Bitcoin (BTC) value soared to a 3 month excessive at $46,293 after bulls confirmed that they intend to take full management of the market. Whereas crypto merchants may be within the inexperienced once more and professional merchants want to add bigger leveraged positions, no each class of traders to acquire direct publicity to Bitcoin.

For institutional traders, a fund administrator units the principles for what share of the portfolio is invested in varied asset courses and completely different corporations have various appetites for threat. Causes traders could also be piling into these property versus merely holding BTC embody the aforementioned restrictions and the regulatory uncertainty surrounding the acquisition of Bitcoin immediately.

Due to this, quite a lot of entities are restricted from investing immediately in Bitcoin and different cryptocurrencies however there are different methods to acquire publicity to the crypto sector.

Corporations focusing on Bitcoin mining have additionally generated immense earnings and a handful are listed and may be an off-set play for traders seeking to acquire some publicity to BTC of their inventory portfolios.

The latest miner crackdown in China has led to a extra distributed mining community and prompted a number of rounds of fundraising and enlargement for listed Bitcoin mining corporations that would doubtlessly profit from the reshaping of Bitcoin’s world mining community that’s prone to proceed for years to come back. Here is a couple of listed corporations that supply traders publicity to Bitcoin.

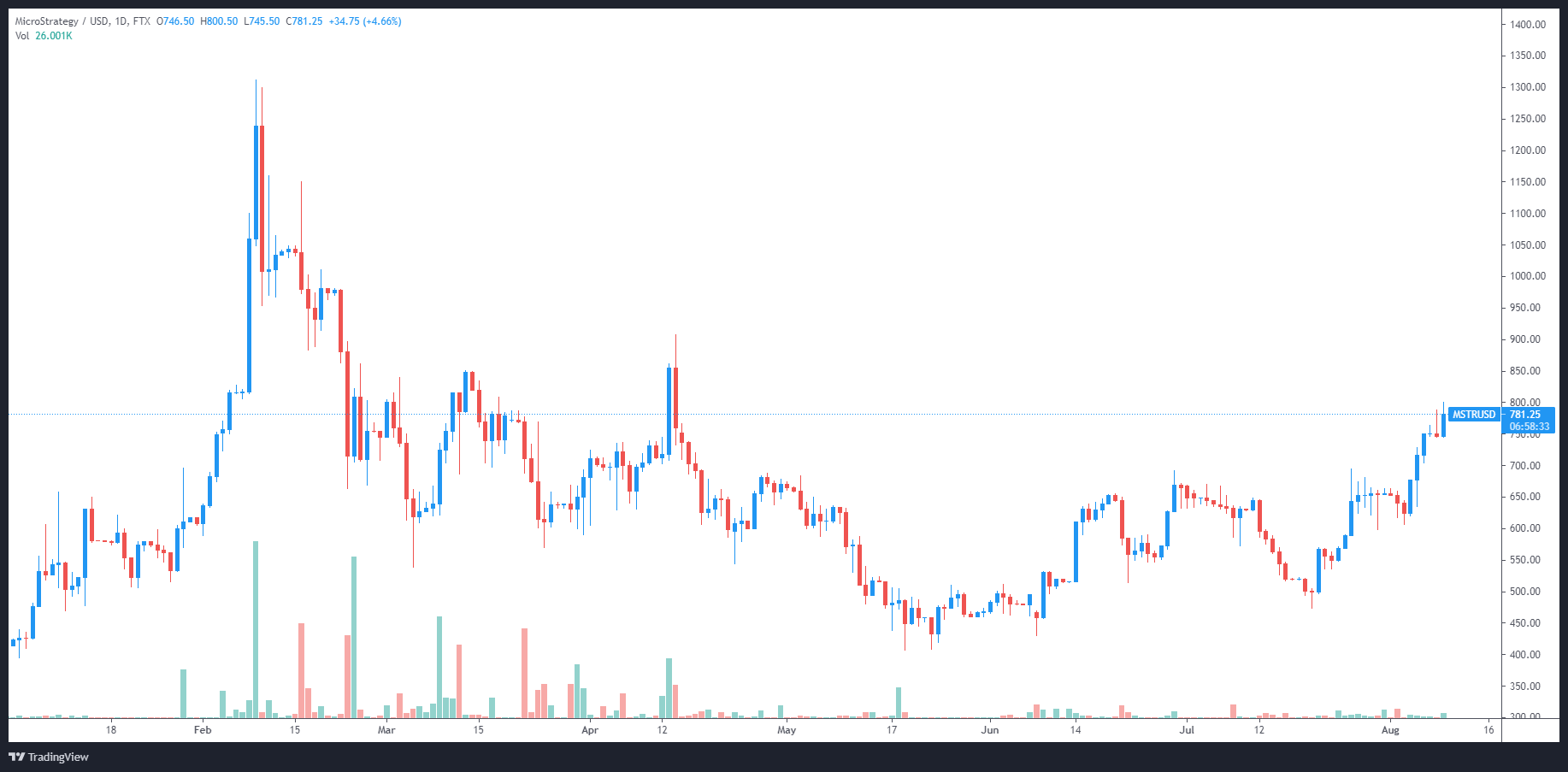

MicroStrategy’s guess on Bitcoin supplies a lift

The software program firm MicroStrategy (MSTR) and its CEO Michael Saylor have grow to be well-known throughout the cryptocurrency sector for his wild help for Bitcoin as a retailer of worth and the huge quantity of BTC the corporate bought within the final 12 months.

Together with serving to educate the world in regards to the promise of Bitcoin and blockchain know-how, MicroStrategy has amassed a Bitcoin portfolio in extra of 105,000 BTC in its treasury as a option to hedge towards inflation.

In consequence, MicroStrategy’s inventory value has grow to be considerably correlated with the worth efficiency of BTC and it has been noticed transferring in tandem with the highest cryptocurrency.

As seen within the chart above, the worth of MSTR reached a low of $474 on July 20, the identical day because the low in Bitcoin, and has since elevated 65% to commerce at $781.

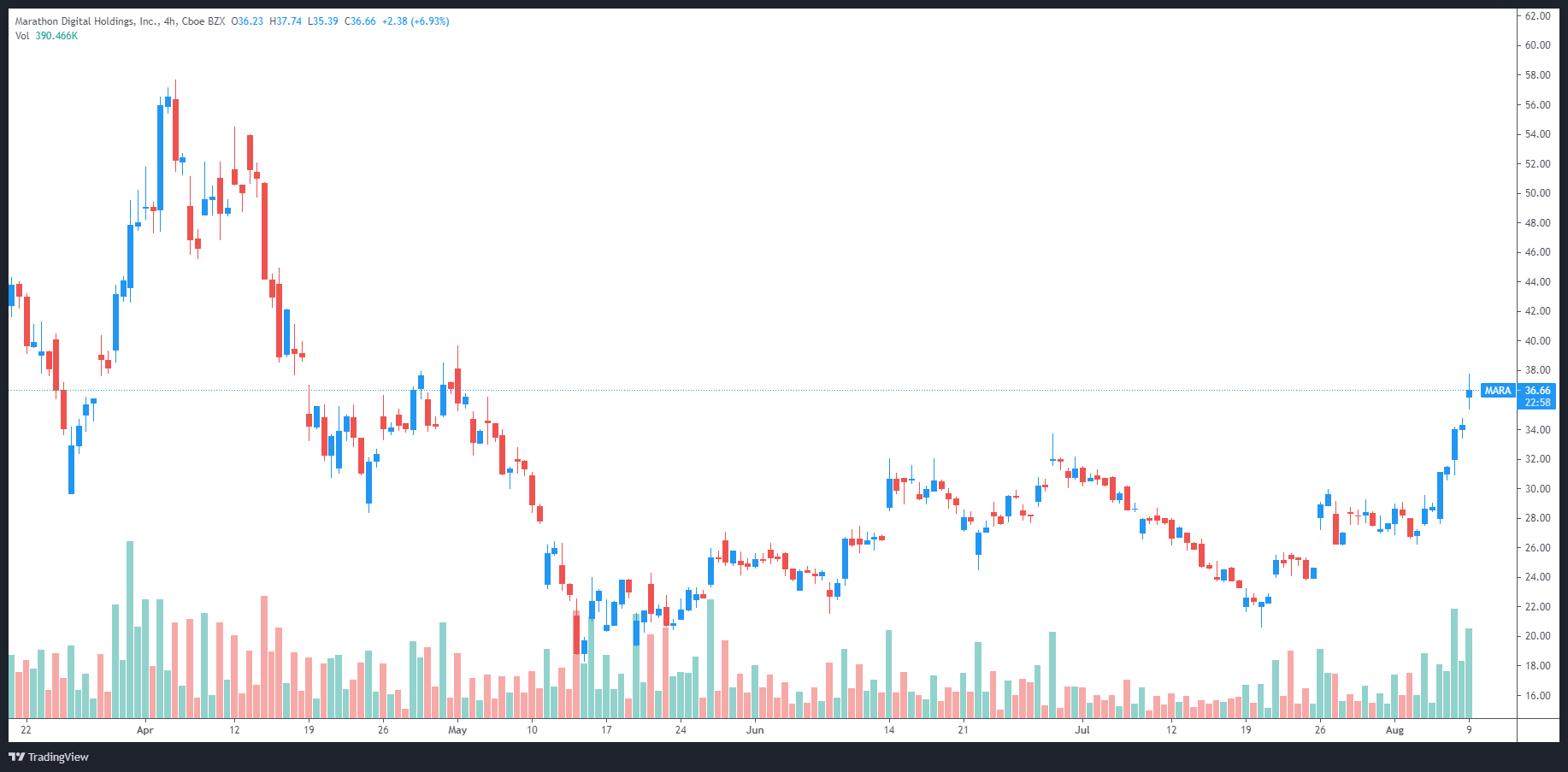

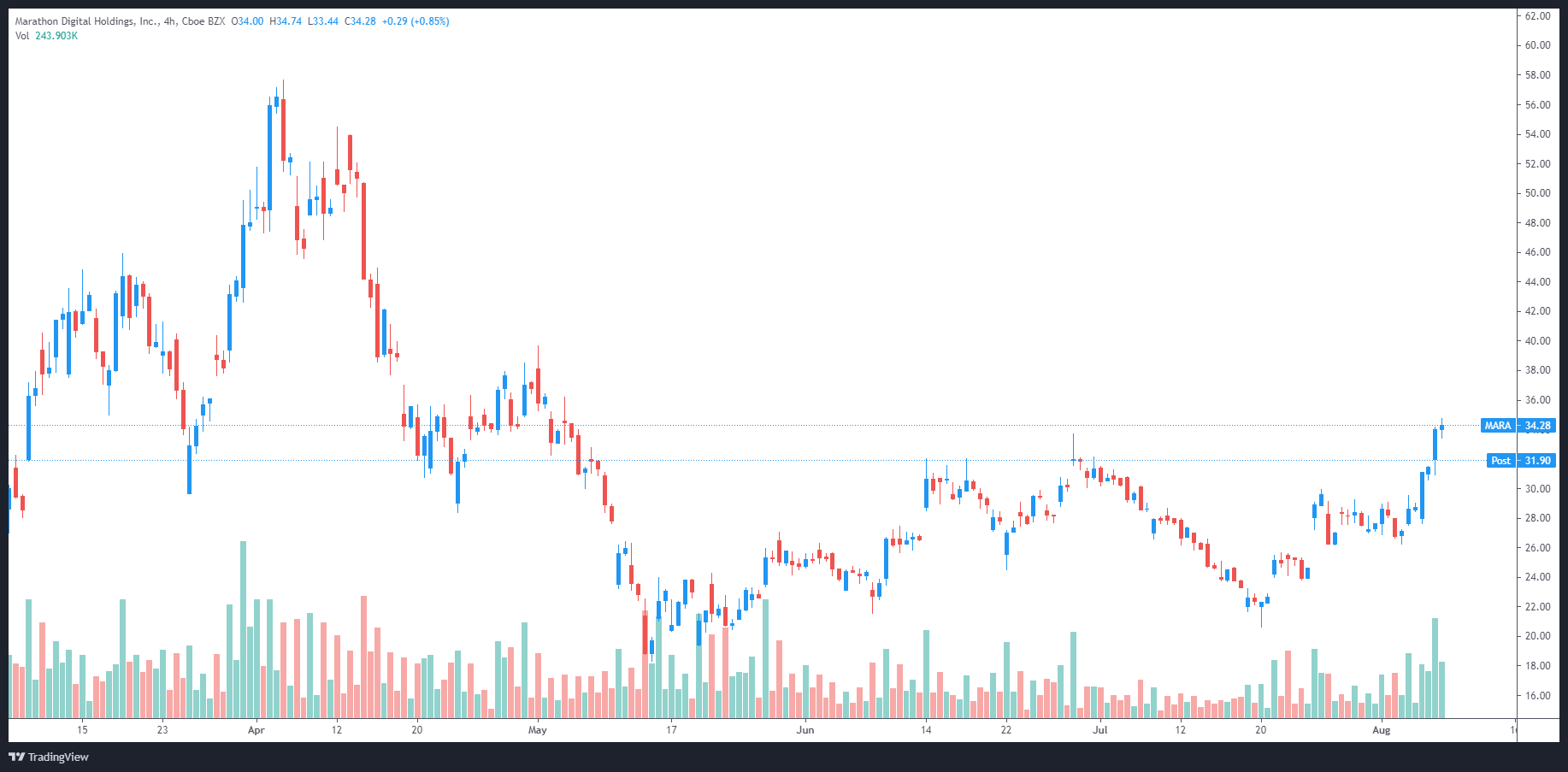

Bitcoin mining shares soar

Listed corporations focusing on Bitcoin and cryptocurrency mining have additionally benefited from the worth development in BTC.

Maybe probably the most well-known Bitcoin mining agency is Riot Blockchain, an organization that operates warehouses stuffed with ASIC miners to assist course of transactions on the community in return for BTC rewards.

Since hitting a low at $23.86 on July 20, the worth of RIOT has elevated by 66% and reached an intraday excessive at $39.94 on Aug. 9.

Associated: COIN value fails to impress as extra crypto companies are desperate to go public

One other firm that focuses on Bitcoin mining in addition to buying BTC with its treasury holdings is Marathon Digital Holdings (MARA).

Information from TradingView reveals that after reaching a low of $20.52 on July 20, the worth of MARA has rallied 83% to an intraday excessive of $37.77 on Aug. 6, making MARA the top-performing Bitcoin mining inventory over the previous two weeks.

The views and opinions expressed listed here are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes threat, it is best to conduct your individual analysis when making a call.

Source link