Welcome to Cointelegraph Market’s weekly publication. This week we’ll establish emerging-sector developments throughout the cryptocurrency panorama with a purpose to broaden your understanding of market cycles and higher equip readers to benefit from the microcycles which can be an everyday incidence within the bigger market construction.

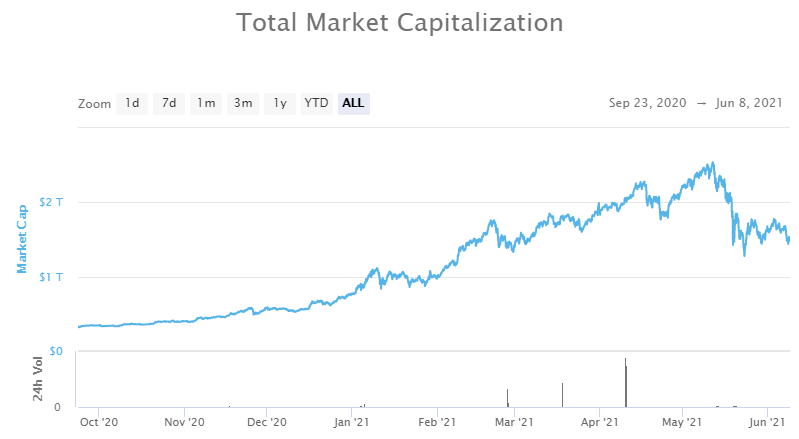

The cryptocurrency sector has a longtime repute for being risky and fast-moving, and these traits have been on full show in Might because the speedy decline within the value of Bitcoin (BTC) from $60,000 to $33,000 led to a mass exodus that wiped off $1.2 trillion in worth from the full market capitalization.

Whereas many throughout the ecosystem have positioned the blame for the downturn on issues like unfavorable tweets from influencers and highly effective figures like Elon Musk or one more announcement that the federal government of China has banned Bitcoin, extra skilled merchants and analysts have been warning concerning the potential for a big pullback for a number of weeks previous to the sell-off.

The speedy rise in costs in 2021 confirmed a few of the basic indicators of bubble-like conduct, with overbought alarm bells ringing whereas Uber drivers and grocery clerks have been happy as punch to supply their opinion on what the following huge mover could be.

With that mentioned, now looks as if a superb time to evaluate the assorted levels of a market cycle to assist get a greater understanding of what the market has gone by means of to this point and what can doubtlessly be anticipated within the months and years forward.

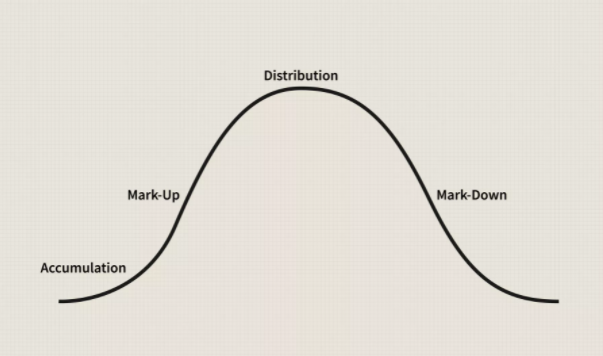

4 phases of a market cycle

The 4 fundamental phases of a market cycle, which all merchants ought to have a fundamental understanding of, are the buildup section, the mark-up section, the distribution section and the mark-down section.

The buildup section takes place after a market has bottomed out and is characterised by the innovators and early adopters shopping for up the asset for its long-term potential earlier than any vital value strikes.

This section was seen within the cryptocurrency market starting round December 2018 when the worth of BTC bottomed under $3,500 and prolonged all the best way till October 2020 when its value started to meaningfully rise above $12,000.

The mark-up section actually started to warmth up in December 2020 and prolonged into January 2021 as BTC and the decentralized finance (DeFi) sector have been attracting world consideration, with the full market capitalization climbing to a excessive above $2.5 trillion in Might because the distribution section started to provoke.

Throughout distribution phases, sellers start to dominate and the beforehand bullish sentiment turns combined, resulting in costs getting locked in a buying and selling vary. The section ends when the market reverses course.

Among the typical chart patterns seen throughout this time, as outlined by Investopedia, are double and triple tops alongside well-known head-and-shoulders patterns, which have been the warning indicators introduced by BTC and seen by technical analysts forward of this most up-to-date sell-off.

$BTC forming Head and Shoulder sample.

Bear market begins? #Bitcoin #Cryptocurency pic.twitter.com/E86WwcCKsX

— Okay A R N A (@iamrajankarna) June 8, 2021

Just like the 2017–2018 bull market, the worth of BTC reached a brand new all-time excessive (ATH) after which started to pattern down, which resulted in funds rotating out of Bitcoin and into the altcoin market, additional propelling the full market capitalization to a report excessive of $2.53 trillion on Might 12.

For the astute crypto dealer, this sample was an indication {that a} mark-down section was approaching and that it will be smart to take earnings as BTC fluctuated between $40,000 and $60,000 and altcoins spiked to all-time highs in preparation to journey out the sell-off and scoop up tokens at a reduction in the course of the subsequent backside.

Deploying funds within the accumulation section

Now that the market has skilled a big pullback and continues to seek for a value flooring, it’s a vital time to watch value actions, with a watch on searching for good entry factors into viable initiatives.

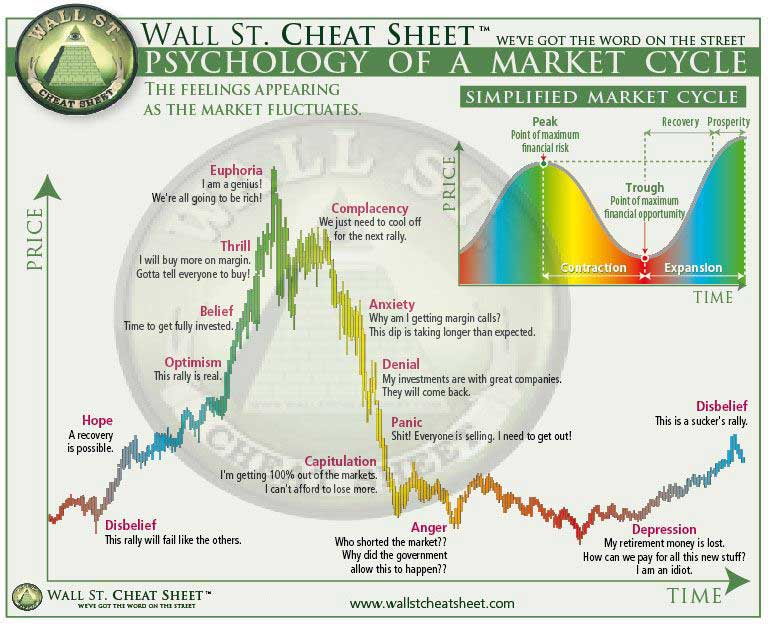

Maybe probably the most well-known graphic detailing the everyday market cycle is Wall St. Cheat Sheet’s “Psychology of a Market Cycle.” The sample has appeared in markets of every kind, from shares and commodities to cryptocurrencies and actual property.

Wanting on the chart for Bitcoin, we will see an identical value sample that started late in 2020 with a potential “disbelief” section beginning in November. The early run-up in January is analogous in look to the “hope” section on the chart above and was adopted by a multimonth run-up to a euphoric all-time excessive in April.

The worth then dipped down from $64,000 to $47,000 earlier than bouncing again to the $53,000–$60,000 vary as complacency started to set in. The sell-off in Might propelled the market by means of the nervousness, denial, panic and capitulation phases, and the ecosystem’s response to Musk’s tweets, along with different forces placing downward strain available on the market, elicited a big quantity of anger inside the neighborhood.

Now comes the problem of coping with the melancholy of a considerably decrease portfolio worth and attempting to determine if the market has bottomed, signaling that it’s a good time to redeploy funds, or if the most effective factor one can do is sit on their arms and watch for additional developments.

Main value rallies throughout this time are sometimes seen with disbelief as a sucker’s rally — thus, the cycle is full, and we’re again initially.

So, does that imply that now is an efficient time to build up your favourite initiatives’ tokens?

Sadly, there isn’t any assured right reply to that query, and it’s one thing for every investor to find out on their very own. With beforehand in-demand tokens now at vital reductions in contrast with only one month in the past, this may very well be a superb time to start dollar-cost averaging again into the highest long-term decisions in preparation for the following cycle increased.

Cryptocurrency sector cycles

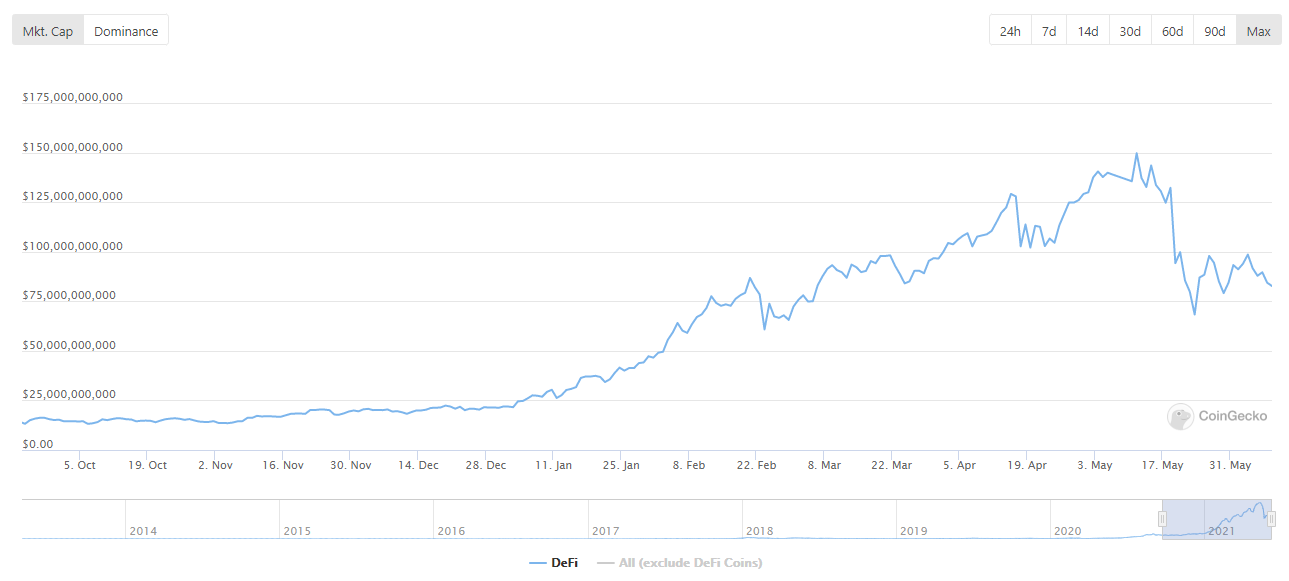

The everyday cycle introduced right here might be utilized to the market as a complete in addition to to particular person tokens or token sectors.

A superb instance of that is the rise of decentralized finance over the previous yr, which took the cryptocurrency market by storm, led by the emergence of standard decentralized exchanges like Uniswap and lending platforms like Aave.

As seen within the chart above, the DeFi sector as a complete went by means of its personal market cycle sample that coincided with its rising reputation and use throughout the ecosystem.

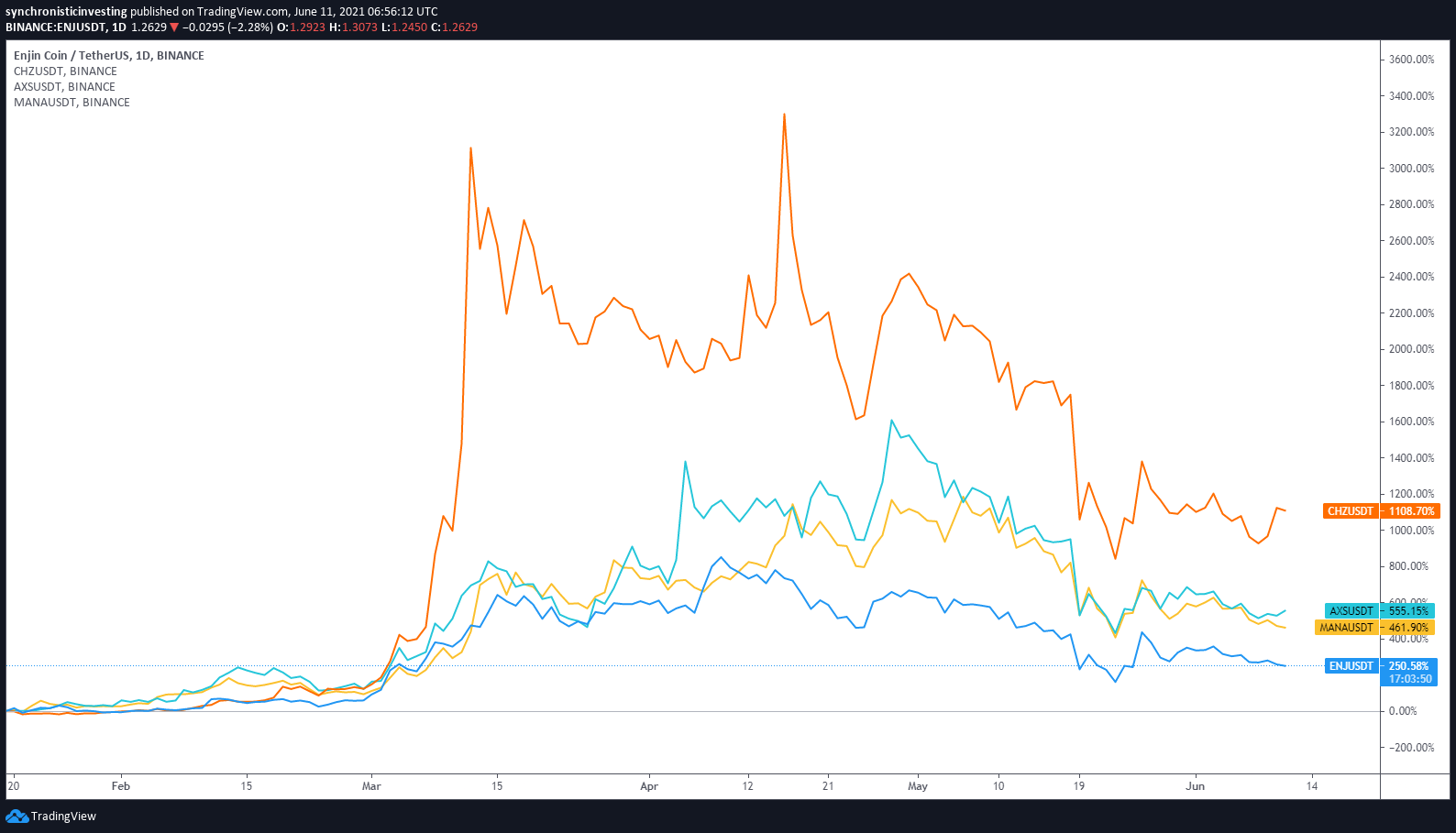

An identical sample was seen within the rise of nonfungible tokens (NFTs) in 2021, however the timing was totally different, highlighting the concept sectors transfer collectively and hinting on the potential advantages of a sector-based method to investing in cryptocurrencies.

So as to benefit from these alternatives, merchants are at occasions compelled to undertake a contrarian method. The buildup section is commonly marked by decreased sentiment, however the most effective time to promote is in the course of the distribution section when sentiment is at its highest and a majority of merchants are going all-in with hopes of nice riches.

As for the present market outlook, it’s potential that the most effective plan of action is adopting a wait-and-see method whereas maintaining some dry powder on the sidelines to benefit from any “flash gross sales” which will come our manner. No matter you could select, simply keep in mind to do your personal analysis and have a danger administration course of in place, because the traditionally risky nature of the cryptocurrency market exhibits no indicators of abating any time quickly.

Need extra details about market cycles?

The views and opinions expressed listed below are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, you need to conduct your personal analysis when making a call.

Source link