“I got here of age and studied economics within the Seventies and I bear in mind what that horrible interval was like. . . . Nobody desires to see that occur once more.” — Janet Yellen

Introduction

Inflation has dominated investing conversations in 2021. Many international locations have rebounded strongly from the COVID-19 disaster and are experiencing considerably higher-than-expected inflation. The annual inflation price in the US jumped to five% in Could 2021, the very best degree since August 2008.

Whereas inflation is an evergreen matter for buyers, ever since central banks rolled out their aggressive financial insurance policies in the course of the international monetary disaster, its prominence has grown. Although inflation has been trending downward for the reason that Eighties, all that cash printing has galvanized the inflation hawks. Some have even warned about potential hyperinflation paying homage to that seen within the Weimar Republic of the Twenties.

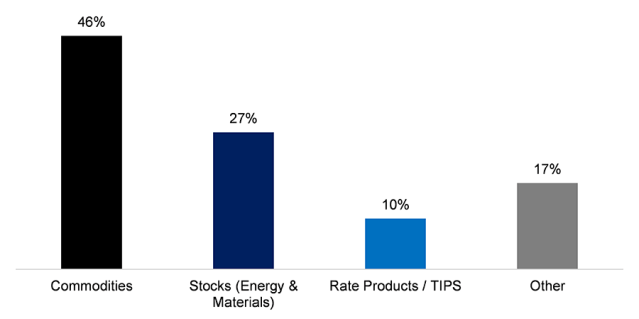

Investor Survey 2021: What Is the Finest Approach to Hedge Inflation?

Whether or not the present larger readings are transitory or structural, how can buyers hedge in opposition to inflation danger? In accordance with a current survey of quantitative buyers at a JPMorgan convention, 47% of respondents consider commodities are the best safety in opposition to inflation, adopted by equities (27%), price merchandise and Treasury inflation-protected securities (TIPS, 10%), and different devices (17%).

The case for commodities like treasured metals is obvious. For equities it’s much less so: Since working companies can enhance their costs at will, the speculation holds, they will mitigate the unfavourable results of excessive inflation by merely elevating their costs together with it.

Does the info assist this argument? Are equities an inflation hedge?

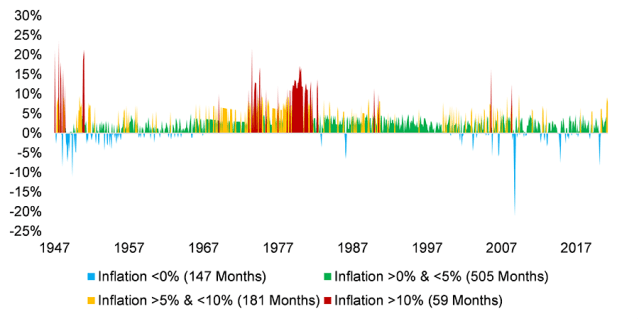

A Look Again at US Inflation

The common annual US inflation price was 3.4% between 1947 and 2021. It solely fell beneath 0% about 15% of the time and solely exceeded 10% simply 7% of the time. For 57% of the time, it stood between 0% and 5% and between 5% and 10% about 20% of the time.

For many buyers in in the present day’s developed markets, their solely expertise of excessive inflation is thru the historical past books. Although it’s continuously mentioned, few merchants have firsthand expertise of the havoc it could wreak on economies and monetary markets.

US Annual Inflation

Fairness Returns in Totally different Inflation Regimes

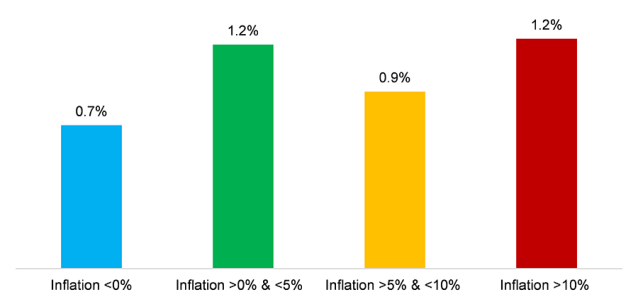

We created 4 inflation regimes for the 1947 to 2021 interval utilizing inflation knowledge from the St. Louis Federal Reserve and inventory market knowledge from the Kenneth R. French Knowledge Library.

Common month-to-month fairness returns had been comparable throughout these completely different environments. The bottom returns occurred in periods of deflation, which often coincide with financial recessions. Nevertheless, inflation above 10% didn’t appear to have a unfavourable affect on inventory market returns.

Month-to-month US Fairness Returns by Inflation Regime, 1947 to 2021

Actual vs. Nominal Returns

In fact, analyzing returns with out correcting for inflation is a straightforward however frequent mistake. A financial savings account with a 2% rate of interest is kind of interesting when inflation is 0%, however not a lot when it’s 3% and implies a unfavourable actual rate of interest.

Contrasting the nominal and actual month-to-month fairness returns within the 4 inflation regimes yields a really completely different perspective. In actual phrases, inflation over 5% sharply diminished returns, whereas inflation above 10% basically made shares unattractive.

Maybe the true return continues to be constructive and due to this fact equities did hedge in opposition to inflation. Nonetheless, shares are risky devices and the common return conceals the dramatic drawdowns that occurred over the 70 years in query.

Actual Month-to-month US Fairness Returns by Inflation Regime, 1947 to 2021

Inflation Losers

So which sectors suffered essentially the most in the course of the larger inflation regimes? Our evaluation of the 30 sectors lined by the Kenneth R. French Knowledge Library discovered that when inflation exceeded 10%, the worst-affected sectors had been those who dealt instantly with customers — client items, autos, retail, and many others. Regardless of their potential to regulate their costs at will, these companies appear to wrestle to cross the will increase to their clients.

A present manifestation of that is the European monetary companies business. Banks have hesitated to impose unfavourable rates of interest on their retail financial savings accounts, however however have charged unfavourable charges on the deposits of asset managers and different institutional clients.

Actual Month-to-month US Fairness Returns: 10 Worst Sectors amid Excessive Inflation, 1947 to 2021

Inflation Winners

The identical sectors didn’t uniformly underperform when inflation hovered between 5% and 10%. Some even generated constructive returns. In distinction, the sectors that almost all benefitted from excessive inflation had been virtually equivalent in the course of the two larger inflation regimes: particularly, vitality and supplies, which buyers usually depend on when positioning fairness portfolios for larger inflation.

Actual Month-to-month US Fairness Returns: 10 Finest Sectors amid Excessive Inflation, 1947 to 2021

Though this affirms the inflation-hedging properties of the same old suspects, there are caveats. The 2 high-inflation regimes occurred principally in the course of the Seventies, when US inflation reached 23.6%. Inflation was influenced by a spike in oil costs as a consequence of an OPEC embargo. The worth of WTI crude jumped from $4 per barrel in 1973 to greater than $10 in 1974, after which rose to $40 in 1980.

Oil worth volatility is probably going right here to remain amid geopolitical unrest and theoretically costs might rise to new highs. However the world is decreasing its dependence on fossil fuels and the US fracking business has helped enhance provide. So whereas the vitality sector has been wager in opposition to inflation traditionally, that development might not persist going ahead.

So what occurs if we strip out the boom-and-bust oil worth cycle and exclude the 1973 to 1986 interval from our evaluation? The identical 10 sectors nonetheless do effectively amid excessive inflation regimes not pushed by oil costs.

Actual Month-to-month US Fairness Returns: 10 Finest Sectors Excluding the Oil Disaster of 1973 to 1986

Additional Ideas

Though some fairness sectors exhibited inflation-hedging traits, this knowledge is of little sensible worth. To be helpful, it could require market-timing abilities. Furthermore, such shares are commodity proxies, so even when buyers might predict inflation, they’d most likely be higher served by holding direct commodity publicity.

And the case for holding commodities is a tenuous one. The Goldman Sachs Commodity Index (GSCI) trades in the present day about the place it did in 1990. Such a place could be insufferable for many buyers. A wager on commodities is a wager in opposition to human progress: It’s most likely a dropping long-term proposition.

A extra fascinating inflation hedge is perhaps to spend money on trend-following, commodities-focused funds, or commodity buying and selling advisors (CTAs). If oil or gold costs rise as a consequence of larger inflation, these funds will soar on the development ultimately. If costs lower amid falling inflation, buyers can quick these asset courses. Naturally, this technique received’t work completely on a regular basis — the final 10 years is a stark reminder of that — however it could be a extra elegant means of hedging in opposition to each inflation and deflation.

For extra insights from Nicolas Rabener and the FactorResearch staff, join their electronic mail e-newsletter.

If you happen to preferred this submit, don’t overlook to subscribe to the Enterprising Investor.

All posts are the opinion of the writer. As such, they shouldn’t be construed as funding recommendation, nor do the opinions expressed essentially mirror the views of CFA Institute or the writer’s employer.

Picture credit score: ©Getty Pictures / Jupiterimages

Skilled Studying for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Members can report credit simply utilizing their on-line PL tracker.

Source link