by David Haggith

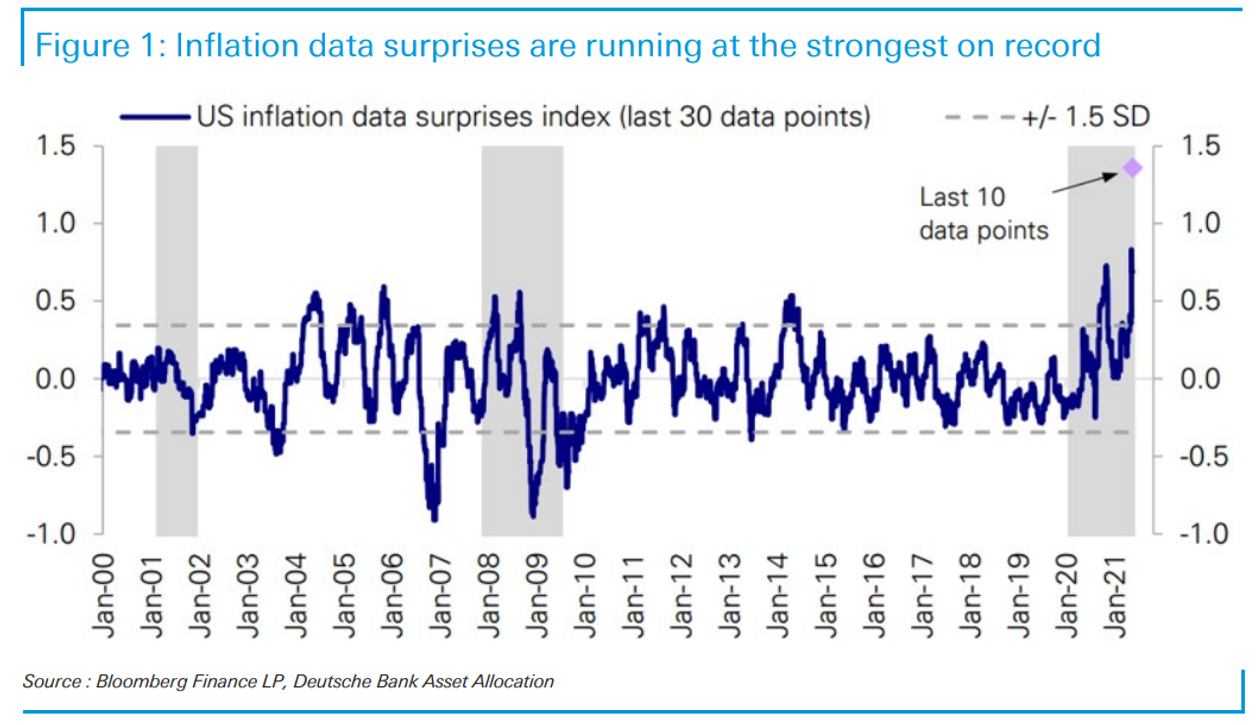

All these economists who went together with the Fed’s inflation-is-temporary-and-going-per-plan narrative are surprised by the information they now see coming in. They shouldn’t be, because it was predicable. Nonetheless, they might want to get greater charts to make room for it. Discover the place the final ten information factors for the rise in inflationary surprises are positioned (look as much as the far, prime proper nook of the chart):

The chart exhibits U.S. inflation information surprises at their highest within the 20-year historical past of the sequence, stated strategist Jim Reid, referring to a word by fairness strategist Parag Thatte. The final 10 information factors had been “nearly off the chart,” he famous.

MarketWatch

A lot for the excessive inflation print in April being as a result of “base results.” The shock index reveals whether or not inflationary information is greater or decrease than economist anticipated. It’s onerous to assert that the bottom impact from final yr’s COVIDcrisis resulted in additional surprises to economists, given these economists had been all attempting to assert inflation was going to rise as a result of a base impact earlier than April’s scorching print. How are you going to shock consultants who’re anticipating the bottom impact when each one among them is aware of precisely the place the bottom was final yr? For those who’re going to assert an impact because of the base — the start line — there isn’t a shock at what that start line was … solely at the place you ended up.

Comparisons with year-ago worth ranges depressed because of the pandemic — had been additionally anticipated to spur a run of scorching inflation numbers. These had been all amongst causes the Federal Reserve had assured it could have a look at rising inflation as “transitory,” or more likely to fade.

A “shock,” nonetheless, means inflation flew in nicely above the anticipated “base impact!”

Reid wrote, “these had been certainly all identified about earlier than the final a number of information prints and will have been factored into forecasts. That they weren’t means that the transitory forces are extra highly effective than economists imagined or that there’s extra widespread inflation than they beforehand believed.”

Initially, costs a yr in the past weren’t depressed. They simply didn’t rise a lot, so any discuss of the bottom impact is meaningless. April’s 4.2% rise YoY remains to be a 4.2% rise in a single yr, no matter what the yr earlier than did. It’s not like inflation has a thoughts to say, “Oh, I have to make up for final yr.” It’s what it’s.

Inventory market coughs up a hairball

As soon as once more, we noticed the market choking right now on this information, turning from inexperienced to purple with the S&P rebounding, once more, off its 45-day ceiling of 4200. It retains pounding its head towards that barrier however probably not busting by as a result of inflation considerations preserve grabbing its butt like a junkyard canine pulling somebody down off the fence he’s attempting to scale.

Reid famous how extraordinary the general run of inflation surprises has been. Because the chart exhibits, surprises throughout the 2007-2009 recession had been sharply detrimental and didn’t overshoot afterward. Throughout the pandemic, inflation didn’t undershoot [exactly, but is now “overshooting massively.… The fact that we’re seeing an overwhelming positive beat on U.S. inflation surprises in recent times must surely reduce the confidence to some degree of those expecting it to be transitory.“

A Reverse Repocalypse in the Making?

Behind the scenes of this monetary deluge, the Fed’s essential response to the overnight reverse repo crisis keeps soaring higher, meaning the Fed is having to suck more and more money out of bank reserves. This is the reverse of the repo-crisis problem back in 2019 where bank reserves were starving, and the Fed was having to add more and more money overnight to hold interest down on interbank loans.

A reverse repo crisis indicates too much money is sloshing around in reserves. The Fed is now sucking out nearly half a trillion dollars and rolling that over every night, and is escalating to a higher level each night!

As for the immediate market implications they are even more ominous: either the Fed will have to hike the IOER or rates will soon go negative.

ZH

In other words, without this Fed interference we would be entering the bizarre netherworld where banks pay other banks to take extra cash off their hands. Interest On Excess Reserves (IOER) is money the Fed pays to banks to hold more cash in reserves than what the Fed mandates. The interest is offered as an incentive not to loan against the money (which would make it mandatory reserves) when too much money is floating around. “Excess reserves” are money banks are not required to hold in their Federal Reserve Bank account to back up loans, meaning they either are not making or cannot make as many loans as their reserves would allow.

Why would the Fed keep adding money into the system to soak up treasuries and finance the government just to suck it back out the other end? Oh, wait. That question answers itself.

Why would banks not want to keep excess money. Who can ever have more money than they want? Well, it’s not that banks want less money. It’s that they don’t want to hold locked in reserves during times of high inflation. Banks that are expecting high inflation are more concerned with preserving capital than building on it and do not want to hold excess money in reserves that will inflate away in value unless the Fed pays them more money (in IOER) to keep those reserves there. When all the banks have excess reserves, they can’t find other banks who want to exchange their cash for something that compensates better for inflation.

They may even loan their excess reserves to other banks at a slight negative interest rate, if they can find takers, because they think they will lose more in inflation during that same period by holding on to it, thus reducing their losses. If they cannot find another bank that wants to trade them or loan them something for cash, they obviously have to pay even more interest to offload their surplus, which they might do if they think inflation is going to be even worse.

That’s when the Fed steps in to avoid a negative-interest spiral — the opposite of the positive-interest whirlwind that hit during the Repocalypse. The Fed can either offer enough interest on excess reserves to offset the inflation banks fear or can trade them interest-bearing treasuries on loan (reverse-repo loans). The pile-up in reserves happens because banks can’t loan out money fast enough because consumers and businesses have as much cash as they care to spend are not as hungry for loans. The system starts backing up.

In short, banks not wanting to sit on cash that is quickly losing value have no one to loan it to because of weak loan demand even at low interest rates; so, they are starting to send money back to the FED for low-interest treasuries that are no risk because the Fed promises to buy them back at a premium down the road.

A key artery of global financial markets may be telling the Federal Reserve that enough is enough. Demand for an overnight funding through the Federal Reserve Bank of New York’s overnight reverse repo program (RRP) has begun to flirt with recent records highs, after almost no one used it for months…. The Fed’s reverse repo program lets eligible firms, like banks and money-market mutual-funds, park large amounts of cash overnight at the Fed in exchange for a small return, which lately has fallen to about 0.06%…. “Why are they going to the Fed?” asked Scott Skyrm, executive vice president in fixed income and repo at Curvature Securities … despite its dwindling returns.

MarketWatch

Skyrm’s answer to his question is that Fed QE has hit the steep downside of the diminishing-returns curve to where it is worse than ineffective. (Remember my articles last year warning “The Fed is Dead?”)

This time, Skyrm views high demand for the Fed’s low-return reverse repo facility as a sign that the central bank’s roughly year-old $120 billion-a-month bond-buying program no longer works as intended by adding liquidity to financial markets, and should be scaled back.

If the Fed wants to maintain its 0-0.25% fundamental interest rate and avoid negative interest that the banks are pushing into being, it has to soak up the slop, or banks will go lower just to avoid an even worse hit from inflation. this is the kind of thing I was talking about when I wrote recently that the Fed is going to increasingly find its hand is being forced.

According to Skyrm,

“On March 17, a little over two months ago, there was no volume at the Fed’s RRP window. Nothing. Today, it was almost $400 billion! How do you go from zero to $400 billion in two months? Not only was today’s activity at the RRP one of the largest ever, it was also THE largest non-quarter-end, non-year-end print. There’s an incredible amount of cash in the Repo market right now! Clearly, the Fed took too much collateral out of the market – or – added too much cash. The market is distorted from too much QE and hopefully QE tapering will be announced in June.“

ZH

The repo expert sees this coming month as the pressing deadline for the Fed to announce tapering! If the Fed doesn’t act by then, this inflationary whirlwind could build into a fiery tornado.

Of course, if the Fed does take his advice and announce it is tapering QE, the stock market would crash in a taper tantrum. As I wrote in my last article, the Fed is increasingly being squeezed between a damned-if-you-do and damned-if-don’t situation where it will be forced to deal with inflation, or inflation will do its own ravaging. The knot they’ve tied is rapidly tightening around their own necks.

117 views

Source link