For years, the 1% rule has been handled like scientific truth, and I’d like to finish that as we speak. The 1% rule is just a rule of thumb—and an outdated one at that. It was created throughout a distinct time and overvalues the function of money stream in as we speak’s actual property investing local weather.

What’s the 1% rule?

The 1% rule makes use of a (rightfully) fashionable metric, often called the rent-to-price ratio (RTP), to estimate money stream.

RTP is a good proxy for money stream as a result of it’s so easy to calculate. All you want are two inputs: lease and value.

If you wish to calculate RTP for a complete space, take the median lease and divide it by the median residence value. For instance, if there’s a median lease of $1,000 in a metropolis and a median residence value of $200,000, the RTP could be 0.5%.

To calculate RTP for a selected deal, do the identical factor. Take the lease you suppose you may get for the property and divide it by your estimated buy value.

It looks like a crude measurement, however it actually works. So lots of your bills—month-to-month funds and pursuits, insurance coverage, taxes, and so on.—will be roughly devised from the property’s value. The maths checks out, too.

I simulated cash-on-cash return (CoCR) for the highest 576 markets in the USA after which correlated the CoCR return to the RTP for every metropolis. The consequence was a correlation of .85, which implies there actually is a robust relationship between RTP and money stream.

My gripe right here is just not with utilizing RTP as a measurement. I believe it’s a superb option to display markets and do some back-of-the-envelope math on a deal.

My gripe is with the rule that RTP must be over 1% to be deal. I see on the boards and listen to from individuals immediately that they haven’t purchased a deal as a result of they can’t discover one thing that meets the 1% rule. Cease!

This isn’t legislation. It’s not gospel. It’s a rule of thumb that was extra helpful than it’s as we speak.

Why the 1% rule isn’t helpful as we speak

Buyers developed the 1% rule in a really completely different market. After the monetary disaster, housing costs declined a lot sooner than lease. That is the proper situation to create excessive RTP: excessive denominators, low numerators.

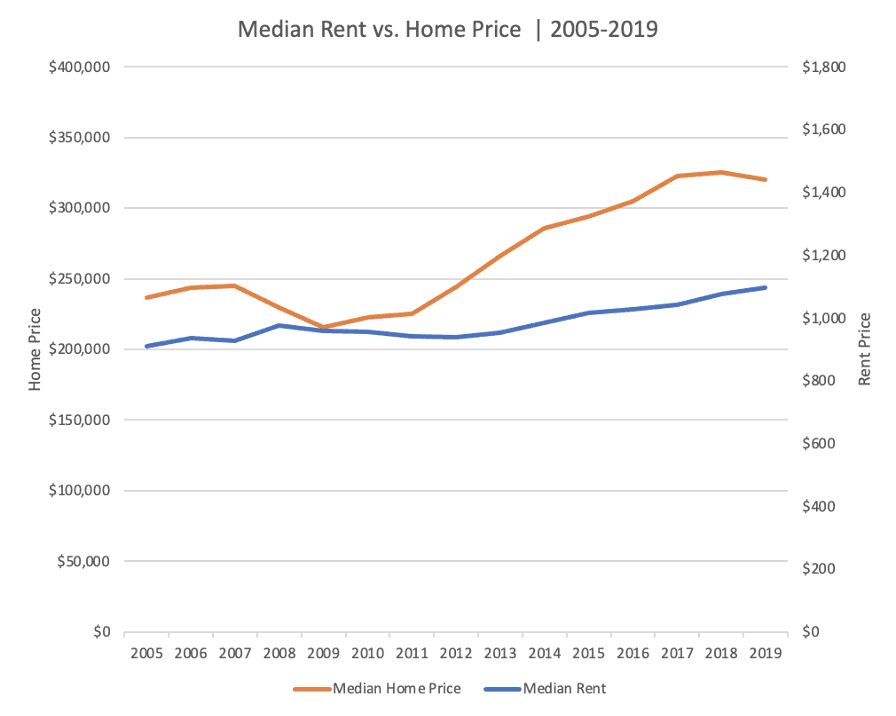

This development continued by the early 2010s. Then residence costs began to get well, and lease charges didn’t preserve tempo, reducing the common RTP throughout the nation. Take a look at this chart.

CHART TK

Throughout the monetary disaster, rents declined modestly, whereas residence costs took an actual dip. (Notice that residence value and lease are plotted on completely different axes to point out the form of their respective development.)

However the market has modified. Housing appreciation is outpacing lease development. Sure, that is partly as a result of COVID-19 pandemic, however it began earlier than that. RTP and money stream are simply tougher to seek out than they had been beforehand.

We have to modify our expectations. What was thought of a benchmark in 2011 can’t be moderately used as a benchmark in 2021 if you wish to be an lively actual property investor.

My second gripe is that 1% is a pleasant spherical quantity, however it doesn’t truly symbolize the road the place money stream turns into optimistic or unfavourable. Actually, my analysis exhibits one thing fairly completely different. Try a few of my findings.

- The common RTP throughout the biggest U.S. metros is .51%

- The common CoCR throughout the biggest U.S. metros is -7%. Yikes.

- Philadelphia has an RTP of .77% (based on some census knowledge blended with BPI knowledge) however nonetheless presents a CoCR of 11%. Signal me up!

- Avondale, Arizona, has an RTP of .56% and a optimistic CoCR at 1%.

To me, this says one thing thrilling. The common deal yields -7% CoCR proper now. You will get one thing far above common (1%) with an RTP of simply .56%. You can too discover glorious money stream in cities with an RTP beneath 1%. Philadelphia is simply one of many examples.

What to make use of as a substitute

Whereas it doesn’t have the identical ring to it, for screening cities or neighborhoods, something above 0.5% ought to be thought of.

We’re speaking concerning the common deal in a metropolis. If the common is an RTP of .5% and a CoCR of 1%, then you possibly can completely discover even higher offers if you’re diligent in your search.

Should you’re utilizing RTP for a selected deal, something over .65% might be price analyzing absolutely utilizing actual assumptions for bills slightly than simply RTP as a proxy. That’s the one option to truly perceive money stream and CoCR.

This brings me to my final level.

Money stream isn’t that essential. Stunning, I do know. However let me clarify.

In case your objective is to stop your job quickly, otherwise you’re nearing retirement age, then money stream is tremendous essential. Should you’re a kind of individuals, ignore this final level.

However should you’re like me, and you intend to maintain working full time (not as an investor) for an additional 10-15 years, you ought to be investing for whole return, not simply money stream. Try to be factoring in the entire methods you may make cash in actual property investing when analyzing a deal: money stream, appreciation, amortization, and taxes.

By simply wanting on the 1% rule and saying sure or no primarily based solely on money stream, you’re solely taking a look at one in every of 4 essential components. Relying in your technique and stage in life, it is best to prioritize completely different mixes of return era. For some, money stream is crucial. For others, the worth of the general combine is perhaps one of the best. The 1% rule overlooks this.

Some traders suppose money stream is crucial think about deal evaluation as a result of it’s essentially the most predictable. I disagree. Taxes and amortization are essentially the most predictable. And, should you suppose that you could’t predict appreciation, that’s not precisely true both—however that’s a subject for an additional submit. For now, although, I’ll go away you with this.

I ran a calculator report on BiggerPockets for a faux take care of the next inputs.

- Buy value: $200,000

- Closing prices: $4,000

- Hire: $1,000/month

- RTP: 0.5%

- Appreciation: 2%/12 months

- Hire development: 2%/12 months

- Expense development: 2%/12 months

I then cooked the expense assumptions so I’d barely break even. With barely breaking even and forecasting modest appreciation and lease development, I wound up with money stream of a whopping $7 per 30 days and a CoCR of 0.19%. I’m going to get crushed on this deal, proper?

Nope.

If I held onto this deal for 5 years, my annualized return could be 12.5%. With 10 years. it might drop barely to 11.4%

Signal me up.

How does it work? Nicely, with 2% property appreciation (a really modest assumption), your property grows in worth from $200,000 to $221,000 in 5 years. Throughout that point, your tenants have paid down greater than $15,000 of your mortgage for you. That comes out to about $35,000 in revenue (we’re rounding right here) in simply 5 years in your preliminary funding of $44,000. Like I stated, signal me up.

If you could find a (non-real-estate) funding you suppose will ship 11% returns for 10 years with much less danger, please let me know the place it’s. I don’t see it wherever.

If after 10 years you need to stop your job and want money stream, you possibly can deleverage your portfolio to generate more money. Should you construct sufficient fairness over time, money stream turns into simple.

My objective is to construct $2-3 million in fairness earlier than I retire (no matter meaning). If I’ve $3 million in fairness, I can liquidate my complete portfolio and purchase properties for money at a 5% cap price and money stream of $150,000 per 12 months. With a greater cap price, let’s say 7%, that $150,000 a 12 months may very well be $210,000 per 12 months in money stream. Sounds fairly rattling good to me.

I in all probability gained’t do one thing that excessive, however I may. I’ll doubtless proceed to make use of leverage and stability money stream with different types of returns. However the level is to consider the lengthy sport.

Don’t get too hung up on money stream should you don’t want money proper now. Take a look at the overall return.

I’m not saying you shouldn’t be in search of money stream—money stream is nice. All different issues being equal, a take care of money stream is best than the identical deal with out it (duh). However it’s not the one factor. And on this loopy market the place excessive RTPs and excessive CoCR are exhausting to seek out, you possibly can nonetheless make glorious cash investing in actual property should you make investments for whole return.

Study the larger image. The 1% rule is only a guideline for individuals who worth money stream extremely. It’s not a terrific rule of thumb, and it’s not very useful for many who don’t want money proper now.

Do your deal evaluation and evaluate your whole return to various investments, and the offers you discover, even on this scorching market, shall be higher than the options.

Source link