Quickly after the primary Olympic tie-in campaigns lastly started to point out up in Japan’s primetime tv slots in early summer time, the promoting big Dentsu advised traders to count on an enormous $800m revenue windfall.

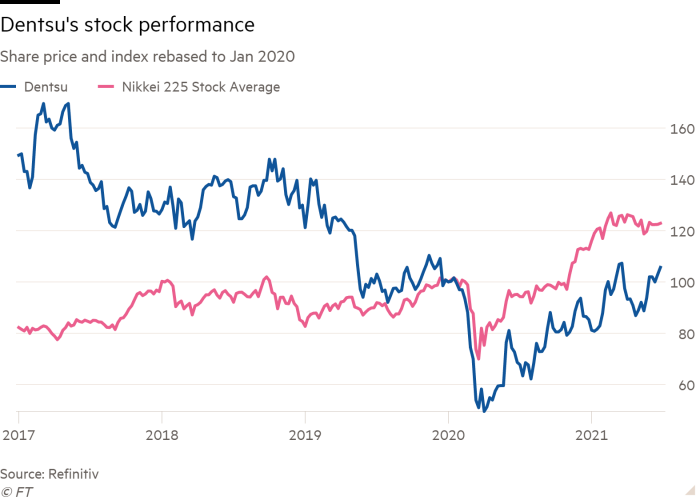

Sadly for the corporate — traditionally thought-about among the many strongest in Japan — the excellent news had nothing to do with its core enterprise, its progress prospects, or the delayed Tokyo 2020 video games through which it has been so centrally concerned.

As an alternative, the earnings got here from the $3bn sale of Dentsu’s headquarters constructing in Tokyo: a 48-storey, teardrop-shaped architectural icon that befits the corporate’s outsized share of Japan’s $55bn promoting market.

The sale of the skyscraper could rank as Japan’s greatest ever single-building transaction, in keeping with analysts, bankers and long-term Dentsu purchasers. However it additionally masks inner torment at an organization whose issues could have lastly outweighed its swagger.

“As with the sale of its headquarters, the corporate is in a part the place it’s shamelessly shrinking its stability sheet to generate money to spend money on future progress,” Citigroup analyst Hiroki Kondo mentioned. “There’s a actual sense of disaster at Dentsu.”

In response to one former Dentsu government, this mighty however conservative group is struggling to adapt to altering instances, to the digital revolution in promoting and to a home market the place it nonetheless has a 28 per cent share however that’s more and more completely different from the one it has dominated for greater than a century.

On the similar time, the Tokyo Olympics, which have been supposed to usher in revenues to purchase the corporate time to deal with its shortcomings, have turn out to be a heavy drag on administration sources.

Sponsors signed up by Dentsu have even introduced in outdoors experience to evaluate the potential injury of constant to belief the corporate with their campaigns and of remaining prominently related to an occasion that consultants warn may produce a medical catastrophe.

“Dentsu is retrenching within the Asia area [as management diverts to the Olympics], and for the final six months it has been dropping each previous purchasers and pitches for brand spanking new enterprise. Purchasers want advertisers to be clear and progressive, and after they have a look at Dentsu, they don’t seem to be seeing that, they see an organization behind the curve,” mentioned one former government.

Dentsu responded that it was “strongly positioned”, noting that its first-quarter abroad media promoting charges doubled from a yr earlier on account of increasing charges from present purchasers and buying new ones.

Earlier than the pandemic and earlier than the postponement of the Olympics, Dentsu’s issues appeared critical, however extra solvable. In 2016, the corporate was caught overcharging purchasers, together with Toyota, for internet marketing. Later that yr, the suicide of a graduate recruit was formally designated as “dying by overwork” and compelled the resignation of the corporate’s president.

French investigators have, for six years, been probing the background of Tokyo’s profitable bid to host the Olympics in 2020. Their allegations embrace that sizeable funds have been funnelled from the bid committee to individuals deemed capable of sway the end result of the vote by means of firms and people that had historic contacts with Dentsu. One former senior Dentsu government, who denied improper behaviour, advised Reuters he distributed items and helped safe the help of a former Olympics powerbroker suspected by French prosecutors of taking bribes. Dentsu has denied any involvement within the issues topic to the French probe.

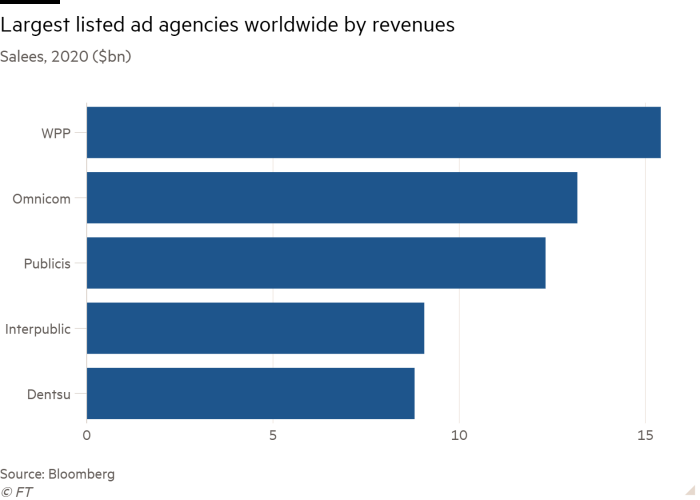

However the Olympics have been additionally a important revenue supply for the world’s fifth largest promoting company and a logo of its persevering with dominance at residence. Dentsu was introduced in quickly after Tokyo gained the Olympic bid and was capable of discuss greater than 40 Japanese firms into turning into sponsors and performing a “nationwide responsibility” by doing so. The end result was essentially the most closely sponsored occasion in historical past, a report $3.1bn financed largely by Japanese firms paying, in some circumstances, $100m every.

However whereas that was helpful to Dentsu, the actual prize would have come within the run-up to and in the course of the video games, within the type of campaigns run by the assorted sponsors and what ought to have been frenzied competitors for one of the best TV promoting slots, most of which Dentsu controls. Citigroup analysts estimated all this may have contributed about ¥10bn ($90m), or 9 per cent, to the group’s annual working earnings.

However that rosy situation has now pale, as company sponsors have held again from Olympic TV adverts fearing reputational injury from affiliation with an occasion that faces public opposition.

“The actual hazard is after all in what notion the Olympics will get — in the intervening time there may be an concept that it may possibly occur with no catastrophe, however the dangers are extraordinarily excessive,” an organization near Dentsu mentioned.

If the Olympics ends with no spike in Covid-19 infections, Dentsu could possibly recoup some revenues by means of adverts capturing post-games euphoria. However even then, Kondo estimates that the corporate will at greatest generate no achieve from an occasion that it has a four-decade relationship with and {that a} former government says is a part of the corporate’s “raison d’être”.

Analysts and business executives say the longer-term fallout may very well be that Dentsu is compelled to fix ties with firms disgruntled by the meagre advertising advantages of their Olympic sponsorship by providing reductions on promoting slots.

“That’s going to harm Dentsu fairly a bit, as a result of they’d been banking on all of the campaigns and the TV promoting that was going to come back out of the Olympics — not the unique sponsorship offers however all of the work these offers would in the end assure them,” the particular person near Dentsu mentioned.

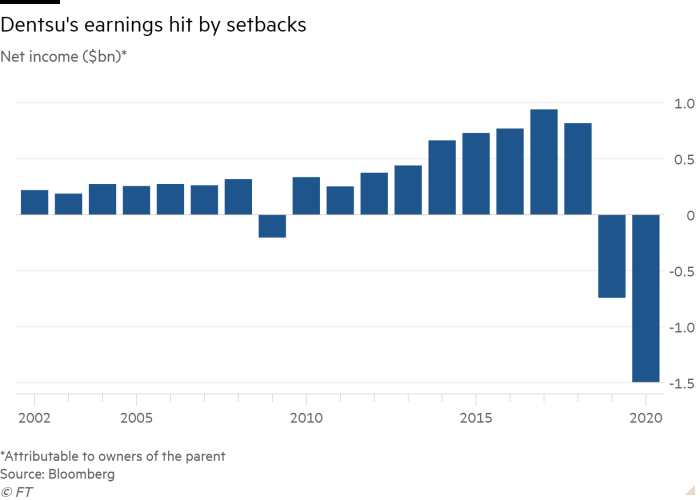

The video games apart, the pandemic has additionally induced massive issues. The downturn in world promoting spending resulted in a big writedown in goodwill from its £3.2bn takeover of the UK’s Aegis in 2013 and the frantic shopping for of almost 200 companies since then, which resulted in a report lack of $1.4bn final yr.

“There was a spree of acquisitions by Dentsu . . . The issue was that they couldn’t combine them,” the previous Dentsu government mentioned.

The group can be aggressively slicing prices, notably in Japan, to attempt to make itself nimbler and a greater match for the digital period. Whereas it now generates greater than half of its gross earnings from digital adverts and associated consulting companies, business executives say its dominance in conventional media resulted in a slower digital transition in contrast with non-Japanese rivals.

The sale of the headquarters, mentioned individuals conversant in particulars of the deal, is an indication of the turmoil on the prime.

Potential patrons mentioned they’d rapidly determined towards it, partly as a result of making area for brand spanking new tenants could be expensive because the constructing was tailored for Dentsu.

One part of Dentsu administration held discussions with a monetary group that was not the corporate’s major financial institution over promoting the constructing to Japanese actual property group Kenedix, in keeping with individuals conversant in the deal.

A second group moved to dam that, inviting one other home property big Hulic to bid. Hulic was profitable, mentioned individuals conversant in the deal, largely as a result of it was supplied low cost financing by Dentsu’s major financial institution Mizuho.

The corporate declined to touch upon the constructing’s purchaser however mentioned the sale was a part of its years-long effort to implement distant work and different versatile work practises, not a results of its monetary efficiency.

Dentsu executives say they are going to use the newly acquired money from asset gross sales for acquisitions, however analysts stay sceptical of the corporate’s progress potential each at residence and abroad past the instant enhance in revenue margins from the price cuts.

“We predict restructuring may have a unfavourable impression close to time period, together with decrease new undertaking acquisition, and count on it’ll take time for these initiatives to contribute to top-line progress,” JPMorgan analyst Haruka Mori mentioned.

Source link

![What is Brand Salience? [+How Do You Measure It?]](../hubfs/brand-salience.jpg)

![How to Write the Perfect Email to Apply for an Unlisted Role [Infographic]](../hubfs/woman applying for unlisted job.jpg)