On a day wherein Bitcoin crashed briefly to $30,000 in a rampant bear market, the main cryptocurrency by no means acquired wherever near that on Korean exchanges. The so-called “kimchi premium” noticed to that, protecting the worth of Bitcoin as a lot as $5,000 above its degree on main U.S. exchanges.

The main motive for this kimchi premium is that Korea’s exchanges are pretty remoted by a mixture of the nation’s strict capital management legal guidelines stopping funds from leaving the nation, and the tax code and anti-money laundering (AML) laws that make it troublesome for foreigners to make use of Korean exchanges — even giants like Bithumb and Upbit — with out native Korean financial institution accounts.

Neither is that premium the one a part of South Korea’s crypto business that units it other than the remainder of the world. Amongst different issues, the market’s isolation mixed with the extraordinary stability of the Korean gained has saved stablecoin utilization low and the embrace of decentralized finance, or DeFi, effectively behind that of the remainder of the world.

Korea’s Bitcoin growth

Regardless of this isolation, Korea’s embrace of Bitcoin specifically and cryptocurrency usually may be very sturdy. In April, greater than 5 million distinctive cryptocurrency customers — about 10% of the nation’s inhabitants — reportedly purchased or offered digital belongings a minimum of as soon as for the reason that starting of 2021.

On Could 19, the day the kimchi premium hit $5,000, only one Korean trade, Upbit, had a 24-hour transaction quantity of greater than $31.5 billion, in accordance with CoinMarketCap. Add in the remainder of the nation’s “huge 4” cryptocurrency exchanges, Bithumb, Korbit and Coinone, and it was $38.1 billion — considerably greater than has been traded lately on the main Korean inventory trade KRX.

One attention-grabbing facet of Korea’s cryptocurrency craze is how broadly it’s unfold throughout age teams. One February survey confirmed that nearly half of the customers of main Korean exchanges Bithumb and Upbit have been of their 40s or 50s — a lot of them moms. That stated, a broader survey of Korean crypto trade apps in March confirmed that younger folks dominate the ranks of latest Korean crypto customers, with these of their 20s and 30s accounting for almost two-thirds of the brand new month-to-month app customers within the first three months of the yr. Nonetheless, they’re investing small quantities, typically lower than $100.

All that’s clearly having an influence. Bithumb Korea lately introduced that its Q1 2021 web revenue was up 876% in contrast with the earlier yr.

Authorities roadblocks

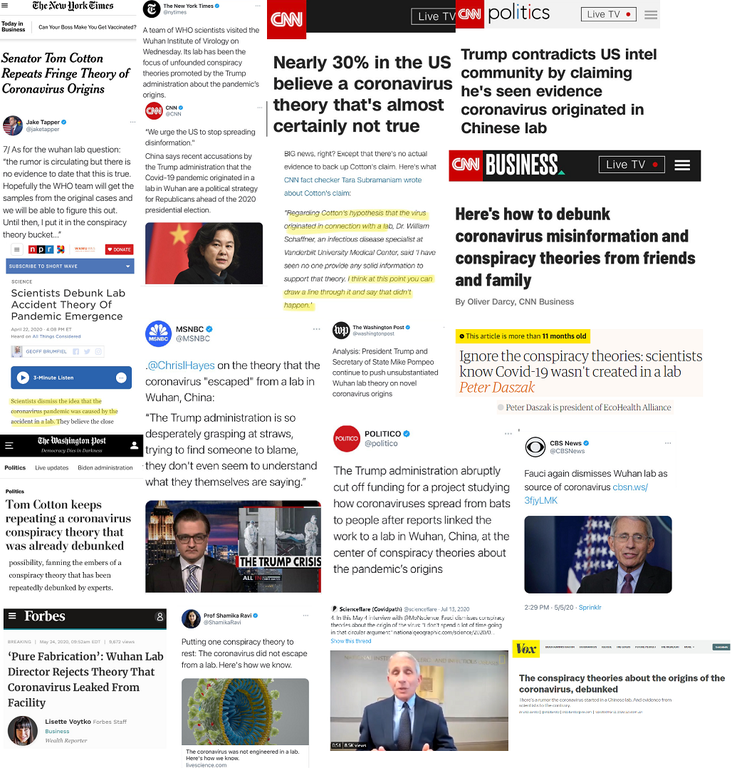

On the similar time, the Korean authorities and regulators are removed from being followers of cryptocurrency. In February, Financial institution of Korea Governor Lee Joo-yeol instructed a Nationwide Meeting committee listening to that “a crypto asset is an asset that has no intrinsic worth.” He added that “it’s obscure why the worth of Bitcoin is so excessive.”

Korea’s crypto laws additionally make it troublesome for international opponents. In December 2020, the world’s largest trade, Binance, shuttered its Binance Korea operation lower than a yr after it launched, thanks largely to a regulation that banned exchanges working within the nation from sharing order books — that means Binance Korea might not lean on Binance’s liquidity.

That regulation got here into impact in March 2021, the identical month that one other main cryptocurrency trade — OKEx — introduced it was shuttering its Korean operations because of the new AML laws. It has additionally been prompt that these guidelines will make it troublesome for smaller Korean exchanges to compete with the massive 4.

Not a fan of stablecoins?

Regardless of this booming crypto market, Korea is much behind the remainder of the world in adoption of stablecoins, in no small half as a result of the Korean gained is secure sufficient that there isn’t as sturdy a necessity for stablecoins within the largely walled-off crypto market.

Past that, the Korean authorities frowns on stablecoins, in accordance with Oleg Smagin, head of world advertising at Delio, a number one Korean crypto lending and staking agency. That makes exchanges leery of them, he provides.

As well as, trade charges are low — largely within the 0.15% to 0.25% vary on the huge 4. Whereas the charges for withdrawals in gained are flat and really low — about $1 — the payment for transferring cryptocurrencies immediately off might be steep. The large 4’s withdrawal charges vary from 0.0005 to 0.0015 BTC to withdraw Bitcoins immediately — $20 to $60 for one BTC at $40,000.

Which might assist clarify why the Korean gained is the fourth-most traded nationwide foreign money for Bitcoin, behind solely the Japan yen, the euro, and the dominant U.S. greenback.

The CeFi-DeFi hybrid

One sufferer of Korea’s closed-off crypto market and unfamiliarity with stablecoins is that the booming DeFi business hasn’t had an opportunity to take maintain there, Smagin says.

“2019 turned a tipping level for the large adoption of DeFi globally, however in Korea it was barely acknowledged, principally as a result of a lot of the native retail traders lacked expertise utilizing abroad crypto providers and the adoption of stablecoins was low,” he says.

Delio’s answer is a hybrid centralized-decentralized finance mannequin that makes use of CeFi as a solution to construct the preliminary crypto lending ecosystem that may turn out to be increasingly decentralized over time. Within the meantime, the agency realized there may be an “huge area of interest for a CeFi crypto-to-crypto lending service that may serve the wants of the native merchants,” Smagin says.

The agency presently has 4 CeFi lending choices, in addition to a brand new fee service that lets Delio pockets holders pay with Bitcoin at a community of greater than 70 retail corporations providers by fee app Cash Tree. As well as, it’s Delio Liquidity arm gives institutional purchasers with digital asset loans of between $800,000 and $45 million.

Delio gives Bitcoin and Ethereum loans of as much as 90% of the borrower’s BTC or ETH collateral, and in addition gives lending providers to Bithumb clients, who can use both BTC or ETH, or Korean gained, as collateral. Staking and yield farming are additionally accessible. Delio lately handed $2 billion in whole worth utilized.

Delio’s DeFi hybrid plans are centered round Ducato, a won-based stablecoin challenge scheduled to launch within the third quarter of 2021. The KRWD stablecoin — fastened at one gained — will likely be generated by collateralizing cryptocurrency. Ducato is a DeFi protocol with its personal token, DUCATO, which is used to pay charges and for governance. However the CeFi Delio platform gives the stablecoin with a user-friendly interface.

Disclaimer. Cointelegraph doesn’t endorse any content material or product on this web page. Whereas we purpose at offering you all essential info that we might get hold of, readers ought to do their very own analysis earlier than taking any actions associated to the corporate and carry full duty for his or her selections, nor this text might be thought-about as an funding recommendation.

Source link