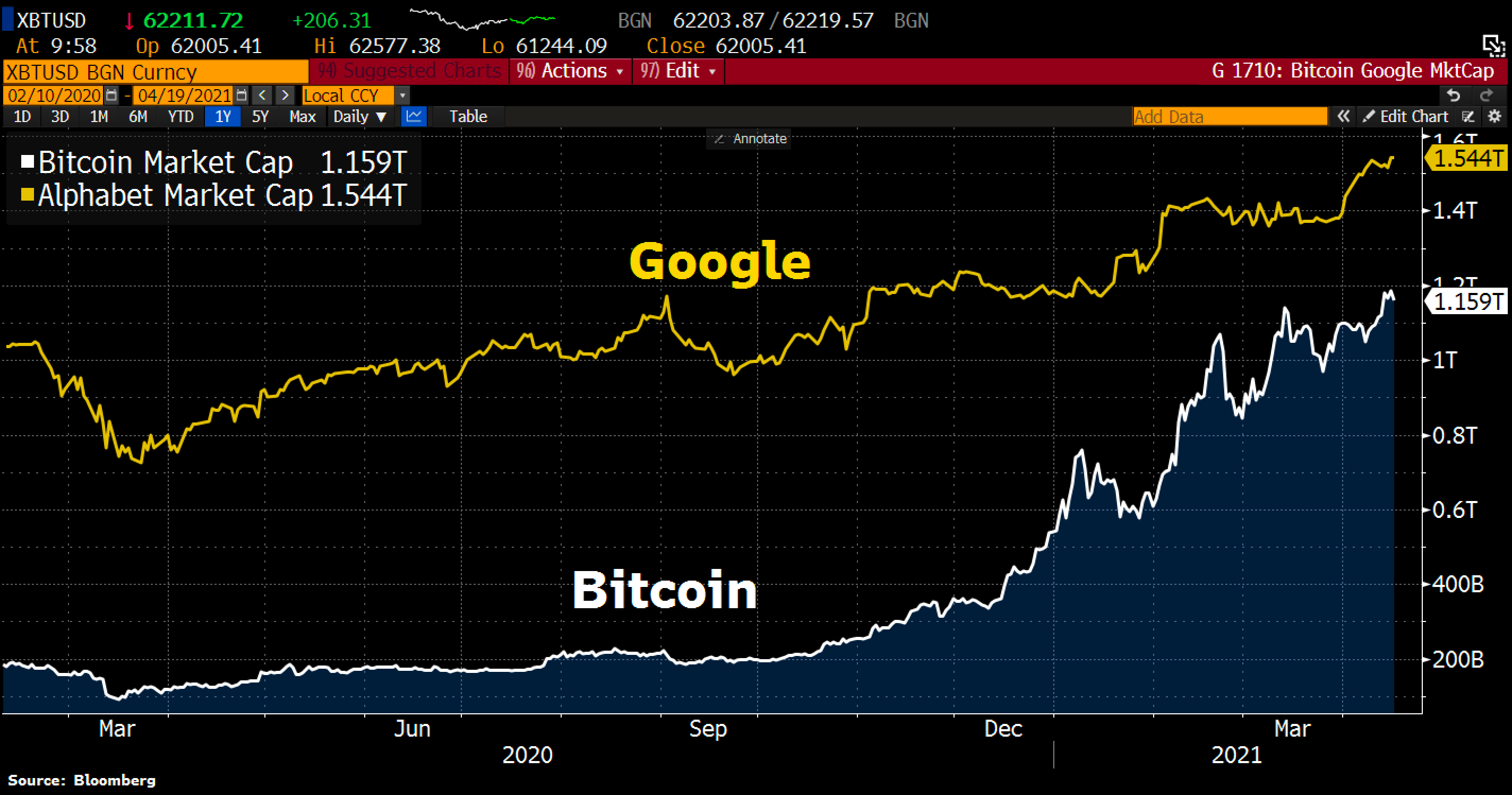

Holger Zschaepitz, a market analyst at Welt, emphasised that Bitcoin (BTC) is nearing the valuation of Google, because it heads towards $1.5 trillion in market capitalization.

At the moment, as of April 17, the market cap of Bitcoin is hovering at round $1.12 trillion as the whole valuation of the crypto market stays comfortably above $2 trillion.

What’s the similarity between Bitcoin and Google?

The similarity between Bitcoin and Google that Zschaepitz identified is that each have dominance of their respective sectors.

Bitcoin has the strongest community impact within the cryptocurrency market, accounting for greater than 51% of the worldwide cryptocurrency market.

Google has dominance over the search engine market and has an enormous share of the video-sharing and streaming sector with its possession of YouTube.

Zschaepitz wrote:

“The Exponential Age: Due to community results, the worth of #Bitcoin is growing and w/$1.159tn has nearly reached the inventory market worth of a traditional community share #Google which is price $1.5tn.”

Whether or not Bitcoin’s dominance over the cryptocurrency market can be sustained over the long run stays in query, because of the rising valuation of Ethereum and layer-one blockchain networks.

Nonetheless, the most important distinction between Bitcoin and the remainder of the market is that there’s clear institutional demand for BTC as a retailer of worth on account of its unmatched blockchain community computing energy and due to this fact, safety and trustlessness.

Therefore, traders typically view Bitcoin as a hedge towards inflation and the de facto reserve cryptocurrency.

In January, JPMorgan strategists wrote that Bitcoin may rise to as excessive as $146,000 because it competes towards gold as a retailer of worth.

The strategists mentioned:

“This long run upside primarily based on an equalization of the market cap of bitcoin to that of gold for funding functions is conditional on the volatility of bitcoin converging to that of gold over the long run. The reason being that, for many institutional traders, the volatility of every class issues when it comes to portfolio danger administration and the upper the volatility of an asset class, the upper the danger capital consumed by this asset class.”

Conventional monetary establishments are additionally acknowledging the significance of Bitcoin’s community impact and its dominance within the crypto market because the go-to retailer of worth.

The place is the value of Bitcoin heading from right here?

Within the foreseeable future, the sentiment round Bitcoin stays combined after the general public itemizing of Coinbase.

Following the itemizing of COIN, there’s hypothesis that it may mark the highest of the crypto market.

Nonetheless, most on-chain knowledge and market indicators equivalent to funding charges don’t essentially recommend {that a} blow-off high is close to.

As an example, well-liked crypto dealer referred to as “Crypto Capo” said:

“I learn many individuals saying that funding is excessive, not solely in Bitcoin, but in addition in altcoins. That is relative. If we examine the present funding ranges with these of the highest of 2017, we see that they’re low ranges, making an allowance for that the value is thrice increased. Additionally, the present development is led by spot buying and selling, and never by derivatives.”

In the meantime, key on-chain metrics additionally recommend that Bitcoin value remains to be removed from the bull market high. Quite the opposite, BTC value might simply attain six figures, as forecast on the favored stock-to-flow mannequin, and even go as excessive as $400,000, in response to Bloomberg analysts.

Source link