Worth motion for Bitcoin (BTC) and the broader cryptocurrency market was comparatively subdued on Might 27 as nervous merchants stay not sure of what comes subsequent following final week’s market plunge that noticed leveraged merchants worn out as BTC dipped as little as $30,000 earlier than its value rebounded.

Information from Cointelegraph Markets Professional and TradingView exhibits that whereas Bitcoin’s value has managed to place in increased highs and better lows over the previous week, bulls proceed to face stiff resistance at any significant try to interrupt above $40,000 as bears defend the psychologically necessary stage.

For a lot of merchants, the latest correction doubtless triggered PTSD-like flashbacks of the market crash of 2017 and 2018 and the following two-year crypto winter, and this might be a motive why the market appears indecisive in the intervening time.

Provided that many merchants are not sure of what may come subsequent for Bitcoin’s value, it is sensible to contemplate the varied bullish and bearish eventualities that might play out and to additionally take inventory of the opinions of analysts within the sector.

Merchants stay cautious after the latest sell-off

Based on David Lifchitz, managing accomplice and chief funding officer at ExoAlpha, it is necessary to look carefully on the latest market occasions and evaluate the catalysts that created the present state of affairs.

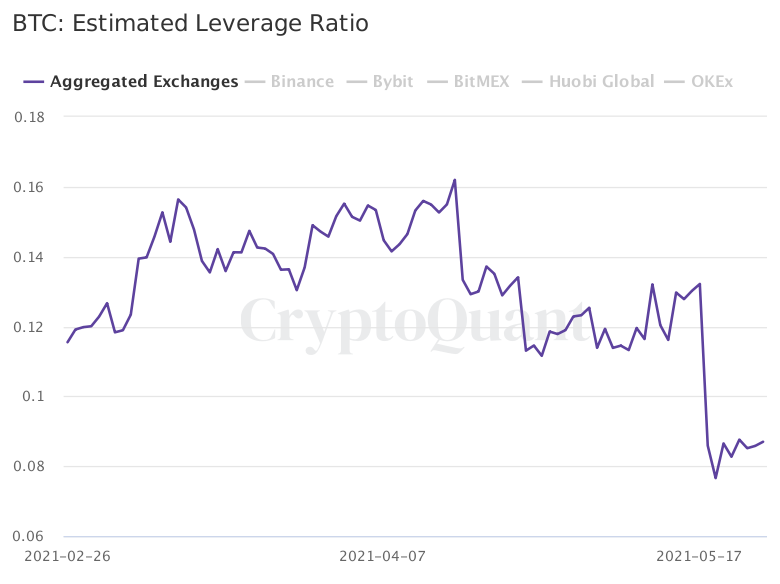

Lifchitz instructed Cointelegraph that following an “nearly uninterrupted bull run from $10,000 in October 2020 to an all-time excessive for BTC at $65,000 in mid-April 2021,” the market noticed a number of waves of profit-taking forward of the “nice deleveraging of 2021,” which noticed the worth of BTC fall by 54% to $30,000, whereas Ether (ETH) and altcoins had been hit even more durable.

Based on Lifchitz, the correction succeeded in “drastically decreasing the quantity of leverage that prevailed within the ecosystem,” which might be seen as a wholesome improvement for the general market, as it’s going to assist “to construct on a extra steady base.”

Lifchitz cautioned that whereas knowledge exhibits that some early dip-buyers managed to select up tokens close to the lows, each volumes and futures open curiosity have remained weak, “displaying no urgency to reload.”

The month-to-month choices expiration for Bitcoin and Ether are lower than 24 hours away, and Lifchitz believes they’re standing in the best way of “any significant transfer within the very quick time period.” He additionally prompt that will probably be “troublesome to persuade burned buyers to get again within the recreation simply now” as a consequence of an absence of upside catalyst and the latest reminder that “costs don’t at all times go up.”

This has put the market in a “wait-and-see part,” in keeping with Lifchitz, with each development followers and contrarian buyers needing “to see some movement, both up or down” earlier than they interact out there.

Lifchitz mentioned:

“The market positively wants a catalyst, both upward or downward to maneuver forward. A too lengthy interval with none catalyst may result in buyers fatigue who may resolve to money out and search different pastures, which might act as gravity on cryptos triggering a downward transfer. The subsequent few days/weeks will likely be very telling of what to anticipate subsequent.”

Bullish indicators abound

Whereas the common crypto dealer is presently in a state of stasis and awaiting the subsequent main market transfer to sign what BTC may do subsequent, on-chain knowledge signifies bullish strikes from bigger gamers who took full benefit of the latest dip by shopping for.

Based on Micah Spruill, managing accomplice and chief funding officer at S2F Capital, many of the promoting that was seen on the latest lows “has been from newer entrants to the market” who’ve “been promoting at a loss and appear to be exhausted at this level.”

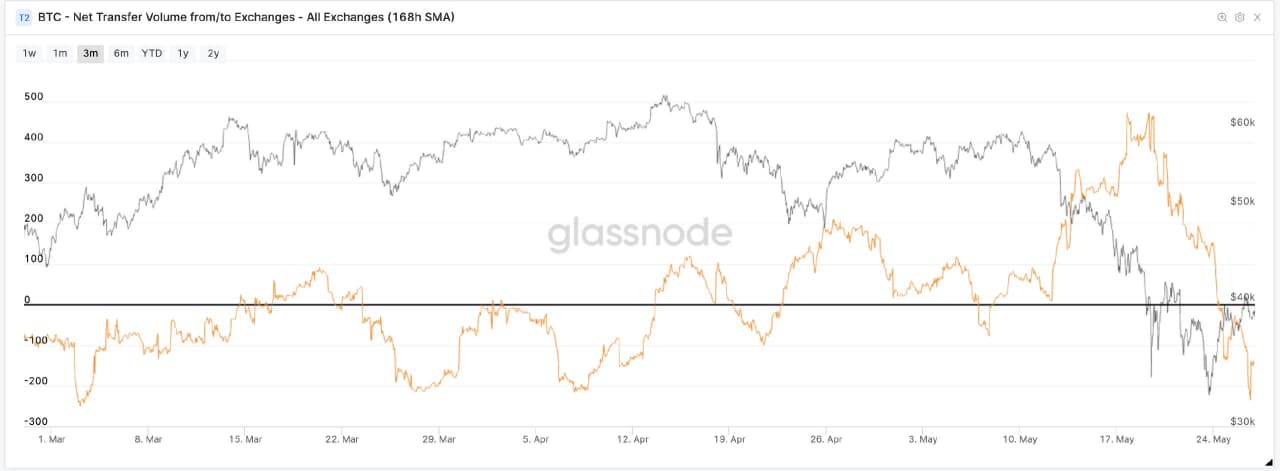

In a dialog with Cointelegraph, Spruill pointed to BTC web switch quantity, which exhibits that following the bearish downturn between Might 17 and 20, “Huge quantities of USDC and USDT have been despatched to exchanges (to purchase BTC, ETH, and so on.) and pull them off to long run storage.”

Additional evaluation exhibits that retail wallets holding between 0.1 and 1 BTC, in addition to whale wallets holding between 1,000 and 10,000 BTC, have been accumulating at these ranges in preparation for an general transfer increased.

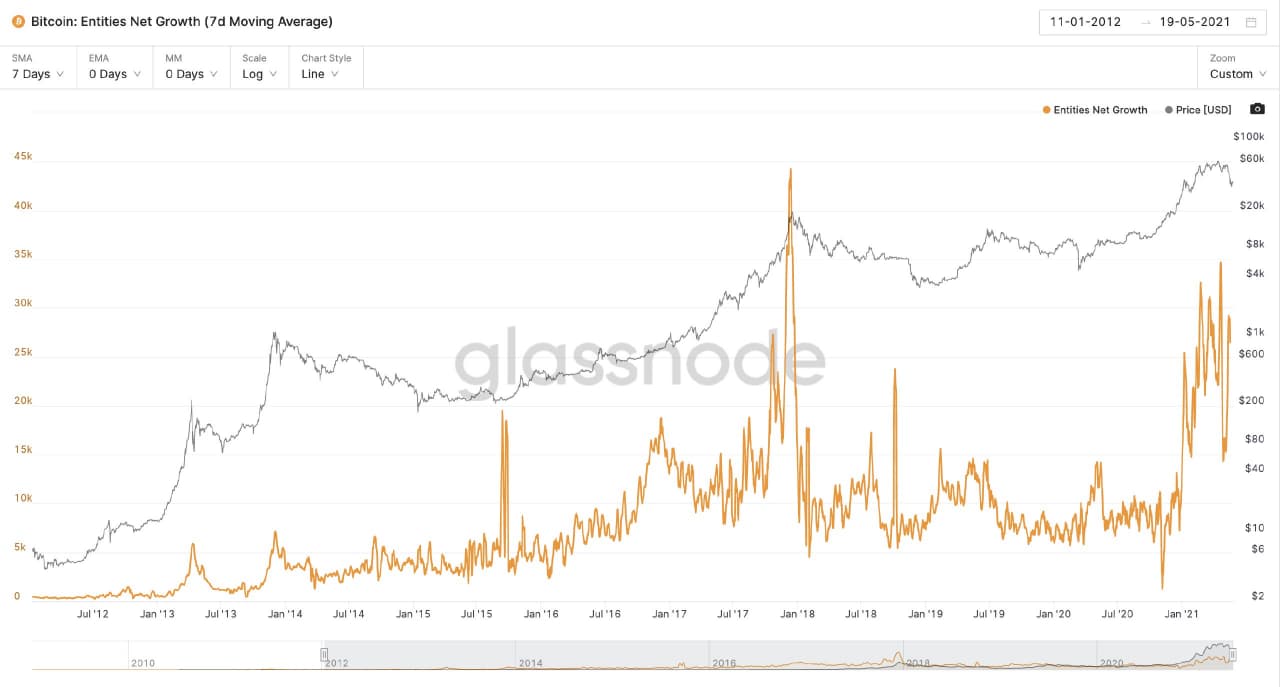

One other bullish indicator talked about by Spruill is entities’ web development, which “is recovering again to prior ranges” and should sign that “the bull market is again in full pressure” if this development continues over the subsequent few weeks and the metric resumes its highs.

General, Spruill sees a optimistic transfer for BTC sooner or later, though the timing is questionable as a consequence of a wide range of elements.

Spruill mentioned:

“I believe there is a chance we may spend an prolonged time frame (months) between the $30,000 to $42,000 stage because the market digests latest occasions and we endure a mid-cycle re-accumulation interval. Alternatively, it is attainable now we have a COVID-like restoration whereby we see Bitcoin break exterior this vary quickly and get well a lot quicker than others expect.”

The views and opinions expressed listed below are solely these of the writer and don’t essentially mirror the views of Cointelegraph. Each funding and buying and selling transfer entails danger, and you must conduct your individual analysis when making a choice.

Source link