Prior to now twenty years, index and exchange-traded funds (ETF) have develop into a few of the hottest types of investing as a result of they provide traders a passive strategy to achieve publicity to a basket of shares versus investing in particular person shares which will increase threat of loss.

Since 2018, this development has prolonged to the crypto sector and merchandise just like the Bitwise 10 Massive Cap Crypto Index (BITX) tracks the full return of Bitcoin (BTC), Ether (ETH), Cardano (ADA), Bitcoin Money (BCH), Litecoin (LTC), Solana (SOL), Chainlink (LINK), Polygon (MATIC), Stellar (XLM) and Uniswap (UNI).

The flexibility to entry a number of prime tasks by one weighted common market cap index seems like a good way to unfold out threat and achieve publicity to a wider vary of property, however do these merchandise supply traders a greater return by way of revenue and safety in opposition to volatility when in comparison with the top-ranking cryptocurrencies?

Hodling versus crypto baskets

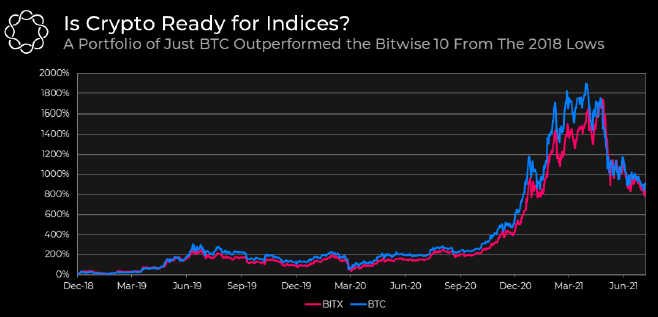

Delphi Digital took a better have a look at the efficiency of the Bitwise 10 and in contrast it to the efficiency of Bitcoin following the December 2018 market backside. The outcomes present that investing in BTC was a extra worthwhile technique regardless that BITX was barely much less risky.

In keeping with the report, “indices aren’t meant to outperform particular person property, they’re meant to be lower-risk portfolios in comparison with holding a person asset,” so it’s not shocking to see BTC outperform BITX on a purely value foundation.

The index did supply much less draw back threat to traders because the market sold-off in Could however the distinction was “trivial” as “BTC’s max drawdown was 53% and Bitwise’s was 50%.”

General, the advantages of investing in an index versus Bitcoin should not that nice as a result of the risky nature of the crypto market and frequent giant drawdowns usually have a bigger impact on altcoins.

Delphi Digital stated:

“Crypto indices proceed to be a work-in-progress. Selecting property, allocations, and re-balancing thresholds is a tough process for an rising asset class like crypto. However because the trade matures, we anticipate extra environment friendly indices to pop up and achieve traction.”

Ethereum additionally outperforms DeFi baskets

Decentralized finance (DeFi) has been one of many hottest crypto sectors in 2021 led by decentralized exchanges like Uniswap (UNI) and SushiSwap (SUSHI) and lending platforms like AAVE and Compound (COMP).

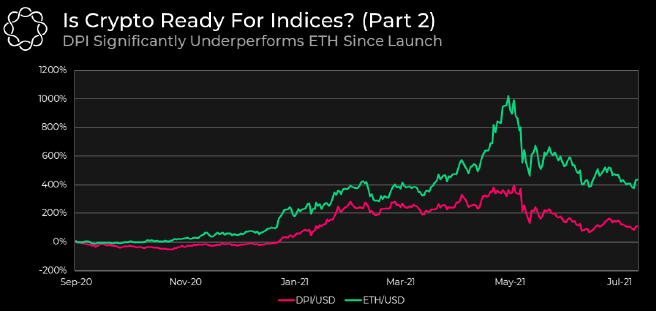

The DeFi Pulse Index (DPI) goals to faucet into this fast development and the DPI token has allocations to 14 of the highest DeFi tokens, together with UNI, SUSHI, AAVE, COMP, Maker (MKR), Artificial (SNX) and Yearn.finance (YFI).

When evaluating the efficiency of DPI to Ether for the reason that inception of the index, Ether considerably outperformed by way of profitability and volatility, as evidenced by a 57% drawdown on Ether versus 65% for DPI.

Whereas that is an “imperfect comparability” in accordance with Delphi Digital attributable to the truth that “the chance and volatility of DeFi tokens are increased than Ether’s,” it nonetheless highlights the purpose that the normal advantages seen from indices should not mirrored by crypto-based baskets.

Delphi Digital stated:

“You might’ve simply HODL-ed ETH for a superior risk-return profile.”

In the meanwhile, Bitcoin and Ether have confirmed to be two of the lower-risk cryptocurrency performs obtainable when in comparison with crypto index funds that provide publicity to a bigger variety of property.

The views and opinions expressed listed below are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Each funding and buying and selling transfer entails threat, it’s best to conduct your individual analysis when making a choice.

Source link