Coming each Saturday, Hodler’s Digest will show you how to monitor each single necessary information story that occurred this week. The perfect (and worst) quotes, adoption and regulation highlights, main cash, predictions and way more — per week on Cointelegraph in a single hyperlink.

High Tales This Week

Infrastructure invoice passes US Senate — with out clarification on crypto

On Tuesday, the controversial infrastructure invoice handed within the U.S. senate In a 69-30 vote.

The bipartisan invoice proposes roughly $1 trillion of funding into transportation and electrical energy infrastructure initiatives. The invoice additionally places ahead extra stringent guidelines for companies dealing with crypto property whereas increasing reporting necessities for brokers, who shall be required to report digital asset transactions value greater than $10,000 to the IRS.

Six senators, together with Pat Toomey, Cynthia Lummis, Rob Portman, Mark Warner, Kyrsten Sinema and Ron Wyden, proposed an modification to the buzz-kill invoice on Monday that may exempt software program builders, transaction validators and node operators as brokers, whereas proposing that tax reporting necessities “solely apply to the intermediaries.”

Their efforts didn’t bear fruit, nonetheless, with additional clarification on crypto not offered. Senator Toomey flamed the invoice within the aftermath, noting that the laws was “too costly, too expansive, too unpaid for and too threatening to the revolutionary cryptocurrency economic system.”

Poloniex settles fees with SEC for working unregistered trade

The USA Securities and Trade Fee, or SEC, introduced a $10 million settlement with cryptocurrency trade Poloniex on Aug. 9.

Poloniex was charged with facilitating trades in unregistered securities between July 2017 and November 2019. In accordance with the indictment, the SEC additionally asserted that Poloniex workers have been misbehaving, as they actively sought to bypass securities regulation in a plot to extend the corporate’s market share.

On the identical day, SEC commissioner Hester Peirce — identified colloquially as “Crypto Mother” as a consequence of her common pushback towards SEC crypto enforcement — slammed the regulators’ actions in a public assertion.

Crypto Mother questioned the regulators’ opaque regulatory framework that crypto companies should navigate within the U.S. whereas asserting that, even when Poloniex had tried to register with the SEC,

they “doubtless would have waited…and waited…and waited some extra” for a verdict.

Coinbase’s Q2 income high $1.6B as ETH quantity surpasses BTC’s for the primary time

Coinbase, the crypto trade led by media-shy co-founder and CEO Brian Armstrong, posted Q2 income of $1.6 billion this week.

The agency launched its Q2 report on Tuesday, and its web revenue of $1.6 billion marked a mammoth enhance of 4,900% in comparison with the $32 million recorded in the identical interval of 2020. Coinbase’s whole income for the quarter was $2.23 billion, beating out analysts’ predictions of $1.78 billion in anticipated income.

Curiously, for the primary time since Coinbase was based 9 years in the past, Ethereum (ETH) had the next buying and selling quantity than Bitcoin (BTC), with the property representing 26% and 24% of whole quantity, respectively.

55% of the world’s high 100 banks reportedly have crypto and blockchain publicity

Regardless of banks typically taking day trip of their busy schedules to slam crypto, a brand new analysis report discovered that 55 out of the highest 100 banks by property beneath administration have some type of blockchain or crypto publicity.

In accordance with analysis by Blockdata, the banks and their subsidiaries have direct and oblique investments in crypto and decentralized ledger expertise companies.

Notable banking giants named and shamed included Barclays, Citigroup and Goldman Sachs, who have been reported as probably the most lively backers of crypto and blockchain companies, whereas JPMorgan Chase and BNP Paribas have been additionally recognized as serial traders within the sector.

Winners and Losers

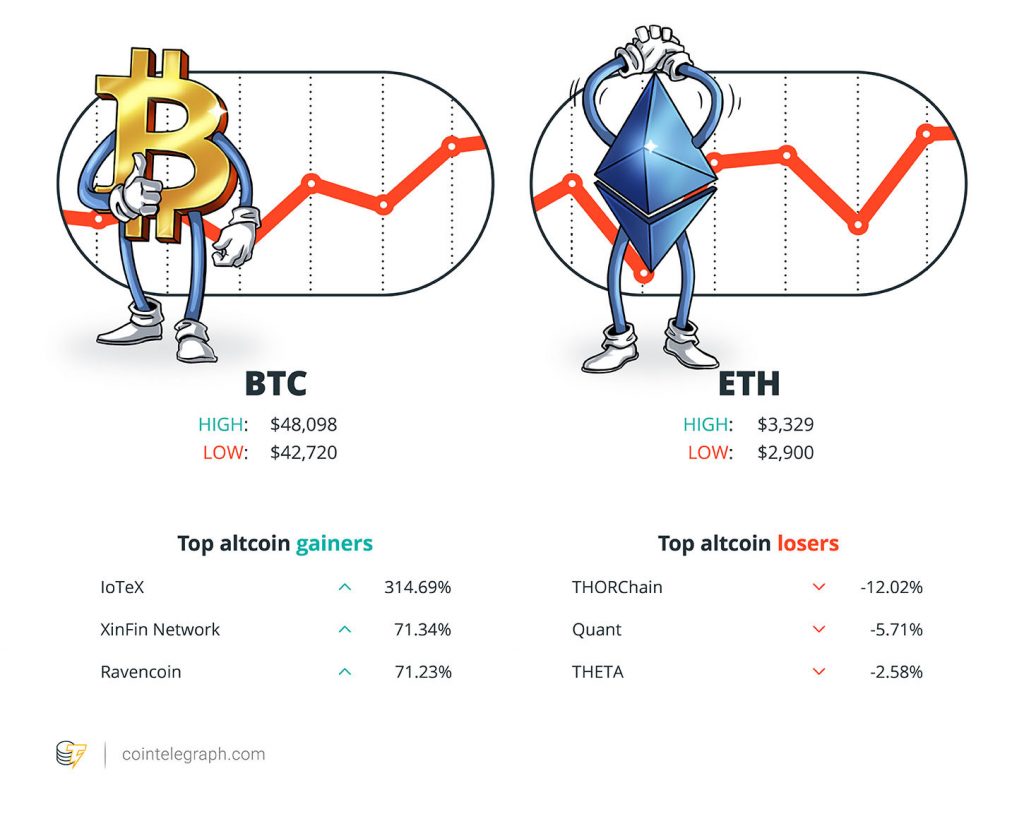

On the finish of the week, Bitcoin is at $46,262, Ether at $3,189 and XRP at $1.01. The whole market cap is at $1.92 trillion, in accordance to CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are IoTeX (IOTX) at 314.69%, XinFin Community (XDC) at 71.34%, and Ravencoin (RVN) at 71.23%.

The highest three altcoin losers of the week are THORChain (RUNE) at -12.02%, Quant (QNT) at -5.71%, and THETA (THETA) at -2.58%.

For more information on crypto costs, be certain that to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“If #Bitcoin have been to catch as much as #Ethereum’s efficiency this yr, the No. 1 crypto’s value would method $100,000.”

Mike McGlone, senior commodity strategist for Bloomberg Intelligence

“Shutting off this progress engine could be the equal of stopping e-commerce in 1995 as a result of individuals have been afraid of bank card fraud. Or regulating the creation of internet sites as a result of some individuals initially thought they have been difficult and didn’t perceive what they’d ever quantity to.”

Mark Cuban, billionaire investor

“If you wish to retailer your cash actually outdoors of the attain of the state, you possibly can simply maintain these non-public keys immediately. That’s the equal of burying a bar of gold in your yard.”

Nic Carter, co-founder of Coin Metrics

“This laws imposes a badly flawed, and in some instances unworkable, cryptocurrency tax reporting mandate that threatens future technological innovation.”

Pat Toomey, U.S. Senator

“I believe we’re already previous the stage of crypto early adoption.”

Stephen Stonberg, Bittrex International CEO

“We live in a time the place all the pieces goes digital, together with conventional property.”

Austin Woodward, CEO of TaxBit

“Given how gradual we have now been in figuring out how regulated entities can work together with crypto, market contributors could understandably be shocked to see us come onto the scene now with our enforcement weapons blazing and argue that Poloniex was not registered or working beneath an exemption because it ought to have been.”

Hester Peirce, commissioner of the U.S. Securities and Trade Fee

“Bitcoin’s journey to turning into Gold 2.0 has been stunning.”

Dan Held, Kraken director of progress advertising and marketing

Prediction of the Week

Bitcoin Technicals: Why BTC value breaking $48K resistance is the important thing to new all-time highs

Bitcoin has recovered a notable quantity of floor in current weeks. The asset hit its all-time excessive of just about $65,000 again in April however subsequently fell within the days and weeks after, discovering its manner all the way down to round $30,000. On a number of events, the asset briefly fell under $30,000.

Current weeks, nonetheless, have proven bullish value motion for Bitcoin, because the asset has posted chart motion seemingly indicative of a reversal, primarily based on evaluation from Cointelegraph’s Michaël van de Poppe.

The $48,000 value vary on Bitcoin’s chart sits as notable resistance. A transfer previous the worth zone of $47,500 to $49,000 might sign a attainable additional transfer as much as eventual recent all-time highs, though van de Poppe famous $55,000 as a nearer-term goal following a break of the talked about resistance zone. Alternatively, ought to Bitcoin’s value break down, a lot of ranges of value help exist, with $37,500 as an necessary degree to carry.

FUD of the Week

Coinbase removes ‘backed by US {dollars}’ declare for USDC stablecoin

Earlier this week Coinbase tweaked its description of number-two stablecoin USD Coin (USDC) to color an image of a barely less-than-stable coin.

Coinbase made the change following an audit displaying that USDC’s reserves weren’t all held in money. The earlier assertion learn: “Every USDC is backed by one greenback held in a checking account.”

The brand new assertion reads: “Every USDC is backed by one greenback or asset with equal honest worth, which is held in accounts with US regulated monetary establishments.”

Whereas this is likely to be a blow to USDC house owners Circle, the agency’s stablecoin money reserves are doubtless bigger than Tether’s and its USDT.

Alex Saunders sued for $350K by Nuggets Information follower

Alex Saunders, the Aussie behind well-liked crypto YouTube channel Nuggets Information, is being sued by a disgruntled investor for nearly 479,270 Australian {dollars}, value roughly $353,027.

Plaintiff Ziv Himmelfarb filed a proper written order demanding that the YouTuber pay the quantity in losses and damages for unpaid loans and allegedly bogus investments.

Himmelfarb said that it was a “no-brainer” to belief Saunders when he was requested for loans and provided funding alternatives by the crypto influencer, as he had been following him since 2017 and located him to be a good determine within the area.

“When he instructed me he had non permanent liquidity points in Might, I used to be glad to assist with a short-term mortgage, however couldn’t get any of my a refund since then. Hopefully I can get repaid,” Himmelfarb stated in regard to his alleged 30 ETH mortgage to Saunders.

DAO Maker crowdfunding platform loses $7M in newest DeFi exploit

DAO Maker, a crowdfunding platform centered on elevating cash for crypto initiatives, was exploited by hackers who stole $7 million value of USDC out of 5,251 person accounts.

In accordance with DAO Maker CEO Christoph Zaknun, the hackers have been capable of syphon round $7 million value of USDC.

“One of many the reason why this did occur might be that the quantity of deposits inside the [Strong Holder Offering] contract actually exceeded our expectations,” stated Zaknun in an AMA on Twitch. “Initially, we by no means anticipated greater than $2.5 million to be deposited in there, however over time, the SHOs grew to become extremely popular.”

Cointelegraph didn’t attain out to the hackers to offer feedback, as no person is aware of who they’re.

Finest Cointelegraph Options

Massive hodlers accumulate Bitcoin under $50K as BTC transactions over $1M soar

The dominance of Bitcoin transaction values above $1 million has doubled year-over-year, hinting at a rising institutional involvement within the cryptocurrency area.

Is the cryptocurrency epicenter shifting away from East Asia?

East Asia has skilled a significant decline in crypto adoption over the previous yr when put next with different areas.

Measuring success: Offsetting crypto carbon emissions essential for adoption?

Crypto corporations are doing their greatest to go inexperienced by offsetting Bitcoin carbon emissions, however how correct are their estimates?

Source link