The cryptocurrency market discovered itself in a state of cautious optimism on June 28 after Bitcoin (BTC) worth briefly spiked above $35,500, renewing hopes that the bull development will resume shortly.

Regardless of the bullish transfer, some analysts have warned that the failure to safe a each day shut above the $35,000 resistance is an indication that merchants are merely closing positions at every breakout to resistance, a touch that additional draw back could possibly be in retailer.

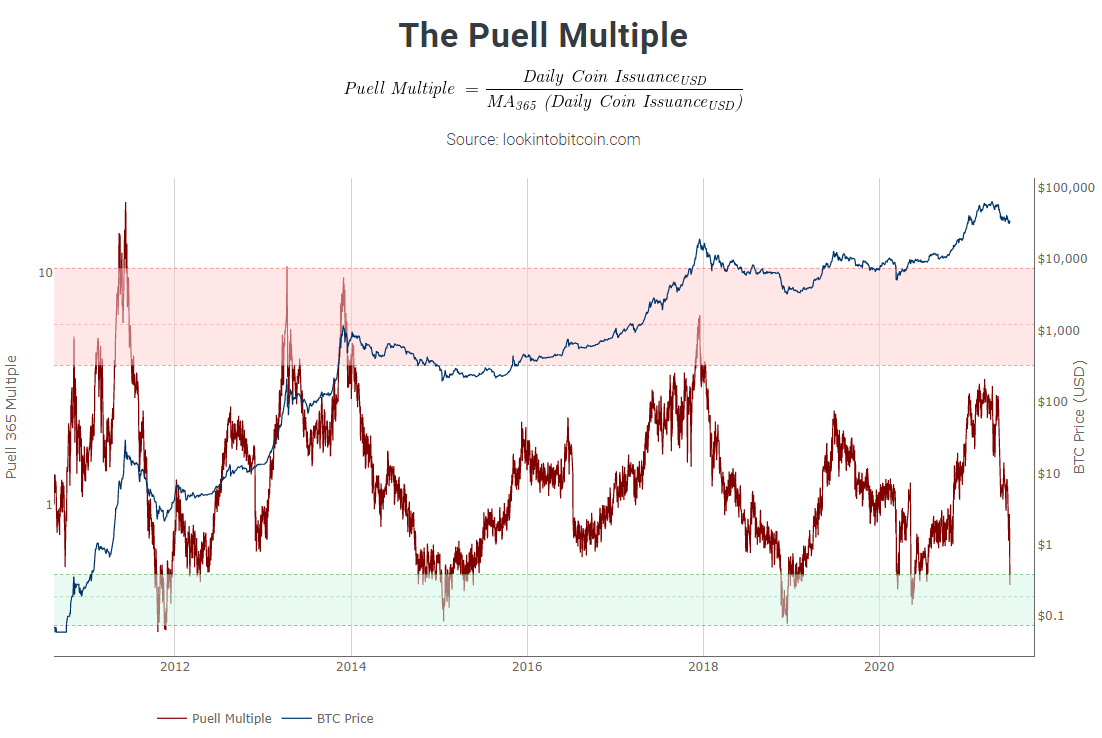

In response to David Puell, on-chain analyst and creator of the Puell A number of, the indicator has simply given its fifth Bitcoin purchase sign in historical past.

$BTC: Getting studies that probably the most awesomely-named indicator simply gave its fifth purchase sign in BTC historical past.

Trying good, sure, however do not forget that Puell A number of reacts to hash charge actions too, and hash charge follows worth, not the opposite approach round.

— David Puell (@kenoshaking) June 28, 2021

The Puell A number of focuses on the availability aspect of the Bitcoin financial system, primarily Bitcoin miners and their income, and explores market cycles from a mining income perspective.

It’s calculated by dividing the each day issuance worth of BTC (in USD) by the 365-day shifting common of each day issuance worth.

As seen on the chart above, the indicator measures durations the place the each day worth of the Bitcoin issued reaches historic lows, represented by the inexperienced field, or traditionally excessive values, that are seen when the indicator climbs into the crimson field.

Previous cases when the Puell A number of indicated good shopping for alternatives embrace mid-2018, when the worth of BTC crashed beneath $4,000 within the midst of the crypto winter and once more in March 2020 when costs collapsed because of the Covid-19 pandemic.

It additionally supplied merchants with a promote sign in late 2017 as the worth of BTC topped out at that cycle’s excessive level, as properly in the course of the Bitcoin bull market of 2013.

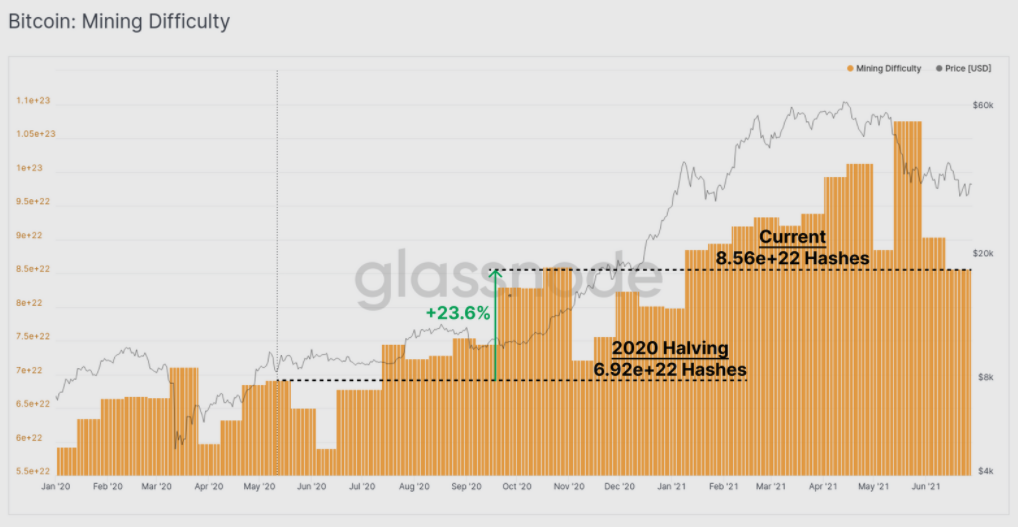

Miner purge results in a historic drop in mining difficlty

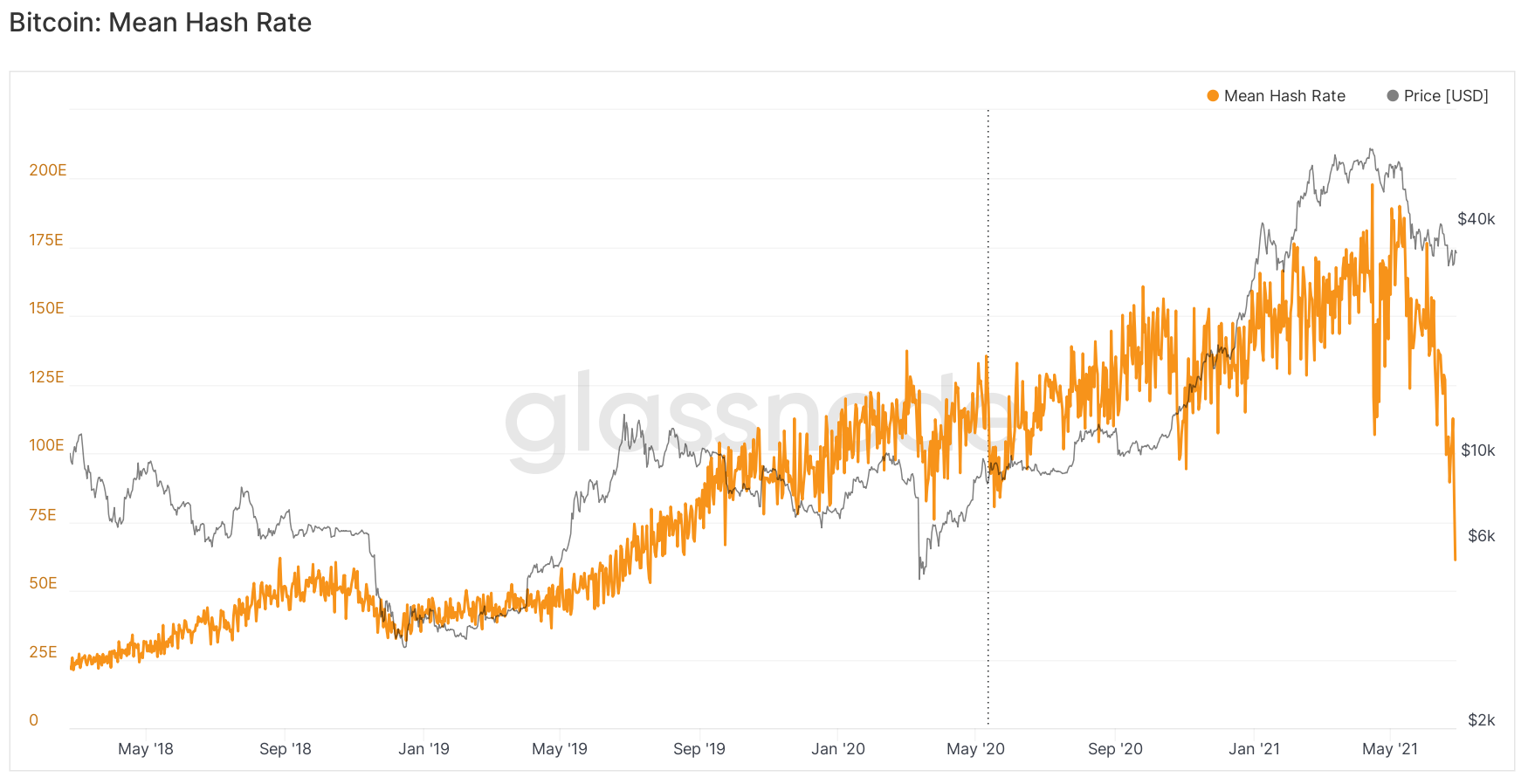

The current struggles for Bitcoin have been exacerbated by the crackdown on mining in China, which prompted quite a few giant mining farms to close down and relocate to different international locations. Analysts now anticipate the most important drop in mining problem ever because the hashrate plunges from historic highs.

Whereas miners are usually considered as obligatory sellers on account of their must cowl the fastened prices concerned in working a mining operation, current promoting habits has been adopted by the 50% draw-down in worth which implies twice as a lot BTC must be bought to cowl the identical prices in fiat in addition to elevated bills incurred by miners shifting their operations out of China.

Associated: Iranian commerce ministry points 30 crypto mining licenses

Cautious merchants could also be centered on the truth that previous cases of serious declines in hashrate have been adopted by worth pull-backs, leading to a reluctance to deploy funds within the present market situations.

Whereas the worth of BTC has made some good points on June 28, Puell provided a phrase of warning that a number of elements needs to be thought-about and no indicator needs to be utilized in isolation to make buying and selling choices.

Puell mentioned:

“Hash charge follows worth AND different exogenous elements, as we’ve clearly seen with the China scenario.”

The views and opinions expressed listed below are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, it’s best to conduct your individual analysis when making a choice.

Source link