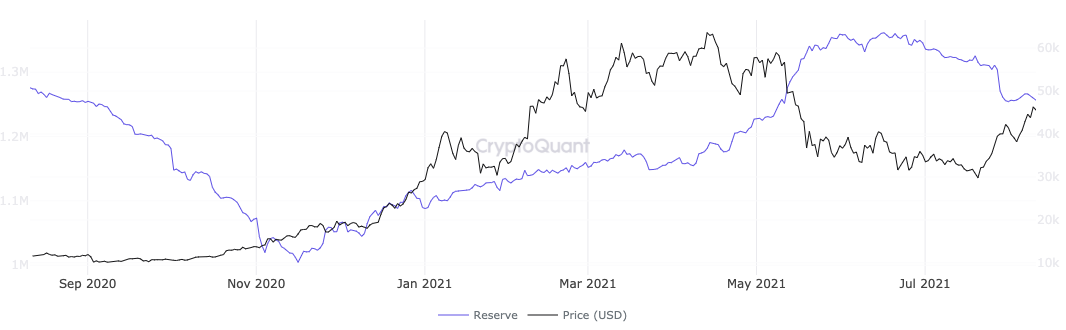

Bitcoin (BTC) reserves on derivatives exchanges have dropped to ranges final seen earlier than the Could worth crash.

Information from on-chain analytics service CryptoQuant confirmed that as of Tuesday, derivatives reserves totaled 1.256 million BTC — the least since Could 11.

Establishments repeat This autumn 2020

Towards a backdrop of institutional curiosity returning to cryptocurrency devices such because the Grayscale Bitcoin Belief (GBTC), figures present that main gamers have in reality been including to their BTC holdings all through the downturn.

“Massive cash has been shopping for,” analyst William Clemente III commented this week.

Change balances show the purpose, with derivatives platforms seeing a repeat of the development final witnessed on the finish of 2020.

Even throughout probably the most intense part of the BTC bull run this 12 months, derivatives balances conversely grew — a reducing steadiness characterised solely the very starting of the run to $64,500.

“Since Could nineteenth, entities with 10K-100K BTC have added +269,450 to their holdings ($12.1B),” Clemente III added, highlighting additional knowledge.

“These entities have between $450M–$4.5B of their capital allotted to Bitcoin.”

Accumulation in motion

Establishments haven’t been postpone by any overriding narrative from inside or past cryptocurrency, together with China’s miner rout since Could, or the continuing saga over the USA’ infrastructure invoice.

Associated: One Bitcoin now buys 0.6 kilograms of gold as 10-year returns flip damaging

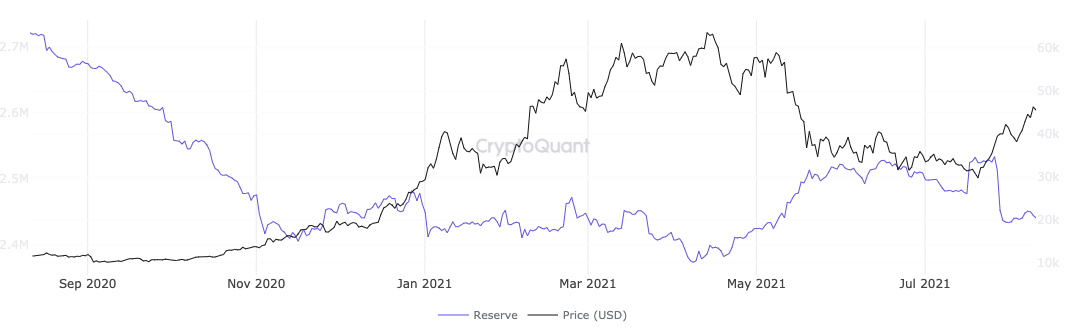

As Cointelegraph beforehand reported, retail trade balances have already been heading decrease for a while.

As of Tuesday, the full trade steadiness determine stood at 2.44 million BTC, additionally a three-month low.

Source link