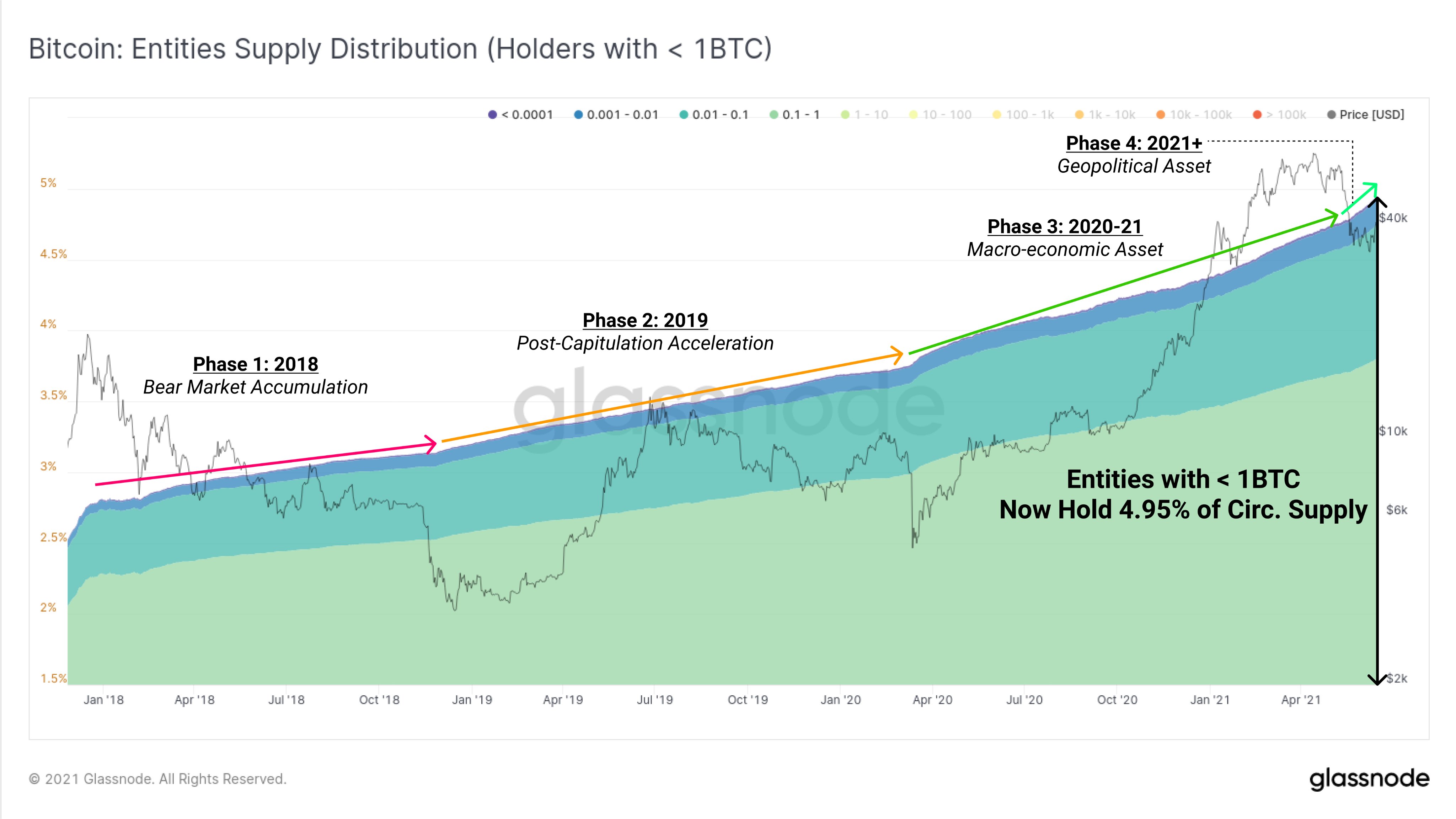

Lengthy or short-term, traders with smaller total holdings are rising.

As Glassnode subsequently famous this week, wallets with lower than 1 BTC proceed to make up increasingly of the general Bitcoin provide.

Associated: Bitcoin value backside is in, says Constancy exec as crypto market exits ‘excessive concern’

“The response of ‘the little man’ to the evolution of Bitcoin as an asset could be seen within the provide distribution,” the corporate posted on Twitter Wednesday.

Whereas institutional and now even state adoption of Bitcoin comprise a lot of the headlines on the subject of increasing affect, it’s particular person small-scale traders who’re making noticeable inroads into the market this yr.

Source link