Revealed on April twenty eighth, 2021 by Nikolaos Sismanis

Based by Lee Ainslie in 1993, Maverick Capital is a Texas-based lengthy/brief fairness hedge fund. The fund’s humble beginnings have been powered by Mr. Ainslie, elevating $38 million in capital by the household of Texas tech-entrepreneur Sam Wyly. Ever since, Maverick has grown into one of many largest hedge funds within the state, holding greater than $6.2 billion in complete Property Below Administration (AUM).

Traders following the corporate’s 13F filings over the past 3 years (from mid-February 2018 by means of mid-February 2021) would have generated annualized complete returns of 14.80%. For comparability, the S&P 500 ETF (SPY) generated annualized complete returns of 15.50% over the identical time interval.

Observe: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

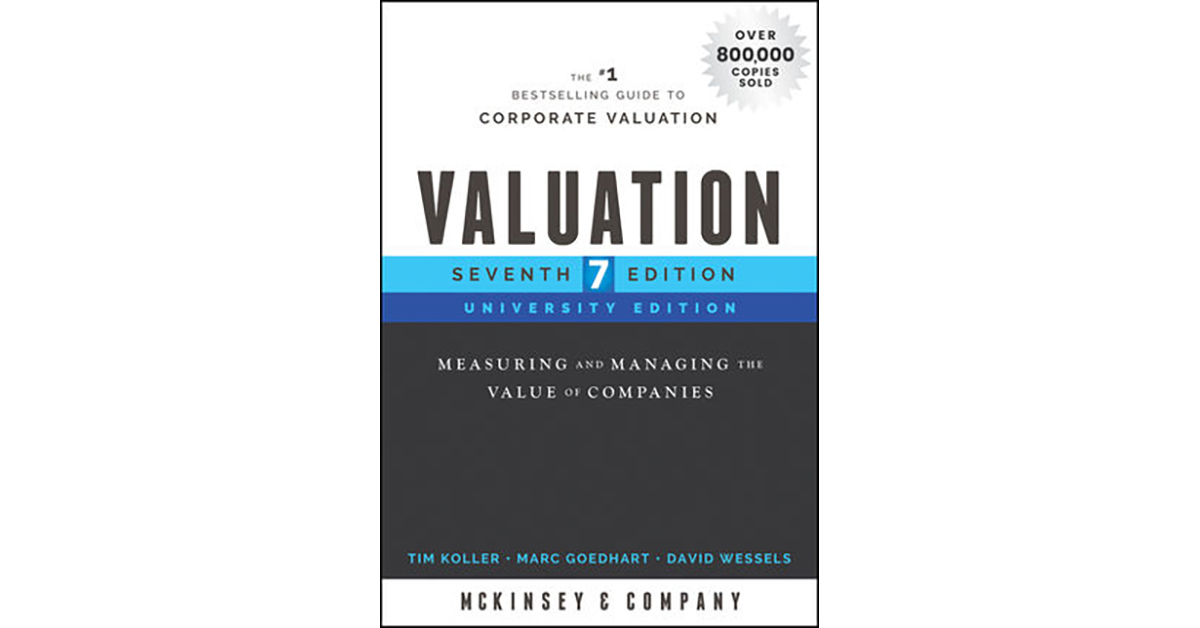

You’ll be able to obtain an Excel spreadsheet with metrics that matter of Maverick Capital present 13F fairness holdings under:

Hold studying this text to study extra about Maverick Capital.

Desk Of Contents

Maverick Capital’s Investing Technique & Philosophy

Just like numerous hedge funds that we’ve coated over time, Maverick Capital shares little to no info relating to its operations. Nevertheless, in a 2006 interview, Mr. Ainslie shared fairly a little bit of perception into how the fund conducts its enterprise. Contemplating that these are some basic ideas, it’s greater than probably that they continue to be true to this present day.

As he goes on to elucidate, Maverick’s analysts are initially making an attempt to grasp an organization’s enterprise mannequin and whether or not its progress and return on capital are sustainable over the long run. The fund’s purpose is to gather and act on high-quality info that the remainder of the market lacks.

Maverick’s sector-specialists have a long time of expertise within the trade, which has helped them develop long-term relationships with numerous senior administration and staff, giving Maverick that further attain from its competitors.

One of many fund’s core catalysts for allocating capital in an organization is belief in its administration. As Mr. Ainslie explains, wonderful administration is what issues essentially the most and might typically justify shopping for equities at a seemingly excessive valuation.

By way of holding interval, Maverick normally intends to carry its stakes from round 1 to three years, although this will simply change primarily based on an organization’s ongoing efficiency.

Maverick Capital’s Portfolio & 10 Most Important Holdings

Maverick’s portfolio is extremely various, holding over 600 particular person equities. Plainly its capital allocation targeted on making a extremely risk-adjusted portfolio, with a number of sector hedges and a statistics-intensive decision-making course of.

On the similar time, nevertheless, the corporate’s 10 most important holdings account for practically 50% of its complete portfolio, which indicators robust and clear confidence on the subject of the fund’s high-conviction picks.

Supply: 13F Filings, Creator

In the course of the quarter, Maverick initiated a place within the following shares:

New Buys:

- Seer, Inc. (SEER)

- MGM Resorts Worldwide, Inc. (MGM)

- ProLogis, Inc. (PLD)

- Chart Industries Inc (GTLS)

- Wynn Resorts Ltd (WYNN)

- Put in Constructing Merchandise Inc (IBP)

- SQZ Biotechnologies Co (SQZ)

- DoorDash, Inc. (DASH)

By way of its sector publicity, Maverick holds vital Communications and Expertise positions, following COVID-19’s staying-at-home-economy development whereas avoiding extra unstable sectors like Industrials and Vitality.

Supply: 13F Filings, Creator

The fund’s 10 most important holdings are as follows:

Fb (FB)

The social media big is Maverick’s largest holding, accounting for 7.0% of its portfolio, with the corporate mountain climbing its place by 19% in comparison with its earlier quarter. The fund’s long-term dedication to Fb dates again to Q1 2015. Since then, Maverick has constructed its place regularly, displaying nice dedication to the corporate’s funding case. The corporate is likely one of the most moderately valued within the tech/communications sector whereas nonetheless rising quickly, regardless of practically 2.8 billion folks utilizing its providers month-to-month.

Fb is presently having fun with wonderful financials, with a web money place of $62 billion (7% of the market capitalization of the inventory). Fb is likely one of the extraordinarily few firms that don’t have any debt. It is a testomony to the energy of its enterprise mannequin and its excellent execution.

Furthermore, regardless that half of the globe makes use of at the least one of many apps of Fb on a month-to-month foundation, its consumer base remains to be rising at double-digit charges. Fb delivered an all-time excessive high & backside line of $28.07 billion and $11.2 billion, respectively.

For these causes, it might not be an entire shock if Fb paid a dividend in some unspecified time in the future sooner or later.

Fb stays one of the crucial cheaply valued progress shares on the market, nonetheless retaining 20%+ income progress, however buying and selling at a ahead P/E of simply 26.9.

Utilized Supplies, Inc. (AMAT)

Utilized Supplies rose the fund’s second-largest place very immediately after the fairness stake was elevated by 158% through the quarter. The corporate has been capitalizing on the rising demand for semiconductors, seeing regular progress over the previous few years. Administration has been rewarding shareholders primarily by means of inventory buybacks, having repurchased round 45% of AMAT’s complete shares excellent over the previous 15 years. As a supplementary return, the corporate pays a miniature dividend, presently yield underneath 1%.

Whereas a top quality firm, AMAT’s ahead P/E has expanded significantly these days, within the low 20s. Contemplating the cyclical nature of semiconductors, the inventory might is probably going barely costly at its present ranges.

The inventory accounts for five.8% of Maverick’s portfolio.

Microsoft (MSFT):

Microsoft’s diversified portfolio of tech services has dominated the tech sector’s digital infrastructure. The corporate’s CEO Satya Nadella has reworked the corporate right into a cloud powerhouse. Consequently, Microsoft has managed to speed up its progress and publish all-time excessive earnings within the final two years.

Microsoft is now a mega-cap inventory with a market capitalization of $1.9 trillion.

Supported by the corporate’s robust profitability, administration has been persistently elevating buybacks over the previous decade, to additional reward its shareholders. The quantity allotted to inventory repurchases has reached new all-time highs over the previous 4 quarters, at practically $26.1B.

Income progress stays within the double-digits, so it’s prone to see capital returns accelerating shifting ahead. The corporate can be rising the dividend at a double-digit fee, although on the present yield which stands under 1%, buyers ought to anticipate nearly all of their future returns within the type of capital beneficial properties.

Regardless of that, Microsoft’s money place has been rising regularly, with the corporate presently sitting on high of an enormous $153.28 billion money pile.

Additional, whereas many firms have chosen to make the most of the present ultra-low rates of interest to boost low cost debt and purchase again inventory, Microsoft’s strategy has been prudent and considerate. Not solely are present earnings extensively masking buybacks (59% buyback “payout ratio”), however long-term debt has been considerably decreased from $76 billion in mid-2017 to round $55 billion as of its final report.

Maverick elevated its place by 19% through the quarter. It now accounts for five.5% of its complete holdings.

DuPont de Nemours, Inc. (DD)

DuPont de Nemours, Inc. gives technology-based supplies, elements, and options for each trade possible that makes use of specialty chemical substances. The corporate comes from the unique DowDupont, which was cut up into 3 separate firms specializing in agriculture (Corteva), supplies science (Dow Inc.), and specialty merchandise (DuPont). The large income decline recorded this previous yr was attributed to the enterprise splitting. The inventory presently trades at a quite wealthy a number of, because the market stays fairly optimistic on the subject of the corporate’s short-term progress.

Maverick trimmed its place by 19%, prone to scale back publicity in what could possibly be thought-about an arguably overvalued inventory within the Industrials sector. Nonetheless, its stake accounts for five.4% of its complete holdings. With a mean buy value of round $96, the fund has probably misplaced cash on the inventory, on combination.

Lam Analysis Company (LRCX)

Semiconductor big Lam Analysis was not materially affected by the continued pandemic, displaying resilient money flows in its previous quarters as demand for electronics remained sky-high.

Regardless of Maverick’s large stake improve taking place solely lately, the fund has been holding shares since 2016. It has a mean buying value of round $324, making Lam Analysis one in every of its most worthwhile picks as of these days. Shares are presently buying and selling in any respect highs, with a ahead P/E of round 23.6, which is a comparatively dear valuation a number of for the sector. Therefore, buyers needs to be cautious about shopping for on the inventory’s present ranges. Like Utilized Supplies, administration has been rewarding shareholders primarily by means of inventory buybacks and a tiny dividend.

Lam Analysis accounts for five.3% of Maverick’s portfolio and is its fifth-largest place.

Alphabet (GOOGL)(GOOG)

Alphabet provides a number of well-known merchandise, akin to Advertisements, Android, Chrome, Google Cloud, Google Maps, Google Play, YouTube, in addition to technical infrastructure. Whereas the corporate’s enlargement has lasted for greater than a decade and a half, it’s nonetheless a high-growth inventory. The corporate’s most up-to-date quarter was as soon as once more a blockbuster, with each their quarterly revenues and web revenue hitting an all-time excessive of $56.9 billion and $15.2 billion, respectively.

The three-year income CAGR (compound annual progress fee) presently stands at a formidable 18%, regardless of the deceleration precipitated through the first couple of quarters through the preliminary pandemic outbreak. The corporate is likely one of the most attractively priced shares within the sector as effectively, buying and selling at round 31 instances its ahead earnings, regardless of its constant progress, large moat, and powerful steadiness sheet.

With its sturdy profitability, Alphabet has gathered a money and equivalents place of $136 billion. Consequently, the corporate can comfortably afford to deplete money for its long-term bets, akin to Waymo, and within the meantime return ample {dollars} again to its shareholders. Alphabet has repurchased practically $32 billion value of inventory over the previous yr, retiring shares at an all-time excessive fee.

Maverick elevated its place by 7% through the quarter. The inventory accounts for round 4.8% of its portfolio.

FLEETCOR Applied sciences, Inc. (FLT)

FLEETCOR gives digital fee options for companies to handle purchases and make funds. The corporate gives company funds options, akin to accounts payable automation, digital playing cards, worker expense administration options, and so on. FLEETCOR’s revenues have but to totally recuperate from the affect of the continued pandemic, which is probably going attributable to the competitors skyrocketing through the previous yr.

Just like a lot of Maverick’s holdings whose administration groups give attention to inventory buybacks as the first technique of capital returns, FLEETCOR makes use of any extra money it generates in the direction of repurchasing its personal inventory.

As a result of competitors dangers and lack of enough progress, the inventory’s valuation is kind of cheap in comparison with its trade friends, which can clarify why Maverick elevated its place in FLEETCOR by 78%. It’s now the fund’s seventh-largest holding, accounting for round 3.9% of its portfolio.

Alibaba Group Holdings (BABA):

Maverick has held its place in Alibaba since Q3-2017, presently occupying round 3.9% of its complete holdings. The corporate lately reported its This autumn outcomes, smashing estimates by delivering revenues of $33.88 billion, a 37.0% progress year-over-year.

Whereas Alibaba stays a extremely worthwhile firm, displaying web revenue margins that usually surpass the 30%+ ranges, its shares have been lately lagging as a result of ongoing considerations surrounding Chinese language equities.

The current incident of Jack Ma’s extended and mysterious disappearance is an unacceptable occasion for one of many largest publicly traded firms on the earth, whereas the Chinese language authorities’s involvement in steering the corporate’s path has additionally been elevating questions amongst buyers. The inventory is presently buying and selling at round 20.5 instances its ahead web revenue, to mirror these dangers.

With Alibaba specializing in reinvesting all its earnings in the direction of rising, buyers mustn’t anticipate an Alibaba dividend within the close to future.

The fund elevated its place in Alibaba by 15% quarter-over-quarter.

GameStop Corp. (GME)

Maverick initially bought its GameStop place in Q1-2020. As of its newest submitting, it hiked its fairness stake by 164%, which now accounts for 3.6% of its portfolio. We imagine essentially the most possible purpose for Maverick so as to add to its GameStop is to wager on the potential of the hype surrounding the inventory. The fund has little to lose because it includes a phenomenal common buying value of $15.5.

1Life Healthcare, Inc. (ONEM)

1Life Healthcare is a membership-based primary care platform working underneath the One Medical model. The corporate has created a healthcare membership enterprise mannequin primarily based on direct shopper enrollment, in addition to employer sponsorship. As of its newest report, 1Life had practically 550,000 members in 13 markets in america in addition to 8,000 enterprise purchasers.

Maverick initiated its place again in Q1-2020, across the firm’s IPO. Revenues have been rising persistently amid the recurring nature of its enterprise mannequin, although the corporate stays unprofitable.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

Source link